Our BDC Investments are on a Roll

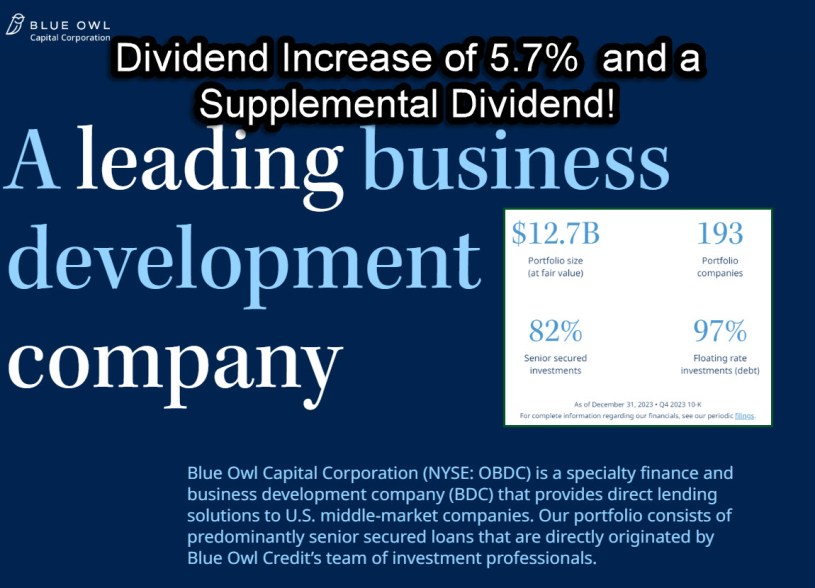

When I wrote about Business Development Companies TSLX and MAIN in my previous two posts, I said TSLX was paying a special dividend and MAIN calls their non-repeating “special” dividend a “supplemental” dividend. Now Blue Owl Capital, another BDC, has declared a dividend increase and a supplemental dividend. It doesn’t get better than that.

A closer look at BDCs

“A business development company (BDC) can be viewed as a wrapper or vehicle for investors to access ownership in a diversified pool of private credit assets. A BDC is a closed-end investment company, created by Congress through an amendment to the Investment Company Act of 1940 under Section 54 called the Small Business Investment Incentive Act of 1980. As the name suggests, the intention of the legislation was to promote capital investment by closed-end funds to an important part of the U.S. economy—small and middle-market businesses, which were struggling for access to debt and equity capital following the recession in the 1970s.” SOURCE: Blue Owl

A New Supplemental Dividend for OBDC

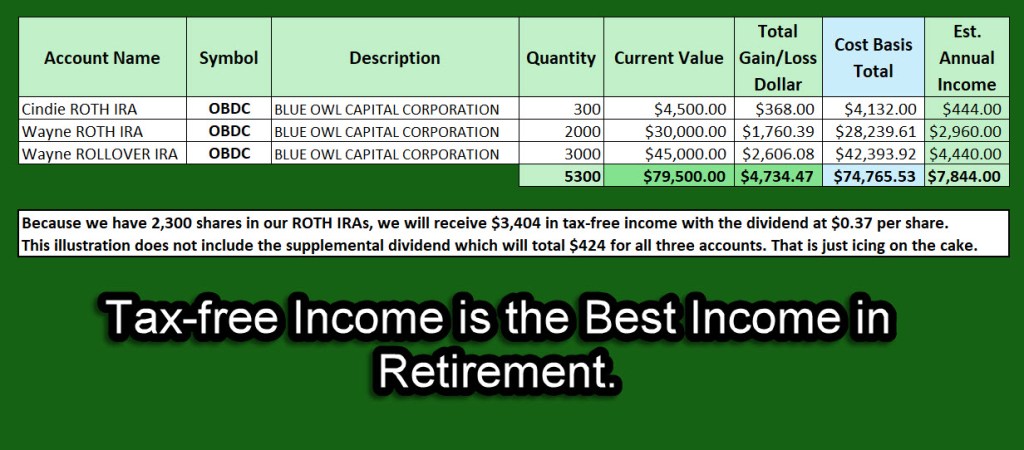

OBDC increased their quarterly dividend from $0.35 per share to $0.37 per share. In addition, the BDC is paying a supplemental dividend of $0.08 per share in March. OBDC does not have a strong history of paying supplemental dividends, so investors should welcome them when they arrive but not expect them as a normal thing.

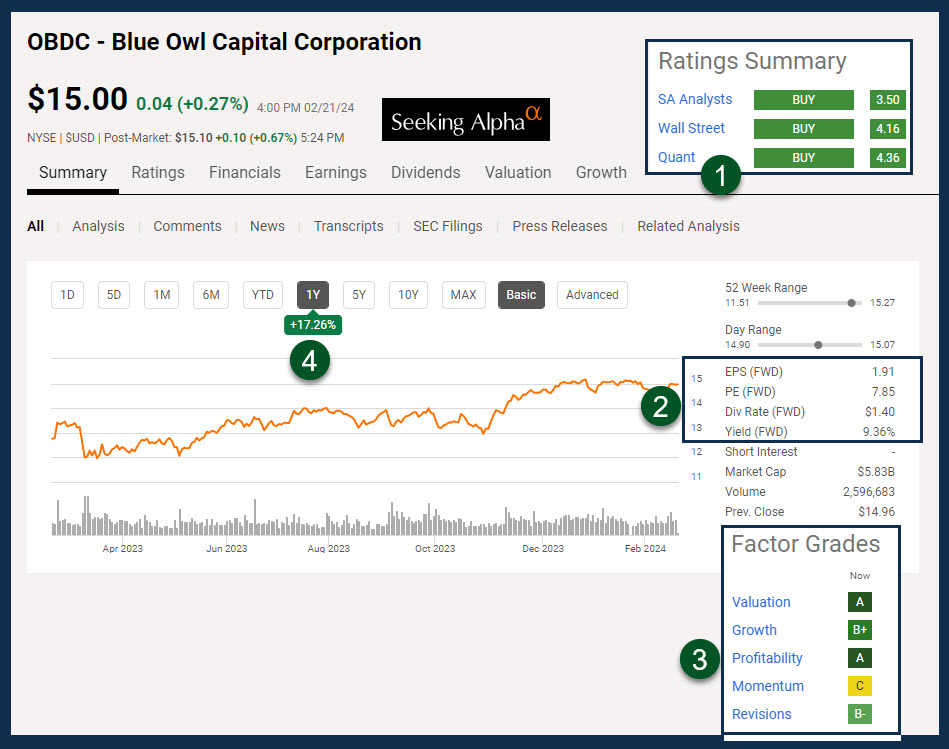

Total Three-Year Returns Are More Than Acceptable

OBDC is a relative BDC newcomer, but I am pleased with our holdings in this BDC. They started trading on the NYSE on July 22, 2019. Therefore, OBDC does not have a lot of history. For risk-averse investors, the shorter history of success might be a caution. However, I think the 3-year returns are acceptable. They are 46.59% compared to the S&P 500’s returns of 28.08% for the same time period.

Stock Rover Graph

The Stock Rover dividend graph might cause some investors concern. 2021-2022 show lower dividends. However, special dividends do play a part in this. OBDC paid four special dividends in 2023, and each time the dividend increased. It was $0.04, $.06, $0.07, and $0.08 for those four supplemental “special” dividends.

Diversification

If you want to see the holdings in this BDC, go to this link: BLUE OWL HOLDINGS

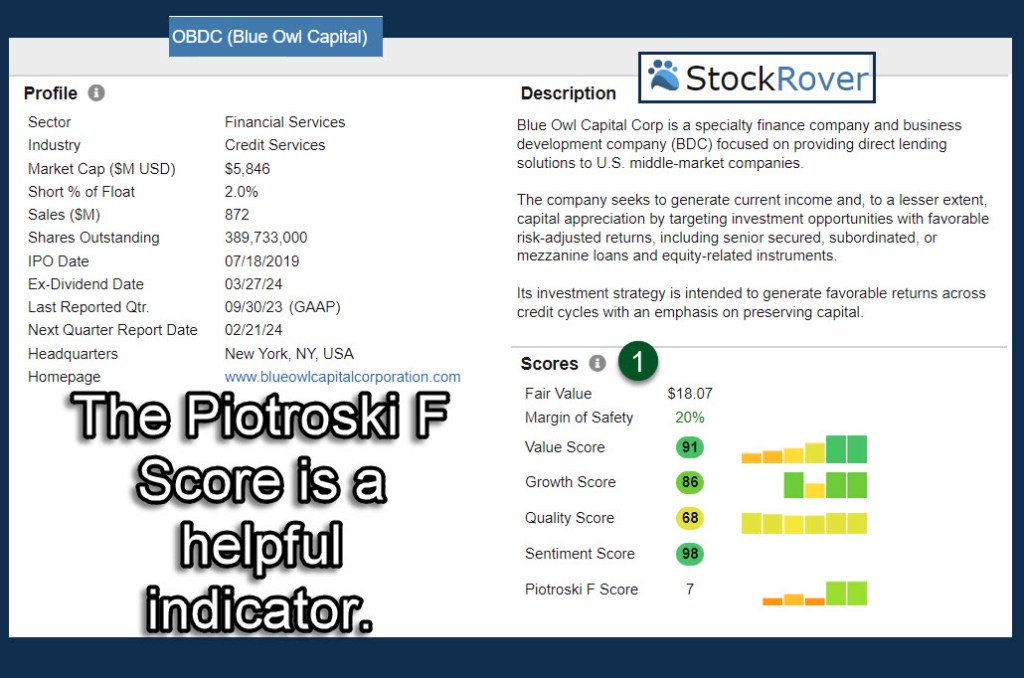

Company Profile

Blue Owl Capital Corporation is a business development company. It specializes in direct and fund of fund investments. The fund makes investments in senior secured, direct lending or unsecured loans, subordinated loans or mezzanine loans and also considers equity-related securities including warrants and preferred stocks also pursues preferred equity investments, first lien, unitranche, and second lien term loans and common equity investments. Within private equity, it seeks to invest in growth, acquisitions, market, or product expansion, refinancings and recapitalizations. It seeks to invest in middle market and upper middle market companies based in the United States, with EBITDA between $10 million and $250 million annually and/or annual revenue of $50 million and $2.5 billion at the time of investment. It seeks to invest in investments with maturities typically between three and ten years. It seeks to make investments generally ranging in size between $20 million and $250 million.

Recommendation

Obviously OBDC is not the only BDC in our portfolio, and it is one of my newer additions. OBDC is classified in the “Financial” sector, and they are in the “Financial Services” industry group. Other Financial Services investments we hold include ABR, ARCC, BCSF, CGBD, CSWC, GAIN, HRZN, MAIN, OMF, PNNT, SAR, and TSLX. If you want to enter the world of BDCs for your investments, think diversification. Don’t buy just one. If your portfolio is at least $250,000, then it might be a good income strategy in retirement to own shares of two or three different BDCs.

Full Disclosure

Cindie and I own 5,300 shares of OBDC as a long-term investment. It is NOT one of our Top Ten Holdings, but it is a significant investment.

If you want to see the holdings, go to this link: BLUE OWL HOLDINGS