Ordered $30K in Certificate of Deposits 4-5-9-Month Ladder

Because of my RMD and QCD strategy, I am holding more cash in my traditional IRA than I normally would. The total dollar amount of cash is now slightly over $100K. While that cash is earning a respectable monthly dividend, it is less than five percent. Every month more dividends flow into this account. Last month, for example, $11,265.35 came into this account as dividends. YTD 2024 I have received $20,819.35 in dividends. This represents 56% of the total dividends we received in Q1 2024.

My CD Requirements Are Simple

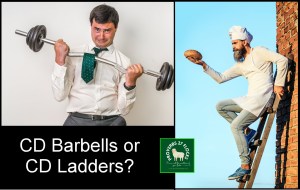

When I purchase a CD, I want the coupon (interest rate) to be greater than the average yield of the investments in my account. Currently, my average yield is 4.7% for my traditional IRA and ROTH IRA combined. Therefore, unless I have a good reason to hold cash (and I do), I want my yield to be around five percent.

Secondly, I want monthly interest, not interest at maturity. This is the “coupon frequency.” The following illustration shows the three CDs I purchased. I bought 10 CDs from each bank, so I purchased a total of 30 CDs worth $30,000.

Thirdly, the CD must not be “callable.” I want call protection. This means the bank cannot close out the CD before the end of the period.

Finally, the CDs I buy should have different maturities. In this case I purchased CDs that mature in 4 months, 5 months, and 9 months. In addition, when I buy a CD, I say “No” to auto-roll. I don’t want the CD automatically renewed at the then current interest rate.

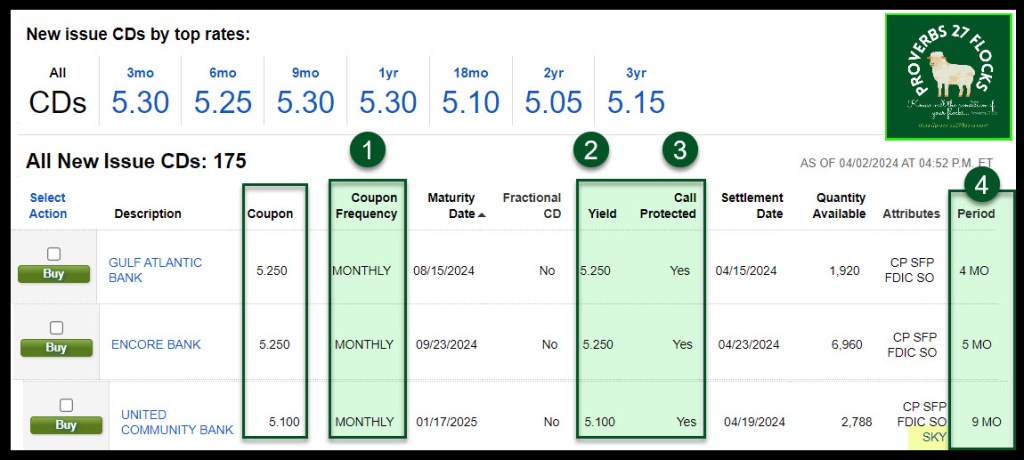

Declining Interest Rates

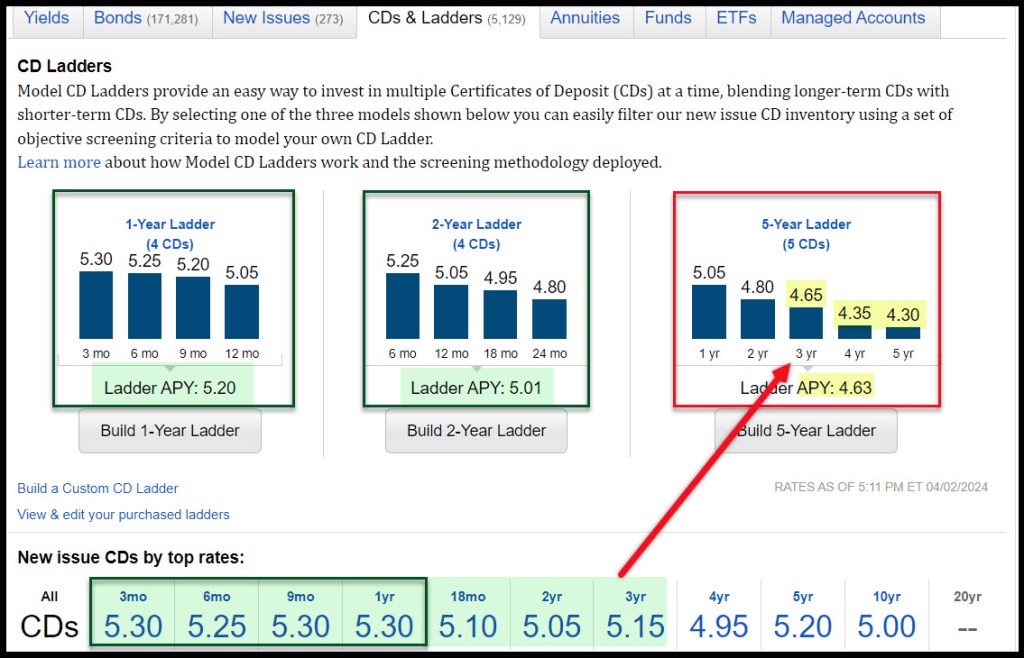

When or if the Federal Reserve starts lowering interest rates, the rates for CDs will drop. As long as the short-term rates are at least 4.5%, I might buy more CDs later in 2024. The banks are anticipating this action, as shown in this illustration. The yield on the five-year CD is only 4.3%. That might be a good rate in 2029, or it might not. I don’t want our cash tied up that long.

Fidelity-Built Ladders

I could have opted for a Fidelity CD ladder. For example, I could have taken $32K and purchased a 1-Year Ladder. Fidelity would then allocate $8,000 to the 3-month CD, and equal amounts to the 6-month, 9-month, and 12-month CDs. That isn’t a bad option, but I prefer to exit in nine months.

CD Barbells

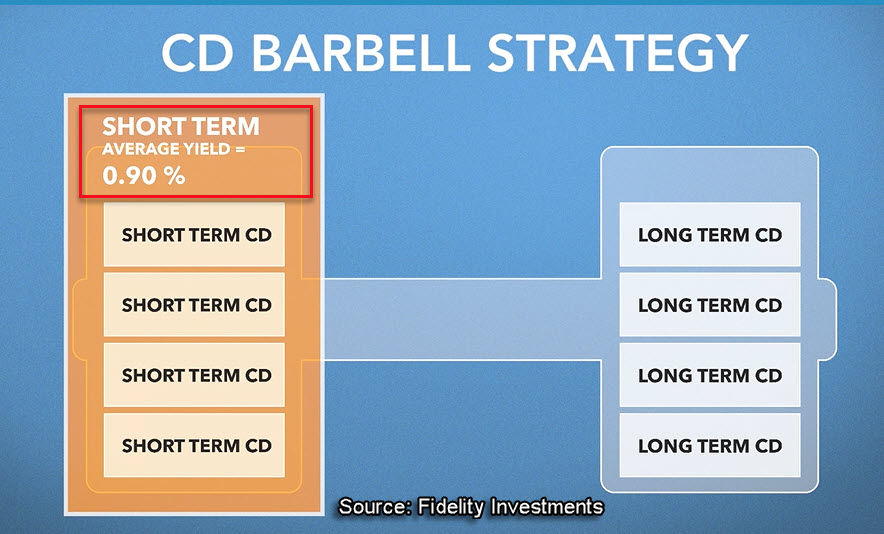

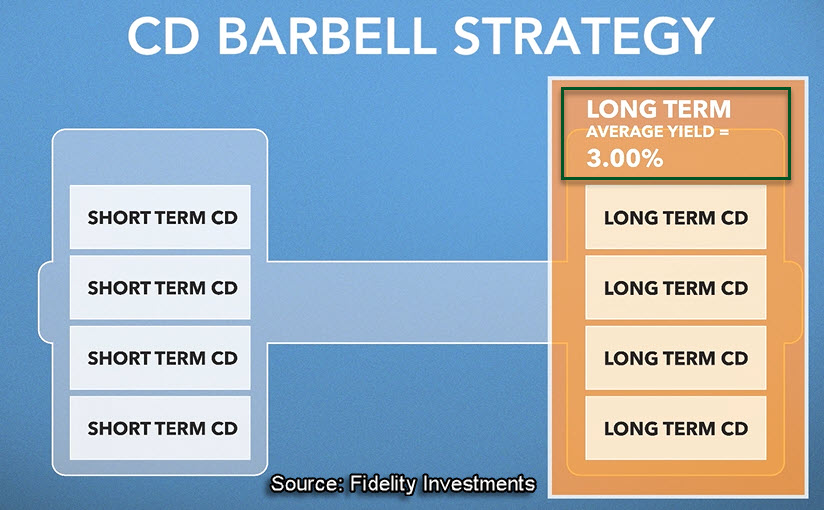

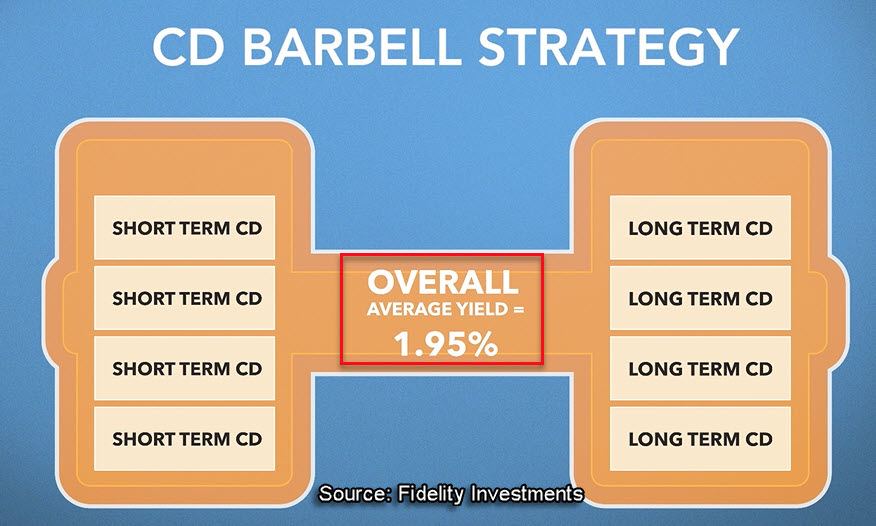

Another CD strategy is the CD Barbell. This strategy makes more sense when short-term rates are lower and long-term rates are higher. That isn’t the case today. The other problem with this strategy is that the lower rates don’t fit my requirements unless the lower rate is 4.5% and the higher rate is significantly more than that. If you want to learn more about this concept, here is a short Fidelity video: BARBELL VIDEO.

CD Risks

Everyone assumes there are no risks with CDs. While the risks are low, they are not zero. Here are some reminders from Fidelity.

Fidelity Investment CD Risks

Lower yields – Because of the inherent safety and short-term nature of a CD investment, yields on CDs tend to be lower than other higher risk investments. That is why I want yields above 5%.

Interest rate fluctuation – Like all fixed income securities, CD valuations and secondary market prices are susceptible to fluctuations in interest rates. If interest rates rise, the market price of outstanding CDs will generally decline, creating a potential loss should you decide to sell them in the secondary market. Since changes in interest rates will have the most impact on CDs with longer maturities, shorter-term CDs are generally less impacted by interest rate movements. The only real risk here is if you sell before the maturity date. If you have a $1,000 CD, someone might not want to pay you $1,000 for that CD. They might only offer $975. You avoid this trap by holding the CD to maturity.

Credit risk – Since CDs are debt instruments, there is credit risk associated with their purchase, although the insurance offered by the FDIC may help mitigate this risk. Customers are responsible for evaluating both the CDs and the creditworthiness of the underlying issuing institution. Banks do go belly up. The good news is that Fidelity offers CDs that have FDIC insurance. I consider this a minimal risk for most banks.

Insolvency of the issuer – In the event the issuer approaches insolvency or becomes insolvent, the CD may be placed in regulatory conservatorship, with the FDIC typically appointed as the conservator. As with any deposits of a depository institution placed in conservatorship, the CDs of the issuer for which a conservator has been appointed may be paid off prior to maturity or transferred to another depository institution. If the CDs are transferred to another institution, the new institution may offer you a choice of retaining the CD at a lower interest rate or receiving payment.

Selling before maturity – CDs sold prior to maturity are subject to a mark-down and may be subject to a substantial gain or loss due to interest rate changes and other factors. In addition, the market value of a CD in the secondary market may be influenced by a number of factors including, but not necessarily limited to, interest rates, provisions such as call or step features, and the credit rating of the issuer. The secondary market for CDs may be limited. Fidelity currently makes a market in the CDs we make available, but may not do so in the future. My advice: Don’t buy a CD and then try to sell it before the maturity date. You are defeating the purpose of the CD if you do that.

Call Risk – The issuer of a callable CD maintains the right to redeem the security on a set date prior to maturity and pay back the CD’s owner either par (full) value or a percentage of par value. The call schedule lists the precise call dates of when an issuer may choose to pay back the CDs and the price at which they will do so. I always look for CDs with call protection.