Two Types of Income

Yes, I know there are more than two types of income. Wages, dividends, lottery winnings, interest income, options trading income, and income from your business all can add to your total income. But there are two types of income just about everyone has: taxable income and tax-free income.

The reason I like tax-free income is that it is tax free. That means, for every $1,000 of income I receive in that bucket I can spend or give $1,000. The other bucket is taxable income. For every $1,000 we receive, we can only spend or give about $800. Given the impact of inflation, I like keeping more of the real dollars for real spending and giving.

ROTH IRA Additions

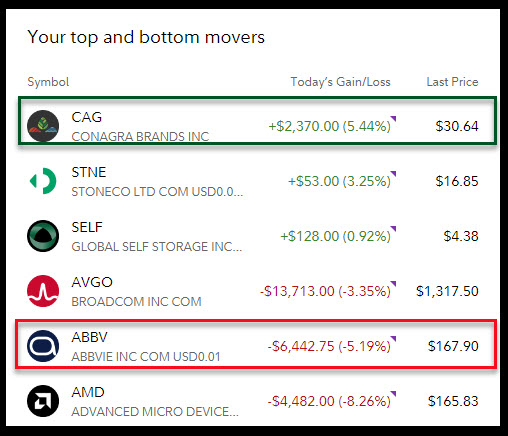

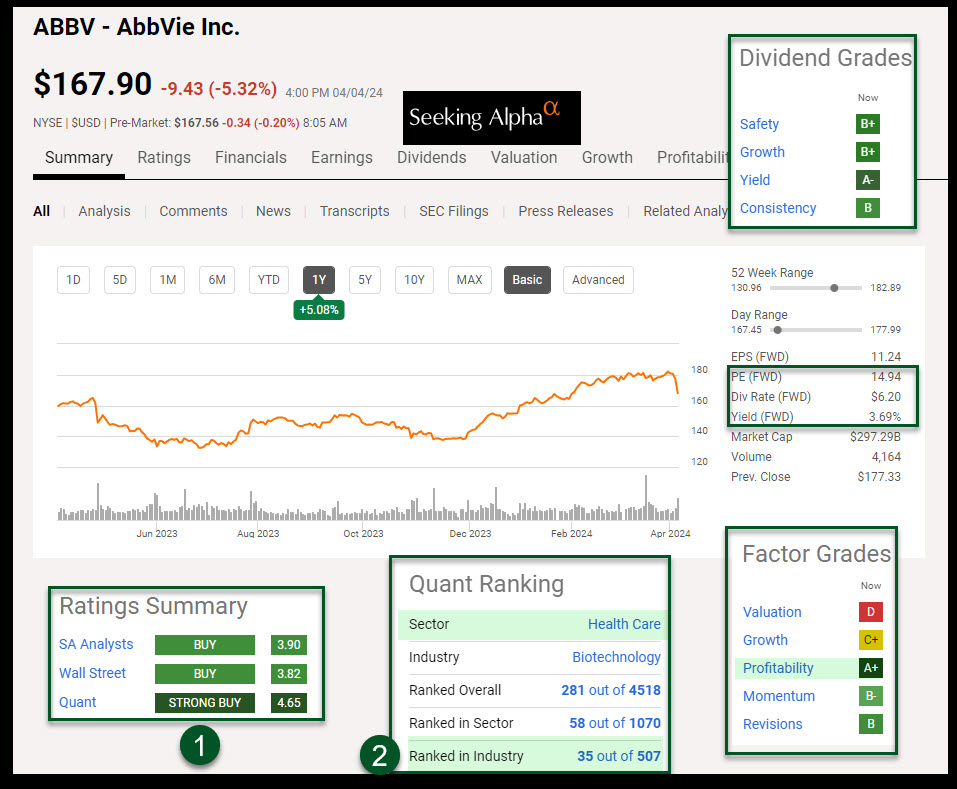

On January 29 of this year I added 50 shares of ABBV (AbbVie Inc.) to my ROTH IRA at a per share price of $164. ABBV closed at $169.80 yesterday afternoon. On March 25, using dividends I received from other investments, I bought another 25 shares at $178.65. Then, on April 4, I bought another 25 shares at $171 per share. This makes my average cost for 100 shares $169.41.

My total holdings of ABBV (Biotechnology Health Care company) now stand at 700 shares. Because ABBV has an annualized dividend of $6.20 per share, I can reasonably expect to receive $4,340 in tax-free income in the next twelve months. However, ABBV has a 5-year dividend growth rate of 8.68%. Therefore, it is likely that my dividends starting in January 2025 will be greater than $4,340 in 2025.

Although the percentage of ABBV in my ROTH is significant, when taken in context with all of our investments, it is only 3.6% of the total. Always look at all of your accounts when determining the risk you are taking with any single equity investment.

Traditional IRA Additions

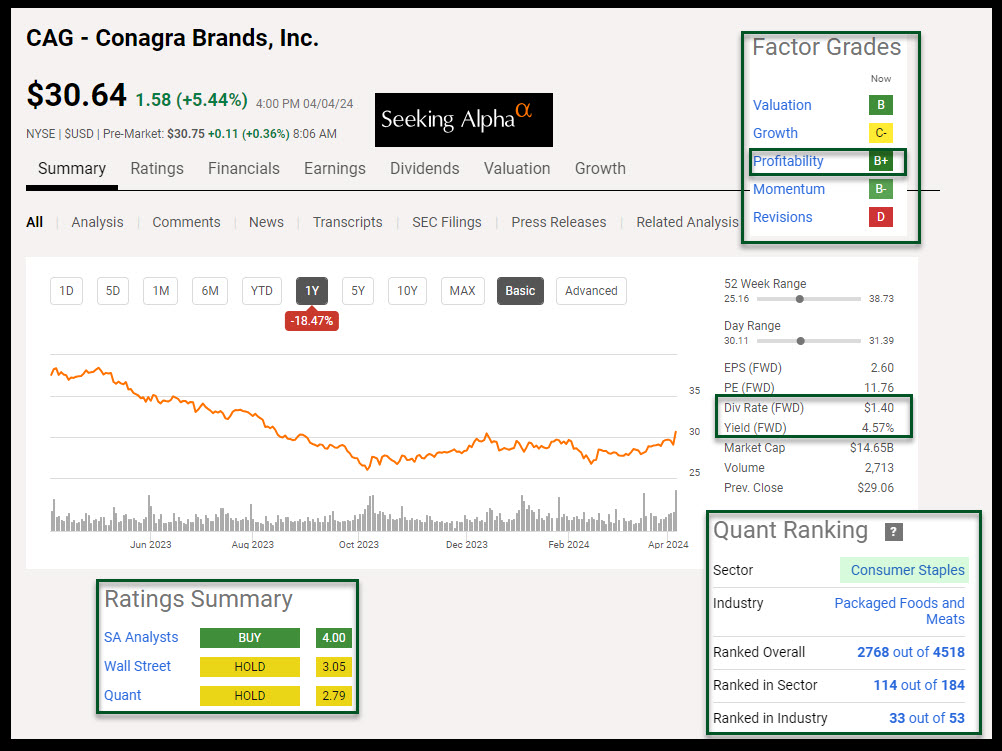

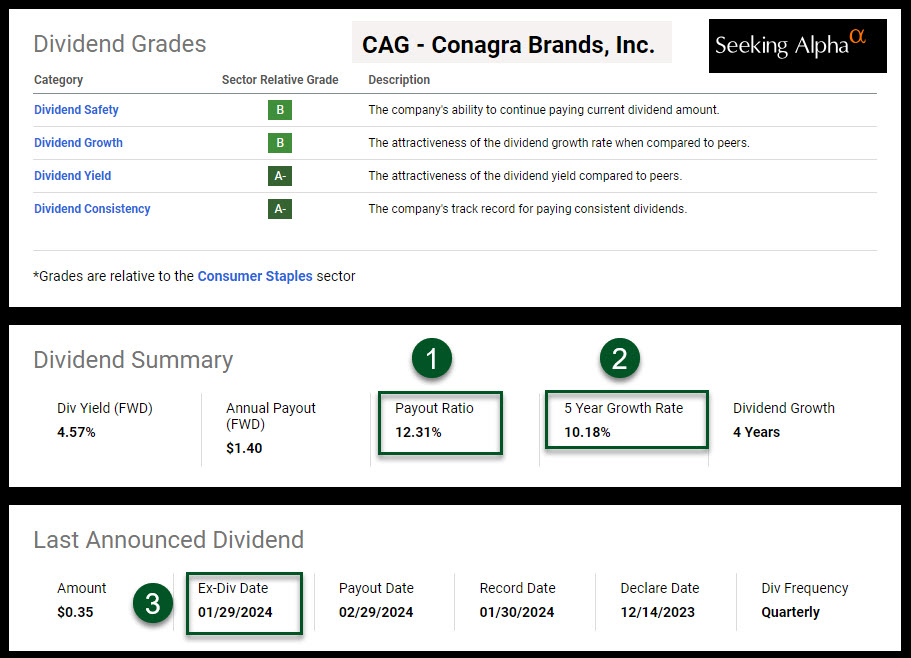

Conagra (CAG) is another dividend growth story. The dividend Payout Ratio is a good 51.49% and the dividend yield is a rational 4.48%. I also like the 5 Year Growth Rate of 10.18%. Furthermore, CAG is in the Consumer Staples sector, which is a good place to have some dollars for diversification. It might not be as fun as Apple, Tesla, and Microsoft, but it is less volatile as well.

I now have 1,000 shares of CAG because I bought 400 more shares on April 4th. But I also have 500 shares of CAG in my ROTH IRA, which is more tax-free income. Total income for the 1,500 shares is expected to be $2,100 this year.

Caution for Other Investors

Although ABBV has a “Strong Buy” QUANT rating on Seeking Alpha, and CAG is a “Buy”, this doesn’t mean you should buy shares. Look at your total portfolio. Don’t buy an investment just because I do. Also bear in mind that you probably already own shares of these investments if you have ETF or mutual funds in your portfolio. For example, DGRO has ABBV as one of its top ten investments.

Another good health care ETF is FHLC (Fidelity MSCI Health Care Index ETF). This fund also holds ABBV in the top ten investments. The downside to FHLC is the dividend yield: 1.35%.

However, if you are interested in dividend growth, then I think ABBV is a good pick especially in a ROTH IRA account. That way you get to keep and spend every dollar.