How To Keep Sailing in Rough Seas

There are many reasons investors might despair at times during the investing journey. Recently so many world events and different pieces of bad financial news have created a choppy, if not stormy, time for investors. One of the benefits of dividend growth investing is remembering what is on the horizon. This requires patience.

As a former sailor, I remember how important it was to get mail. In fact, when I was stationed at Great Lakes as a seaman recruit in 1971, one of my first jobs was the “Mail Petty Officer.” I got this job because I had delivered mail in my first job at Nordberg Manufacturing in Milwaukee after high school, so I guess they thought I knew the importance of delivering the mail. This role meant I was the only one in Company 939 who could go to the base post office to pick up the mail for my shipmates. Boot camp wasn’t exactly fun, but there were things to look forward to. One of those things was a letter or treat from home.

Mail Helps Investors Too

Quite frequently mail shows up in my Google in box. As dividend announcements arrive from Seeking Alpha, I look at them and move them into a folder called “1Dividends” This folder name keeps this folder at the top of all of my mail folders.

I started saving these email message on April 28, 2023. Twenty six of the 156 messages in this folder have the word “raises.” Actually, 32 of the messages have the word “increase.” Don’t miss the significance of this. Dividends are usually declared quarterly for most company stocks and ETFs. In half of a year (May-September) 32 of our investments have increased their dividend payout. This also means that I am reminded, on average, about 26 times per month, of a declared or increased dividend. That frequency is almost once each day.

The Last Month

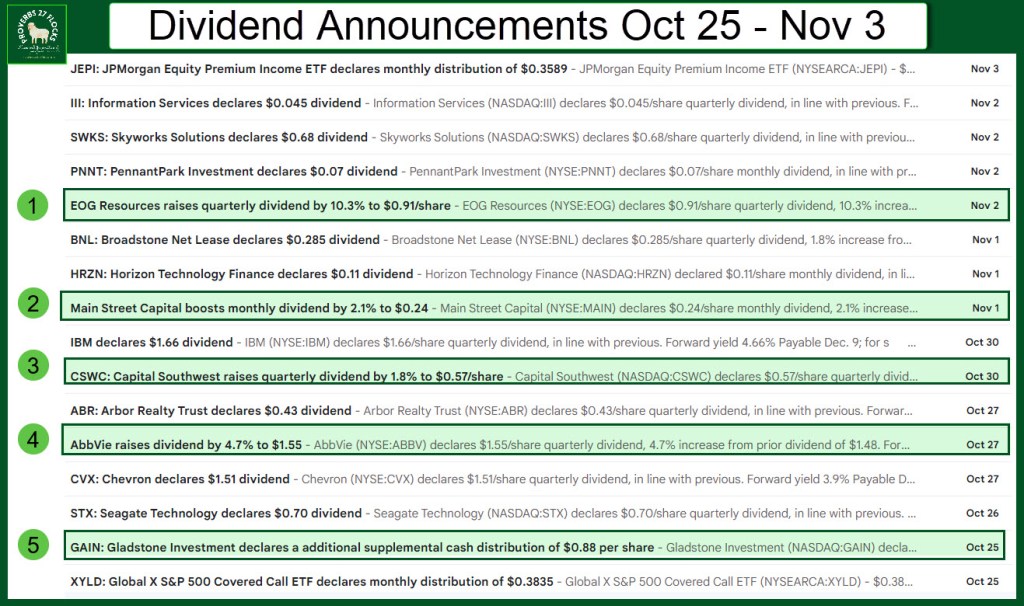

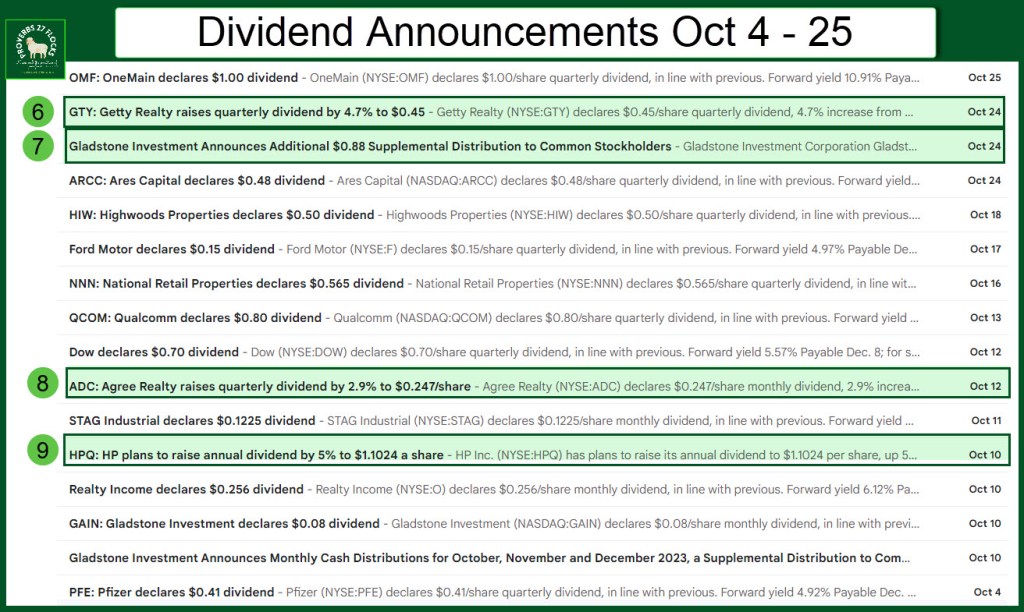

If you read my “Easy Income Strategy” posts, you might think there are just a couple of pieces of good news each year. However, as the following snapshots from “1Dividends” reveals, there have been 32 announcements since October 4. Furthermore, of the 32, nine were dividend increase announcements. It is like mail from home in 1971.

Each incoming message reminds me of why I bought the investment, regardless of the current price per share. Each message tells me the amount of the dividend and the date it will be paid. That is a strong incentive to keep investing no matter what the market or the traders are doing.

Easy Income is Better when it is Tax-Free Income

Many of the dividends are coming into our ROTH accounts. Therefore, not only are the dividends “easy”, but they are also tax free. Over $41,000 of the annual dividends have already arrived in our ROTH IRA accounts. Those dividends are true income. There are no taxes to pay. By the end of the year that number will easily hit $50K. Given our current tax bracket, that means we get to keep $10,000 that would have otherwise gone to the IRS and to the Wisconsin coffers.

In Conclusion

If you ever wonder why I like dividend growth investments, remember the good news that arrives almost every day of the year. You cannot always say that about investments that don’t pay dividends. Furthermore, to create income from dividendless investments, you have to sell them to raise the cash. That isn’t easy and it takes time. I prefer to just keep the easy income approach and focus on other aspects of our lives.

There is another problem with non-divided-paying investments. You might be forced to sell them when the market is down. That is usually the wrong time to be selling.

Wayne,

I have enjoyed your emails throughout 2023. Thank you for sharing your wisdom and insight into both financial and faith topics. God Bless you. Jim

LikeLiked by 1 person