Every Profession Uses Tools

When I want to work with wood, I use my bandsaw, drill press, router, table saw, and other wood-cutting tools. When I make Zuppa Toscana, I need a sharp knife, a good pan, some measuring cups, a teaspoon, a tablespoon, and a ladle. If I am working on my snowblower or lawnmower, I need a good wrench. Cutting the grass requires the use of a lawnmower, and helping Cindie in the garden is best done with a shovel. Investors use tools too.

Two Excellent Tools

There are two tools in my investing toolbox that I believe are worth the subscription cost. They not only save time, but they help me avoid costly mistakes. The two tools are Seeking Alpha and StockRover. Both add value in different ways. I also have a subscription to the AAII Journal, but I bought a lifetime subscription some time ago, so I no longer have to make payments for that resource.

StockRover Premium Plus

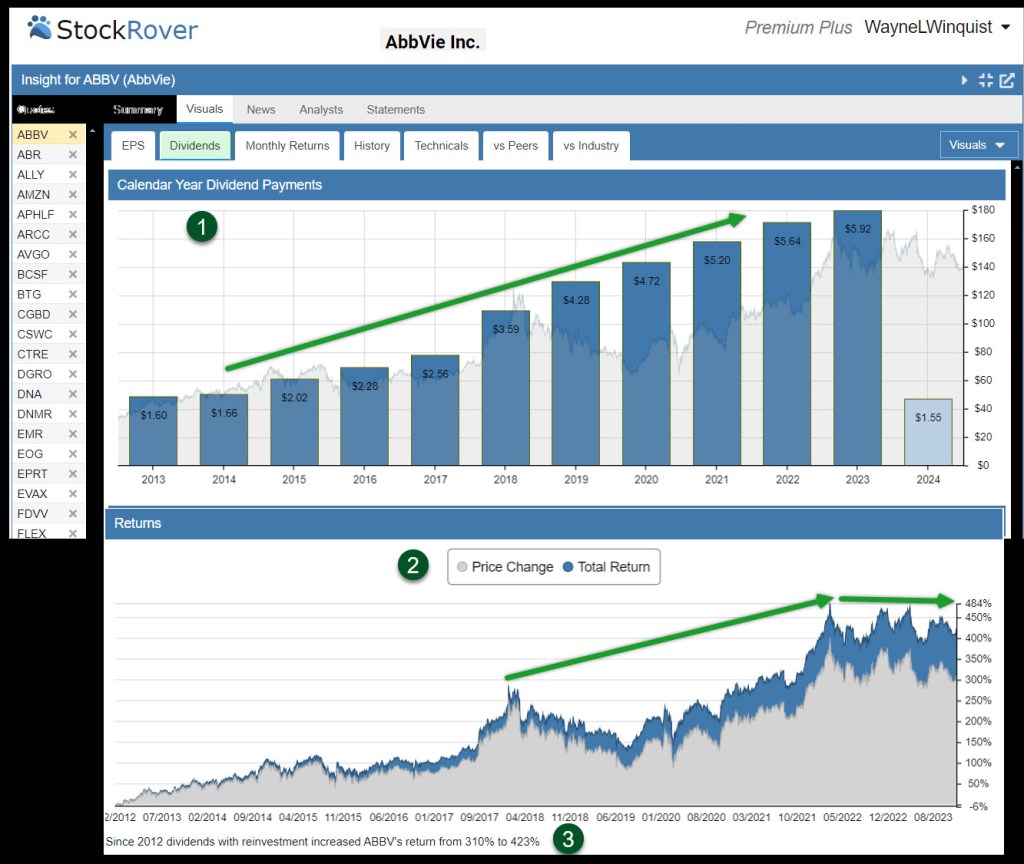

I like several things about this tool. It makes it easier to see important information about our investments. For example, I own shares of ABBV. There are two ways StockRover helps me see the value of this investment over time. One is a dividend growth graph. Another is a total returns perspective. Both are important.

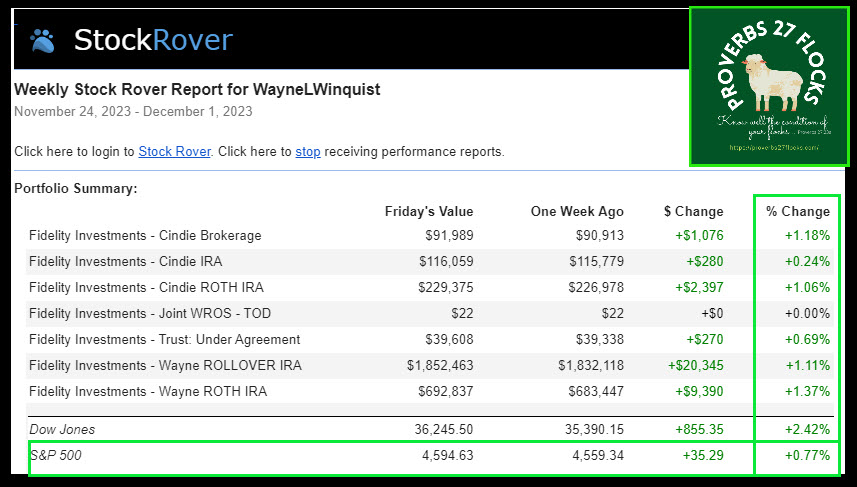

The cost of my “Premium Plus” annual subscription is $279.99. It was much less costly the first year at $194.99. However, even at $280, it is only about $23 per month. Avoiding just one bad investment is well worth the subscription cost.

Looking at the Graphs

The “Calendar Year Dividend Payments” view helps me see the trend in dividends. I want dividend growth for most of our investments. ABBV’s 5-year dividend growth rate is either 9.0% (StockRover) or 10.52% (Seeking Alpha.) I’m fine with either one. I suspect that StockRover’s calculation is more accurate.

The “Returns” portion is also important. “Since 2012 dividends with reinvestment increased ABBV’s return from 310% to 423%.” In other words, ABBV is a wonderful healthcare biotechnology company. Furthermore, ABBV just announced a buy of IMGN (AbbVie to acquire cancer drugmaker ImmunoGen for $10B cash.) I view that as a positive, because ImmunoGen, Inc., is a commercial-stage biotechnology company, focused on developing and commercializing the antibody-drug conjugates (ADCs) for cancer patients.

IMGN Company Profile

ImmunoGen, Inc., a commercial-stage biotechnology company, focuses on developing and commercializing the antibody-drug conjugates (ADCs) for cancer patients. The company’s product candidates include mirvetuximab soravtansine, an ADC targeting folate-receptor alpha (FRa), for the treatment of platinum-resistant ovarian cancer; and a cell-surface protein expressed in various epithelial tumors, including ovarian, endometrial, and non-small-cell lung cancers, as well as Pivekimab sunirine, a CD123-targeting ADC that is in Phase II clinical trial for treating acute myeloid leukemia and blastic plasmacytoid dendritic cell neoplasm. Its preclinical programs include IMGC936, an ADC in co-development with MacroGenics, Inc.; and IMGN151, an anti-FRa product candidate. The company has collaborations with Roche; Amgen/Oxford BioTherapeutics; Bayer HealthCare AG; Eli Lilly and Company; Novartis Institutes for BioMedical Research, Inc.; CytomX Therapeutics, Inc.; Fusion Pharmaceuticals Inc.; Debiopharm International SA; and MacroGenics, Inc. ImmunoGen, Inc. was founded in 1980 and is headquartered in Waltham, Massachusetts.

ABBV Company Profile

AbbVie Inc. discovers, develops, manufactures, and sells pharmaceuticals worldwide. The company offers Humira, a therapy administered as an injection for autoimmune, intestinal Behçet’s diseases, and pyoderma gangrenosum; Skyrizi to treat moderate to severe plaque psoriasis, psoriatic disease, and Crohn’s disease; Rinvoq, a JAK inhibitor to treat rheumatoid and psoriatic arthritis, ankylosing spondylitis, atopic dermatitis, axial spondyloarthropathy, and ulcerative colitis; Imbruvica for the treatment of adult patients with blood cancers; and Venclexta/Venclyxto to treat hematological malignancies. It also provides facial injectables, plastics and regenerative medicine, body contouring, and skincare products; Vraylar for depressive disorder; Duopa and Duodopa to treat advanced Parkinson’s disease; and Ubrelvy for the acute treatment of migraine with or without aura in adults; Qulipta for episodic migraine. In addition, the company offers Lumigan/Ganfort and Alphagan/Combigan for the reduction of elevated intraocular pressure(IOP) in patients with open angle glaucoma (OAG) or ocular hypertension; Restasis, a calcineurin inhibitor immunosuppressant indicated to increase tear production; and eye care products. Further, it provides Mavyret/Maviret to treat chronic hepatitis C virus (HCV) genotype 1-6 infection and HCV genotype 1 infection; Creon, a pancreatic enzyme therapy; Lupron to treat advanced prostate cancer, endometriosis and central precocious puberty, and patients with anemia caused by uterine fibroids; Linzess/Constella to treat irritable bowel syndrome with constipation and chronic idiopathic constipation; and Synthroid for hypothyroidism. It has collaborations with Calico Life Sciences LLC; REGENXBIO Inc.; I-Mab Biopharma; Genmab A/S; Janssen Biotech, Inc.; Genentech, Inc.; and California Institute for Biomedical Research (Calibr). The company was incorporated in 2012 and is headquartered in North Chicago, Illinois.

Full Disclosure

I own 600 shares of ABBV as a long-term investment. The shares are currently worth about $86,000 and they produce about $3,700 in dividends each year. The following image is part of an email I get from StockRover each week. It is a helpful way to watch what is happening with our accounts.

LINK: StockRover Plans