How to Craft Smarter Withdrawals in Retirement’s Game of Risk

There is a thread on the website of the American Association of Individual Investors that talks about withdrawal strategies. One of the contributors, Robert Adams, said a couple of things in just one paragraph that resonate with me. He said, “I think allocating assets to bonds is like running a marathon while wearing ankle weights, and rebalancing is a fruitless (and often counterproductive) enterprise. I’ve never had a balanced portfolio to begin with, so rebalancing would be absurd. On that topic, look at Warren Buffett’s portfolio. There’s nothing balanced about it and never has been.”

Robert addressed what I view as two investing practices that can be harmful. The first is thinking that a 60/40 allocation to stocks/bonds is a prudent strategy. The second is that most investment advisors like to “rebalance” their clients’ investments. This, I believe, is often a very bad idea. If you buy quality investments, “rebalancing” by selling the winners and buying assets that are now a smaller percentage of your portfolio is not likely to be a winning strategy.

Three New Dividend Announcements

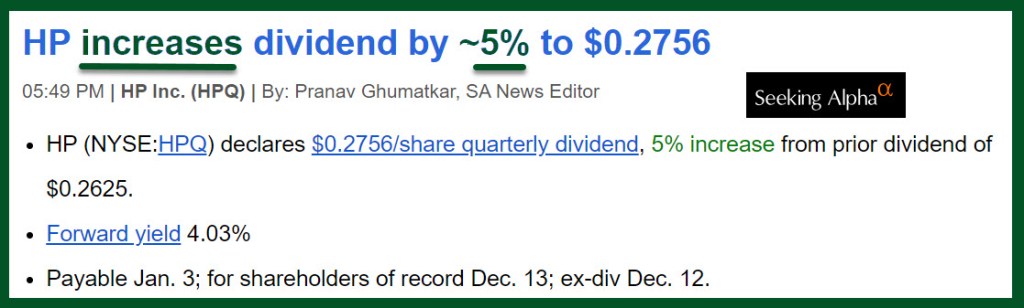

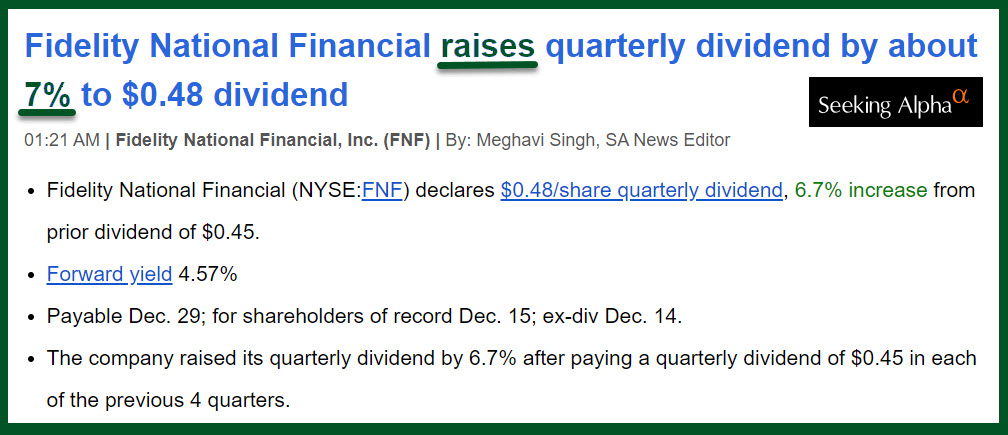

During earnings season it is quite normal to see not only earnings reports but also dividend announcements. Sometimes the dividends don’t change, and sometimes there is an increase. In yesterday’s emails from Seeking Alpha I saw that HPQ and FNF both declared an increase to their quarterly dividends. HPQ’s increase was about 5% and FNF bumped their dividend by 7%. You generally won’t see this with bonds.

When investors buy bonds or bond funds, they believe the value of their bonds will at least remain stable over time. This makes them think, “At least I did not lose money like the people who invested in stocks.” The last two years have made it painfully obvious that this is not the case. Furthermore, many bond funds can have declining, not increasing, dividends.

Bond fund EIM, the Eaton Vance Municipal Bond Fund, for example, has a negative 6.44% five-year dividend “growth” rate. The fund is down almost 10% YTD. Although EIM pays a monthly dividend, it also charges an expense ratio of 1.09%. There are many other bond funds with even more appalling expenses and horrible returns on your invested dollar. Some that I looked at had expense ratios of 1.32%, 1.56%, 1.23%, and 1.31%. They were: VKI, AFB, IQI, and MMU.

Some non-municipal bond funds with far lower expense ratios are VCLT, SPLB, VCSH, IGLB, and IGHG. The first four have an expense ratio of 0.04%. The Dividend Growth 5 Year (CAGR) for these bond funds are -0.90%, -1.22%, 2.42%, -1.39%, 5.46%, and 41.39%. All of them, with the exception of IGHG, have a negative 3 Year Price Performance, 5 Year Price Performance, and 10 Year Price Performance.

A prudent investor should really reconsider the recommended stock/bond allocation of their financial advisor. You are wearing investment ankle weights when you commit too much of your total portfolio to bonds.

Dividend Announcements

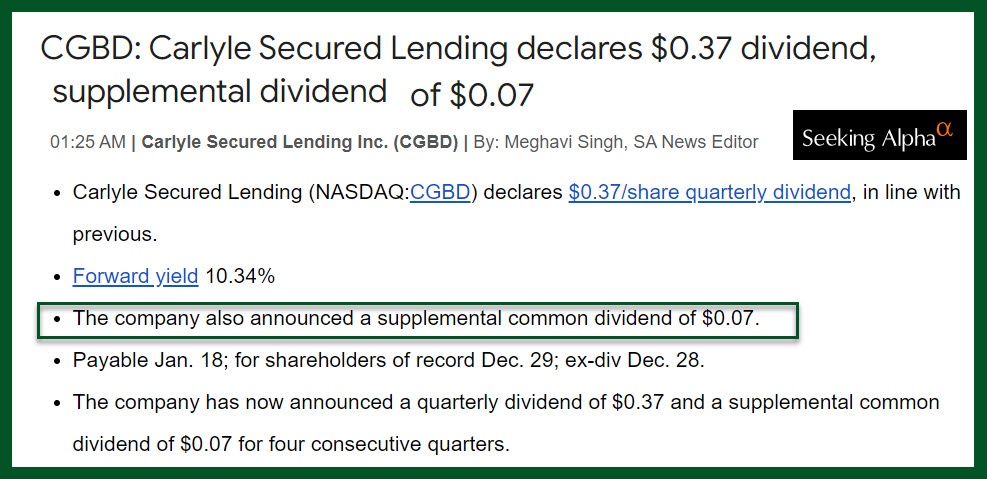

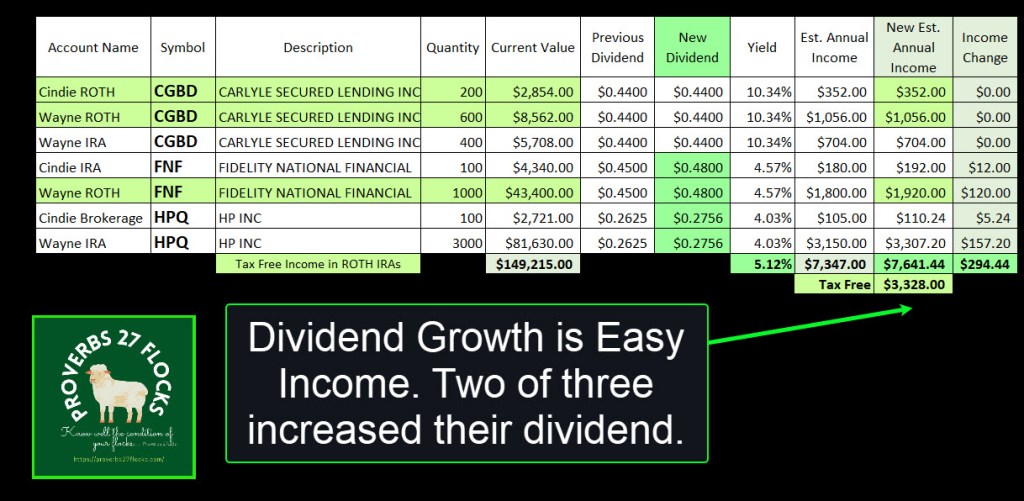

Here are the three dividend announcements for CGBD, FNF, and HPQ. CGBD did not increase their dividend, but the combined quarterly and supplemental dividends did remain the same. Yesterday I bought another 200 shares of CGBD.

Reviewing the Ratings

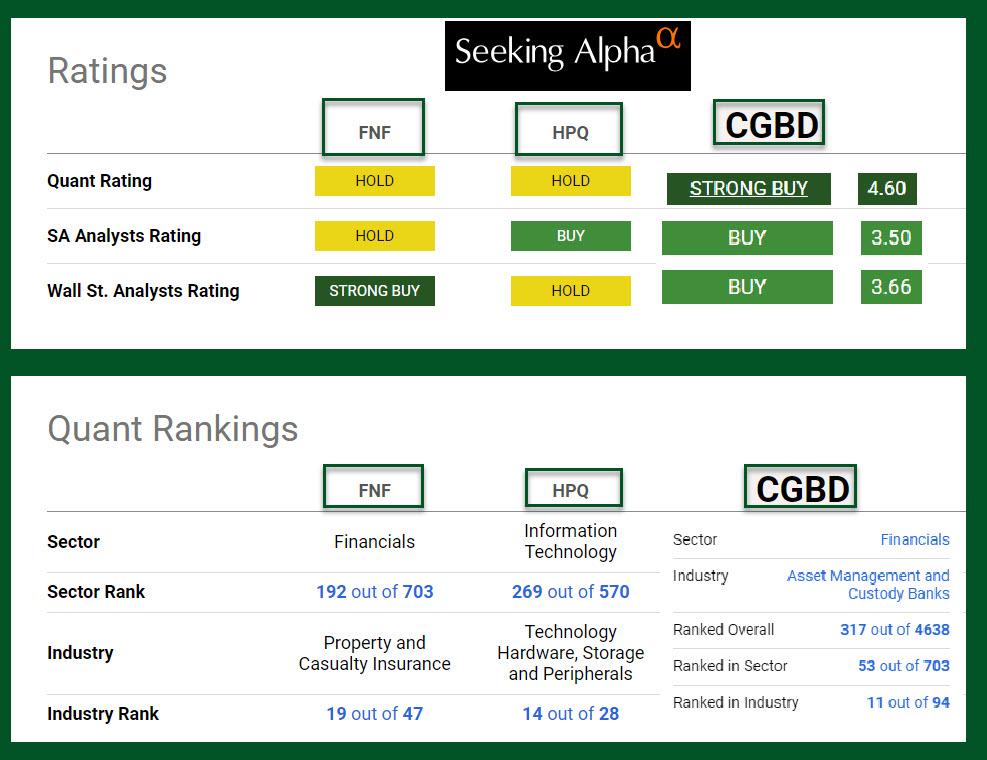

Seeking Alpha’s QUANT ratings helps me judge when I might want to buy more of an investment. In the following illustration, CGBD has a QUANT rating of “STRONG BUY.” However, this is not a dividend growth investment. It is a high dividend yield investment.

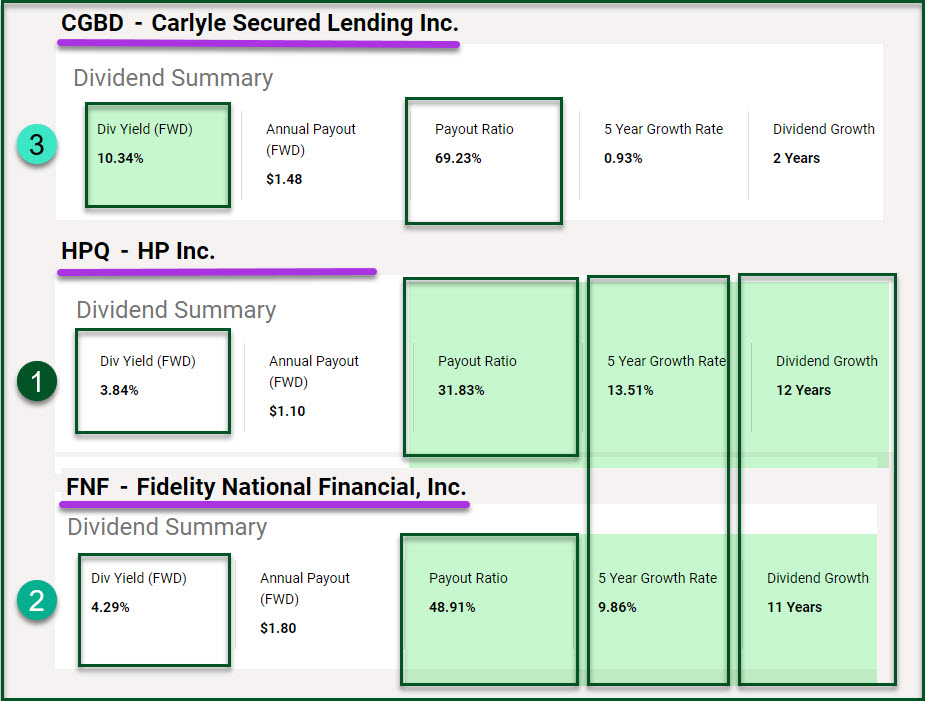

Reviewing the Dividend Metrics

Because I am interested in dividend growth and/or sustainable dividend yield, the following helps me understand the historical parts of the dividend story for CGBD, FNF, and HPQ. From a payout ratio perspective and a 5-year dividend growth rate perspective, HPQ is my favorite. Having said that, FNF is no slouch, and it offers a slightly better dividend yield.

Some More of Robert’s Wisdom

Robert went on to talk about stewardship. He said, “Running out of money is not my primary concern. Instead, my focus is on how well I can continue to grow my assets. All my adult life, I scrimped, saved, and invested a portion of whatever income I had in order to grow my nest egg, and I see no reason to do anything different now in retirement. At the beginning of retirement, I used a flexible 4% rate as my “income,” but in keeping with habit, I saved and invested a portion of that 4%, which really means that I simply kept my spending well below the 4% limit as a margin of safety. I’ve always maintained a 100% allocation to equities, and as a result of this allocation, my assets have grown nicely through the first 10+ years of retirement. That has provided an even higher margin of safety below the 4% limit. I’m now thinking of adjusting my spending limit to 100% of dividends plus 1% of the previous year’s ending portfolio value, and I’ll be sure to maintain a margin of safety below that.”

“I guess I should add that I view my assets as belonging to my loved ones as much as to me. Thus, I’m a steward for them, and a good steward cultivates and grows the assets under his charge.”

In Conclusion

These three holdings add $7,641.44 in annual income in our portfolio. $3,328 of that income is in the ROTH accounts, so that income is tax-free if withdrawn. The increase in income for FNF and HPQ totals $294.44. That is easy income.

Afterward: How to Craft Smarter Withdrawals in Retirement’s Game of Risk

Here was my response to the same thread: “Before I retired, I looked at my likely RMD from my traditional IRA and then set a dividend growth goal that would more than cover the RMD from dividends. Although I thought i set an aggressive goal, it turns out I was too conservative. I not only reached my goal, but far exceeded it. This was done by buying investments that have a solid dividend growth trajectory.”

Therefore, I don’t think about the need to sell investments, regardless of the market climate or volatility, as dividends far exceed both my income needs and the RMD requirement. I will take my first RMD next year. I have been retired for ten years.

Dividend growth stocks, combined with some options trades, capped with Social Security, provides far more income than I had when I was working. Furthermore, $50K of our dividend income pours in from ROTH IRAs, so there is no additional tax burden. We can give generously and spend without worry. It also helps to be debt free going into retirement and staying debt free.

Bonds and rebalancing are not a part of my long-term strategy.