Why Understanding Helps an Investor

The book of Proverbs talks about understanding over thirty times. There are three things that are linked in a helpful chain for all of life. The first is knowledge, the second is understanding, and the third is wisdom. Knowledge can be corrupted or lacking in truth. Therefore it is important to know if the knowledge you have is based on truth. If it is, then it is possible to have understanding that can inform your decisions. Many may have knowledge and understanding, but wisdom is required to apply both of those in life’s decisions. That is why Proverbs 15:21 says, “Folly is a joy to him who lacks sense, but a man of understanding walks straight ahead.”

Now for understanding: What is the Nasdaq Composite Index (IXIC)? It is a list of all of the equity securities listed on the Nasdaq. “They include common stocks, ordinary shares, American depositary receipts (ADRs), units of real estate investment trusts (REITs), and publicly traded partnerships, as well as tracking stocks.” – Investopedia

However, there are stocks that are not included. The NASDAQ IXIC index does not include the “securities of closed-end funds, exchange-traded funds (ETFs), preferred shares, rights, warrants, convertible debenture securities, or other derivatives.” – Investopedia

Another significant factor about the Nasdaq Composite is that it includes U.S. International companies. The other two well-known indices, the S&P 500 Index (SPX) and the Dow Jones Industrial Average (DJIA) do not include international stocks.

Cautions Regarding the NASDAQ

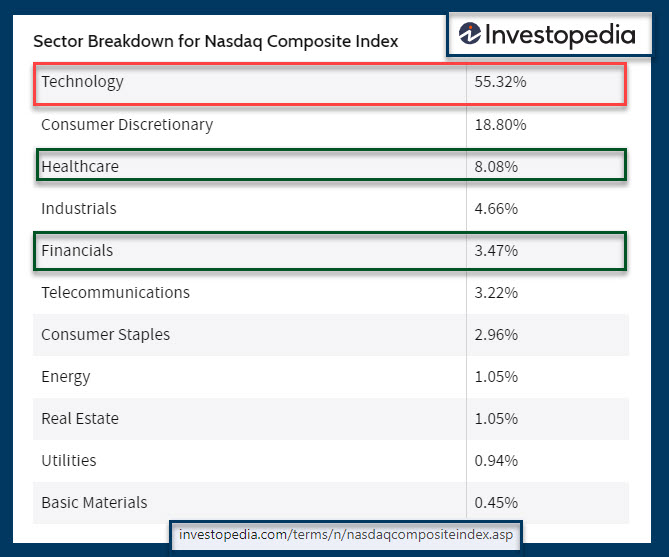

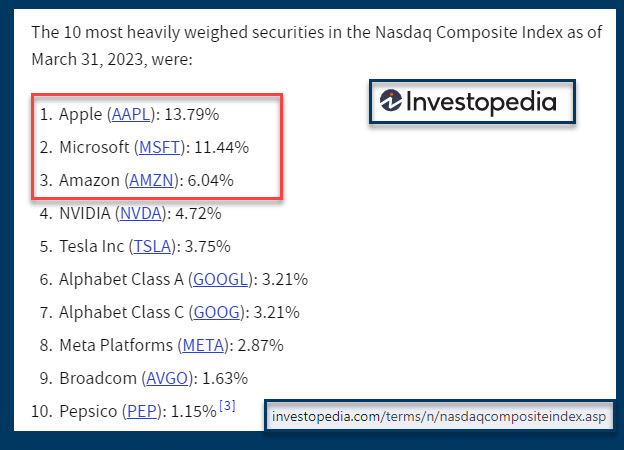

The NASDAQ has a great history of very solid returns that are better than those of the Dow Jones and S&P 500. However, be careful, as the IXIC is very heavily focused on technology companies. If you are investing for the long haul, then you should note that having a good base of technology stocks or ETFs can work to your advantage in growing your wealth.

However, if there is an economic downturn, this can also be a frightening sector. What goes up quickly is also more prone to considerable declines. That is why I always look at the top ten investments in all ETFs and mutual funds before I buy shares. I don’t want to have 50% of our investments in a single sector or focused on a few key companies.

Results Depend on Your Strategy

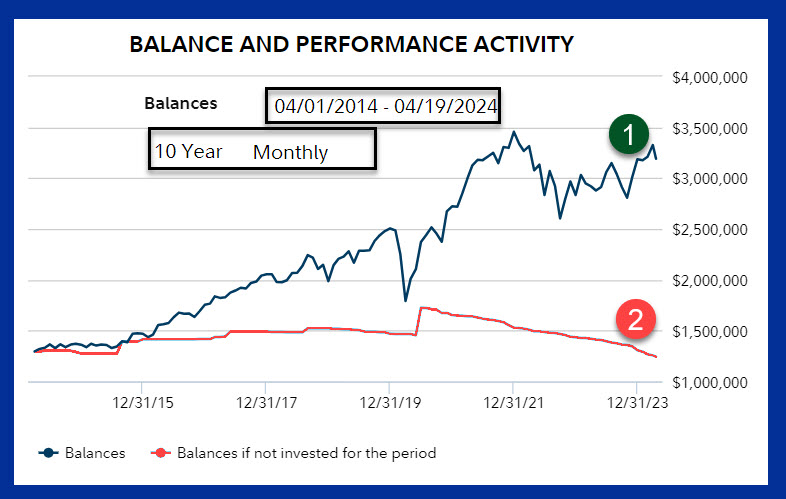

If you look at my results, you can see that our 10-year “performance” lags the IXIC, SPX, and DJIA indices. However, I am almost certain that a majority of passive investors do not achieve 8-10% ten-year returns if they allow an “expert” to manage their investments. There are two primary reasons for this. The first is that you are probably paying the expert too much for the work they are doing. The second is that most advisors think owning bonds is a good way to “diversify” and add some measure of “safety” to a portfolio.

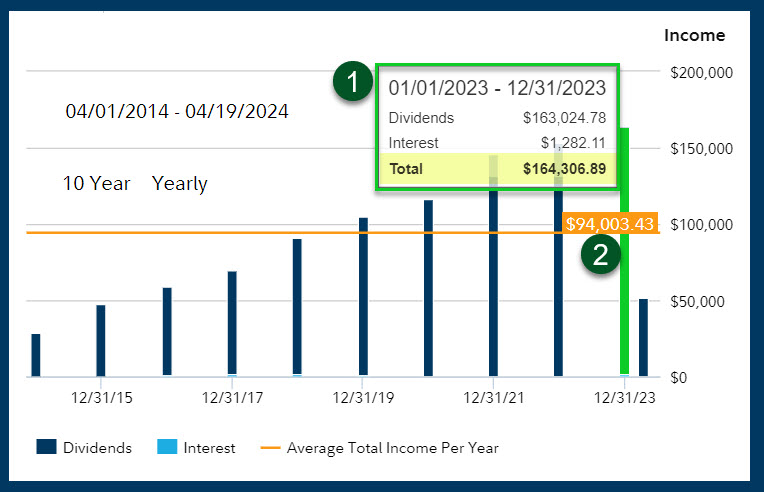

Investors should also consider if they are in the accumulation phase of their retirement investing or if they are in the income and withdrawal stage. Cindie and I have been in the retirement phase of income and withdrawals for over ten years. Cindie still works part-time as a baker, but that is not out of necessity. She likes what she is doing and the people she gets to serve.

As a dividend growth investor, I want easy income. That means I don’t want to have to buy-and-sell investments to get income even though I can. I want most of our investments to pay me monthly or quarterly. That income is then primarily given to a select number of gospel-focused 503(c)(3) ministries. Organizations described in section 501(c)(3) of the Internal Revenue Code are commonly referred to as charitable organizations. We did not need $164K of income from our investments for personal needs, so most of the 2023 income was given as gifts to charities and to family members.

Walking Straight Ahead as an Investor

“Folly is a joy to him who lacks sense, but a man of understanding walks straight ahead.” If you use an investment advisor, then you should understand how the returns your advisor is delivering compare with the three significant indices. The ticker symbols of the three I have mentioned are IXIC, SPX, and DJIA. I don’t believe many investors need to beat these indices, and most cannot. However, if your advisor is delivering less than 8-10% returns over the last ten years, you need to carefully evaluate if you are getting value for the payments you make to your advisor for managing your investments.

In addition, I think it is wise to think about how you will create income during your non-working years. This includes factoring inflation into your evaluation. A person with understanding can then ask God for wisdom to make the right decisions.

Great knowledge, understanding, and wisdom, Wayne!

Thank you!

LikeLiked by 1 person