Do You Know What You Pay?

“Education is learning what you didn’t even know you didn’t know.” Daniel J. Boorstin

Did you know that it is generally very hard for most individuals saving for retirement to know what they are paying in total dollars every year for their advisor’s work, and the expenses associated with each mutual fund and ETF they own? This is not without purpose. Those who provide investing solutions or services know you would be shocked or at least concerned if you knew the total amount you spend each quarter.

This is true of every statement I have ever reviewed from many different brokers and retirement fund providers. However, I can often find the beginning costs just by careful examination of a monthly statement and asking a few questions.

AAII May 2024 Journal

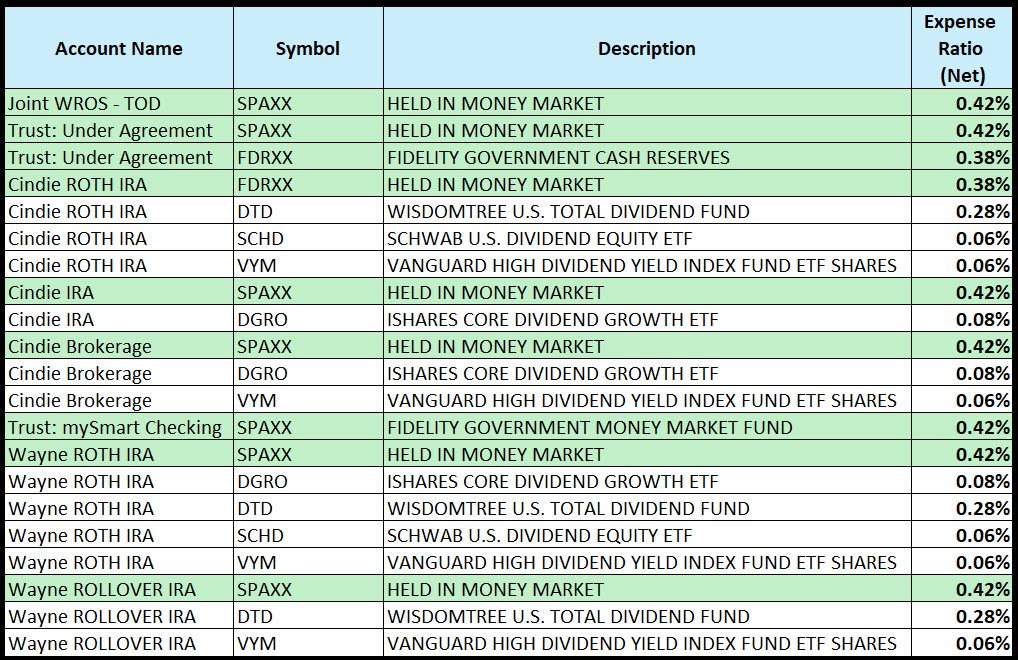

In this month’s AAII Journal there is a very thought-provoking article by Paul Merriman. The article’s title is “Winning the Battle Against Investment Fees and Biases.” Let’s just talk about fees. Most of my friends know that I strive to keep our non-money market holdings to an expense ratio of less than 0.10%. Here is a list of all of the mutual funds and ETFs we own at Fidelity. With the exception of DTD, all of the other non-money market funds have an expense ratio of 0.06% or 0.08%.

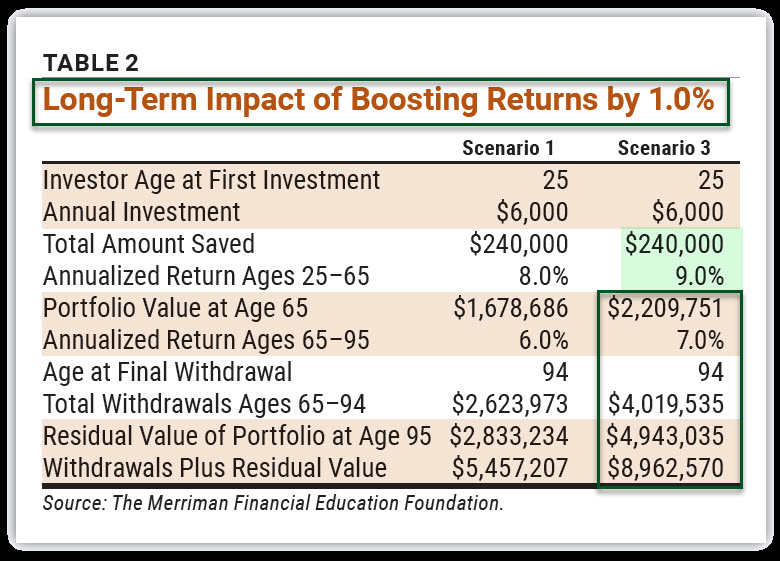

The AAII article had several tables that are eye-opening for those who think that fees and returns don’t matter. Look at it this way: if your advisor can get you an 8% return, and they are charging you one percent for their services, you are missing out on some significant growth in your investment dollars. Table 2 compares hypothetical returns until age 65 and then after 65. The assumption is that you will shift your strategy when you reach age 65 and you would, therefore, accept lower growth in your retirement portfolio.

Notice the difference between the two columns, especially the “Withdrawals plus Residual Value.” By gaining just one percent over the lifetime of investing you dramatically increase the total potential returns. While $5.5 million dollars seems like a good return, $8.9 million is even better. Note that in both cases the total contributions to the retirement accounts were only $240,000.

Table 1 is also most interesting. Let’s imagine that your total costs of investment are only 0.50%. Even then your total “Withdrawals plus Residual Value” by being cost conscious is significantly better by keeping your costs low.

Buying Stocks in Addition to ETFs Lowers Your Total Costs

I learned a long time ago that costs and expenses matter. That is why it is one of the first things I look at when I review someone’s retirement statements.

One of the reasons I like to buy stocks in individual companies is that there is no expense. There is no cost to buy shares, no cost to hold them, and no cost to sell them. When expenses are zero, if the investment is a quality holding, all of the profits remain. With mutual funds and ETFs, the fund manager is continually taking a portion of the worth of the investment. If you have a mutual fund with $100,000 invested, and the annual expense ratio is 0.7% you are paying the fund manager $700 per year. If the amount invested increases to $200,000, then you are paying the fund manager $1,400 per year. Every dollar in the fund manager’s wallet is no longer growing for your benefit. Ask yourself a question: “Did the fund manager do more work to earn the $1,400?” No, they did nothing different for you. Your actual costs increase as you invest more in a fund.

Striking a Balance

If you buy $100,000 of shares in a quality ETF with an expense ratio of 0.06%, you are only paying $60 per year. It makes sense to me to diversify between low-cost funds to increase your exposure to more companies and then also buy some quality stock investments, including REITs, and BDCs. This effectively reduces the real expense for the entire portfolio.

For example, if I invest $100K in a 0.06% ETF and $100K in various individual stocks, I have reduced my effective portfolio cost to 0.03%. I’m still paying the $60 per year, but that is a lower percentage of the total dollars in my account.