Refreshing the Top 10

Because the market has so many moving pieces, sometimes investments drop out of my “top ten” and others appear. The purpose of this brief post is to review the top ten and comment about a couple of the positions. If you look at the top ten, you will see investments that pay dividends, with the exception of AMD, which is a speculative investment. I trade covered call options on AMD.

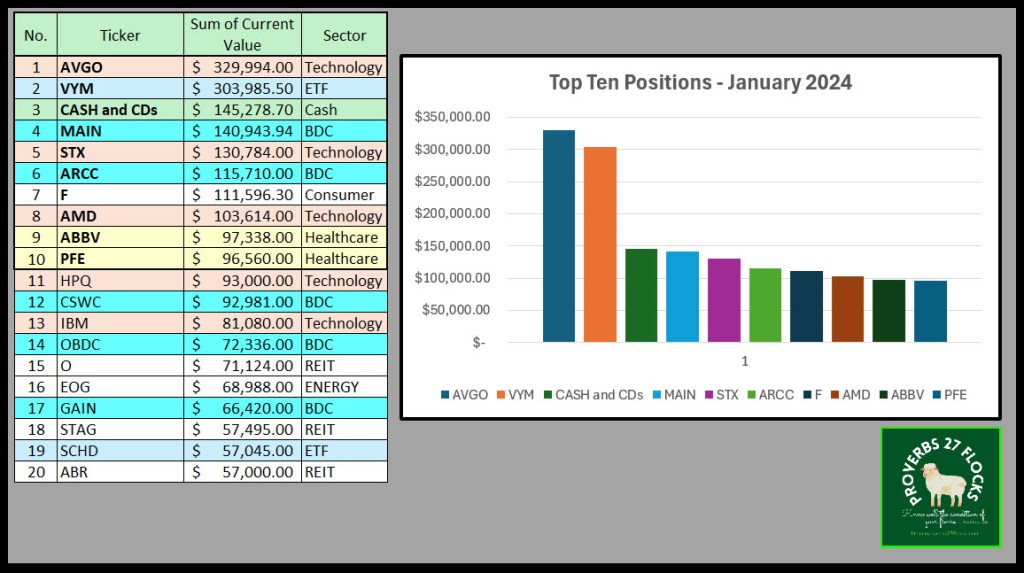

The Top Ten List

The current top ten include: ticker symbols AVGO, VYM, CASH and CDs, MAIN, STX, ARCC, F, AMD, ABBV, and PFE. I have a focus on VYM, technology-related investments and BDCs. In the top ten the dollars invested are: Technology ($564K), ETF ($304K), Cash ($145K), BDC ($257K), Consumer ($111K), and Healthcare ($194K).

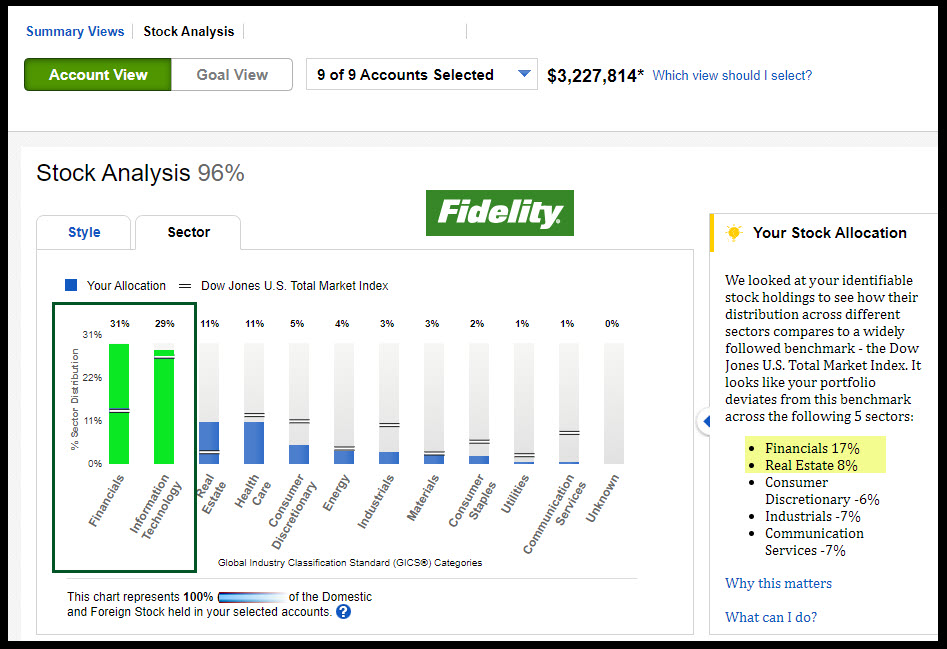

Bear in mind that this does not represent all of our investments. We have a total of 68 investments, with most of them also in technology, healthcare, REITs, BDCs, and the financials. In general I avoid utilities, as they are similar to buying CDs in my view.

The Next Ten

Positions 11-20 are: HPQ, CSWC, IBM, OBDC, O, EOG, GAIN, STAG, SCHD, and ABR. You will see that this group includes Technology, BDCs, REITs, Energy, and ETF SCHD. When you add HPQ and IBM, our total technology investment grows to $738K.

Be careful. Our largest holdings focus on the financial sector, with 31% of our investment dollars in banks, BDCs, and other financial companies. So even though we have a large allocation to technology (29%) don’t assume it is the largest sector in our total portfolio.

What You Should Not Do

A word of caution to those who read my blog and think, “I will do what Wayne does.” That isn’t necessarily a good idea. Bear in mind that your investment choices should take into consideration your total pool of investment dollars. As always, I highly recommend that no single stock investment exceeds five percent of your total investment dollars. This does not include ETFs.

I Broke the Rule

I have broken my rule with AVGO. It is certainly more than 5% of our total dollars. However, I have two open covered call option contracts on two thirds of my shares, and I expect those shares to be called away at some point in the future. When and if that happens, I will probably invest in more SCHD for additional diversification.

Another thing I want to consider is selling some of my VYM to buy more shares of SCHD. The reason is that SCHD has a better dividend growth history. However, I still like VYM for better diversification.

What You Should Do

Consider the nature of your investments. Where are most of your dollars invested? Do you have a dividend growth strategy? Will you be trading options on shares that don’t pay a dividend? In the end, the goal is income in retirement. If you don’t work on it today, then you might regret your procrastination tomorrow.

This Year’s Primary Goal

We want to give more away using QCD (Qualified Charitable Distribution) disbursements from my traditional IRA. I want to aim to give away at least a dollar amount equal to my RMD (Required Minimum Distribution.) This is the most tax-efficient way to support our church and other charities. In 2024 the maximum QCD is $105,000. That is a worthy goal. That also frees up more opportunities for ROTH conversions.