Ask Some Questions in the Right Sequence

Recently a good friend sent me a message with a link to something he had read. He then asked two good questions. 1) “Can a person retire in a recession”, and 2) “If so, how do you protect yourself as a retiree in a recession?” These are sensible questions, but perhaps we need to step back a bit and answer some more fundamental questions. Then I will come back and answer the first question. The second question requires more time.

Two Fundamental Essential Questions

Many people don’t have a budget and don’t even like them. But a budget is just a tool that helps you know if your income is sufficient to meet your living expenses. When you are working you believe your job or business will provide the income you need, and as long as you have little or no debt you may feel comfortable. But this is false comfort. You never know when your health might change, or your employment might change. In fact, a recession (or Covid) can cause you to lose your job or ruin your business. Essential question number one is: “Do you have a budget?”

Secondly, a fundamental question is, “What will my sources of income be during retirement?” When a person is working, they are accustomed to receiving pay for their work. If you are employed and bring home $5,000 per month after taxes and deductions, your spendable annual income is $60,000. In retirement some costs shift. Decisions must be made about health insurance, lifestyle, luxuries, and any obligations you have. If you have a mortgage, insurance, property taxes or other debts, those will continue to be a consideration. Some costs will increase, and others will decrease. This is best tackled with some research and a budget.

When it comes to income in retirement, usually five sources are considered: Social Security, a pension, retirement investments, annuities, and working part-time. A small segment of my readers also has rental properties as a source of income. Social Security benefits are easy to determine online. Most people don’t have a pension. Only 15% of companies provide pensions these days, according to the Bureau of Labor Statistics. (MarketWatch article)

Retirement Investments are Crucial

Retirement investments might not be sufficient. On page ten of the Vanguard 2023 report “How America saves report 2023”, some frightening statistics are presented regarding the average and median balances at Vanguard. “In 2022, the average account balance for Vanguard participants was $112,572; the median balance was $27,376. Vanguard participants’ average account balances decreased by 20% since year-end 2021, driven primarily by the decrease in equity and bond markets over the year.”

This is concerning. If the median balance is less than $27K, that means half of those who have retirement accounts at Vanguard have saved far too little to date for retirement. Granted, that may mean they are in their early adulthood. But if you look at the average balance of about $112K, you have even more reason to be concerned. Using the often-cited “Four percent retirement withdrawal” rule, you can only reasonably withdraw $4,480 per year from an IRA with a $112K account balance. That will not cover much of your normal $60K in after tax income in retirement.

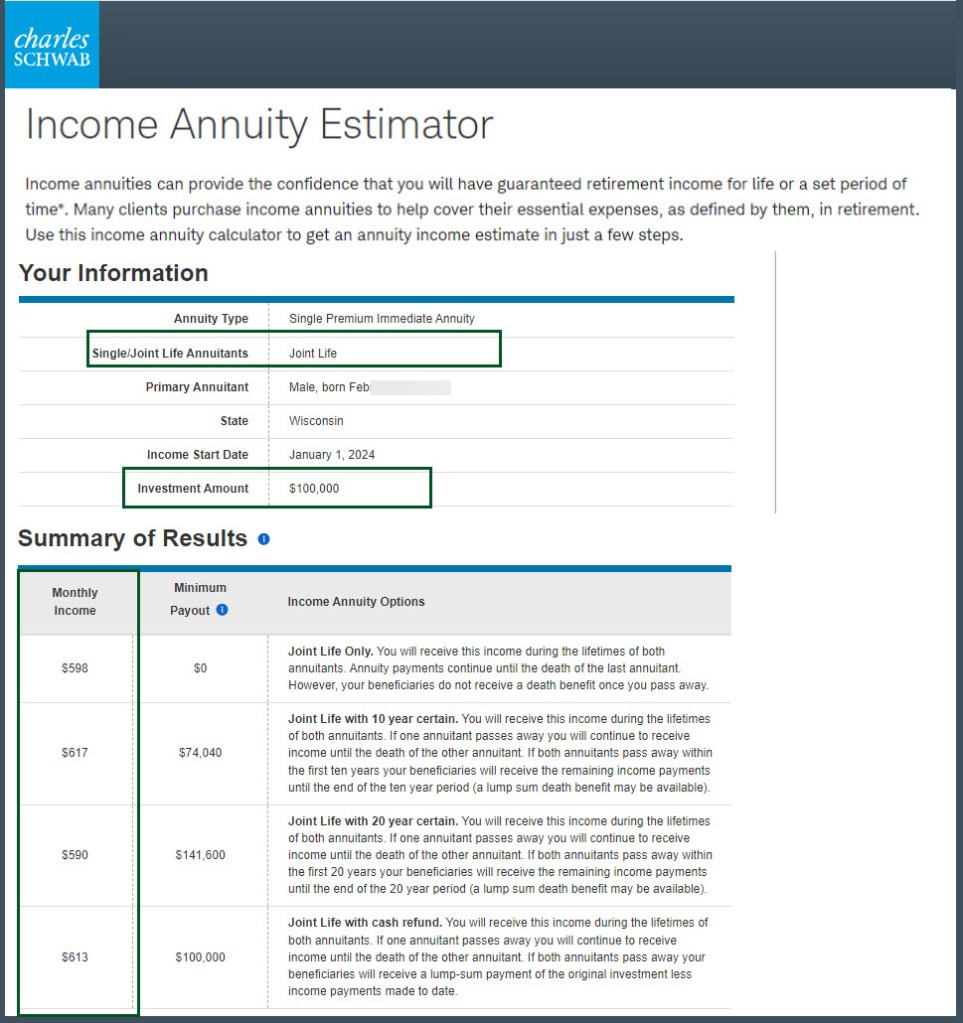

When we look at annuities, bear in mind that they are insurance products. Realistically, if all you have in your retirement account is $112K in assets, the annual income you can expect from an annuity isn’t all that great and it is NOT indexed for inflation. If I were to purchase a $100K annuity today with payments to start next month, there are four choices presented by Schwab’s annuity calculator. All of them fall around $600 per month, or $7,200 per year based on my current age and Cindie’s age. While this is better than $4,480, never forget that the annuity option is not inflation protected. I won’t buy an annuity. It is a last resort. Understand what you are buying before you give your retirement assets to an insurance company.

Working Part-time

Some can do this, and others due to health or other life limitations cannot. The problem with this as a reliable source of income is that it isn’t reliable. However, if you haven’t saved enough for retirement, then this might add to your potential annual income.

The First Question About Retirement Timing

So now to return to the original questions. 1) “Can a person retire in a recession”, and 2) “If so, how do you protect yourself as a retiree in a recession?”

The short answer to the first question is a qualified “yes.” If you add up the income from your Social Security, any pension you might receive, the dividend and interest income from your investments, income from rental properties, and the total income is greater than your budget, there is little reason to delay retirement. For example, Social Security is unlikely to change, it is somewhat indexed for inflation, and it is better than an annuity. If you and your spouse receive a combined Social Security benefit of $40,000 after Medicare premiums are deducted, then you are only $20K away from your hypothetical $60K goal. Cindie and I will have a combined Social Security income of just under $45K in 2024 if we live the entire year. So we need to make up the $15K from income from investments and Cindie’s part-time work.

The impact of a recession should be minimal or unlikely when it comes to Social Security and a pension. If you have investments that are paying dividends, most of them will continue paying dividends through the types of recessions we have seen in the past. Therefore, you should plan accordingly by being careful about the types of investments you buy and avoid buying any investments you might need to sell in a bear market due to fear or panic.

The “can I retire” question should not be focused entirely on my IRA or ROTH balance on the day I retire. If you retire today, and you think the market will continue upwards, you might be mistaken. It could drop 20% next week or 30% next year. While that may be disconcerting, if you have structured your retirement account for income, then the total value of your stocks is less important than you might think. In reality, you have no way to know the future.

The Second Question About Retirement Protection

My friend asked if you do retire in a recession, “How do you protect yourself as a retiree in a recession?” That is an excellent question, and it will be the subject of my next post.

I will also present some interesting ideas from “Eight Safe Withdrawal Questions and Responses” from the November 2023 AAII Journal. The author of the article is Chris Pedersen, a financial analyst and writer at the Merriman Financial Education Foundation.

Think Biblically About Recessions and Boom Times

There are two equally dangerous ditches in life: boasting that you have everything under control and being anxious because you think things are out of control or will be out of control. Neither of those are rational nor healthy.

Proverbs 27:1 “Do not boast about tomorrow, for you do not know what a day may bring.”

Matthew 6:34 “Therefore do not be anxious about tomorrow, for tomorrow will be anxious for itself. Sufficient for the day is its own trouble.”

James 4:13-14 “Come now, you who say, ‘Today or tomorrow we will go into such and such a town and spend a year there and trade and make a profit’— yet you do not know what tomorrow will bring. What is your life? For you are a mist that appears for a little time and then vanishes.”

All scripture passages are from the English Standard Version except as otherwise noted.

LINKS: MARKETWATCH VANGUARD PDF SCHWAB