Another Way To Begin Options Trading

When most of my friends find out that you have to have 100 shares of a stock or ETF to trade options, they tend to think that isn’t an option for them. However, there are several ways to begin to trade options. In the past I have talked about covered call options, cash covered puts, and rolling options. In the world of options, there are “Call options” and “Put options.” Cash covered call options can only be done if you own at least 100 shares, because each option contract is for 100 shares.

For example, if I wanted to trade a cash covered call option on the stock for Palantir Technologies Inc. (PLTR), I would have to own 100 shares. I could buy the shares, and based on the current price, it would cost me about $1,700 to get started. I could then trade a single covered call option for those 100 shares.

There Is Another Path for PLTR Shares

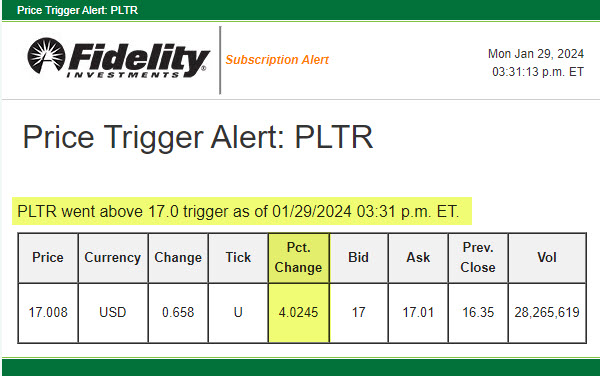

If you have at least $2,000 in cash in your brokerage, IRA, or ROTH account, there is another way to enter the options trading arena. Using this approach you have the least amount of risk and a very low dollar investment. For example, you could buy a single call option for $17 (which means you need to have $1,700 in cash available if the option exercises) for around $0.22 per share, or about $22.00 for the 100 shares included in the option.

Your cost would be $22. However, you are only buying the possibility to acquire PLTR shares at the $17/share price. If the shares shoot up to $18 per share at the close of the contract, you only pay $1,700 for the shares. Your total investment would be $1,722, and you could, on the next trading day, sell your shares and pocket a nice profit of $78 – if you could get $18 for your shares. But perhaps the shares would bounce higher to $19 per share. Then your quick profit is $178. The work to do this is less than 15 minutes, so your “hourly income” from this trade is $44.50 per hour.

Why PLTR?

There are many reasons to avoid PLTR. The risk for this investment is fairly high, especially for the short-term. The QUANT rating is a HOLD. The Weiss Ratings score is C-. The Fidelity Equity Summary Score is 0.9 – VERY BEARISH. These scores tell you that the risk is great for this investment.

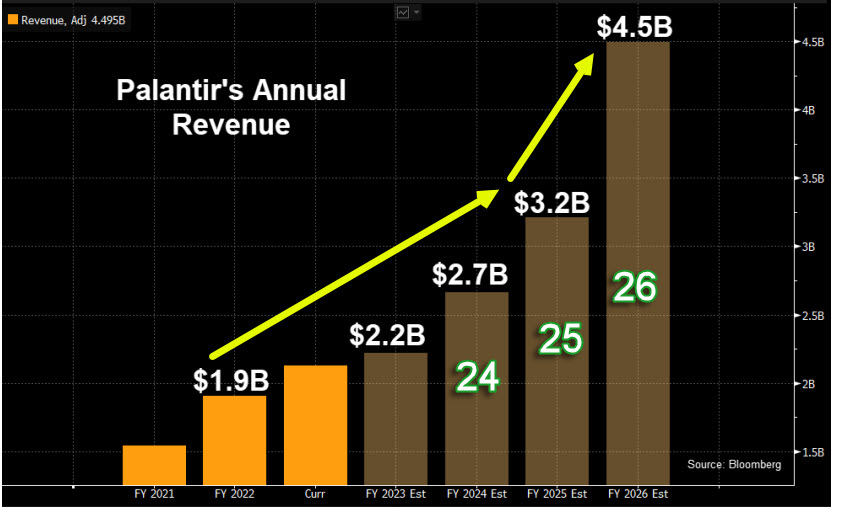

However, one other data point needs to be considered. PLTR’s annual revenue is likely to increase dramatically in 2025 and 2026. Why is this so? Because “Palantir Technologies Inc. builds and deploys software platforms for the intelligence community in the United States to assist in counterterrorism investigations and operations.”

They also have some other interesting markets: “The company provides Palantir Gotham, a software platform which enables users to identify patterns hidden deep within datasets, ranging from signals intelligence sources to reports from confidential informants, as well as facilitates the handoff between analysts and operational users, helping operators plan and execute real-world responses to threats that have been identified within the platform. It also offers Palantir Foundry, a platform that transforms the ways organizations operate by creating a central operating system for their data; and allows individual users to integrate and analyze the data they need in one place. In addition, it provides Palantir Apollo, a software that enables customers to deploy their own software virtually in any environment.”

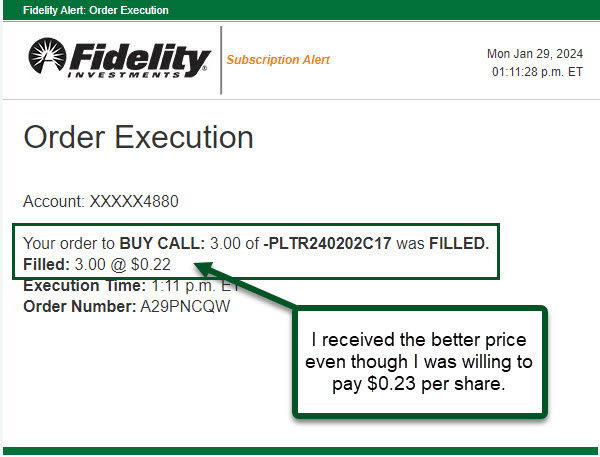

Buying a Call Option on PLTR Shares

Yesterday I decided to set aside $5,100 for PLTR shares at $17 per share. That means I am willing to buy 300 shares for a total of $5,100. To get this opportunity, I had to spend $67.95. That is my total risked cash. It includes the $66 for the 3 contracts plus a $1.95 commission. If the shares trade above $17 at market close on Friday, February 2, then I will have $5,100 deducted from my cash balance and I will receive 300 shares. My total cost basis for this investment will be $5,167.95.

If the shares trade at $18 or $19, or even $25 on Monday, I can make a nice profit in one week’s time. If the shares don’t rise to $17, my only loss is the opportunity cost of $67.95. This is a good trade off. I could have spent $5,100 to buy 300 shares, and the shares might drop to $15 per share. Then my loss would be greater. Therefore, there are times when buying a call option is a clever and low-cost way to potentially gain shares of an investment I like.

Nine Images to Show My Process

In the following nine images, taken from Fidelity’s Active Trader Pro, I show the steps I did to create the trade. This took me less than ten minutes. On each slide I put some numbers to draw your attention to what I was looking at on each screen. In addition, I will put a brief note on each slide so that you can see what was important to me before placing my order.