Three Dividend Increases and Three Special Dividends

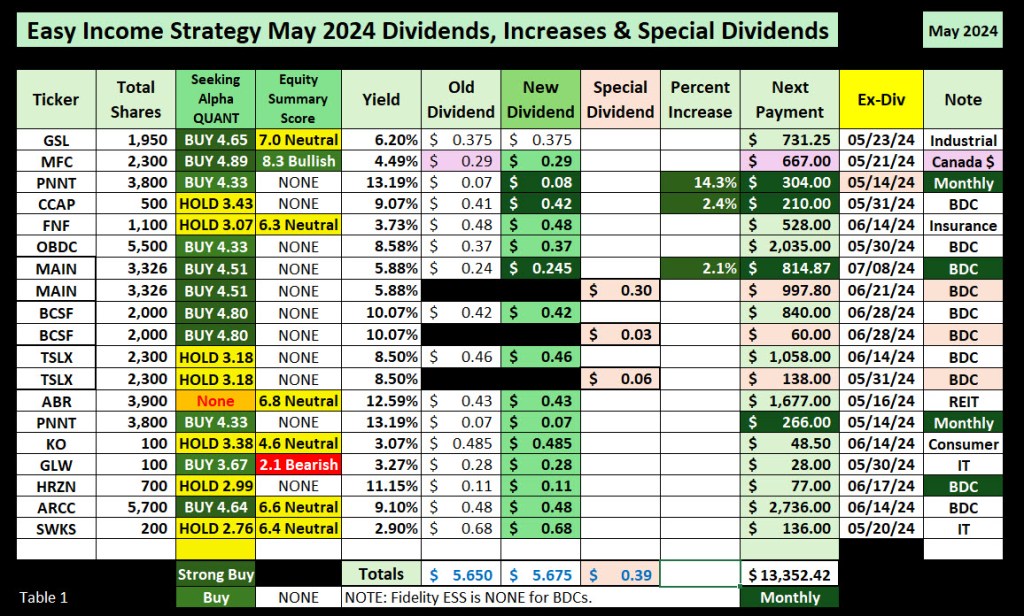

Here is a secret for those who fear bear markets: if you pay attention to the dividends that are coming your way, it is far less likely that you will sell your investments in a panic. Thus far during the month of May, my Seeking Alpha subscription has reminded me nineteen times that I am a dividend investor. Those reminders equal $13,352.42 of income during the next couple of months.

Three of the reminders were increases. These included PNNT, CCAP, and MAIN. Three of the reminders were the normal dividends plus a special or supplemental dividend. The supplemental dividends are being paid by MAIN, BCSF, and TSLX. These three are BDCs.

Before you rush out and buy any of these, be careful to understand what you are buying. At the very least, be cautious about ABR, KO, and GLW.

Easy Income Strategy Reminders

The goal of easy income is to have consistent and often increasing income that requires little or no effort. When I buy any position, whether it is a stock or an ETF, I want to see gradually increasing dividends. Sometimes good news comes in groups, but that is, admittedly, rare. It really depends on the makeup of your investment portfolio.

The best thing about a long-term investment perspective is that it requires very little time, effort, or maintenance. I don’t have to day-trade, sell covered call options, or even think about the ups-and-downs of a volatile stock market. It is like the furnace in our home. I don’t think about adding fuel or checking to see if it will work. I do, however, have to change the filter 3-4 times per year. That is the way I want my investments to work.

Dividend Notes

The Seeking Alpha QUANT Strong buys include GSL, MFC, MAIN, BCSF, and ARCC. Understand that three of these are BDCs (Business Development Companies.) If the QUANT rating is Buy or Strong Buy (greater than 4.50) then I add shares from time-to-time.

You must own the shares by the ex-dividend date to receive the next dividend payment. Therefore, it is too late to buy shares of PNNT. However, PNNT pays a monthly dividend, so it is never really that long before the next dividend appears.

MFC is a Canadian company, so the dollars expressed are CAD$. US shareholders receive the dividend in US$. I did not take the time to do the currency translation.

HRZN, MAIN, and PNNT pay monthly dividends. MAIN is one of our top ten holdings, and it is also an investment in the UTMA accounts for our grandchildren.

Recommendation

As always, diversify your investments. While I like all of these investments, they aren’t for everyone. As I said earlier, be cautious about ABR, KO, and GLW. Understand what a BDC is and does before you buy shares.

Full Disclosure

Although I share the number of shares for these investments, be aware that none of them is a huge portion of our total investments with the exception of MAIN. We currently own about $164K of MAIN. We own about $120K of ARCC. By comparison, our MFC holdings are only about $59K and our KO investment is only about $6.3K.