Every Dollar In One Account

It has been just over a year since we abandoned Wisconsin Bank and Trust as a place for checking and savings. The reason was simple: They were using our money and paying us essentially nothing for the use of our funds. It wasn’t unusual for our checking account to have $5,000-$10,000 at any one time. As interest rates rose, WB&T did nothing.

Obviously, this meant I had to do a little work. The direct deposit of our Social Security income had to be redirected. The automatic payments for our utility bills also had to be changed. Once that was done, very little maintenance has been required.

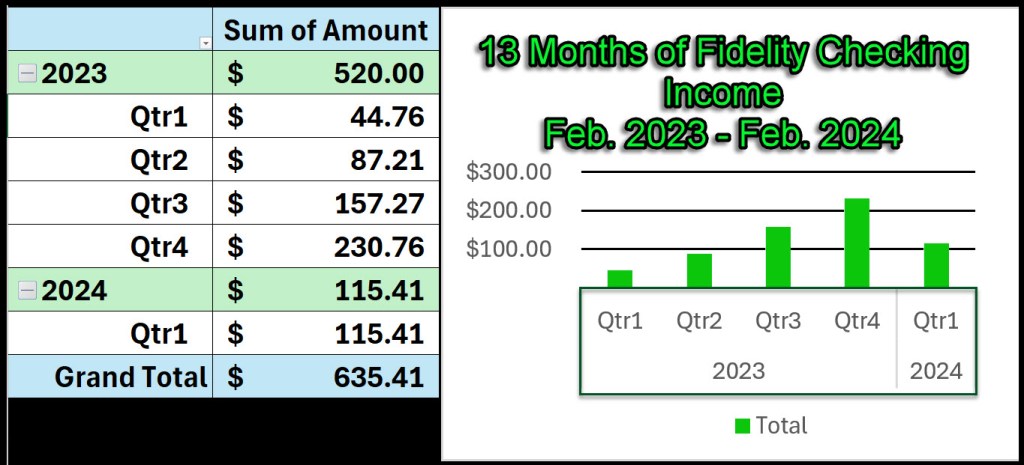

Thirteen Months of Results

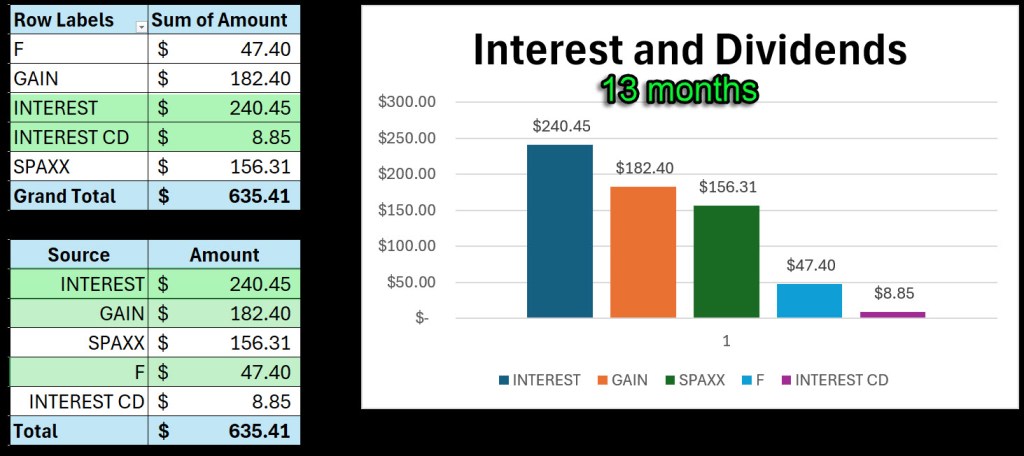

From February 2023 through February 2024 we have earned $635.41 in interest and dividends with the new approach. The first of the following images shows the quarter-to-quarter growth of income using Fidelity’s checking account. The second image shows the source of the various types of income. They include interest on the core account, dividends from the money market holding (SPAXX), interest from a short-term CD, and dividends from two stock holdings; F and GAIN. The interest from the core account, which is usually the largest dollar amount, is leading the others.

Portfolio Positions

The next two images show the holdings in the checking account. I think of the SPAXX holding as the “emergency savings” and the stock holdings for F and GAIN as “savings.” The FDIC sweep pays a lower rate of interest, but that is OK because those dollars are treated as “checking account” funds that will be spent within 30 days.

When we look at the dividend view (1), you can see that the estimated annual income provided by the small holdings (3) in Ford and GAIN is $114. Just that is more than WB&T was willing to give me on $10,000 in checking or savings. Even WB&T’s CDs paid next to nothing. Notice that the yield (2) on SPAXX is 4.96%, which is a decent yield for an emergency fund.

Average Balances

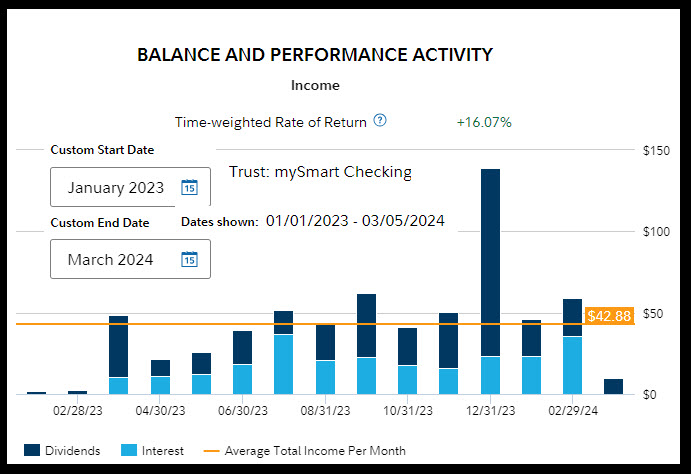

Fidelity also does a better job of showing how our balances look over time. Banks generally don’t give you very good tools for seeing your money visually. In looking at this graph is it easy to see that we tend to have a minimum of $10K in the account at all times.

Monthly Income

Finally, Fidelity also gives us a graph of the monthly (or quarterly, or annual) income in all of our accounts including the checking account. Interest and dividends shot up starting in March 2023, as that is when I got serious and moved funds from WB&T to Fidelity.

Conclusion

Now we really don’t have to have a local bank relationship. I can use the Fidelity debit card to take free ATM withdrawals wherever we are. The account comes with free checks. You can set up electronic payments to family members (or anyone) or have Fidelity write the checks for you – and they do that and mail them for free. While we still have a small balance at WB&T (less than $200), I only did that so that I would still be a “customer” if I needed other services on a walk-in basis. For example, I recently went into the local branch to get some $20’s exchanged for small bills.

We also have an online savings account with Ally Bank. I could close that account as well, and I probably should. It is just another “emergency” savings account.

Fidelity’s Account is a Brokerage Account

“Best in the business – Recognized By Forbes Advisor As The #1 Cash Management Account of 2024.” – SOURCE: Fidelity

“The Fidelity Cash Management Account (“Account”) is a brokerage account designed for spending and cash management. Fidelity is not a bank and brokerage accounts are not FDIC-insured, but uninvested cash balances are eligible for FDIC insurance. Balances above $5 million may be placed in a non-FDIC insured money market fund, which earns a different rate.”

The core account currently has an interest rate of 2.72%. The national average interest rate on checking is 0.07% APY. I don’t want to be average.

If you are interested in learning more about the Fidelity Cash Management Account, here is the LINK.