WisdomTree U.S. Total Dividend Fund ETF

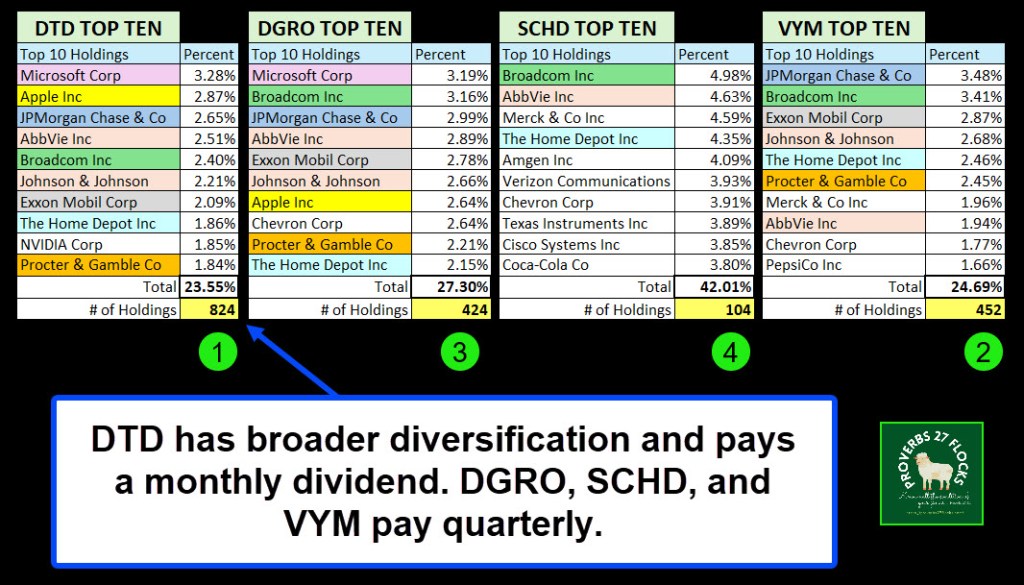

This ETF is classified as a “Large Value” fund. That means it invests in the big companies that are generally mature in their industries and are not likely to grow quickly. However, there are growth investments in DTD. The top ten companies include Microsoft Corp, Apple Inc, JPMorgan Chase & Co, AbbVie Inc, Broadcom Inc, Johnson & Johnson, Exxon Mobil Corp, NVIDIA Corp, Procter & Gamble Co, and The Home Depot Inc.

DTD – 824 Positions and Monthly Dividends

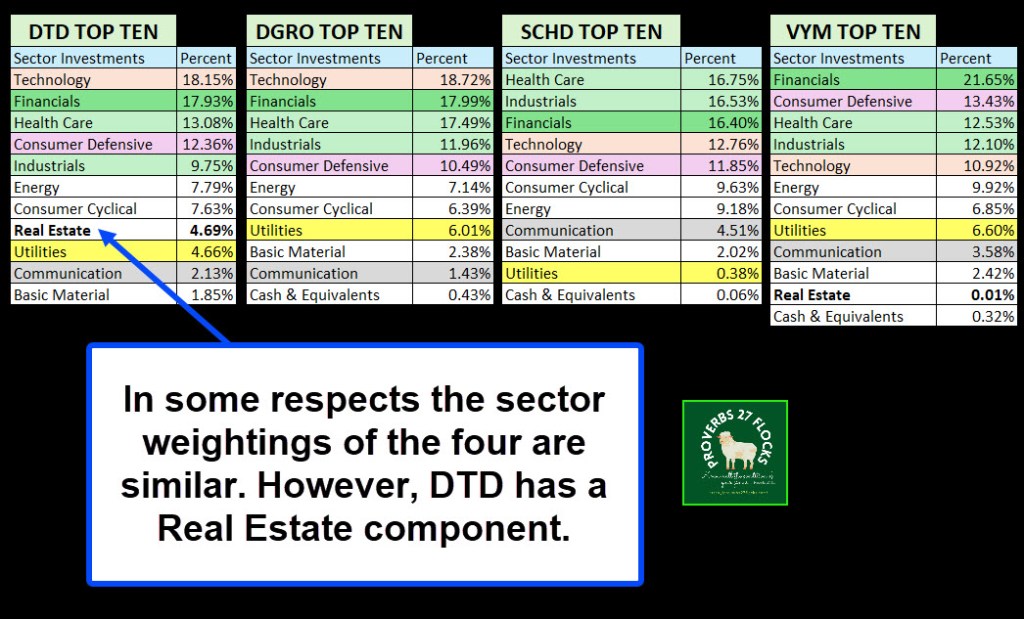

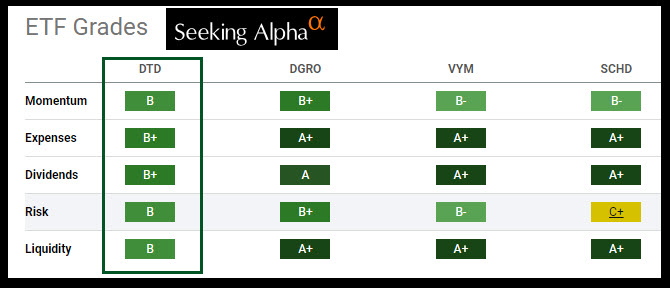

There are three reasons I am adding this to my normal mix of VYM, DGRO, and SCHD. First of all, DTD holds 824 companies that pay dividends. VYM is next with 452, DGRO has 424, and SCHD has 104. Because the focus is on dividends, there is an overlap in the top ten. The following two images show the sector mixes and the top ten holdings in all four ETFs.

The second reason is that this ETF pays a monthly dividend. The other three do not. If you are not retired, then monthly dividends may not have as much appeal to you. However, in retirement it is sometimes nice to have dividends rolling into our accounts every month.

The third reason is the ten-year returns. The ten-year price performance is about 100%. That is a good return for the long-term investor.

DTD’s Drawbacks

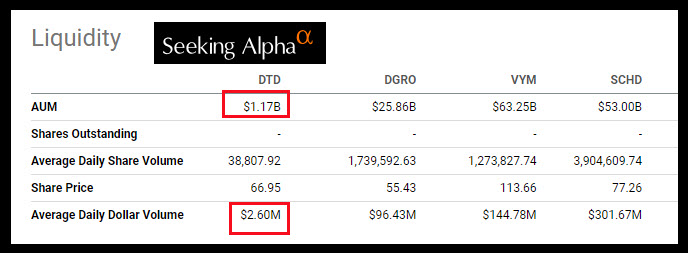

DTD is considerably smaller in assets under management (AUM). The other three ETFs are considerably larger. While one billion dollars in assets is not small, it certainly is not a large ETF in total dollars invested.

Also, DTD is thinly traded. This means that on any given trading day, relatively few shares are bought and sold. DTD has an average daily dollar volume of only $2.6 million, where DGRO, SCHD, and VYM are more actively traded. For long-term investors, this is less of an issue, but it also means you won’t be able to grab shares at a price much below the current price.

WisdomTree Offers Companion Funds for Small-Cap and Mid-Cap

DTD isn’t the only opportunity. There is also DES and DON. DES is the WisdomTree U.S. SmallCap Dividend Fund ETF and DON is the WisdomTree U.S. Mid-Cap Dividend Fund ETF.

Both of these also offer monthly dividends. DON’s ten-year returns are 78.68%, which isn’t terrible, but it isn’t as good as DTD. DES is even worse, at 39.23%.

DTD Fund Description

WisdomTree Trust – WisdomTree U.S. Total Dividend Fund is an exchange traded fund launched by WisdomTree, Inc. The fund is co-managed by Mellon Investments Corporation and WisdomTree Asset Management, Inc. It invests in public equity markets of the United States. It invests in stocks of companies operating across diversified sectors. It invests in growth and value stocks of companies across diversified market capitalization. It invests in dividend paying stocks of companies. The fund seeks to track the performance of the WisdomTree U.S. Dividend Index, by using representative sampling technique. WisdomTree Trust – WisdomTree U.S. Total Dividend Fund was formed on June 16, 2006 and is domiciled in the United States.

The index is a fundamentally-weighted index that is comprised of U.S. companies listed on a U.S. stock market that pay regular cash dividends.

Full Disclosure

Cindie and I own 350 shares of DTD as a long-term investment.

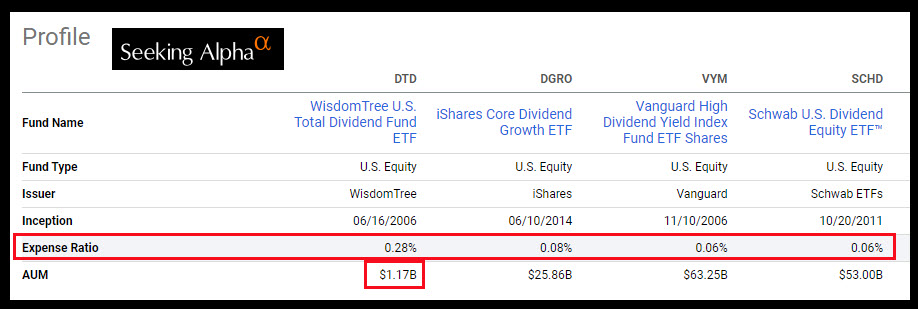

Thank you for your post. Question: DTD has an expense ratio of 0.28% vs 0.06 to 0.08% for VYM, DGRO and SCHD. Do you consider this a drawback or do your reasons for buying outweigh the higher expense ratio?

LikeLiked by 1 person

While it is true that DTD has a higher expense ratio, I am OK with a bit more of an expense ratio if it is less than 0.30% or if there are compelling reasons for the ETF’s unique positioning. Part of the reason for DTD is that there are a larger number of holdings. I am also willing to accept a slightly higher expense ratio for the monthly dividend. I have to believe the ETF managers have a bit more work to do to make the dividend a monthly goal.

LikeLiked by 1 person