It is Now Number Nine

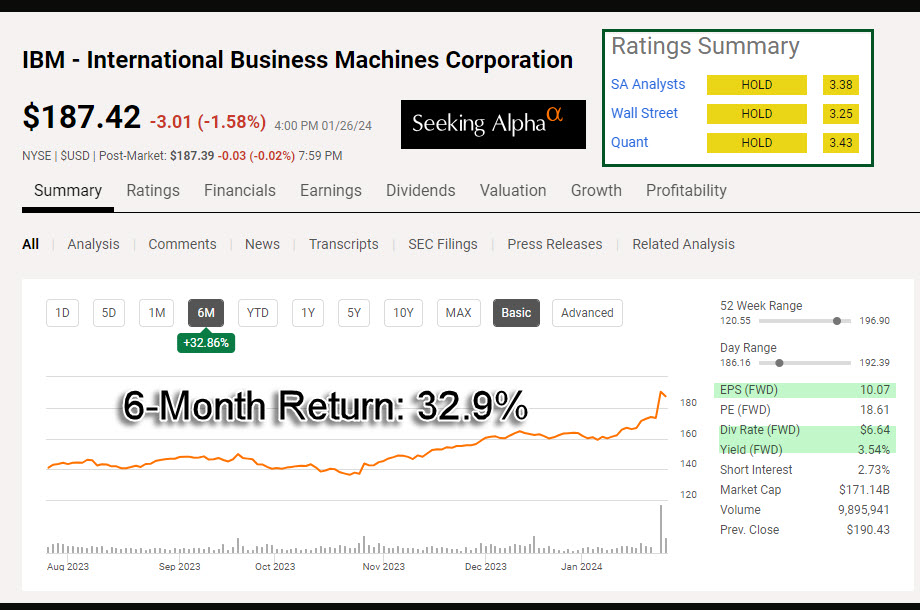

Although I have not added shares of IBM (International Business Machines Corporation) recently, and the last 100 shares I purchased were purchased in August 2023 for $140 per share, the value of this investment has increased over time. Now my 500 shares are worth $187.42 per share for a total current value of $93,710. This means our IBM holdings are about 2.8% of our current portfolio. The shares are held in my traditional IRA.

Do You Know What IBM Does?

Most of us old time IT guys (and gals) think of IBM has a supplier of big mainframe computer hardware and software. Most big companies ran their businesses on IBM systems. During most of my working years I was working with IBM computers like the IBM/360, IBM/370, AS/400, and iSeries systems.

It is, therefore, obvious that IBM is in the Information Technology sector. However, they are classified in an industry you might not expect: “IT Consulting and Other Services.” For a stodgy company with 288,300 employees that was founded in 1911, that might come as a surprise. Read the “Company Profile” below if you want to understand their four business segments. You won’t see “hardware.”

Key Ingredients for Success

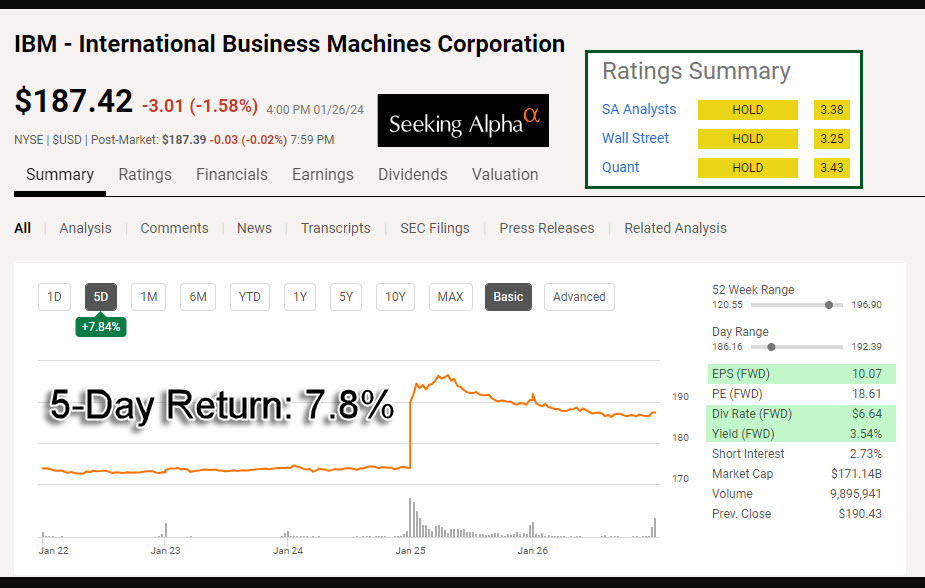

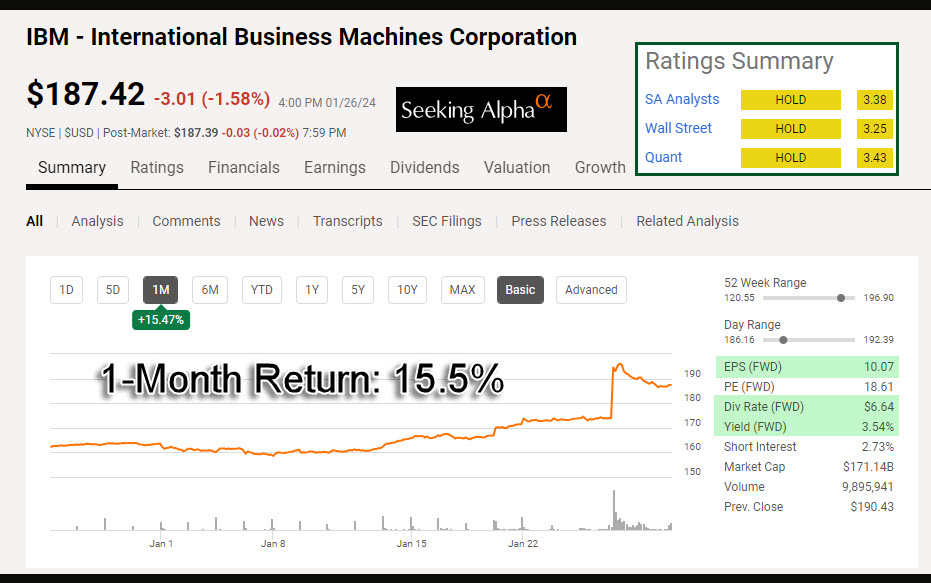

In the last twelve months IBM’s stock has risen 39.4%. What is even more remarkable is that their shares have increased 15.5% in the last month. This is the result of good earnings growth and IBM’s involvement with the very popular artificial intelligence solutions. It isn’t just the chipmakers that are thriving. IBM’s EPS (FWD) is $10.07, and their current P/E (FWD) is 18.61. Of the $10.01, they will pay at least $6.64 in the next twelve months in dividends. This means the dividend payout ratio is less than 70%, which is a good thing. The dividend yield (FWD) 3.54% and the 5 Year Growth Rate for the dividend is 2.25%. Another attraction is that IBM has had 24 years of dividend growth.

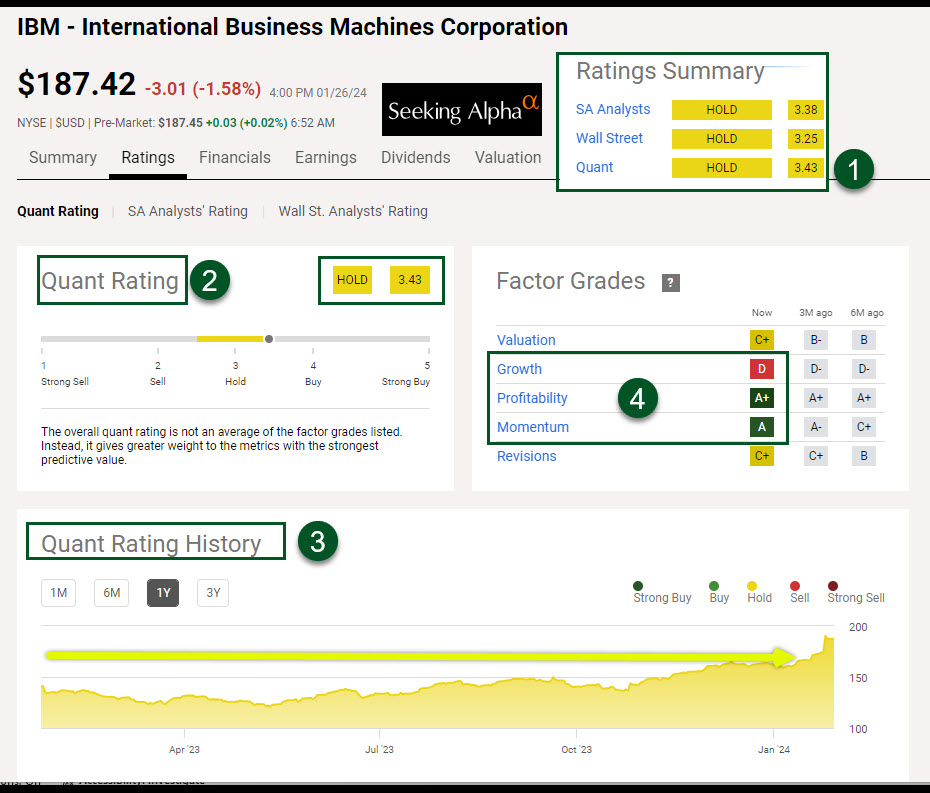

Seeking Alpha Quant Rating

What is most interesting to me about IBM is that the Seeking Alpha QUANT rating has never been above “HOLD” in the last three years. In other words, if you always follow the QUANT rating, you wouldn’t sell shares that you own, but you also would not buy more. Wall Street has rarely put IBM in the “buy” category, and the SA authors have mixed opinions, including, “Buy”, “Sell”, and “Hold.” Therefore, there are times when I buy an investment just because I think the future is bright.

Dividend Growth Investing

I recently purchased a copy of a Freeman Publications book. The title of the book is Dividend Growth Investing. On pages 114-116 the authors highlight IBM as one of their seven best dividend growth stocks for 2021 and beyond. The book was published in 2021, so the authors did not know then what is very apparent now: they were right. Furthermore, I think they will continue to be right.

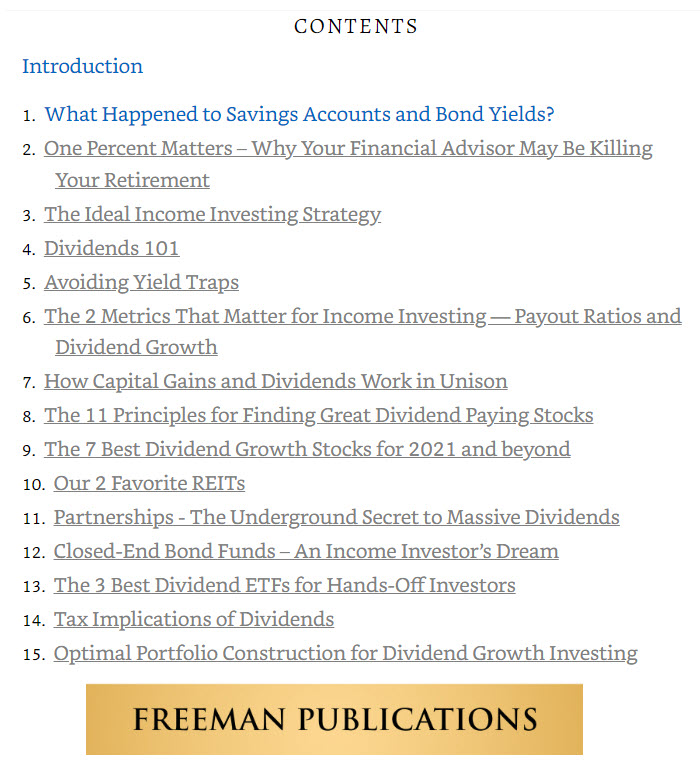

It is likely that I will talk more about this book in a future post. Here is a list of the table of contents for the book.

What Should You Do?

IBM’s shares went from $163.55 at the end of 2023 to the current price of $187.42. However, the shares have a 52-week high of $196.90. I believe there are still opportunities to buy shares for the long-term investor. Therefore, I would not be afraid to buy more IBM shares for our portfolio for prices below $190 per share. Of course, you need to evaluate IBM for yourself. Ask questions and I will do my best to answer them.

Company Profile

International Business Machines Corporation, together with its subsidiaries, provides integrated solutions and services worldwide. The company operates through four business segments: Software, Consulting, Infrastructure, and Financing. The Software segment offers hybrid cloud platform and software solutions; software for business automation, AIOps and management, integration, and application servers; data and artificial intelligence solutions; and security software and services for threat, data, and identity. This segment also provides transaction processing software that supports clients’ mission-critical and on-premise workloads in banking, airlines, and retail industries. The Consulting segment offers business transformation services, including strategy, business process design and operations, data and analytics, and system integration services; technology consulting services; and application and cloud platform services. The Infrastructure segment provides on-premises and cloud-based server and storage solutions for its clients’ mission-critical and regulated workloads; and support services and solutions for hybrid cloud infrastructure, as well as remanufacturing and remarketing services for used equipment. The Financing segment offers lease, installment payment, loan financing, and short-term working capital financing services. The company has collaboration agreement with Siemens Digital Industri Software to develop a combined software solution. The company was formerly known as Computing-Tabulating-Recording Co. International Business Machines Corporation was incorporated in 1911 and is headquartered in Armonk, New York.

Full Disclosure

Cindie and I own 500 shares of IBM as a long-term investment. This investment recently moved into our top ten just by being patient and holding the shares we already own.