Four Choices

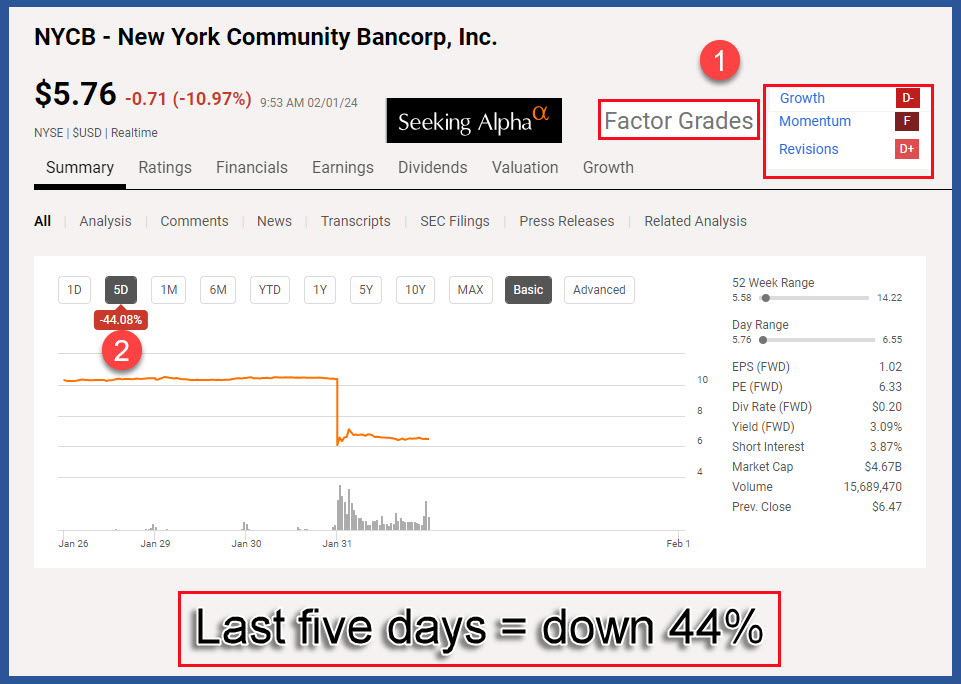

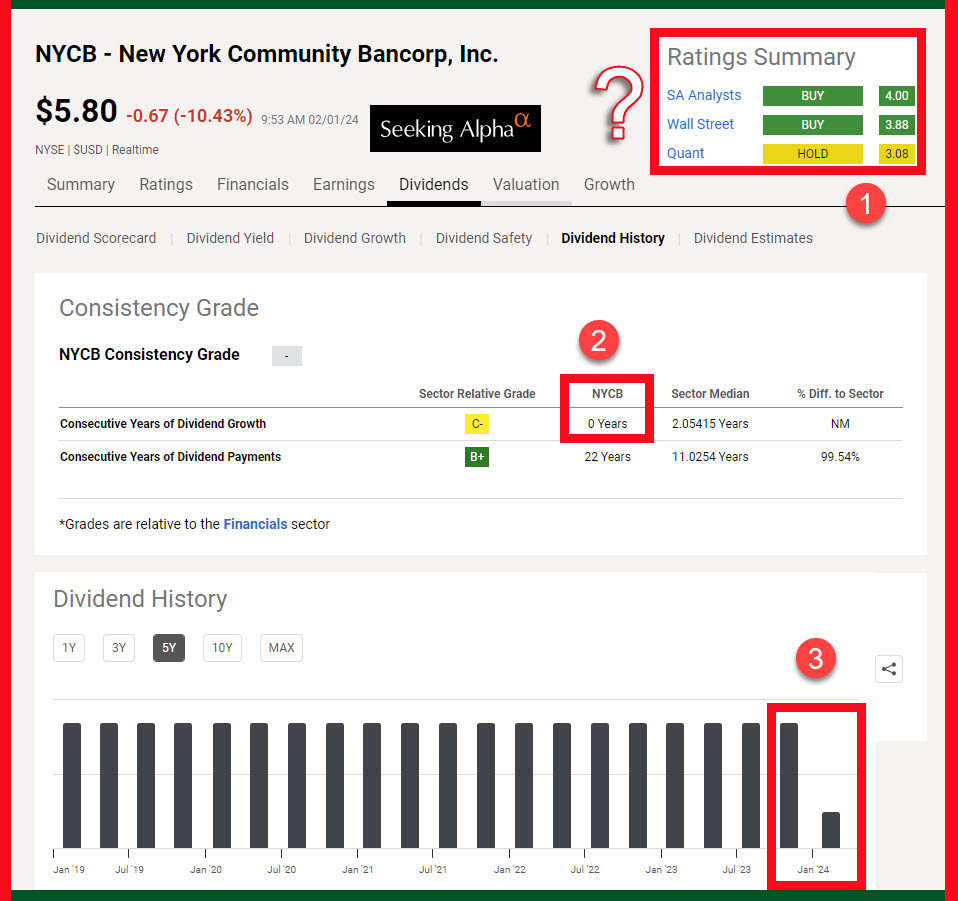

When a business reduces or eliminates their dividend, a dividend growth investor should sit up and take notice. NYCB (New York Community Bancorp, Inc.) reduced their dividend from seventeen cents per quarter to five cents. Whenever that happens at the same time that negative earnings are released, many investors run very quickly for the exit. That happened yesterday and is happening again today as more catch on to the troubles facing this bank.

The four choices are, buy shares, sell shares, hold the shares you have, or do nothing. Because we don’t own shares of NYCB, I don’t have to sell or hold. I will not be buying, so I will do nothing. However, Quad 7 Capital, a team made up of former asset management fund analysts, and contributors on Seeking Alpha say, “for traders, and long-term investors, the bank is growing and making strategic moves to secure its future. We think shares rebound in the coming weeks and months from the $6 level.” In other words, they think this is the time to buy. Let me explain how I look at this bank.

Weiss Ratings

I am amused when I see the rating Weiss gives this bank. Currently they rate the investment as a HOLD. However, if you look at the returns for any time period, you would have to ask, “Why isn’t this a D- investment? Perhaps they are right, so let’s look at StockRover.

Stock Rover

StockRover has a number of warnings about this bank. Here are just four of them: (Name of the Warning, Severity, Details, and their Explanation)

Earnings Miss Medium Act. EPS: -$0.27; Last Qtr. Exp. EPS: $0.29 This company reported lower EPS than was expected last quarter.

Negative Sales Growth Years Medium Number of Years: 7; Sales 1Y change (%): 114.0% In the last decade this company has had several years with negative revenue growth. If the top-line sales are shrinking this company could be a value trap that looks inexpensive on some measures but never outperforms the market.

Low Sentiment Score Medium Sentiment Score: 5 The sentiment score for this company is low. The stock has worse momentum than most other stocks. Contrarian investors love this sort of stock but be sure to understand why it is out of favor.

Number of Earnings Misses Low Number of Quarters: 4; EPS Surprise: 1.69% Over the past 10 quarters there have been several earnings misses. Historically, meeting or beating estimates is twice as common as missing. Frequent misses are a warning sign to investigate.

Seeking Alpha

I will let the images tell the story. Again, Seeking Alpha is less than enthusiastic about NYCB.

Now back to the review I read. I think they are overly optimistic. Here is what they said:

Quad 7 Capital’s Summary

- New York Community Bancorp reported a surprise earnings miss, and a massive dividend cut, causing shares to tank 40% premarket.

- Despite the negative news, New York Community Bancorp shares are a buy at $6.00, with potential for a rebound in the coming weeks and months.

- The bank’s asset quality improved, but there are concerns about exposure to commercial real estate and the office sector.

- NYCB sports a huge discount-to-book.

- We are Quad 7 Capital, a team made up of former asset management fund analysts. We lead the investing group Bad Beat Investing, where we share our trades and invest personally in our ideas. We believe strongly in investing in every name we recommend.

Quad 7 Capital’s Final thoughts on NYCB stock

I disagree with their final thoughts. They might be right, but the history of this bank is not stellar. However, here is what they said: “This was a shock to the market and New York Community Bancorp, Inc. shareholders. But we think you (should) take advantage of the drop. Sure, the new yield reset is painful, $0.20 is now a 3% yield, cutting income from income investors. It is tough to swallow. But for traders, and long-term investors, the bank is growing and making strategic moves to secure its future. We think shares rebound in the coming weeks and months from the $6 level.”

There is a link to their article at the end of this post.

Company Profile

New York Community Bancorp, Inc. operates as the bank holding company for Flagstar Bank, N.A. that provides banking products and services in the United States. The company’s deposit products include interest-bearing checking and money market, savings, non-interest-bearing, and retirement accounts, as well as certificates of deposit. Its loan products comprise multi-family loans; commercial real estate loans; acquisition, development, and construction loans; commercial and industrial loans; one-to-four family loans; specialty finance loans and leases; warehouse loans; and other loans, such as home equity lines of credit, boat and recreational vehicle indirect lending, point of sale consumer loans, and other consumer loans, including overdraft loans. The company also offers cash management products; non-deposit investment and insurance products; and online banking, mobile banking, and bank-by-phone services. It primarily serves individuals, small and mid-size businesses, and professional associations. The company was formerly known as Queens County Bancorp, Inc. and changed its name to New York Community Bancorp, Inc. in November 2000. New York Community Bancorp, Inc. was founded in 1859 and is headquartered in Hicksville, New York.

Full Disclosure

Cindie and I do not own shares of NYCB and I will not buy shares.

LINK: New York Community Bancorp Collapses On Massive Dividend Cut, Now What?