Etude Storage Partners proposes to acquire Global Self Storage for $6.15 per share

Whenever I see that one business is offering to buy a business in our portfolio, I quickly look at the offer and then usually decide to sell my shares. SELF is a REIT, and it has been a reliable source of dividend income. However, I believe now is the time to exit this position, assuming I can receive $6 per share for our 3,200 shares.

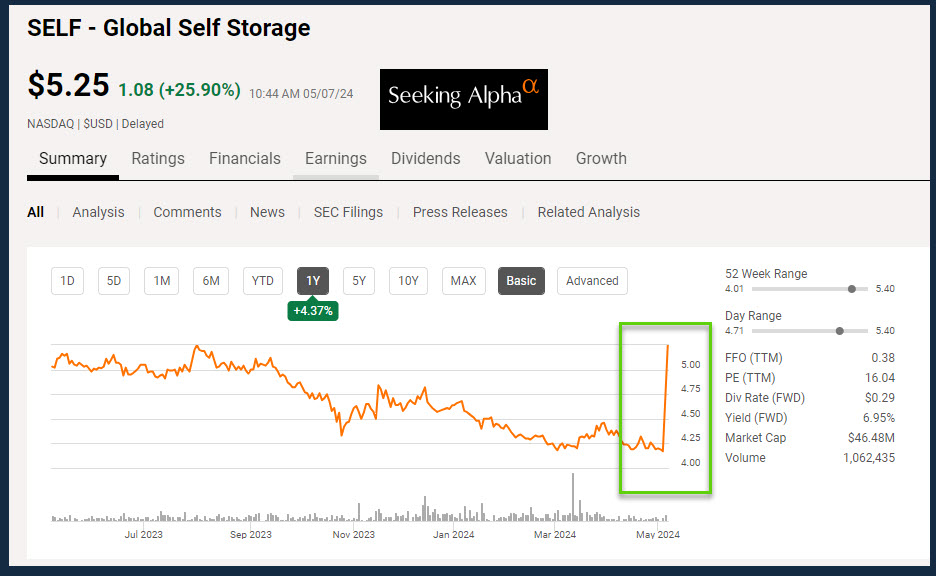

As I write this, the shares are up over 34% today, and the current price is $5.56/share. I entered sell limit orders for all of our shares at $6/share. I am selling because I want the cash for other investment opportunities.

Offer Details

Etude Storage Partners, a self-storage-focused investment firm, on Tuesday, proposed to acquire Global Self Storage for $6.15 per share in cash.

The proposal represents a 47% premium over Monday’s closing price of $4.17 per share and a 45% premium over the 30-day volume-weighted average price of $4.24, Etude said, in a letter sent to Global Self Storage board.

Etude, which has been a stockholder of Global Self Storage for over five years, said that it has previously submitted two separate proposals to acquire all the outstanding shares of common stock of the company, initially at a price equal to $5.52 per share in cash, on February 15, 2024, and then raised the offer to $6.05 per share in cash on April 5.

Etude added that Global Self Storage board rejected both the proposals.

Full Disclosure

Cindie and I own 3,200 shares of SELF as a long-term investment. However, I tend to exit positions if the company or REIT will be acquired by another company.