Adding More Insurance – Manulife Financial Corporation

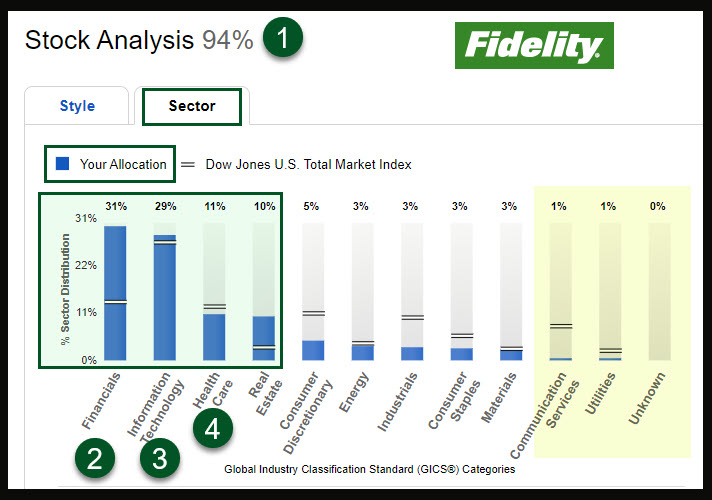

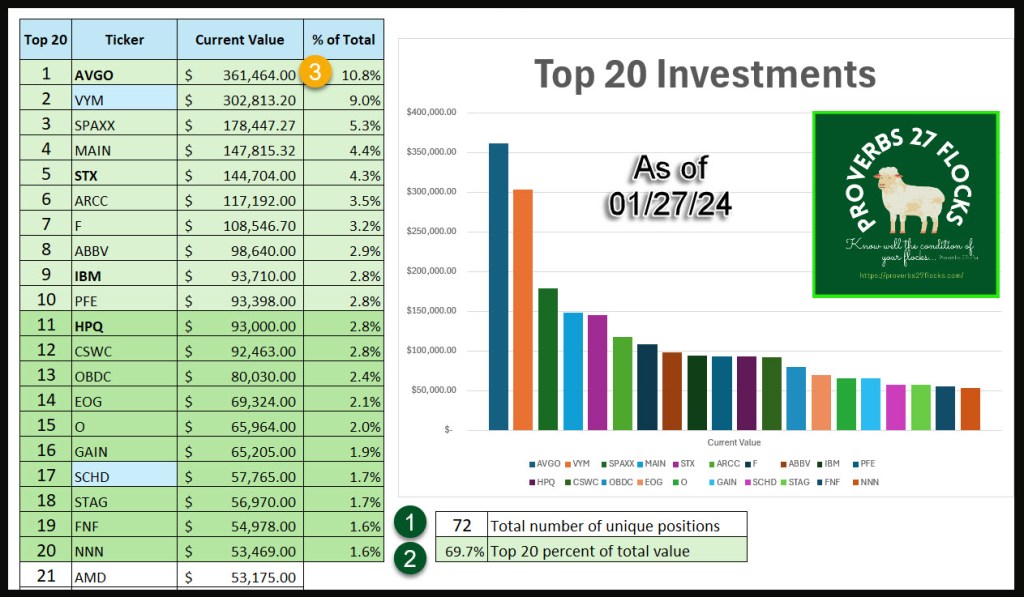

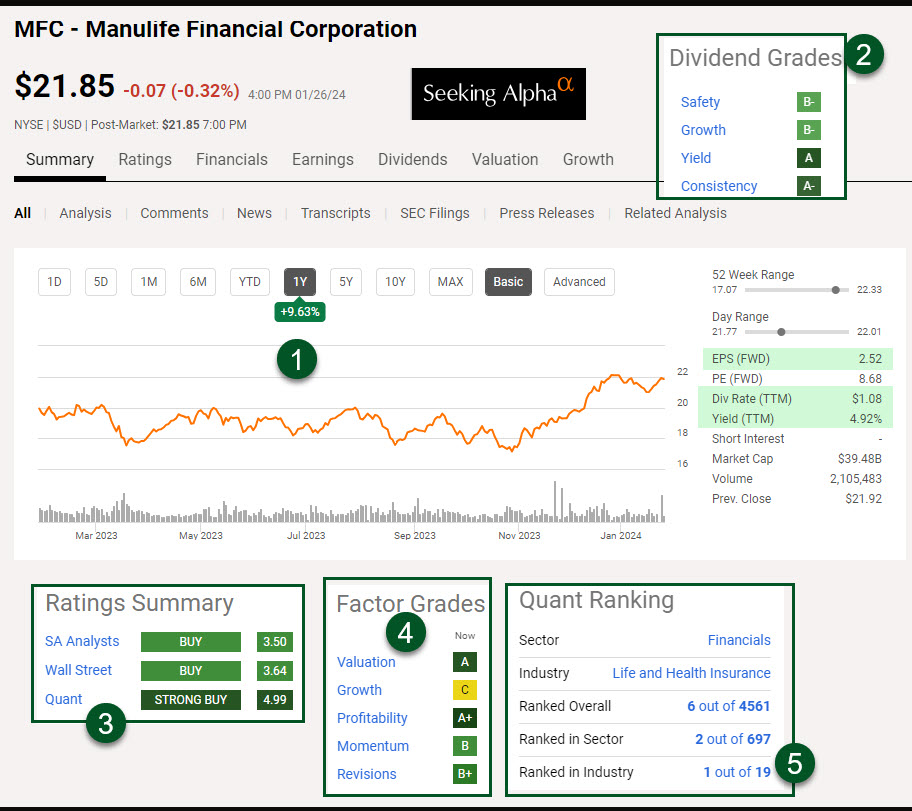

Manulife Financial Corporation is a Canada-based business focused on Life and Health Insurance. MFC was founded in 1887, so it has been around a couple of years. It falls within the financial sector, which is one of my top four favorite business sectors. This week I bought another 400 shares, bringing our total investment to 2,300 shares.

Specifically, on January 26 I added MFC shares to my ROTH and traditional IRA accounts. This increased our total holdings of MFC to $50,255 (2,300 shares), making it number 24 in our holdings by size. To put this in perspective, we have a total of 72 unique holdings. The average cost of the shares is now $44,260.

What Does MFC Really Do?

It is a mistake to just pigeonhole MFC as “an insurance company.” The reality is that they have products for individuals in the following offerings. These are quotes from the MFC website.

Insurance – It’s not what we have in life, but who we have that matters. Protect the people you care about most with easy-to-understand insurance options that offer peace of mind and put precious time back where it belongs – in your hands.

Health Life Travel – Group benefits

Group retirement – Make the most of your retirement – track and manage your savings here.

Investments – Whether you’re investing for the first time, saving for the future or embarking on retirement, we can help you enjoy today while you prepare for tomorrow. Mutual funds Investment pools Segregated funds GICs ETFs

Wealth management – Guidance to help grow your wealth – and secure the future for you and your loved ones. Manulife Securities Manulife Capital Markets Manulife Private Wealth

Banking – What are your financial goals? Innovative, flexible solutions are designed to help you achieve them.

They also have small business solutions and group plans for companies.

A Caution for New Investors

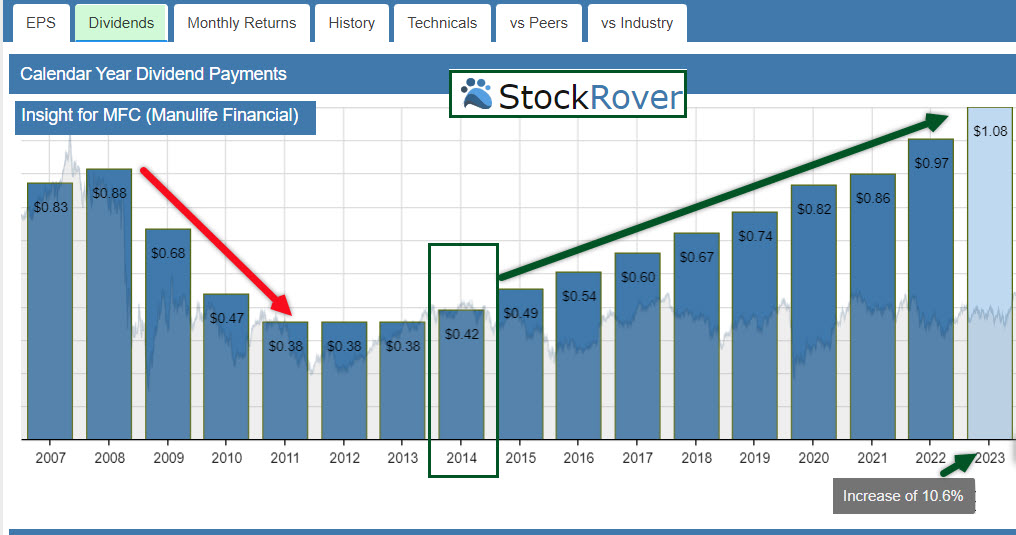

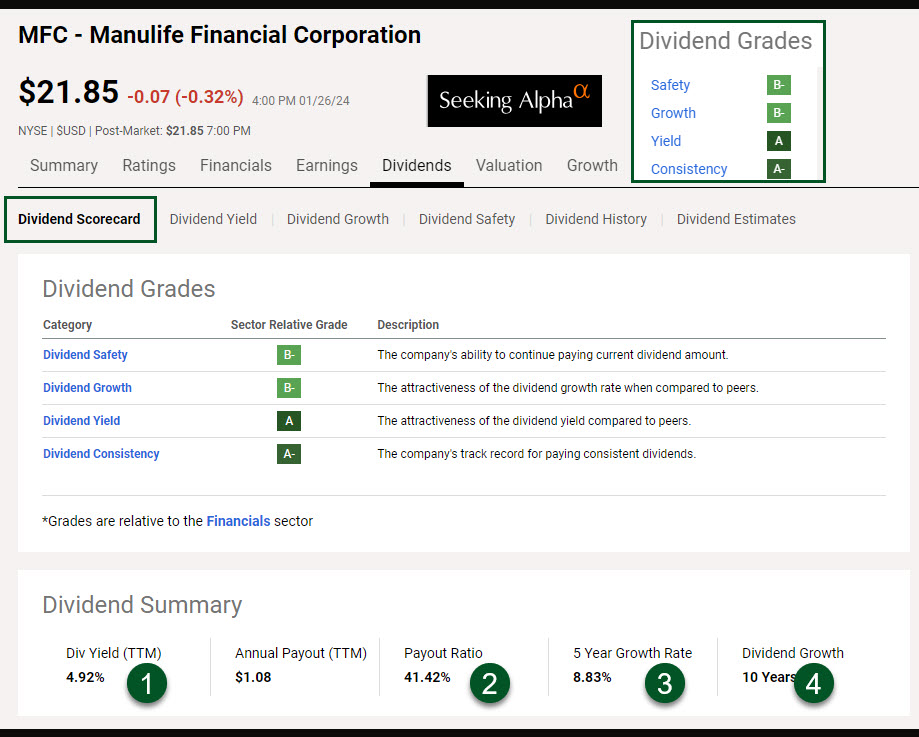

MFC is an income investment. Therefore, don’t expect huge price appreciation on the shares. However, as the following Stock Rover chart shows, the income does seem to grow in a helpful way. If you want dividend growth and are not looking for any significant increase in the share price, then MFC is a worthy contender.

Business Profile

Manulife Financial Corporation, together with its subsidiaries, provides financial products and services in Asia, Canada, the United States, and internationally. The company operates through Wealth and Asset Management Businesses; Insurance and Annuity Products; and Corporate and Other segments. The Wealth and Asset Management Businesses segment offers investment advice and solutions to retirement, retail, and institutional clients through multiple distribution channels, including agents and brokers affiliated with the company, independent securities brokerage firms and financial advisors pension plan consultants, and banks. The Insurance and Annuity Products segment provides deposit and credit products; and individual life insurance, individual and group long-term care insurance, and guaranteed and partially guaranteed annuity products through multiple distribution channels, including insurance agents, brokers, banks, financial planners, and direct marketing. The Corporate and Other segment is involved in property and casualty reinsurance businesses; and run-off reinsurance operations, including variable annuities, and accident and health. The company also manages timberland and agricultural portfolios; and engages in insurance agency, investment counseling and dealer, portfolio and mutual fund management, property and casualty insurance, and mutual fund dealer businesses. Manulife Financial Corporation was incorporated in 1887 and is headquartered in Toronto, Canada.