The Big One: Health Care

While it is easy to grow accustomed to health care, hospitalization, eye care, dental care, and a host of other benefits during the working years, the rules and options change in retirement. When you leave the workforce, it will be necessary to decide what you will do and what it will cost to keep from having health care catastrophic events from making life very complicated.

This post clearly has a bias based on my experience and my observations of a limited number of situations faced by family and friends. However, I think I can help you start to think about the choices so as to be able to ask the right questions so that you can find the best solutions.

Decide What You Don’t Need

In my previous post on this topic, I shared that I felt that vision and dental care insurance is probably going to cost more than it provides in benefits. That is because the typical eye care and dental care costs are usually fairly consistent. Dental care is largely preventative care, and you can keep those costs low by taking care of the hard white (or yellowish) sharp pointy structures in your mouth.

Vision care is a function of your individual needs. You may never need glasses or contact lens replacements. You might need more frequent exams. While I don’t have any scientific data or survey results, I strongly suspect that most people do not get annual eye exams unless they have some serious vision problems. My brother-in-law, for example, has many eye examinations and treatments at the VA hospital. However, most of the time I don’t need to have a change to my progressive bifocal prescription. While the glasses I wear every day have a slightly different prescription than the ones I had four years ago, my sunglasses have the old prescription and work just fine for driving.

Health Care Coverage In Retirement is More Complicated

When you reach age 65 you must enroll in Medicare Part A, and it is prudent to purchase a Medicare Part B supplement policy. You also need to have a prescription drug “Part D” policy that has a separate premium. I won’t cover this in painful detail. The goal is to talk about the main pieces of the puzzle and what we did to keep costs rational for what we hope are relatively long lives.

Medicare Part A is the key component of Medicare coverage and it costs “nothing.” It is hospital insurance and helps pay for inpatient care at hospitals, skilled nursing facilities, hospice, and some outpatient home health care. (See https://www.ssa.gov/medicare/plan/medicare-parts)

Part A is free if you worked and paid Medicare taxes for at least 10 years. You may also be eligible because of your current or former spouse’s work.” Source: Medicare

Part B is medical insurance that helps cover services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventative services.

You will probably have to pay for this insurance. Most people pay a monthly premium for Part B. The exact premium depends on your income level. In our case, our monthly Medicare premiums are deducted from our Social Security each month.

During 2023, both Cindie and I had a total of $1,978.80 (each) deducted from our Social Security income. Therefore, the Part B coverage provided by the US government was $3,957.60.

In 2024, each of us has $174.70 deducted from our monthly Social Security deposit for Medicare Part B insurance. That means our total 2024 cost will be $4,192.80. This is roughly half of the total cost for health care insurance. If you aren’t drawing Social Security, then you can pay the premium directly.

Medicare Supplemental Insurance or “Advantage Plans?”

As you might expect, the Medicare solution is not complete. The government does not cover all costs for all things you might need. Some companies offer “supplemental” insurance, and you can also opt for “Advantage” plans. If you want the advantage plan (these are heavily promoted on television) be aware that you are getting locked into something that you might regret down the road.

Private companies run Parts C (Medicare Advantage) and D (Drugs). While the federal government approves each plan, costs and coverage types vary by provider. Part C is known as Medicare Advantage. It’s an alternative to Parts A and B that bundles several coverage types, including Parts A, B, and usually D. It may also include vision, hearing, and dental insurance. That sounds nice, but read the fine print before you go down that path.

I went to several presentations from different providers when I first looked at my options. I concluded that Medicare advantage plans have weaknesses that I wanted to avoid.

Here is a quote from NerdWallet that is most instructive: “Medicare Advantage networks and coverage can change year to year. It’s important to understand that if you have a serious health issue, you may not have access to the specialists you prefer if they’re out-of-network.” They go on to say, “The insurance carrier is in charge, and they get to decide what’s medically necessary or not, instead of the government,” says Scott Schwalich, a certified financial planner in Centerville, Ohio. “The insurance carrier is a little more profit conscious, and they’re a little bit more stringent on what is medically necessary in some situations.” SOURCE: NerdWallet

There is another reason I wanted to avoid the “Advantage” plan. “If you choose a Medicare Advantage plan, you may not be able to switch back later to Original Medicare with a Medigap plan.”

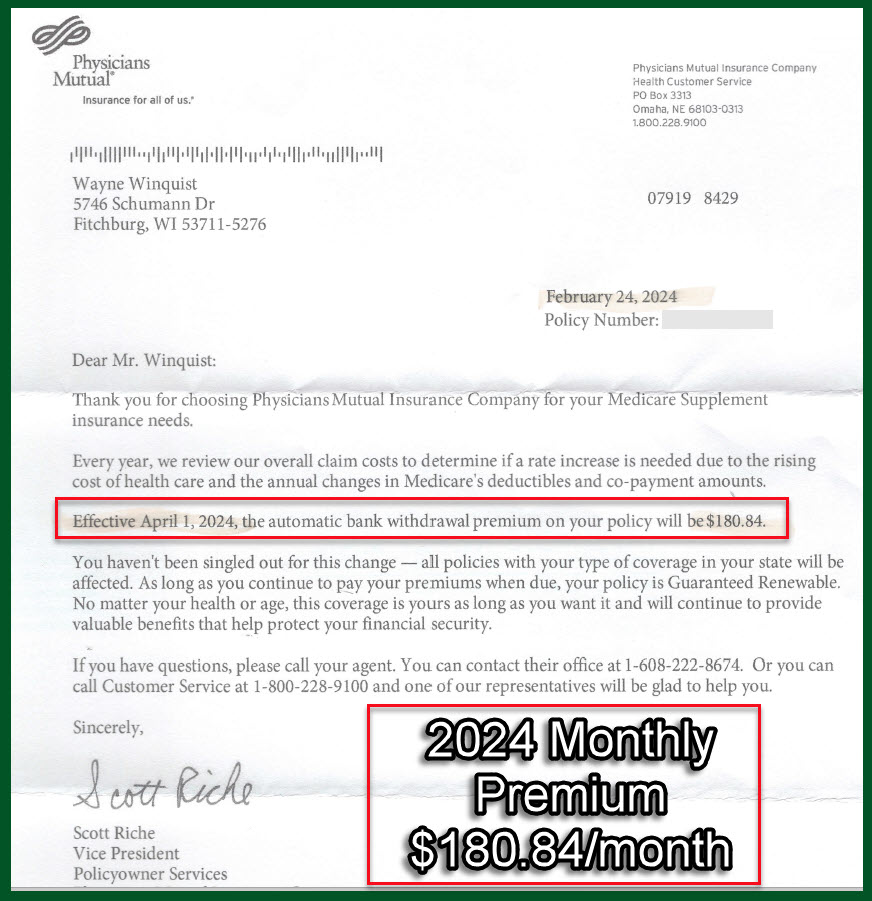

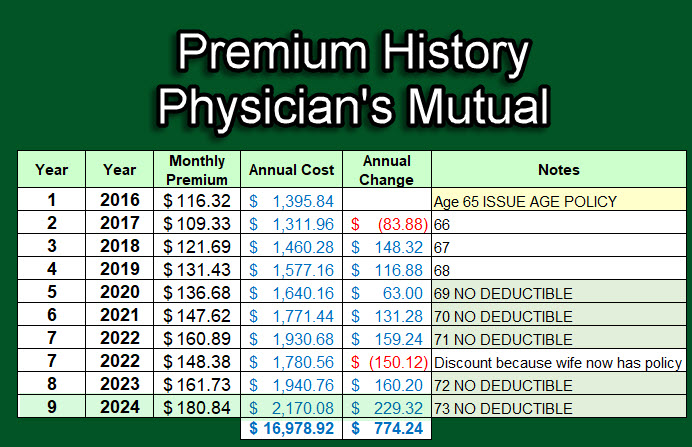

We Chose Physicians Mutual for Our Supplemental Coverage

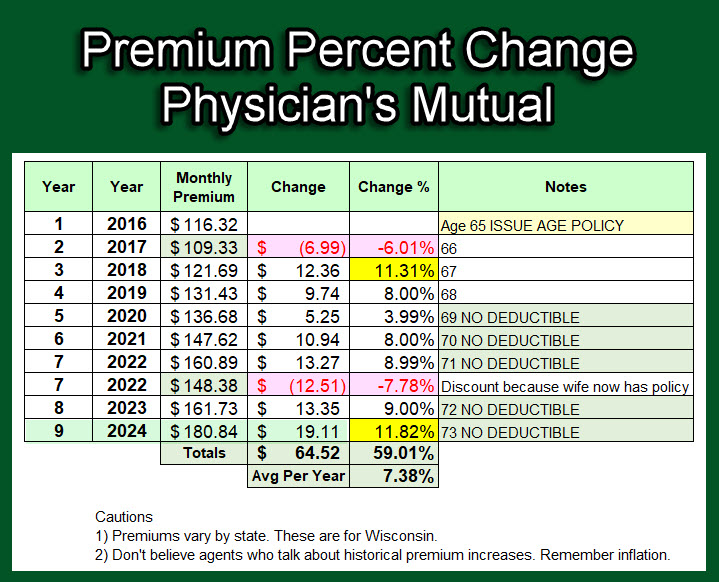

I’m not going to bore you with the details. I did research that included talking to other retirees, attending seminars, and getting a report I paid for from Weiss Research. Physicians Mutual rose to the top for Wisconsin providers.

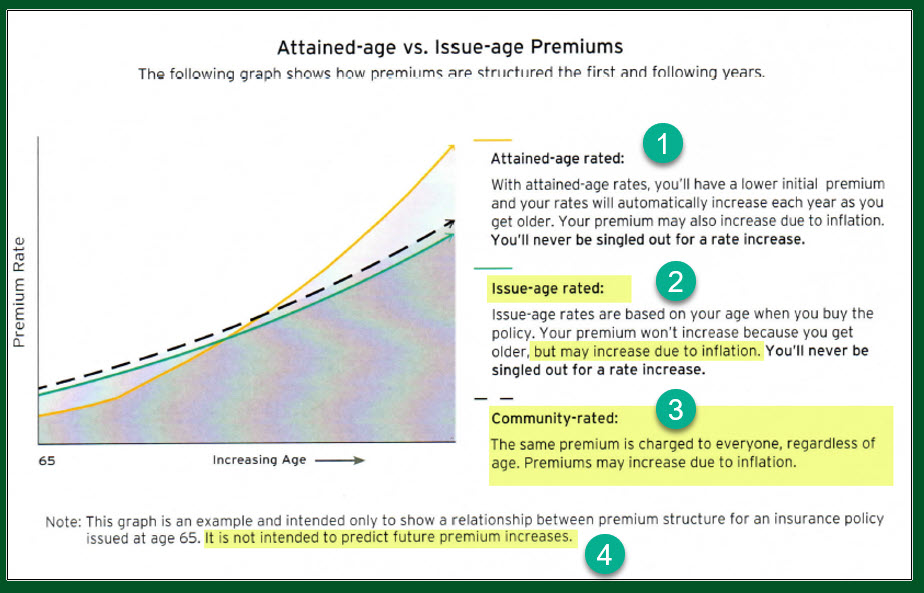

The most critical cost component is your age. As you get older, if you purchase a policy that is “attained age related” it means you will pay more each year as you get older like the older people in that group. That means your costs will increase more quickly than the costs for the 65-year-old retiree who just enters Medicare for the first time.

Cindie and I decided to buy the “issue age rated” policy. There were some upfront risks with deductibles, but ultimately Cindie and I will continue to have premiums that match the premiums of other 65-year-old adults even if we are 75 or 85 or 95. In other words, we will still see inflation, but it will only be the cost required of a “young” retiree.

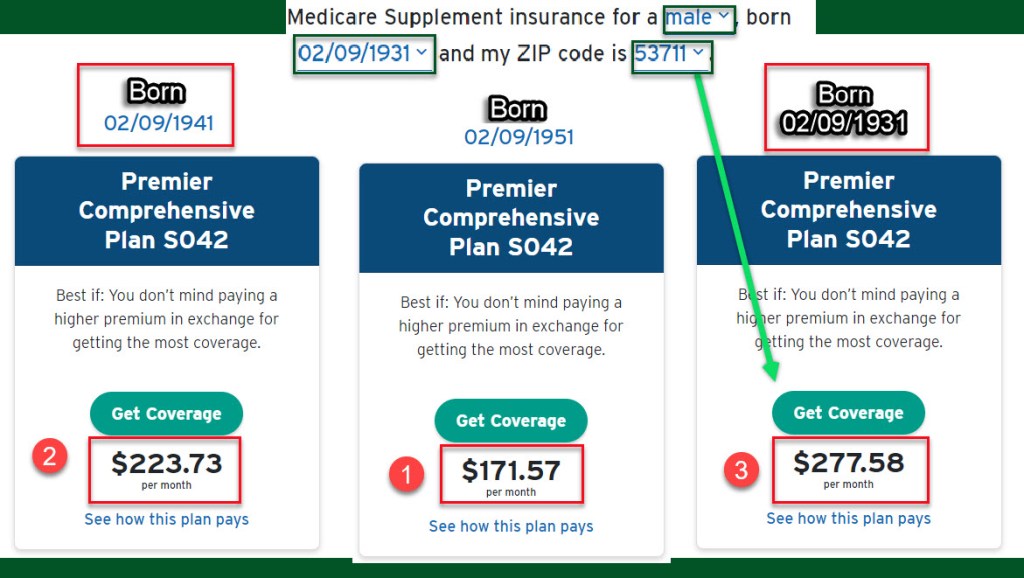

It is true that I don’t know what other 73-year-olds are paying for Medicare coverage. However, I quick check using the Physician’s Mutual web site shows that older insurance applicants will pay more than younger men. If I was born in 1944, I would pay at least $206 dollars per month, and if I was born in 1941, I would pay $224 per month. If I had been born in 1931 my monthly premium would be $277 per month. I am paying about $181 per month, which makes sense based on the dates I entered.

Medicare Part D (Prescription Drugs)

Thankfully, Cindie and I don’t need ongoing prescriptions. I don’t take any doctor-prescribed medications and Cindie is also very healthy. That means our costs for drug insurance is very low. My premium is less than $120 per month, and Cindie pays $115 per month. Your insurance provider can help you pick the right Medicare Part D provider. The good news is that you can change from one provider to another if costs increase. I switched because my previous provider thought they could dramatically raise prices and that I would just pay up. They were wrong.

Suggestions

Think carefully and critically about the supposed advantages of the Medicare “Advantage” plan approach to health coverage in retirement. Any time I see something heavily advertised I view that as at least a caution flag.

If you opt for a supplemental policy, which I believe is the best choice, then the “attained age related” policy has built-in dangers for costs related to age. Give serious thought to the option called “issue age rated” so that you always are “youngish” each year as costs go up. It generally costs more to take care of the health needs of someone who is 65, instead of 85 or 95.

Finally, consider using Weiss Ratings Medigap to get a report to help you choose the right Medigap supplement insurance. You can get a customized “Guide to Choosing the Best (and Most Affordable) Medicare Supplement Insurance For You.” LINK

What I did not Cover

Because long-term care insurance is often a concern for many retirees, I realize that I did not discuss this type of insurance. I’ve done the math on those policies and have concluded that it is best to be self-insured for long-term care. Of course, that is because I started early in our savings and investing, so that the income from our investments can pay for long-term care in our area.