Risks and Rewards

Most investments have some level of risk. It is not unusual for different analysts to come to different conclusions about the risks and rewards associated with an investment. In the case of OneMain Holdings, Inc., the risk is higher, but the dividend reward is as well. Most analysts that follow OMF are not enthusiastic about this as an investment. However, some analysts (JPMorgan and Jefferies) are increasing their price targets for the shares. Fidelity’s ESS score is, however, bearish. Weiss Ratings are neutral.

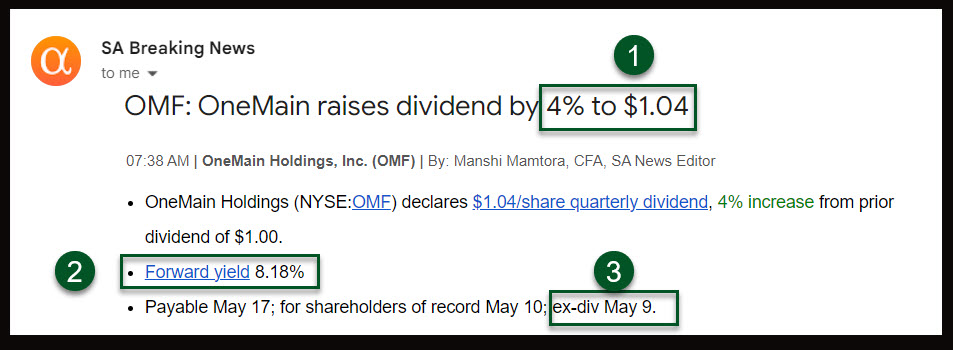

Dividend Increased

Not only is the dividend yield high (Forward yield 8.18%), but the dividend has been increased by 4%. I bought my first 100 shares in August of 2021 for $59.35 per share. I added another 100 shares in October 2021 for $54.13 per share. The shares are now trading at just under $51/share, so I am tempted to buy another 100 shares to increase the dividend income from this investment and lower my cost basis.

However, it is likely that I would not just buy the shares. Rather, I might sell a put option to buy the shares at $47.50 on May 17. This would give me at least $80 in immediate income but does not guarantee that I would get the shares.

OMF Earnings

If the future earnings continue to grow, the P/E ratio will fall. This will make the stock more attractive to investors. Based on the earnings projections, I think the dividend is safe. It is never wise to chase dividend yield, but I think the current yield of OMF is not at risk.

Company Profile

OneMain Holdings, Inc., a financial service holding company, engages in the consumer finance and insurance businesses in the United States. It originates, underwrites, and services personal loans secured by automobiles, other titled collateral, or unsecured. The company also offers credit cards; optional credit insurance products, including life, disability, and involuntary unemployment insurance; optional non-credit insurance; guaranteed asset protection coverage as a waiver product or insurance; and membership plans. It sells its products through its website. The company was formerly known as Springleaf Holdings, Inc. and changed its name to OneMain Holdings, Inc. in November 2015. OneMain Holdings, Inc. was founded in 1912 and is based in Evansville, Indiana.

Caution for New Investors

Do not buy shares of OMF if you cannot handle the volatility of this investment. Furthermore, this stock does not have much trading volume, so the price can fluctuate greatly, especially if there is a panic due to interest rates or the quarterly results announced by the company are disappointing.

Full Disclosure

I own 200 shares of OMF as a long-term investment.