If You are Young, Aim High

A recent Seeking Alpha author suggested a goal for your retirement balance for the year you enter retirement. Don’t be terribly shocked by this and recognize this varies by your cost of living and income you might receive from Social Security or from a pension. The title of the author’s post was “Why You Should Aim For $2 Million For Retirement.” That sounds ridiculous for many people. But his suggestion is not without some merit.

The problem is that the article failed to consider a couple of factors. If you factor in the cost-of-living for your state (or perhaps your city/county) your income needs can vary. In addition, state sales and income taxes can eat away at your retirement income, as can property taxes. If you have debt, the complexity of the calculation rises. Grocery costs, fuel costs, and housing costs vary from area-to-area.

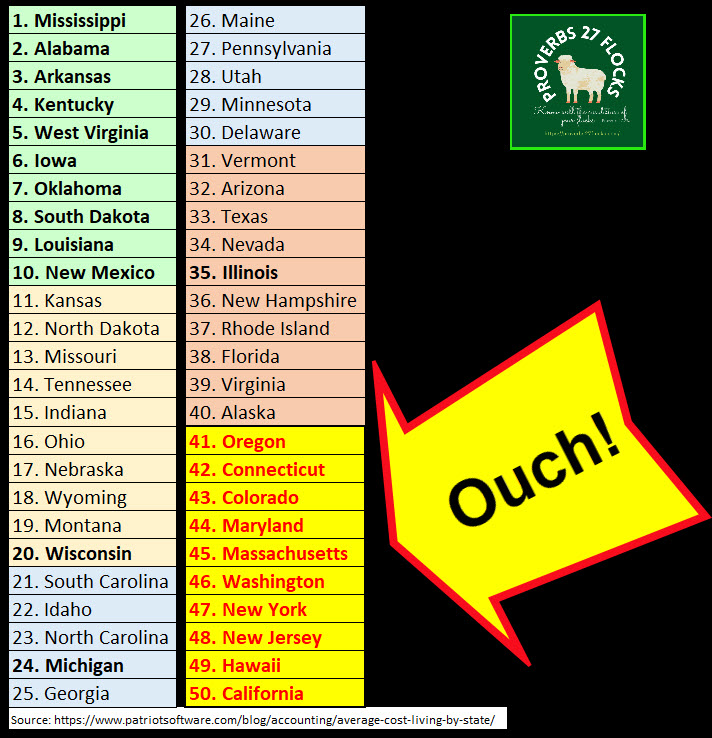

Looking at Cost of Living By State

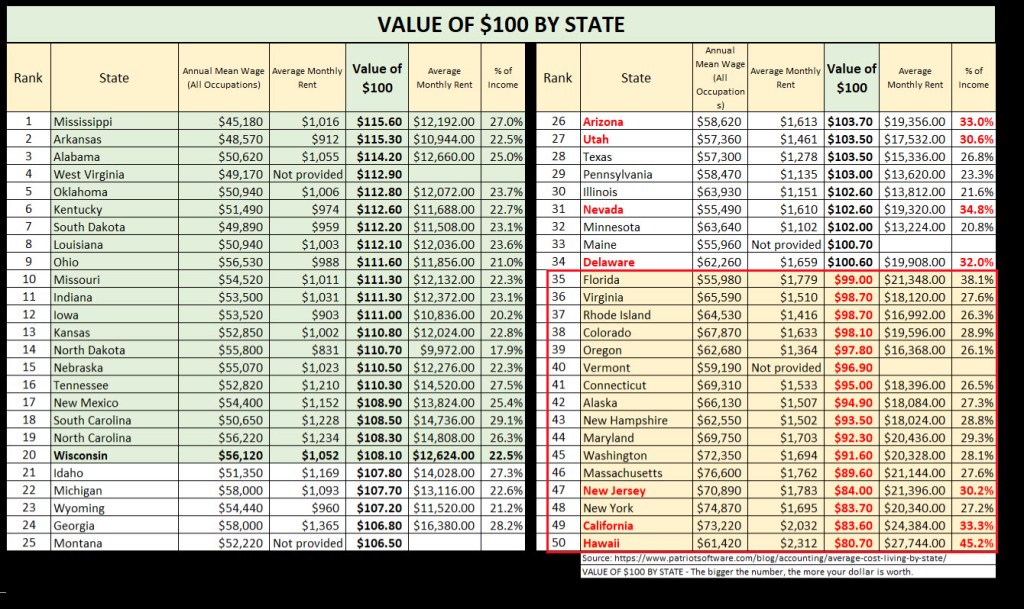

According to Patriot Software (LINK) the state with the lowest cost of living is Mississippi. The state with the highest cost of living is, not surprisingly, California. We should not be terribly surprised by the top ten low cost of living states or the top ten high cost of living states. Of course, cost of living is a function of spending habits and many choices. Therefore, what you might need to save to live within a state can depend greatly on the cost to live in that state.

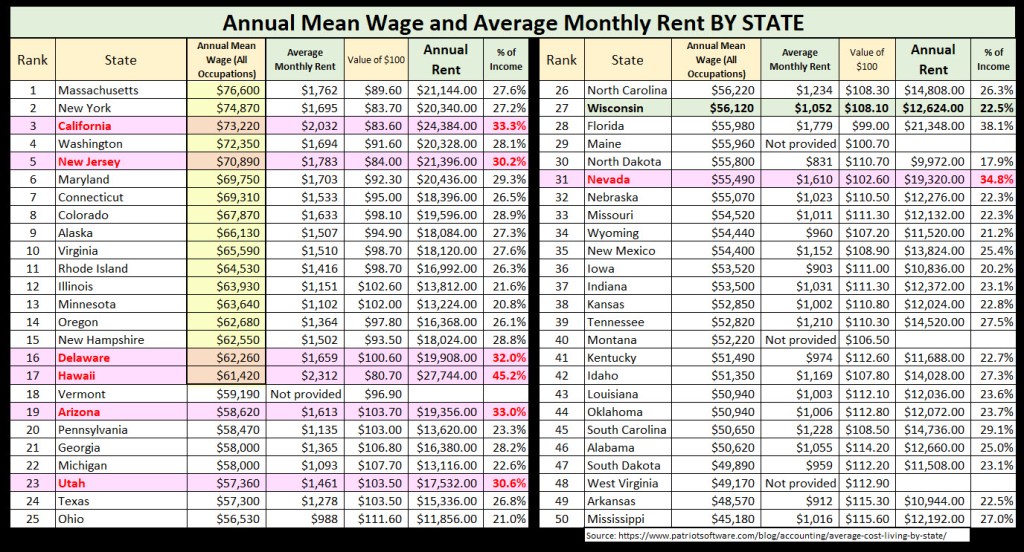

Average Monthly and Annual Rent By State

The Patriot Software tables did not show the annual rent, or the percentage of income for the annual rent based on the annual mean wage within the state. I added those data points. This is helpful because you can then see what your dollar might buy in each state.

The California cost of housing (rent) will likely be two times the cost of housing in Wisconsin, where we live. Just because you receive more income doesn’t necessarily mean you have more spending money. This is an important consideration for those who enter retirement. In some states shooting for a two-million-dollar investment portfolio may be unnecessary, and in other states it might not be enough.

The Value of $100 By State

I also sorted my table by the value of $100 to see which states give you more dollar power. In an ideal world, you would want your dollar to buy at least a dollar of goods. That is probably true in thirty-four states, and it would appear that those who live in Vermont, Connecticut, Alaska, New Hampshire, Maryland, Washington, Massachusetts, New Jersey, New York, California, and Hawaii are stretched.

Why Does This All Matter?

Most financial advisors have long suggested that you should never take more than four percent of your total investment portfolio as income in any one year. Therefore, if your investments total $250,000 when you retire, you should avoid withdrawing more than $10,000. For $500,000 the 4% number is $20,000, and for $750,000 it is $30,000. All of this is in today’s numbers and does not include any inflation.

If you have, however, one million dollars your annualized 4% withdrawal could be $40,000 and at $2M it would be $80,000. Again, this does not factor into your budget any Social Security income you might receive.

Now We Have to Talk Inflation

The following table (yes, there are a lot of numbers) shows what your retirement fund, historically and theoretically speaking, needs to be worth based on inflation from 2001-2023. If your fund was worth $250,000 in 2001, it would not have the same spending power in 2023 if it stayed at $250K. You would really need to have $442,242 by 2023 to break even in spending power. For $500,000 you need to increase your balance to almost $885,000 and for $750,000 it needs to grow to $1.3M just to keep up with inflation. Again, all of this ignores any other sources of income. This all matters because of the 4% “rule.”

So as you look at this table, notice that inflation is not consistent. Some years are awful. If you retired in 2007 then inflation quickly ate into your monthly income from your investments. If you retired in 2021, 2022, or even 2023 (YTD only), the pain was probably even greater. Notice that the pain, however, is cumulative. $250,000 in 2001 does not have $250K of spending power in 2023.

Investment Choices Matter

If you have followed me thus far, you are probably wondering, “how can I make $250,000 grow during the next five, ten, fifteen, or twenty years?” The answer has several pieces but two are most important both before and after retirement. The most important one before retirement is how much you are willing to save (not spend) today, to begin to build a base for growth? The second, and probably equally important piece is your willingness to stay out of cash, bonds, CDs, and other “investments” that don’t return at least 8% annually on average. This is true both before retirement and after you retire.

This is why I constantly suggest buying investments with both asset growth and substantial dividend growth in mind. This is an income producing snowball. As you push it, the retirement account balance grows faster and faster. This can be accomplished using dividend growth ETFs and stocks.

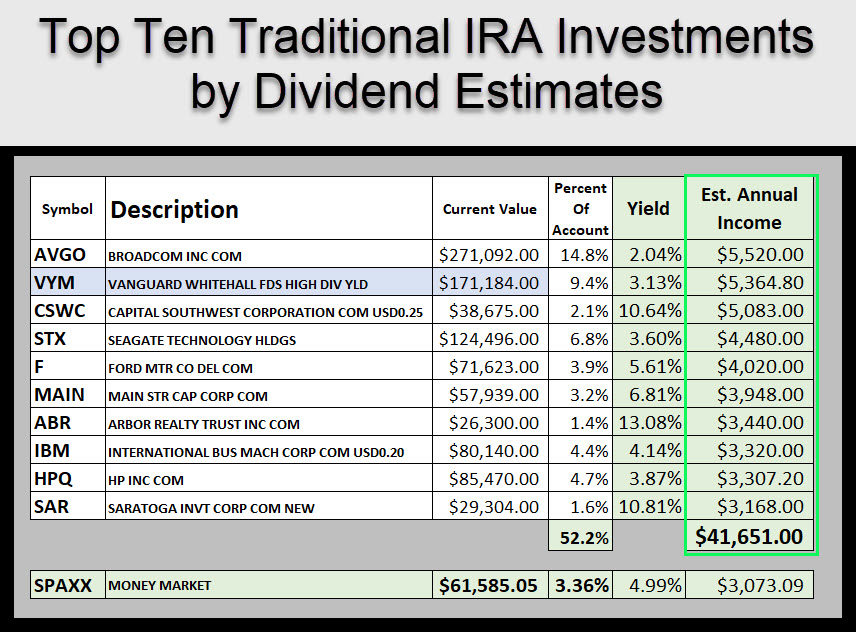

Top Ten Investments in my Traditional IRA

The top ten are not a recommendation and they do not consider all eight of our Fidelity Investments accounts.