Today I Bought EMR Shares

When I saw the email that said that Emerson Electric was down over eight percent, I went to look at the reasons. I’ve owned EMR in the past but did not currently own shares. That changed this morning. I bought my shares at $83.46 per share. There are two ways I will leverage this investment. One is just collecting the dividends. The second will be careful covered call options trades to supplement the dividend income. If the shares were to gain more than 15%, I would probably sell them.

The News Did Not Warrant the Response – in my opinion

As is often the case, traders get nervous when companies don’t hit the expected revenue and profit goals. What follows are some of the highlights of their earnings announcement.

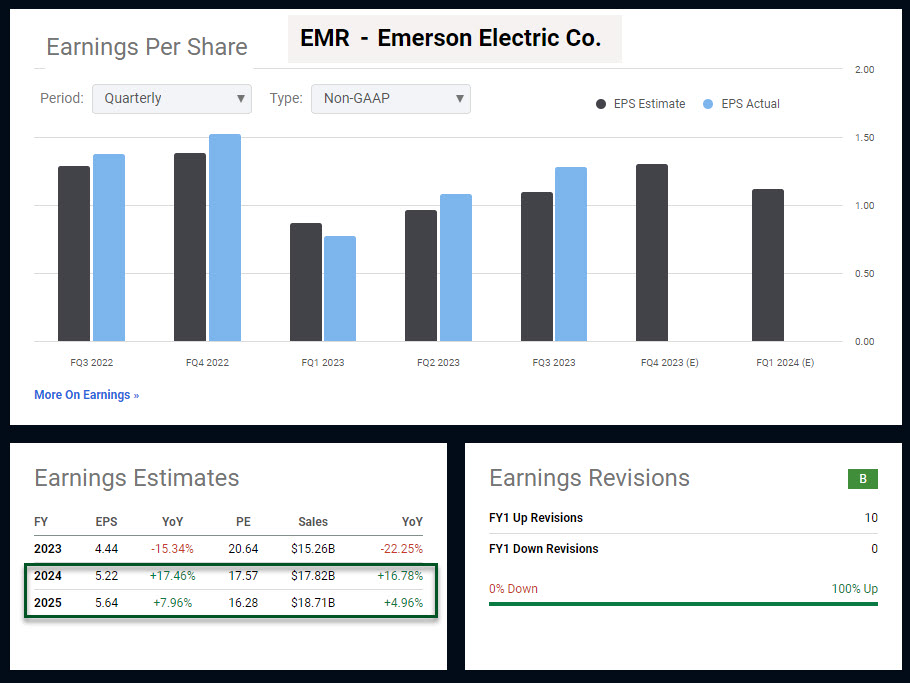

Emerson Electric’s Q4 Non-GAAP EPS of $1.07 missed by $0.24. Their revenue of $3.89B (down -4.9% Y/Y) and missed by $300M. However, I like the 2024 Outlook: Net Sales Growth of 13% – 15.5% vs 16.78% growth; Earnings Per Share of $3.82- $4.02; Adjusted Earnings Per Share of $5.15-$5.35 vs. consensus of $5.22; Operating Cash Flow of ~$3.0B-$3.1B. In other words, a drop in the price of the shares of more than eight percent seems like an overreaction to me.

Dividends

Emerson Electric raises quarterly dividend by 1% to $0.525 a share. Clearly that isn’t a big increase. However, EMR has been paying dividends for a really long time. Furthermore, the dividend payout ratio is a respectable 44.24%. In other words, for every dollar of profit EMR makes, they are paying their investors $0.4424. That is a rational approach for the company’s board of directors, as it provides cash for other business purposes.

EMR says they have been paying 66 years of increasing dividends. Seeking Alpha is probably wrong when they say it is 26 years. Either way, it is a long time.

Emerson’s Company Profile

Sector: Industrials and the Industry is Specialty Industrial Machinery.

Emerson Electric Co., a technology and engineering company, provides various solutions for customers in industrial, commercial, and consumer markets in the Americas, Asia, the Middle East, Africa, and Europe. It operates in six segments: Final Control, Control Systems & Software, Measurement & Analytical, AspenTech, Discrete Automation, and Safety & Productivity. It offers measurement and analytical instrumentation, industrial valves and equipment, actuators and regulators, and process control software and systems. The company also provides asset optimization software that enables industrial manufacturers to design, operate, and maintain operations for enhancing performance through a combination of decades of modeling, simulation, and optimization capabilities. In addition, it offers residential and commercial heating and air conditioning products, such as reciprocating and scroll compressors; system protector and flow control devices; standard, programmable, and Wi-Fi thermostats; monitoring equipment and electronic controls for gas and electric heating systems; gas valves for furnaces and water heaters; ignition systems for furnaces; and temperature sensors and controls. Further, the company provides reciprocating, scroll, and screw compressors; precision flow controls; system diagnostics and controls; environmental control systems; air conditioning, refrigeration, and lighting control technologies; and facility design and product management, site commissioning, facility monitoring, and energy modeling services, as well as tools for professionals and homeowners. The company was incorporated in 1890 and is headquartered in Saint Louis, Missouri.

In Conclusion

It is never wise to assume that the right time to buy is when the price of the shares drops eight percent. However, it is often a great time to buy. This approach has worked for me in the past. But the purchase of shares should always be based on the quality of the company and the potential for continued growth in both the dividend and the price of the shares.