Long-Term or Short-Term Strategy?

I believe investors should focus on a long-term strategy for 95% of their portfolio. However, careful investment of 2-3% can result in some amazing short-term profits. Even a non-dividend stock can produce income in the form of capital gain profit. In just a couple of days I received a profit of $760, or 22.1% on a portion of my PTLR shares. I bought the shares on Friday via an option trade, and sold two thirds of the shares on Tuesday.

The Background

On January 29 I entered a buy call option trade for three contracts of PLTR, or 300 shares. This cost me $68.03. The shares had to rise to $17 by February 2 in order for the contract to work in my favor. They just barely did. But they did, so I bought 300 shares of PLTR on Monday, February 5 for $17 per share, or a total cost of $5,100. If you add in the $68.03, I paid for the option contract, my cost basis for the 300 shares was $5,168.03, or $17.23 per share.

This was a Two-Fold Strategic Purchase

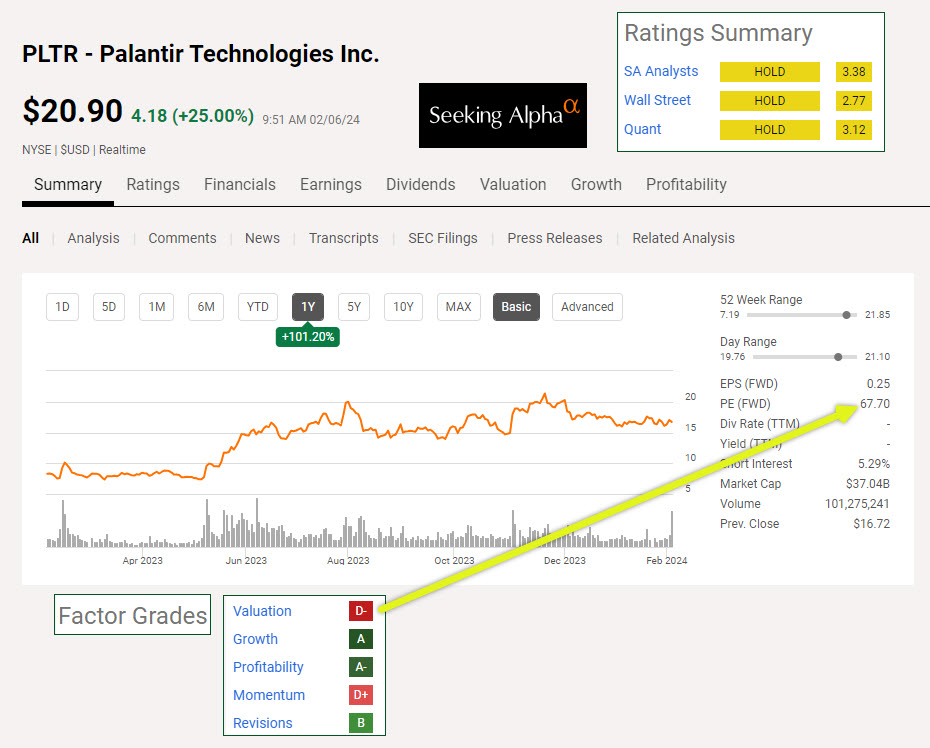

I have owned PLTR shares in the past, and each time I sold the shares I made a profit. In 2021-2022 I realized a profit of $423 from a couple of trades, including some covered call options trades. There are two things that attracted me back to PLTR. The first is that they were scheduled to announce earnings yesterday. They did, and their results were very good. Therefore, early this morning everyone was trying to purchase PLTR shares.

The second piece of the strategy has to do with their industry. Palantir Technologies builds and deploys software platforms for the intelligence community in the United States to assist in counterterrorism investigations and operations. It is an artificial intelligence software company. If you have been following the news, AI (Artificial Intelligence) is all the rage. The stock in several companies deemed to be involved with AI have gone up quickly, including AMD, SMCI, and even good old IBM.

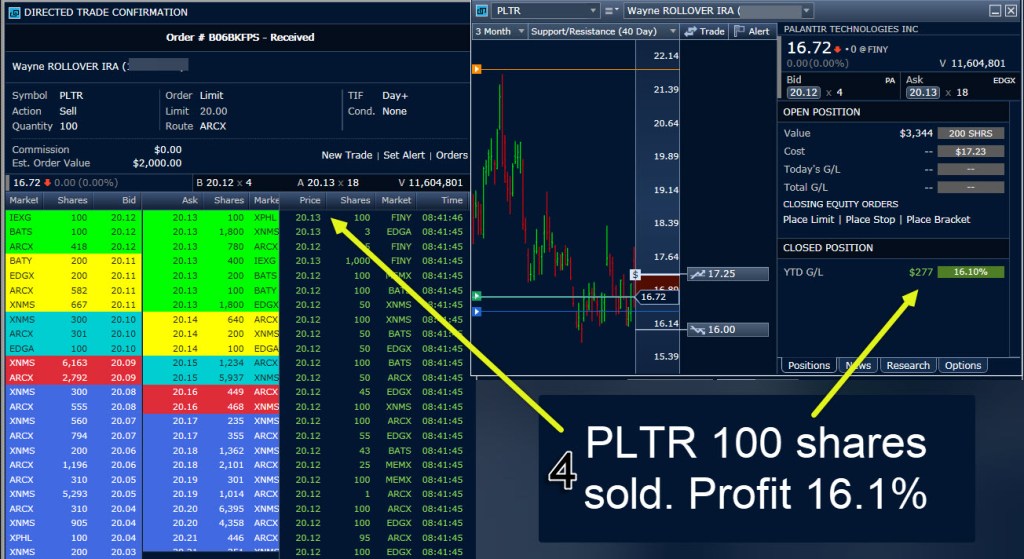

In just a couple of days I beat that former result by earning the $760 yesterday. In the following images I demonstrate how I set up my trades on 200 of the 300 shares I owned.

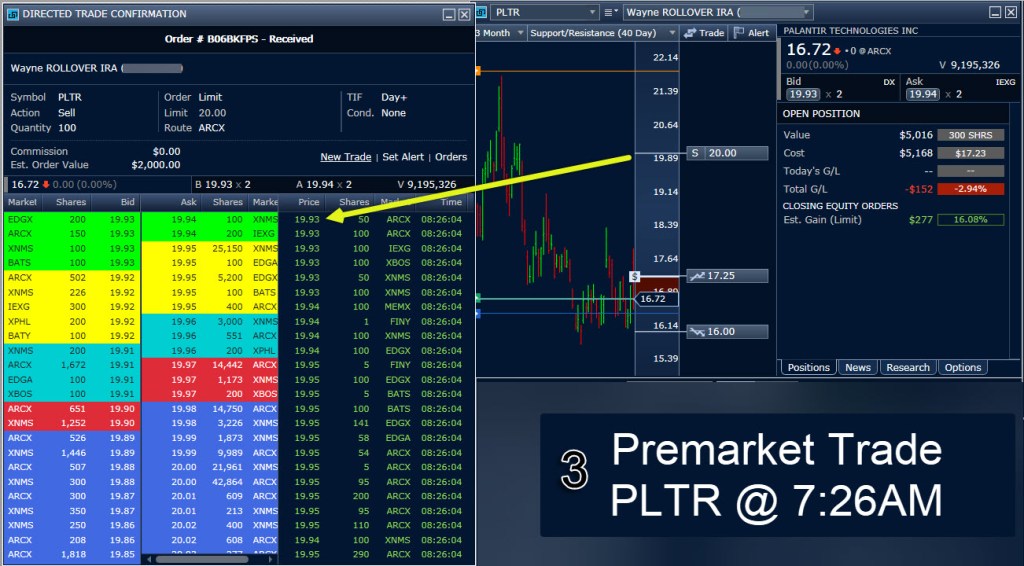

A Premarket Sell Limit Order for $20 per Share

Using the Fidelity Active Trader Pro software, I can observe the going prices of any stock or ETF before the stock market opens. In this first image, on the left-hand side, you can see that I entered a sell limit order for 100 of my 300 shares at $20 per share. $20 is well above my cost of $17.23 per share. Therefore, my estimated gain on the sale of one third of my shares is $277 or about 16.1%. That is a very nice one-day profit.

The “TIF” is the time the order is in force. The “Day+” means that I am willing to sell my shares before the market opens. At the time I entered this order, shares were trading around $19.50 per share, so I wanted another fifty cents before I would sell.

At 6:41 AM the price being offered by buyers of PLTR shares had risen to $19.63. The “BID” price is the price a buyer is willing to pay to buy shares. The “ASK” price is the price the seller wants for his shares. If you look at this image you will see that my ask price does not appear. The ask prices range from $19.64 to $19.73. But I am a patient seller.

At 7:26 AM the price being offered by buyers of PLTR shares had risen to $19.93. At that point I could have changed my sell price upward, but I have learned not to be greedy and I left my sell price at $20.

At 7:42 AM, before the stock market opened, my first lot of 100 shares sold at $20, giving me a profit of $277 on those shares.

A Premarket Sell Limit Order for $22 per Share

At 7:45 AM, before the stock market opened, I entered a sell limit order to offer my next 100 shares at $22 per share. If my shares sold at any point during the day, I would realize another $477 in profit or about 27.7% profit in just one day.

At about 9:23 AM, it appeared likely that my shares would sell for $22 per share. So I increased my sell price to $22.05 to increase my profit potential to $482 or about 28%.

At 2:04 PM my 100 shares sold. Now I have 100 shares remaining. Those shares are worth far more than I paid for them. I can now enter another order tomorrow at a higher price, or I can start trading a covered call option on the remaining 100 shares. For example, I can enter an option contract to sell the shares for $22.50 per share, and someone (at the current time) is willing to pay me $37 for that opportunity. The contract, if I entered it, would expire on Friday.

Next Steps

I could buy more PLTR shares if the price drops below $20 per share and then start selling covered call options on the shares I own. I could also sell a cash covered put option to buy shares if the price drops below $20. In either case I would add to my PLTR profits.

Palantir Technologies Inc.

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community in the United States to assist in counterterrorism investigations and operations. The company provides Palantir Gotham, a software platform which enables users to identify patterns hidden deep within datasets, ranging from signals intelligence sources to reports from confidential informants, as well as facilitates the handoff between analysts and operational users, helping operators plan and execute real-world responses to threats that have been identified within the platform. It also offers Palantir Foundry, a platform that transforms the ways organizations operate by creating a central operating system for their data; and allows individual users to integrate and analyze the data they need in one place. In addition, it provides Palantir Apollo, a software that enables customers to deploy their own software virtually in any environment. Palantir Technologies Inc. was incorporated in 2003 and is based in Denver, Colorado.

Full Disclosure

I own 100 shares of PLTR as a short-term investment. It is an opportunistic holding. I don’t think market euphoria is sustainable, even if PLTR is an excellent investment.