Easy Income Increases

In January there was only one dividend increase announcement for our portfolio holdings, and it was a small one. February was a different story. Four of our holdings increased their dividend, and six positions declared a supplemental dividend. The purpose of this post is to summarize those gains in four tables. Before we go there, it is helpful to review my EIS strategy.

Ten Characteristics of the Easy Income Strategy (EIS)

- My EIS is based on long-term thinking. It is best to ignore market volatility or sector-dependent factors. Each investment is chosen based on the merits of that holding, not the views of short-term traders. As a result, income should continue for the majority of the stocks and ETFs I buy and hold. There is no need to panic during a bear market or when volatility is high.

- Investments must be “easy” in the sense that they don’t require a lot of time, effort, or ongoing maintenance. The idea in retirement is to focus on things that are more important than investing.

- EIS investments should provide, for many positions, growing dividends that are based on a rational dividend payout ratio. The dividend payout ratio is one helpful indicator to know whether or not it is possible for the company to maintain and increase their dividend, if revenue and earnings continue to grow.

- EIS investments can include investments that others view as “high risk” like REITs and BDCs. These often have higher yields. It is best to review REITs understanding that their payout ratios will be higher due to the requirements of the law. BDCs may also be viewed as higher risk, but only if the BDC has factors that are the result of the BDCs management’s decisions.

- Easy income must include good diversification. ETFs are a good way to diversify and realize growing income. My top three favorite ETFs for dividend growth are DGRO, SCHD, and VYM.

- Companies that cut or suspend their dividends are usually sold and replaced. When I make exceptions, I will explain why. No one likes a cut in their pay. Two exceptions I have weathered are Ford and MPW.

- The EIS focus is income that is most appropriate in retirement or in the 5-10 years leading up to retirement. It is not a growth stock focus. However, I do buy growth stocks that don’t pay dividends and trade covered call options on those positions

- Dividend yield is important, but not at the expense of reasonable safety. My yield goal for the portfolio is roughly 5%.

- Easy income makes it less likely that you have to sell an investment to generate income in retirement. You don’t want to sell investments in a bear market.

- My goal was to fund my Traditional IRA RMD (Required Minimum Distributions) with dividends, not by selling positions for cash withdrawals.

EIS February 2024 Dividend Increases

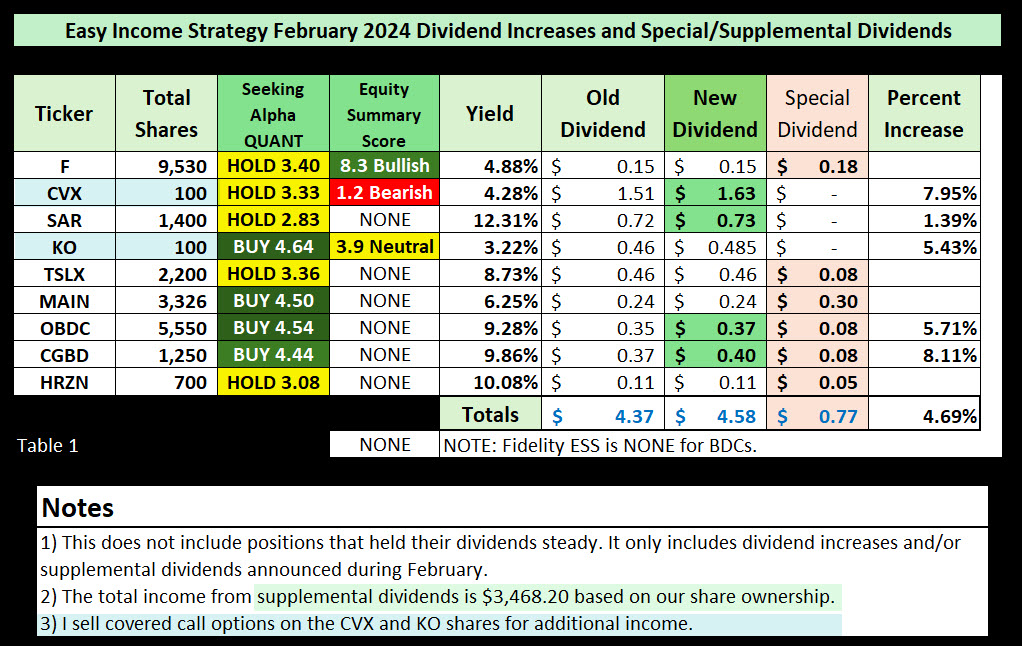

TABLE 1 summarizes any company that increased their dividend or paid a supplemental dividend. Although supplemental dividends or special dividends are not recurring, they are like walking into your boss’s office and learning that you will receive a bonus. In two cases, OBDC and CGBD, there is not only a dividend increase but a supplemental dividend.

a) This table does not include positions that held their dividends steady. It only includes dividend increases and/or supplemental dividends announced during February. Some announcements in February were just holding steady with the existing dividend amount. There were no reductions in any dividend payments in February.

b) I sell covered call options on the CVX and KO shares for additional income. I call this income “synthetic” dividends because I can generate this income at any point during the month.

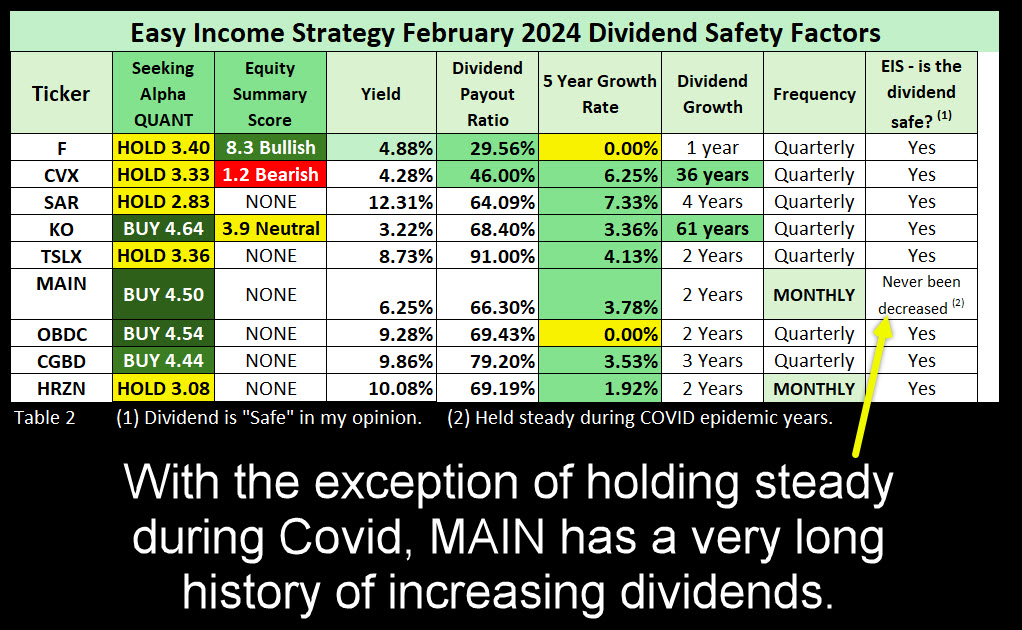

February 2024 Dividend Safety Factors

Just because I think a dividend is “safe” doesn’t mean there is no risk. The best way to tell if a dividend is sustainable is to look at the dividend payout ratio as shown in TABLE 2. If the ratio is above 100% it is clearly unsustainable. This means the company is paying a dividend greater than the profits received from business activities. Typically, BDCs and REITs will have higher payout ratios. For other investments, I like to see payout ratios between 20-70%.

Another safety factor is dividend history. If a company, like Coca Cola has paid a growing dividend for 36 years, it is unlikely that this trend will end. Of course, the key word is “unlikely.” Some companies that paid increasing dividends went out of business during our lifetimes.

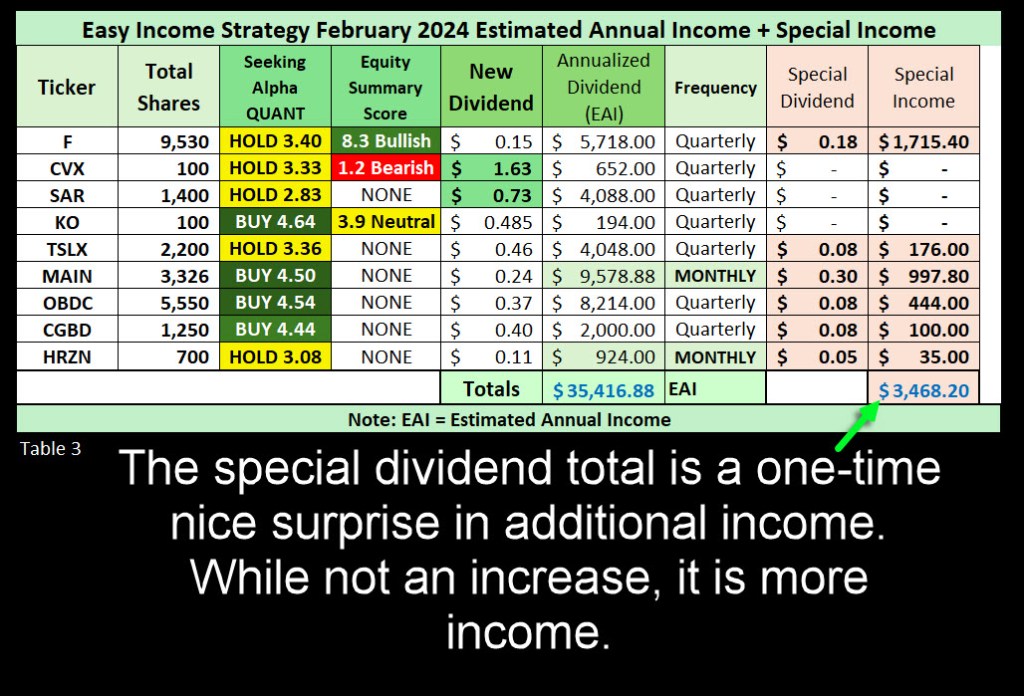

February 2024 Estimated Annual Income + Special Income

The nine positions shown in TABLE 3 are likely to deliver annualized income of $35,417 just from quarterly or monthly dividends. But there is a bonus. The positions that pay a special dividend are contributing a one-time bonus of $3,468. Bear in mind that some of this income is in our ROTH IRA accounts, so a large chunk of this income is tax-free.

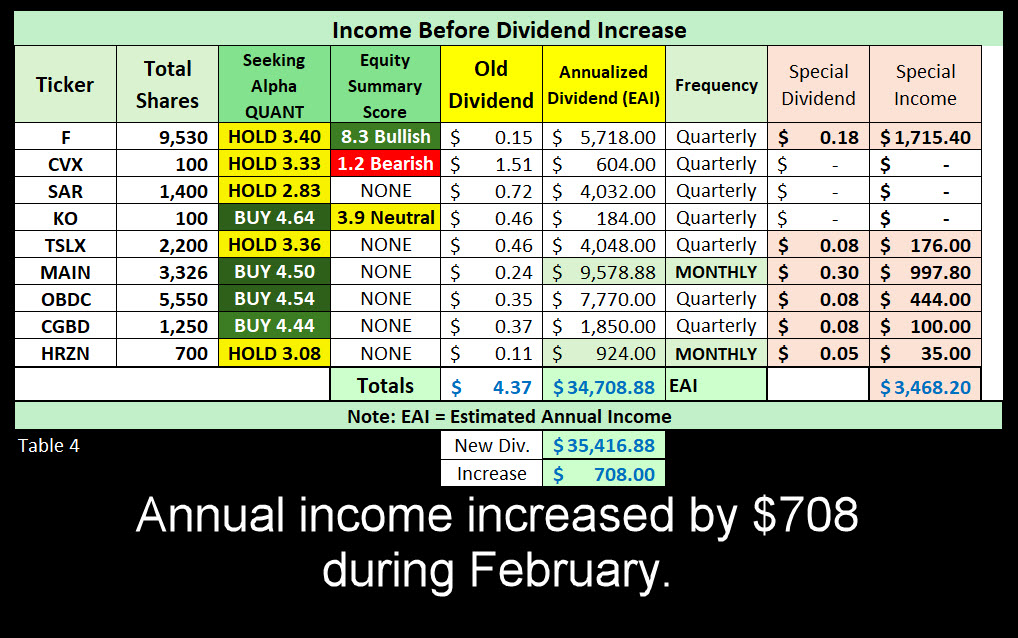

Income Before Dividend Increase

TABLE 4 reveals the income we would have received if the dividends had not increased. As you can see, we can expect to see another $708 in estimated annual income from these nine positions during the next twelve months. This assumes, of course, that there are no dividend reductions for any of the nine. When you add in the special dividends, our annualized income increases to $4,176.

Recommendation

Six of the nine investments are in the financial sector. Don’t buy investments just because they are in this table, or just because the QUANT rating is “BUY.” Ask questions if you don’t understand an investment. The first step is always to know the risks before you grab the rewards.

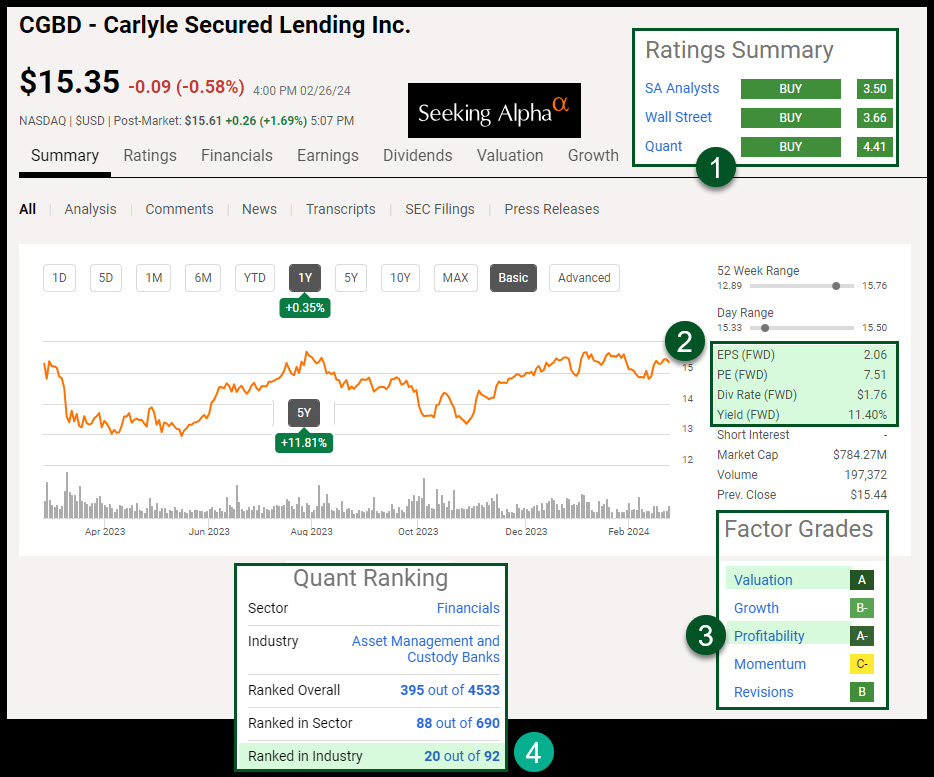

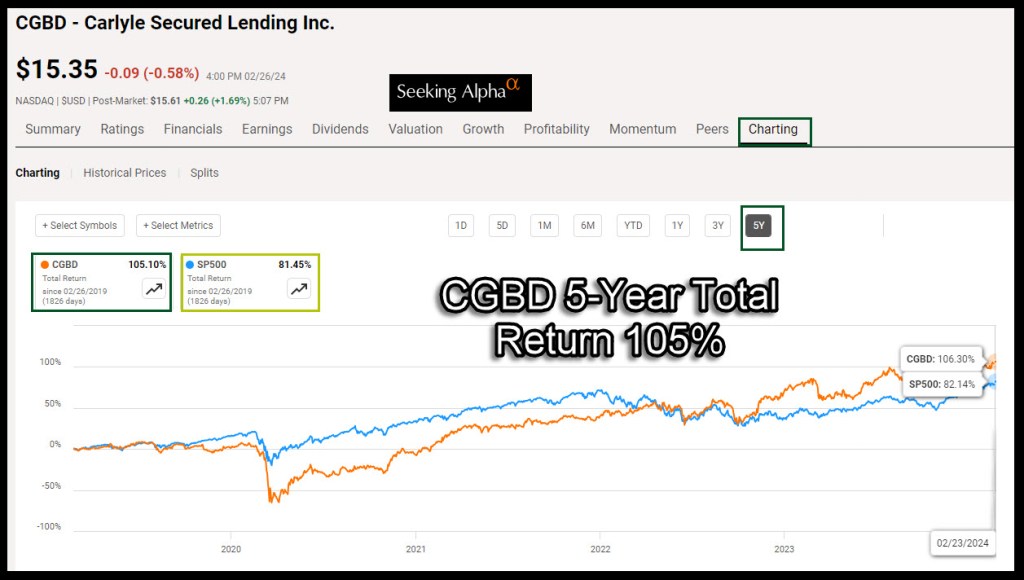

A Quick Look at CGBD

Carlyle Secured Lending Inc. is a relative newcomer to the BDC fold. It is a business development company specializing in first lien debt, senior secured loans, second lien senior secured loan unsecured debt, mezzanine debt and investments in equities. It specializes in directly investing. It specializes in middle market. It targets healthcare and pharmaceutical, aerospace and defense, high tech industries, business services, software, beverage food and tobacco, hotel gaming and leisure, banking finance insurance and in real estate sector. The fund seeks to invest across United States of America, Luxembourg, Cayman Islands, Cyprus, and United Kingdom. It invests in companies with EBITDA between $25 million and $100 million.