The Rent is Paid Without Fail

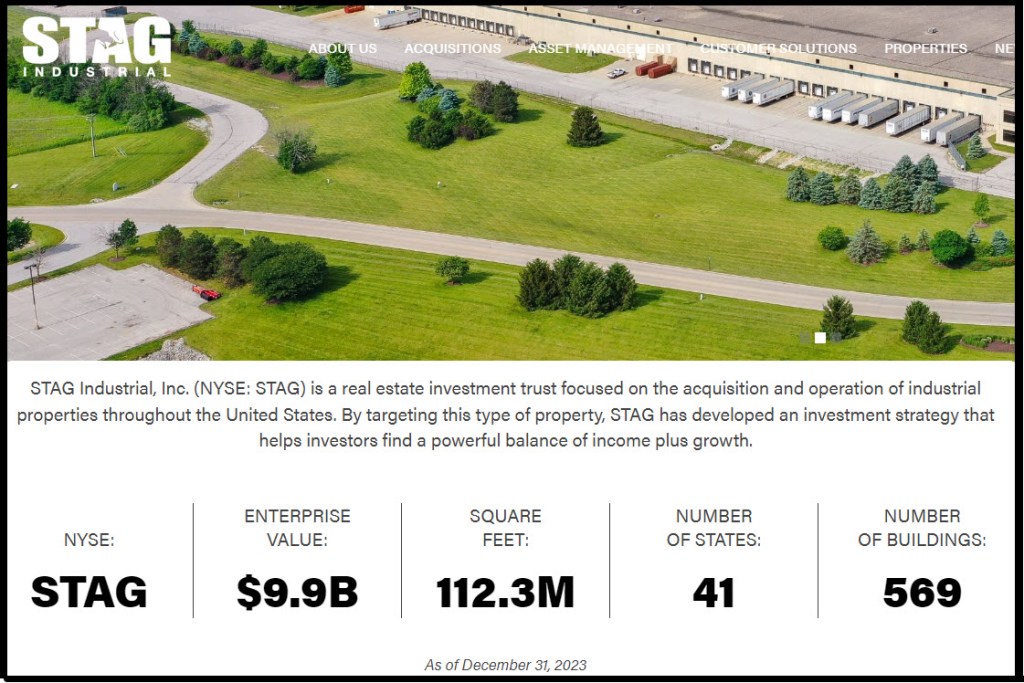

I like real estate that I don’t have to manage. I also like real estate diversification into the Industrial REITs segment, especially warehousing. But I would never buy a warehouse or be able to afford 569 warehouses like STAG.

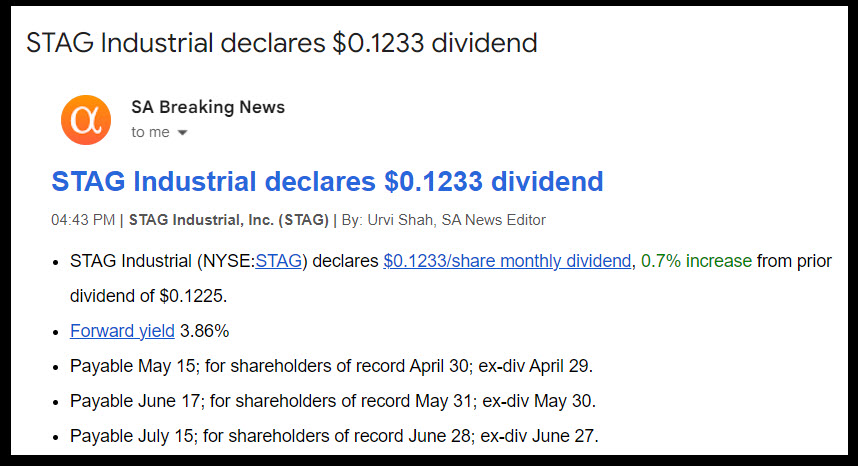

Although the dividend increase is not significant, the value of the investment can increase over time where a CD or other investments won’t increase in value. Annualized dividends for us would be $2,220. Some of these dividends are tax-free, because we hold STAG more than half of our shares in our ROTH IRA accounts.

But dividends are only a small piece of the story. Pay attention to total returns. That is the result of the change in the price of the shares plus the dividends.

Diversification Is Important

I like the reality that STAG has a footprint in 41 states. I like the diversification in the number of warehouses. It is a good thing that STAG is a mid-cap stock with growth potential. If you read the Company Profile STAG Industrial below, you will see more aspects of their diversification.

STAG’s QUANT Rating

Currently STAG is a Strong Buy (3) on Seeking Alpha. Within the Industrial REITs category they are three out of twelve (1) and 14 out of 171 in the sector, I am comfortable saying STAG is a good addition to just about any portfolio. However, I think it would be wise to keep the value of STAG to less than 2% of the total investments a person holds.

Nearshoring and Onshoring

As many of my readers know, the recent global events have caused companies in the USA to rethink sending all manufacturing overseas. As a result, more warehouse capacity is needed for parts and finished products. STAG fits the bill.

Company Profile STAG Industrial, Inc.

We are a REIT focused on the acquisition, ownership, and operation of industrial properties throughout the United States. Our platform is designed to (i) identify properties for acquisition that offer relative value across CBRE-EA Tier 1 industrial real estate markets, industries, and tenants through the principled application of our proprietary risk assessment model, (ii) provide growth through sophisticated industrial operation and an attractive opportunity set, and (iii) capitalize our business appropriately given the characteristics of our assets. We are organized and conduct our operations to maintain our qualification as a REIT under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended (the “Code”), and generally are not subject to federal income tax to the extent we currently distribute our income to our stockholders and maintain our qualification as a REIT. We remain subject to state and local taxes on our income and property and to U.S. federal income and excise taxes on our undistributed income. As of December 31, 2023, we owned 569 buildings in 41 states with approximately 112.3 million rentable square feet, consisting of 493 warehouse/distribution buildings, 70 light manufacturing buildings, one flex/office building, and five Value Add Portfolio buildings. In addition, as of December 31, 2023, we had six development projects (which are not included in the building count noted above). While the majority of our portfolio consists of single-tenant properties, we also own a growing number of multi-tenant properties. As of December 31, 2023, our buildings were approximately 98.2% leased, with no single tenant accounting for more than approximately 2.9% of our total annualized base rental revenue and no single industry accounting for more than approximately 11.0% of our total annualized base rental revenue. We intend to maintain a diversified mix of tenants to limit our exposure to any single tenant or industry. As of December 31, 2023, our Operating Portfolio was approximately 98.4% leased. SL Rent Change on new and renewal leases together grew approximately 44.0% and 24.3% during the years ended December 31, 2023 and 2022, respectively, and our Cash Rent Change on new and renewal leases together grew approximately 31.0% and 14.3% during the years ended December 31, 2023 and 2022, respectively. We have fully integrated acquisition, leasing and operations platforms led by a senior management team with decades of industrial real estate experience. Our mission is to deliver attractive long-term stockholder returns in all market environments by growing cash flow through disciplined investment in high-quality real estate while maintaining a strong balance sheet.

Full Disclosure

Cindie and I own 1,500 shares of STAG as a long-term investment. I like it because it is an industrial ETF.