When Is a Player Worth What He is Paid?

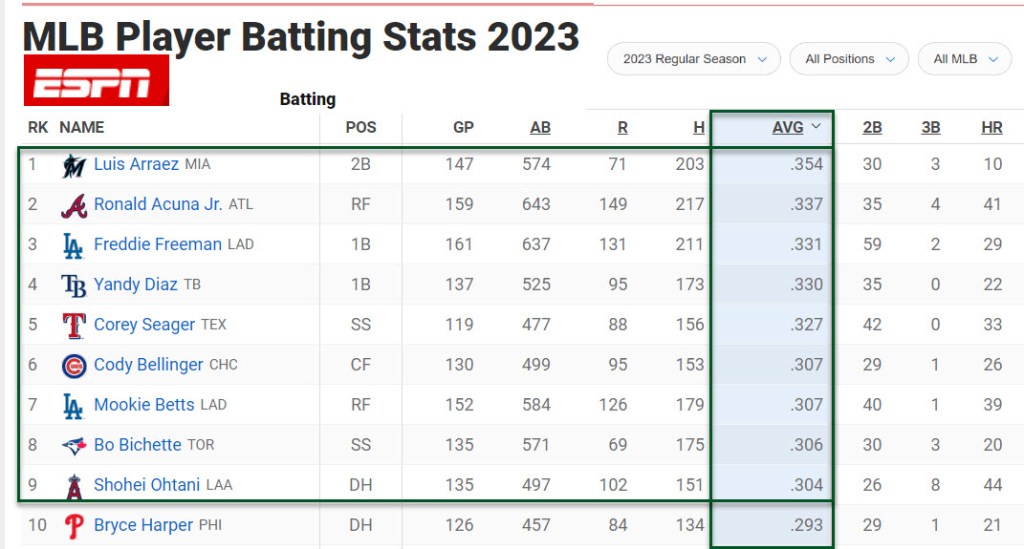

What does a batting average mean? In baseball, a batting average simply means the percentage of at-bats that a hitter gets a hit. If a batter has a batting average of zero, it means they never get a hit. If their average is 1.000, then they get a hit every time they are at bat. Some batters have decent batting averages.

Although I don’t follow baseball and couldn’t name a single current player if my life depended on it, I do know that things like a batting average are important measures. I (wrongly) assumed that there would be a lot of players who might hit three out of ten times they are at bat. Apparently, that isn’t even close to reality, as the following images illustrate.

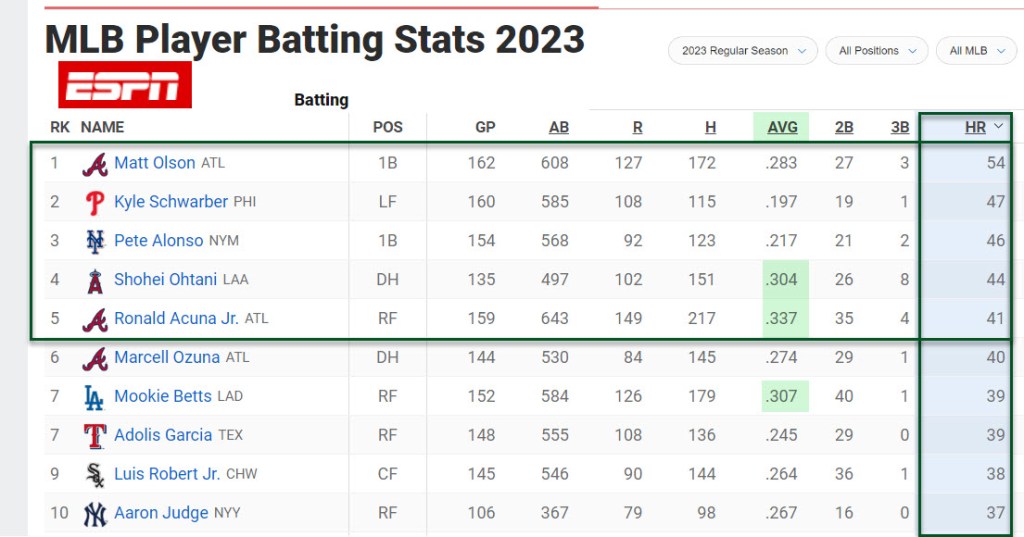

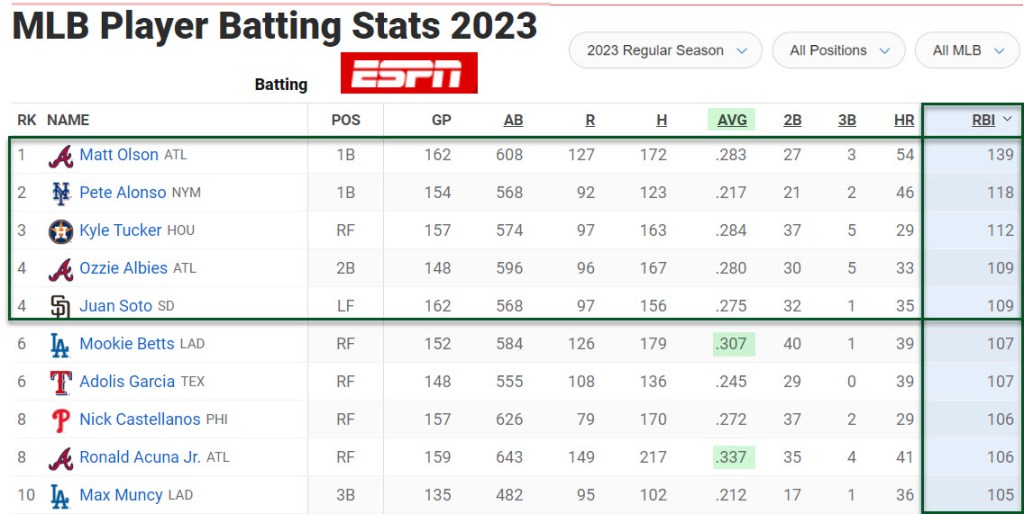

Now all of life consists of a few people who seem to excel and a lot of people who are average, and a whole host of people who are not performing very well. This includes investment advisors. What is an acceptable batting average in the investing world? Although I am not a registered advisor and view my blog posts as educational, not recommendations, it is helpful for my readers to know that I strike out sometimes. When I do, it is fairly obvious that I did some swinging with zero hits.

Sold Some Speculative Positions

Most of the time I like to talk about my successes, but the reality is that I also have some losers in the overall investing journey. This past Friday I started some cleanup of our portfolio in multiple accounts owned by me and my wife to cull some losers I feel have limited upside potential. Although I am primarily a dividend growth investor, I like to speculate on some positions and that speculation often provides rich rewards. In other words, I am trying for some home runs when I should focus on singles and a few doubles.

Some of my speculative buys are losers. I struck out trying for some home runs. As painful as it is to sell losers, it is better to take a loss and put the money to work in more productive ways.

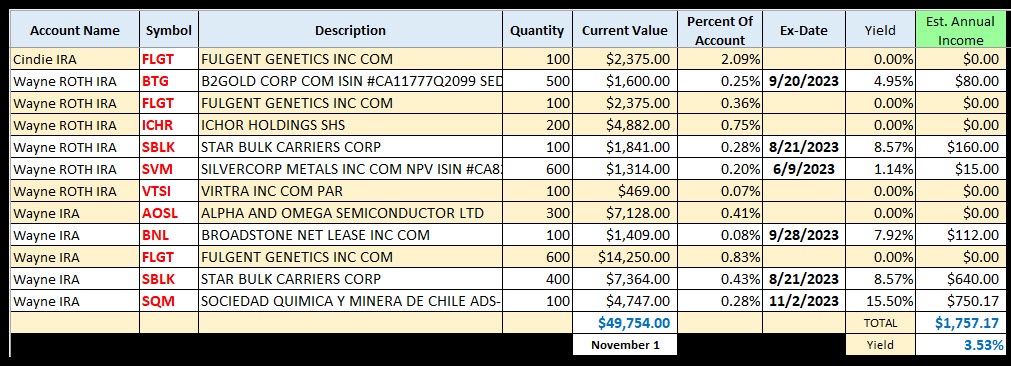

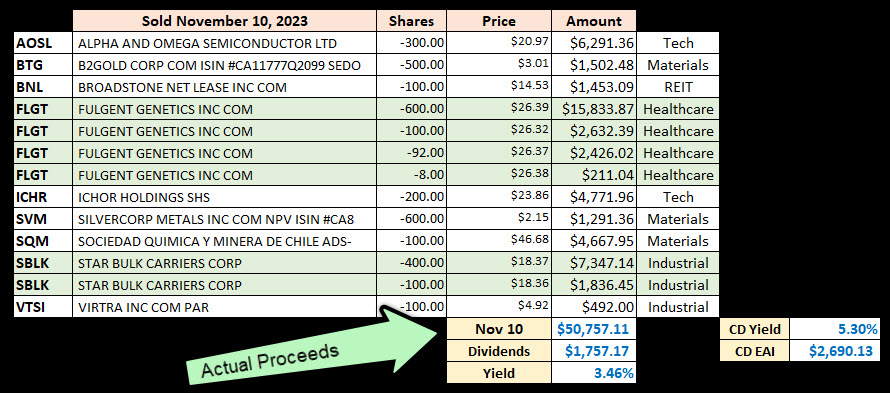

Friday I sold the following investments: Alpha and Omega Semiconductor, B2Gold Corp, Broadstone Net Lease Inc, Fulgent Genetics Inc, Ichor Holdings, Silvercorp Metals Inc, Sociedad Quimica Y Minera De Chile ADS, Star Bulk Containers Corp, and Vitra Inc. This caused me to book a loss of just over $100,000. Ouch! The true loss is less than $100K. I received over $16K in options income from these positions and $3,294 in dividends.

These investments, however, only represent a small slice of our total invested capital. Some might be terrified with even that amount of speculation, but as I stated earlier, the risk is often counterbalanced with some great rewards. Some examples come to mind, but I won’t list them for fear that you will buy them without knowing the risks. In other words, you might be thinking I am recommending a home run when it might be a game-losing proposition.

Look on the Bright Side

On the plus side, the estimated annual dividends from BNL, BTG, SBLK, SVM, and SQM were only $1,757. So around $18K of investment dollars were earning a dividend. Over $31K were not earning a dividend. I did not take the time to review the dividends I have received from these positions, but the dollars weren’t enough to satisfy me to hold these for the long term. In addition, the potential income from trading options on these was not a compelling reason to hold.

I did take the time to review each holding on Seeking Alpha to see if there was something worthy of a continuing hold. I did not see anything compelling. Furthermore, by simply purchasing $50K in CDs paying 5.3%, I can generate $2,650 in income with far less volatility in this slice of the overall portfolio. I’m not saying I will buy CDs, but some of the money might be parked in 1–2-month CDs for the remainder of 2023.

Full Disclosure I really don’t have a good way to quantify what percentage of the time I have sold losers. My overall success tells me that I consistently have more winners than losers. However, I don’t know that I am batting more than .900. I’m more focused on overall dividend growth, year-after-year, coupled with portfolio growth. Our average annual portfolio growth is around 9%. My annualized dividend growth is certainly at least 10%.

Similar token there is a player ( dog) name MPW not performing at all ( looks like short sellers bread & butter stock) . Not only that, it is just about in a graveyard!!. What do you think about it? Keep it or sell it or is it too late to sell?

On a different note , you have mentioned about proceed you have received to invest in 1-3 months treasuries or CDs.. just curious why not value advantage type Money Market ( SWVXX) which yields( 7 day yield) 5.26% ( just about equivalent of short term CD). Your thoughts please!

Thanks

LikeLiked by 1 person

If I had a Schwab account I might consider SWVXX. You cannot buy SWVXX on Fidelity. I suspect this is because Fidelity has similar funds so they don’t want to offer a competitor’s Money Market offerings. Regarding MPW: I am not selling, but I am no longer buying. The remaining dollars are not enough to cause me to abandon ship. I am beginning to doubt that a recovery is not likely, certainly not in the next year. However, I can help but wonder if some of the selling is an overreaction. In my mind it is too late to sell, so I will just wait to see how it shakes out. Others don’t have the stomach for that and probably should sell if they are depressed about their MPW holding.

LikeLike