Super Micro Computer, Inc.

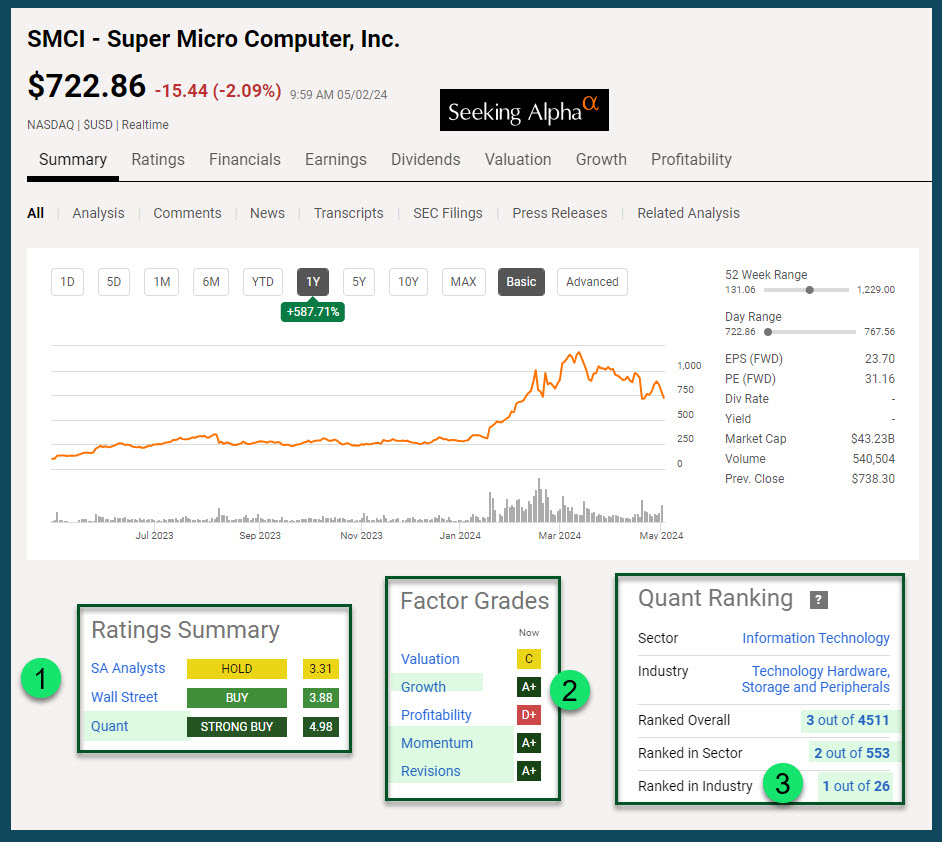

SMCI is in the Information Technology sector and the industry category is Technology Hardware, Storage and Peripherals. It does not pay a dividend, but it does have high growth potential given the focus on AI (Artificial Intelligence).

On April 22, 2024 I purchased one share of SMCI for my traditional IRA and one share for my ROTH. Then, on April 29 I sold a cash covered put (-SMCI240503P725). This ticker symbol meant that I was committed to buying 100 shares of SMCI if the put price dropped below $725 by Friday, May 3.

Because the share price is declining today, I rolled my put option from $725 to $700 and received $598.70. I had to extend the contract date to May 10, but I feel this is a worthwhile strategy.

My put option trade on April 29 earned me $1,299.30. Therefore, I have received $1,898 in income from my original put sale plus the roll of the put today.

To state this differently, even if I have to buy 100 shares at $700 per share, I am further reducing my potential real cost for my shares by another $18.98 per share. The beauty of this is that I can then sell covered call options on 100 shares. This has the potential to earn me even more income.

Of course, one hundred shares at $700 per share is $70,000. Therefore, this trade is only viable for someone with a portfolio of $1.5M. However, the average investor can still enter a buy limit order for one or two shares and still participate in some eventual profits if things continue to look positive for SMCI.

Company Profile

Super Micro Computer, Inc., together with its subsidiaries, develops and manufactures high performance server and storage solutions based on modular and open architecture in the United States, Europe, Asia, and internationally. Its solutions range from complete server, storage systems, modular blade servers, blades, workstations, full racks, networking devices, server sub-systems, server management software, and security software. The company provides application-optimized server solutions, rackmount and blade servers, storage, and subsystems and accessories; and server software management solutions, such as Server Management Suite, including Supermicro Server Manager, Supermicro Power Management software, Supermicro Update Manager, SuperCloud Composer, and SuperDoctor 5. In addition, it offers server subsystems and accessories comprising server boards, chassis, power supplies, and other accessories. Further, the company provides server and storage system integration, configuration, and software upgrade and update services; and technical documentation services, as well as identifies service requirements, creates and executes project plans, and conducts verification testing and technical documentation, and training services. Additionally, it offers help desk and on-site product support services for its server and storage systems; and customer support services, including ongoing maintenance and technical support for its products. The company provides its products to enterprise data centers, cloud computing, artificial intelligence, and 5G and edge computing markets. It sells its products through direct and indirect sales force, distributors, value-added resellers, system integrators, and original equipment manufacturers. The company was incorporated in 1993 and is headquartered in San Jose, California.

Full Disclosure

I currently own two shares of SMCI with a cost basis of $700. If the shares trade below $700 by Friday, May 10, 2024, I will own 102 shares.