Loving the Easy Income Dividends

OBDC is one of my newer holdings in the BDC realm for the Easy Income Strategy (EIS). I bought 1,200 shares in July, 1,600 shares in August, 200 shares in September, and another 700 shares in October. We now hold 3,700 shares.

I often encourage friends not to feel compelled to buy all of the shares you want at one time. To illustrate this, the OBDC shares were purchased eighteen times over the four-month period, and the average size of the orders was just over 200 shares per purchase. As I write this, OBDC shares are trading at around $14.15 per share. As the price of the shares dropped, I kept entering small orders to add to our portfolio.

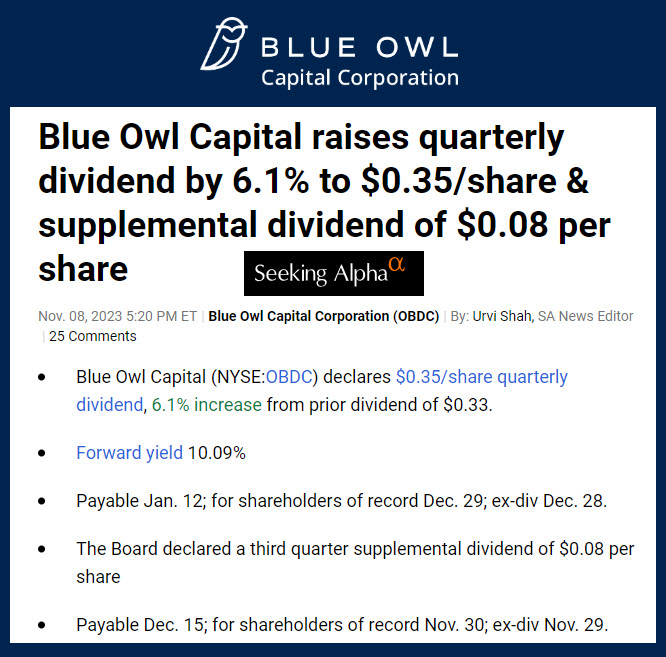

During the short period of time we have owned our shares, we have already received $1,186 in dividends. With the announcement of the dividend increase and the supplemental dividend, our next dividend will total $1,591. This is due, in part, to the supplemental dividend of $0.08 per share.

Supplemental Dividends Are Increasing

If you dig into the 12-month dividend history for OBDC, you will see that the regular quarterly dividend has been $0.33 per quarter. It is now $0.35. The other interesting piece is that there have been four supplemental dividends this year. The first one was $0.04 (03/03/23), the second one was $0.06 on May 31, the third one was $0.07 on August 31, and the last one for the year is another penny at $0.08. In other words, if you include supplemental dividends, income has increased every three months.

To put this another way, the true total dividend in March was $0.37, for the second quarter was $0.39, for the third quarter $0.40 and for the most recent quarter, yet to be paid $0.43. There is certainly no guarantee that this will repeat in 2024. In fact, the investor page for Blue Owl clearly states, “The amount of future dividends declared and approved by the board could be higher or lower. Past performance is not a guarantee of future results.”

Other Dividend Announcements

In addition to OBDC, Realty Income (O) declared a monthly dividend, Manulife Financial (MFC) declared a quarterly dividend in Canadian currency, and Cresent Capital (CCAP) also declared a quarterly dividend. I no longer hold shares of CCAP, preferring to focus on OBDC and other BDC investments. Cindie and I own 1,500 shares of MFC, and a total of 1,200 shares of O.

OBDC has a Seeking Alpha QUANT rating of 4.69, which is a strong buy. In all fairness, CCAP also has a strong buy rating of 4.59. MFC has a strong buy rating of 4.89, and O is sitting at 3.06 as a HOLD investment. O is considerably below the 52-week high, so I am somewhat tempted to add more shares. At this point I will be more inclined to buy more shares of OBDC.

For Your Consideration (Repeating what I said before)

If you are nearing retirement and you have not considered dividend growth investments, now might be a good time to start a transition to that type of income. Bear in mind that if you have Social Security, it is already like an annuity. You really should avoid buying an annuity unless you have no hope of making sound equity investments. Cindie and I can live on our Social Security income, so all of the dividend income can be put to work in charitable giving and in special times like an upcoming 2024 vacation to Hawaii with one of our beautiful granddaughters. That will be fun.

OBDC Business Profile

Blue Owl Capital Corporation is a business development company. It specializes in direct and fund of fund investments. The fund makes investments in senior secured, direct lending or unsecured loans, subordinated loans or mezzanine loans and also considers equity-related securities including warrants and preferred stocks also pursues preferred equity investments, first lien, unitranche, and second lien term loans and common equity investments. Within private equity, it seeks to invest in growth, acquisitions, market or product expansion, refinancings and recapitalizations. It seeks to invest in middle market and upper middle market companies based in the United States, with EBITDA between $10 million and $250 million annually and/or annual revenue of $50 million and $2.5 billion at the time of investment. It seeks to invest in investments with maturities typically between three and ten years. It seeks to make investments generally ranging in size between $20 million and $250 million.