What Really Matters

For many retirement seems like a distant destination. For some it might mean the next stop in your life plan is stepping away from the normal full-time work you have done for many years. In either case, there are some decisions you should make as soon as possible. They have to do with income and income taxes.

Income Tax Quick Calculations

Income taxes can have a significant impact on your retirement income. Therefore, when looking at your potential income, deducting income taxes should be one of the first calculations you perform. You might also want to consider property taxes if you own property. If you have someone else prepare your taxes you might not be as engaged in the process as you should be. One thing you should know is the approximate percentage of your total tax bill removed from your income. In our case, it is about 15% for federal income tax and around 5% for Wisconsin’s state income tax.

Of course, it could be higher if our income increased considerably, but it is a good rule of thumb. Therefore, if our taxable income in 2024 is around $150,000 (after the standard deduction or itemized deductions) then we will be paying about $30,000 in income taxes, leaving us with $120,000 in spendable income. If I include our property taxes, the spendable income drops to $112,000. That means our monthly income, after taxes, is around $9,000.

Reducing Income Taxes in Retirement

It is impossible to know much about your future. You don’t know the date on your death certificate. You have no clue as to what inflation will be like during your retirement. There is no way to know how income taxes might grow over the remaining years of your life. Income taxes eat away at your assets every year, and the tax bite reduces your capital for investing. Sometimes, however, it makes good sense to pay the tax today to avoid paying the tax tomorrow, and the next decade or more.

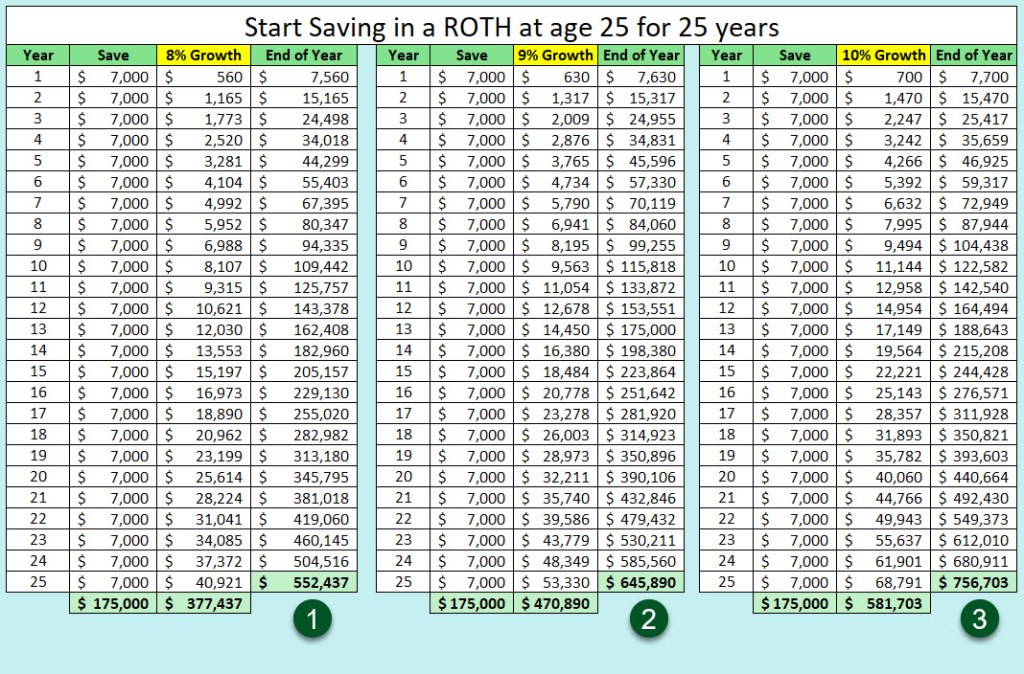

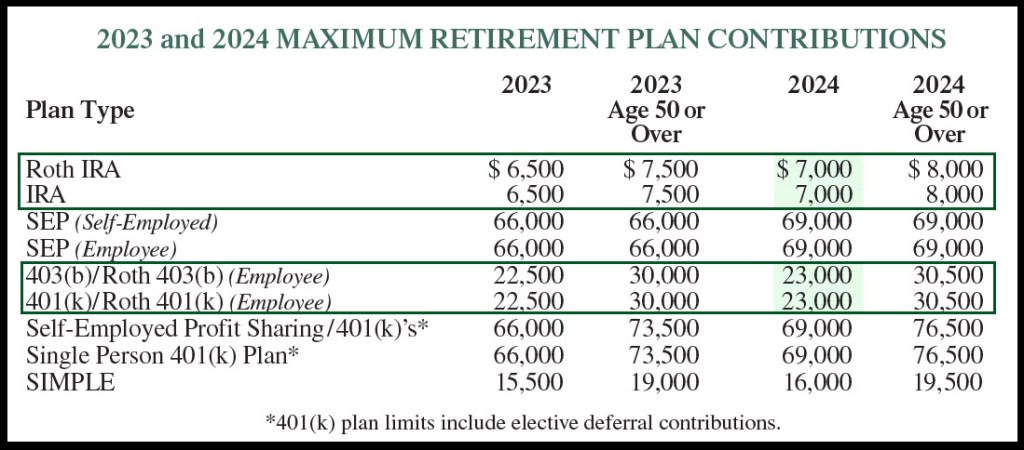

Therefore, I think most young adults should pay the income tax on their entire income each year and, at the same time, contribute the maximum amount to a ROTH IRA or a ROTH 401(k). The maximum amount for 2024 is $7,000 if you are under 50 years old. If you are over 50 years old, you can deposit up to $8,000 of your earned income in a ROTH IRA. If you save $7k per year for 25 years, you will have saved $175,000. If you were prudent in your investment choices, you will have over a half million dollars when you are fifty years old at an average annual return of 8%. If you can manage 9-10% returns, your results will grow to over $640K or $756k.

That is after only 25 years. Most adults can expect to work 40 years. If you save $7K per year and earn 8-10% on those savings and the growth of those savings, your total will grow significantly. Now, look back at the tax table. The total dollars you might avoid paying Uncle Sam or other taxing authorities can be significantly less.

Traditional IRA Income in Retirement

If you choose to save on taxes today, and deposit before tax dollars in a traditional IRA or a traditional 401(k), it is likely that your totals can be the same after 25 years. The problem is that you will be paying income taxes on every withdrawal, based on your total income from all sources. That is why I have been converting my traditional IRA assets to my ROTH IRA for several years. This increases my tax-free income and decreases, over time, my taxable income.

Furthermore, because I am over 70.5 years old, I can take advantage of QCD (Qualified Charitable Distributions) for up to $105,000 in 2024. This satisfies my RMD withdrawal requirement and increases the total dollars we can give to charities.

What Produces Spendable Income in Retirement?

Most investment advisors do not have a focus on income before retirement. They are more focused on helping their clients grow their wealth in their retirement accounts. This may be satisfactory for the first half of your working life, but it starts to be an unacceptable path when you approach or are in retirement. That is why I am a dividend growth investor. If I save $1,000,000 for retirement, and my yield, or return on that million dollars is 4%, then I have the potential for an annual income of $40,000.

But it doesn’t have to stay that way. Remember that the total account value of your ROTH IRA can continue to grow in the same way that a traditional IRA can grow. Therefore, if your ROTH IRA has a balance of $1,000,000 on the day you retire, it could easily be $1,080,000-$1,100,000 at the end of your first year of retirement.

If you have a dividend growth income strategy to increase your income by at least 5% per year by doing nothing, then your year two income could easily be $42,000. It would probably be more, because your asset base has also increased, so your yield can certainly increase as well.

Conclusion

If you take the time to think about income taxes, I think most of my readers will conclude that the ROTH IRA is the best long-term strategy for retirement savings. If your employer matches any of the dollars you save in a ROTH 401(k), the power of those dollars will increase all the more.

Of course, it is possible to contribute more to a ROTH 401(k) than you can contribute to your own ROTH IRA, so that is always the best path when it is available.