Each One is Different But Good

Because I use Seeking Alpha, I receive email updates when any position I follow or own announces a dividend. Each time I verify that the dividend is either the same as the previous one or that the dividend increased. In the case of the four this week, all of which we own, the news is good.

The four are Ford (F), Chevron (CVX), PennantPark (PNNT), and Ares Capital (ARCC). A brief discussion is warranted as to the differences of each dividend. The good news is that in the first quarter I can be assured of dividends of $6,841.90 from just these four investments. That will be a lot of Culver’s lunches or dinners and groceries.

Easy Income Strategy Basics

Easy income must be automatic and require minimal effort. However, just because an ETF or a stock pays a dividend, it doesn’t necessarily mean that it merits inclusion in our investment mix. I generally want to pay attention to the Seeking Alpha QUANT rating, the dividend payout ratio, and the company’s history of paying dividends without surprises.

No one who works for a living wants their income next month to be less if they can help it. Therefore, dividend sustainability is a sensible requirement. For most investments the dividend payout ratio should be between 20-60%. However, for REITs and BDCs, it is normal and expected for those to pay 80-95% of the cash flowing into the company.

The Different Types of Dividend Announcements

FORD Gave a Gift

Ford: In the case of Ford, it is unique this time because their board declared a $0.15/share quarterly dividend, in line with previous quarter, and a $0.18/share supplemental dividend. While you cannot depend on supplemental dividends, they are a nice surprise. February is my birthday month, so Ford gave me an extra present. Both dividends are payable March 1 for shareholders of record Feb. 16 with an ex-div date of Feb. 15.

The forward yield 4.97%. Because Cindie and I currently have 9,530 shares, our total dividend we will receive on March 1 will be $3,144.90.

Ford Motor Company develops, delivers, and services a range of Ford trucks, commercial cars and vans, sport utility vehicles, and Lincoln luxury vehicles worldwide. It operates through Ford Blue, Ford Model e, and Ford Pro; Ford Next; and Ford Credit segments.

CHEVRON Raised The Dividend

Chevron also gave me a birthday present. CVX declared a $1.63/share quarterly dividend, which is a 7.9% increase from prior dividend of $1.51. The forward yield is 4.41% and the dividend is payable March 11 for shareholders of record Feb. 16 with an ex-div date of Feb. 15.

Because I currently have 100 shares, our total dividend we will receive will be $163.

Chevron Corporation, through its subsidiaries, engages in the integrated energy and chemicals operations in the United States and internationally. The company operates in two segments, Upstream and Downstream.

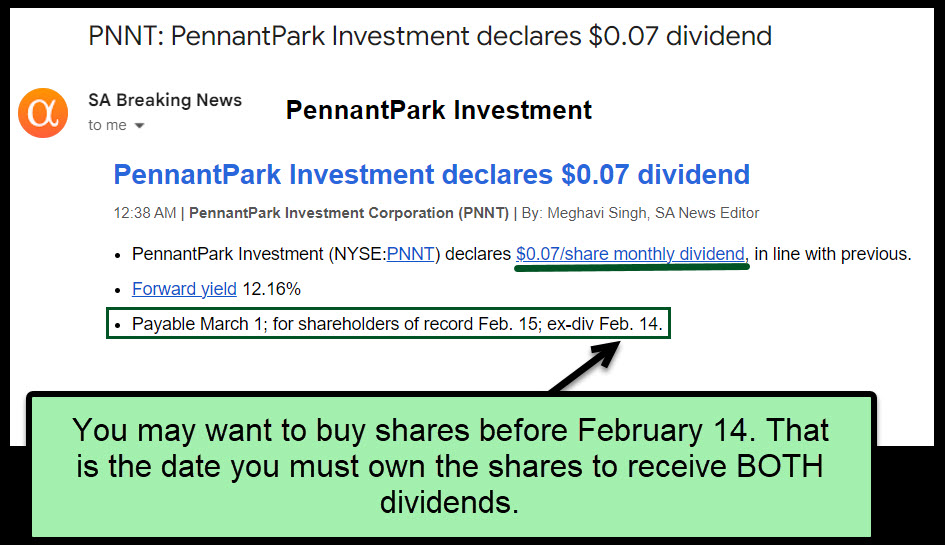

PennantPark Investment Pays Monthly

PNNT declared a $0.07 dividend that is paid monthly. This is normal and it has a high forward yield of 12.16%. Because PNNT is a BDC, they can afford to pay out a larger percentage of their income in dividends. The dividend is payable March 1 for shareholders of record Feb. 15 with an ex-div date of Feb. 14.

Because Cindie and I currently have 3,800 shares, our total dividend we will receive on March 1 will be $266. However, remember that PNNT pays the dividend monthly, so the estimated quarterly income from this investment is $798.

PennantPark Investment Corporation, a business development company, is a private equity fund specializes in direct and mezzanine investments in middle market companies. It invests in the form of mezzanine debt, senior secured loans, and equity investments.

Ares Capital Corporation Rounds Out the Four

Ares Capital declared a $0.48/share quarterly dividend, in line with previous. This investment sports a forward yield of 9.63% according to the email I received. The dividend is payable March 29 for shareholders of record March 15 with an ex-div date of March 14.

Because Cindie and I currently have 5,700 shares, our total dividend we will receive on March 29 will be $2,736.

Ares Capital Corporation is a business development company specializing in acquisition, recapitalization, mezzanine debt, restructurings, rescue financing, and leveraged buyout transactions of middle market companies. It also makes growth capital and general refinancing. It prefers to make investments in companies engaged in the basic and growth manufacturing, business services, consumer products, health care products and services, and information technology service sectors.

Comparing the Four

I created the following table so that you can see how I look at the Easy Income Strategy investments. There are no alarm bells ringing, so we will not be selling our shares.

I like easy income. While some think it is better to have growth investments, and that does make sense in the early years of saving for retirement, you cannot pay the bills with growth. Therefore, in retirement, I think dividend growth investing is the easy way to get cash for life.