Why I Buy Investments

There are three reasons I buy investments, but not each investment fits every category. The first reason, and my primary focus is dividend growth. Pfizer has increased their dividend for thirteen years at just under 5% annually.

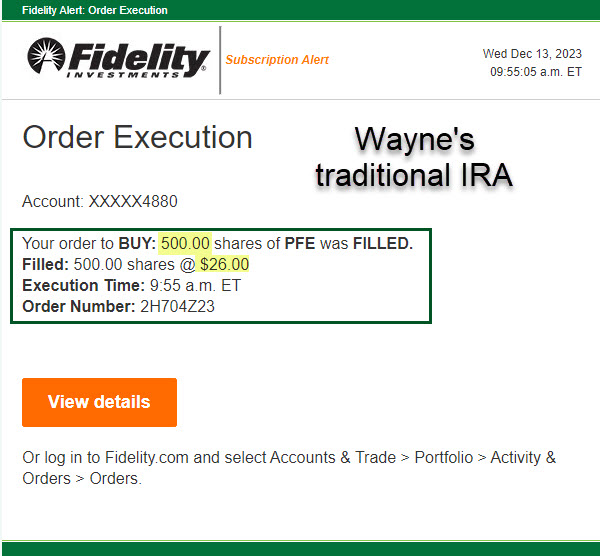

The second reason is to capture price appreciation. This means I want to buy shares when the price is low. There are two reasons for this. First of all, when I am ready to sell an investment, I want to make a profit. But there is a second reason. When the price drops, the dividend yield increases. PFE’s dividend yield jumped to around 6.1% based on today’s price, but my yield for my buys is better than that because I paid less than the current price of the shares. My two buys were for $25.95 and $26.00. Both buys were limit orders. As the day progressed the shares increased in value to a closing price of $26.66.

The third reason is that I often want to trade covered call options on my shares. Because we now own 3,400 shares of PFE in our accounts, I can trade up to thirty-four option contracts as each contract is for 100 shares. This is especially fun for investments like AMD. AMD does not pay a dividend, but I can still get income from our AMD shares using covered call options.

What is Happening With Pfizer?

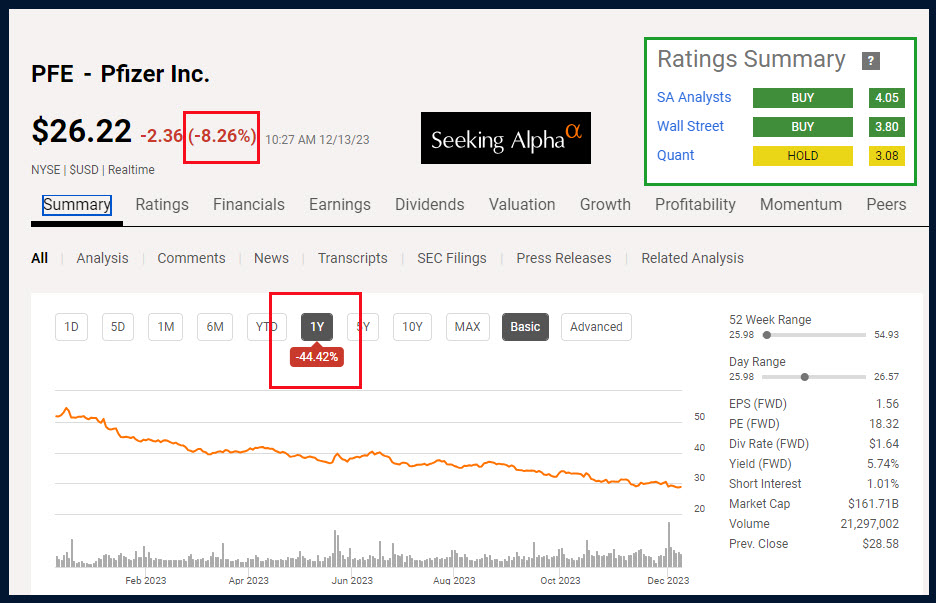

At one point yesterday morning PFE shares were down over 8.3%. I noticed this because it shows up in two ways. First of all, I have alerts set for most of our holdings that tell me when a stock drops or rises 3%. In addition, when I sign on to Fidelity Investments, I can see my top “winners” and my top “losers” at that moment in time. PFE was clearly a “loser.”

One Barron’s article talked about Pfizer’s deal spree and the costs associated with that strategy. “Pfizer’s big spending on acquisitions could come under investor scrutiny as it closes its $43 billion deal for cancer drug developer Seagen today. That’s because Pfizer’s 2024 profit is taking a 40-cent-a-share hit from deal-related financing costs. Waning interest in Covid-19 treatments will also hurt its results.” – Barron’s (Josh Nathan-Kazis and Janet H. Cho)

In addition, the same article said, “Pfizer slashed its 2024 guidance. It expects adjusted earnings of $2.05 to $2.25 a share, including the addition of Seagen and the Seagen financing-related cost, compared with estimates for $3.17 a share. Projected revenue of $58.5 billion to $61.5 billion is also below expectations.” – Barron’s (Josh Nathan-Kazis and Janet H. Cho)

Pfizer’s CEO, Albert Bourla, said “Pfizer’s product portfolio remains strong, saying its cost realignment program is expected to save at least $4 billion by the end of 2024. That cost-cutting target is an increase from the $3.5 billion goal it set in August, based on the midpoint of a range.” – Barron’s (Josh Nathan-Kazis and Janet H. Cho)

According to another Barron’s article, “Pfizer has made a long list of multibillion-dollar acquisitions in recent years, and on Tuesday announced it had received regulatory clearance to spend $43 billion to buy cancer-focused biotech Seagen.” – Barron’s (Josh Nathan-Kazis and Adam Clark)

Then there is the issue of the crash in Covid-related spending. So there are certainly issues, but the overall story, does not warrant an 8% drop in the price of the shares, at least in my opinion.

Some Pictures To Help Get the Big Picture

It never hurts to look at a graph of dividend trends. To that end, here is the StockRover view.

I am also interested in the Seeking Alpha ratings. At the present time the QUANT rating is a hold. This is no wonder. Over 70% of “Institutions” own shares of PFE stock. The investing public owns around 29%. I don’t see institutions selling their shares, as they (hopefully) have a long-term perspective.

Finally, the Stock Rover main screen gives some interesting perspectives. I copied/pasted pieces together to help you see what I look at. I’m interested in Valuation, Profitability, Competitors, Dividends, and the various Scores SA provides. “Sentiment” is running against PFE at the moment, and that is not surprising. When others are fearful, I look for buying opportunities.

Pfizer’s Business is Diverse

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products worldwide. It offers medicines and vaccines in various therapeutic areas, including cardiovascular metabolic, migraine, and women’s health under the Eliquis, Nurtec ODT/Vydura, and the Premarin family brands; infectious diseases with unmet medical needs under the Prevnar family, Nimenrix, FSME/IMMUN-TicoVac, and Trumenba brands; and COVID-19 prevention and treatment, and potential future mRNA and antiviral products under the Comirnaty and Paxlovid brands. The company also provides medicines and vaccines in various therapeutic areas, such as biosimilars for chronic immune and inflammatory diseases under the Xeljanz, Enbrel, Inflectra, Eucrisa/Staquis, and Cibinqo brands; amyloidosis, hemophilia, endocrine diseases, and sickle cell disease under the Vyndaqel family, Oxbryta, BeneFIX, and Genotropin brands; sterile injectable and anti-infective medicines under the Sulperazon, Medrol, Zavicefta, Zithromax, Vfend, and Panzyga brands; and biologics, small molecules, immunotherapies, and biosimilars under the Ibrance, Xtandi, Inlyta, Retacrit, Lorbrena, and Braftovi brands. In addition, the company is involved in the contract manufacturing business. It serves wholesalers, retailers, hospitals, clinics, government agencies, pharmacies, individual provider offices, retail pharmacies, and integrated delivery systems, as well as disease control and prevention centers. The company has collaboration agreements with Bristol-Myers Squibb Company; Astellas Pharma US, Inc.; Myovant Sciences Ltd.; Merck KGaA; Valneva SE; BioNTech SE; and Arvinas, Inc., as well as strategic partnership with CSPC Pharmaceutical Group Limited to launch a local brand of the COVID-19 oral therapeutic treatment Nirmatrelvir/Ritonavir in China, and a collaboration with Carrick Therapeutics Limited. Pfizer Inc. was founded in 1849 and is headquartered in New York, New York.

Full Disclosure

Cindie and I own 3,400 shares of PFE as a long-term investment. The shares, at the moment, are worth about $90K. Our total investment in ABBV is slightly higher at about $92.5K. It is reasonable to expect over $5,500 in dividends from PFE in the next twelve months.

LINKs

Pfizer Stock Falls After Company Slashes Guidance. Why Wall Street Is Disappointed.