The Big Picture

The thing I call my “Easy Income Strategy” (EIS) is a way for me to think about my overall strategy. My big picture is to grow our income with little effort. One section of the stock market is helpful in this goal. Investments classified as “Business Development Companies” (BDCs) not only have growing income, but they also have high yields. However, be forewarned that high yields in some business sectors are really very high risk. There are high yield BDCs that are very high risk. The ones I have purchased, I believe, are not risk-free, but they are rational.

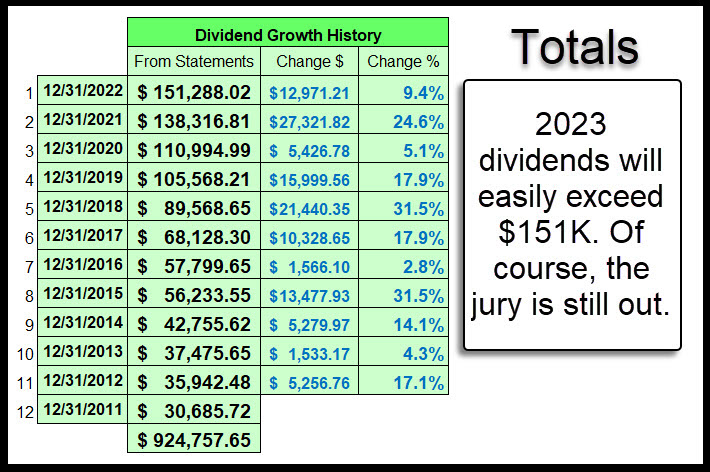

It is very likely that our 2023 total dividend income will exceed that of 2022. The following image shows what my easy income strategy has produced since 2011. Bear in mind that I have been “retired” for over ten years. Therefore, the growth in our income is better than most of the raises I received in my working years. For example, how many of you got a 24.6% increase in 2021? How about 31.5% increases in 2018 or 2015?

BCSF and OBDC are two of my newer holdings in the BDC realm for the Easy Income Strategy (EIS). Therefore, I think it prudent to give my readers an updated view on the dividends coming from our BDC investments as a part of the total dividend picture. As you can see, about one-third of our income pours in from the BDC investments. Some of this is due to the supplemental dividends that come from investments like OBDC.

Let’s use Seeking Alpha to examine some of the key factors I use to evaluate our investments. The beauty of SA is that I can create my own “portfolio” that includes just the stocks I want to review. In this case, I created a portfolio called “CompareBDCs.” Note that the Seeking Alpha “Health Score” for our BDC investments is quite high. This is due, to a large extent, by Dividends, Returns, and the SA QUANT rating.

The QUANT Rating for Our BDCs

The QUANT rating is just a way to know if now might be a good time to buy an investment. As the following illustration indicates, HRZN, OBDC, PNNT, TSLX, BCSF, and CGBD are all currently “buys.” The others (GAIN, ARCC, CSWC, SAR, and MAIN) are currently in HOLD territory. However, it is important to note that all of these investments have high scores for valuation (they are currently undervalued by the market) and high scores for profitability. Profitability, as you might imagine, is VERY important.

The RETURNS for Our BDCs

Dividends are nice, but they are only one piece of the investment puzzle. The five-year total return for these BDCs is shown in the following image. You can also see the YTD performance of the two BDCs I have been adding to our mix of BDC investments.

The DIVIDENDS for Our BDCs

While dividend yield is a factor, the wise EIS includes a careful consideration of the dividend payout ratio and the dividend growth rates. BDCs will not typically have the same dividend growth rate as a stock like AVGO (AVGO has a five-year dividend growth rate of 21.32%), but they tend to make up this shortfall by just giving you great yield. As you can see in this illustration, every dollar invested in these BDCs is giving me some wonderful income. PNNT, for example, is currently yielding 12.86%. CGBD is yielding 10.05%. Those are very attractive.

In addition, some of these pay their dividends monthly: GAIN and MAIN fit into this category. Monthly income is a nice thing in retirement.

For Your Consideration (Repeating what I said before)

If you are nearing retirement and you have not considered dividend growth investments, now might be a good time to start a transition to that type of income. Bear in mind that if you have Social Security, it is already like an annuity. You really should avoid buying an annuity unless you have no hope of making sound equity investments.

BDCs are certainly higher risk investments than cash or CDs. However, if you are thoughtful about the BDCs you buy, you will realize some great quarterly and monthly income from those investments. Here are some examples of some awful BDCs. Don’t buy SMURF!