Balance is Ubiquitous

Balance is important. So much so, that even our ears have a complex system for helping us maintain our balance and move about without falling. Balance is important when it comes to eating. Many people rebalance their diets in the new year. Balance is important for the round wheels on vehicles. If they aren’t balanced, they wear out more quickly, so wheels must be rebalanced. There is even something called the “balance of nature.” I see it in my aquariums. The plants help the fish, and the fish help the plants. Therefore, balance and therefore “rebalancing” is always a good thing. Or is it? For our bodies it is a good thing.

The Fascinating Canals of the Ear

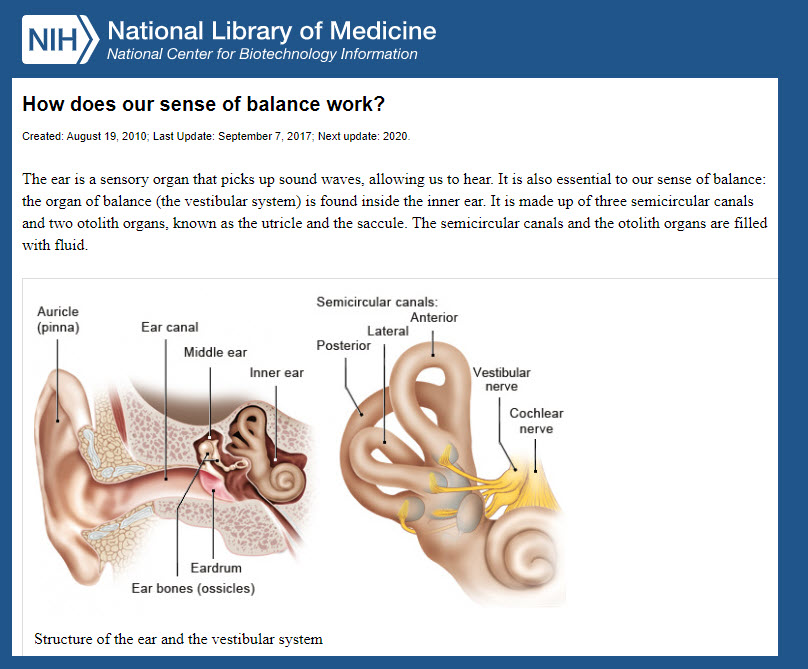

According to the National Library of Medicine, in our ears, “Each of the semicircular canals end in a space that has small hair cells in it. These spaces are called ampullae. Whenever we turn our head, the inner ear turns along with it. But it takes a very brief moment for the fluid in the semicircular canals and ampullae to move with our head too. This means that the sensory hair cells in the ear are bent by the “slow” fluid. The hair cells then send this information to the brain via nerves.”

“Each of the three semicircular canals is responsible for a specific direction of head movement: One of the canals responds to the head

- tilting upwards or downwards,

- one responds to it tilting to the right or to the left, and

- one responds to it turning sideways.”

Rebalancing happens all the time as we get up, walk, turn, run, and sit down. If there was no adjustment, we would fall, and we might be hurt. This is a masterful part of our Creator’s design of our bodies. However, “balance” can be sold as a good thing when it just might not be.

Rebalancing Investments

Whenever I hear an advisor or someone talking about rebalancing investments, I have to think they may be doing this for their own financial benefit. You see, this looks like a good idea, but good ideas often cost money. In order to “rebalance” you have to sell some investments and keep the cash or invest in different investments. It “makes sense” in a superficial way. Advisors want you to believe that they are earning their keep by doing many things for you, including rebalancing your investments.

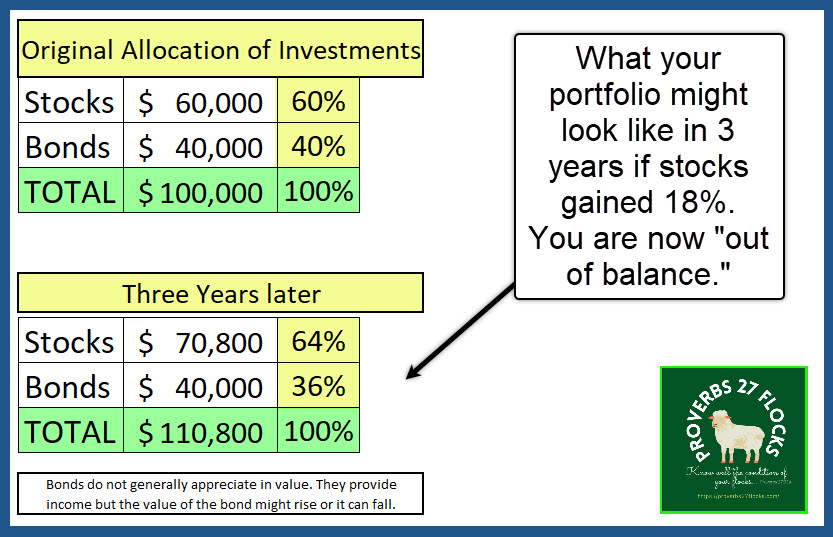

There are several problems with this thinking. First of all, it often results in selling winners and buying something that has not performed as well. For example, you might decide your portfolio should be 60% equities (stocks, ETFs, mutual funds) and 40% fixed income (bonds, CDs, and related ETFs and mutual funds.) In year one, you (or your advisor) execute trades to purchase investments that help you achieve this mix.

During the next 3-4 years, your stocks go up by 18%. As a result, you no longer have a 60/40 portfolio of investments. Your mix might be more like the following illustration.

Your advisor looks at this, calls you, and says he (or she) wants to rebalance your portfolio. What they are saying is “I will sell some of your stock-type investments and buy more of the bond-type investments with the cash.” Let me caution you to use three words in response: “No thank you.” The logic of this is flawed. You are really potentially selling your good investments that are doing what you want them to do to buy another type of investment that probably isn’t or won’t do as well. Always remember inflation when you think about this.

What You Should Do: Ask Two Questions

You should not just rebalance to rebalance. Rather, you should look at your investments from an investor’s point of view. Always ask the question, “Why did I buy this investment?” Then ask the question, “Does the original reason still stand?” If the answer is “yes” then you should not, I believe, sell the investment or investments only to buy something else.

Does Rebalancing Work?

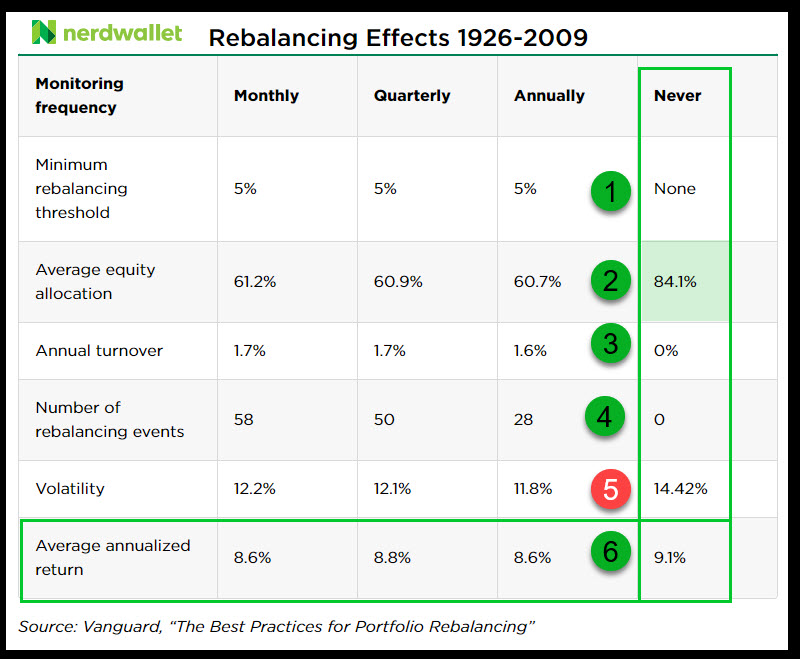

I found an interesting article at NerdWallet about this very thing. Here is a portion of that piece. The question is, does rebalancing work? The answer:

“Almost never: A Vanguard paper on the best practices for portfolio rebalancing back-tested four different rebalancing scenarios — monthly, quarterly, annually, never (solely redirecting investment income back into the portfolio) — between 1926 and 2009 in a portfolio that held 60% stocks and 40% bonds. It calculated average annualized returns, portfolio volatility and costs (by measuring the number of rebalancing events).”

Furthermore, the article goes on to say, “Vanguard’s findings? Rebalancing more frequently than never had no material impact on a portfolio’s volatility. In fact, the less frequently the portfolio was adjusted — other than reinvesting the portfolio’s dividends and interest payments — the better the return.”

So What Shall You Do?

In my next post I will suggest what I believe are some far wiser and more helpful or beneficial investment practices that will allow you to maintain your balance.

One other thought before I go: don’t think that balanced mutual funds are a good idea. If you really want both stocks and bonds, then buy individual stock and bond funds. You don’t need an expert creating that fund for you. It is far better to pick the best stock fund(s) and bond fund to meet your needs.

Full Disclosure

We do not have a balanced portfolio and I do not rebalance. However, there are some prudent behaviors that require action. That will be the subject of my next post.