Stock Style Number Four

By way of review, our top three stock styles are Large Value (28.4%), Small Value (22.9%), and Large Blend (13.8%). You might conclude that makes me a Large-Cap focused investor. However, when you combine our total small and mid-cap holdings, they make up 52.5% of our total holdings. You won’t get that if you invest in the S&P 500 index. Fidelity categorizes me as leaning towards a “medium value” investor.

Stock Style Medium Value

They say, “We looked at how the stocks in these accounts are spread across two key indicators – market capitalization (Small, Large or Mid-sized) and valuation style (Growth, Value or Blend) to determine the overall style of those holdings. We then compared this style to a widely followed benchmark – the Dow Jones U.S. Total Market Index. While the style of that benchmark resembles the Large Blend category, the style of your identifiable holdings is somewhat different and most closely resembles the Medium Value category.”

Asset Allocation is Most Aggressive

“98% of your selected accounts are invested in stocks, which resembles a Most Aggressive portfolio.” In other words, the average financial advisor would say that I am crazy. The reason is simple. At my age our investments should probably be about 50-60% bonds to “play it safe.” I believe that is faulty thinking. Bonds and Bond funds (ETFs and mutual funds) fight a losing battle against inflation and rising income taxes.

Buy Quality Dividend-Paying Stocks

If you look at our top ten medium value investments, you will see that ARCC is number one in the category. The top ten in this group are ARCC, HP, FNF, VYM, DKS, SWKS, UNM, CAG, SPYD, and SCHD. In the image, the tickers with the blue background are ETF investments. Once again, let me remind you that these allocations are for the mid-cap section only. In other words, VYM really isn’t our number four investment. Rather, the allocation of mid-cap value in VYM ranks it as number four, but it is our number one investment.

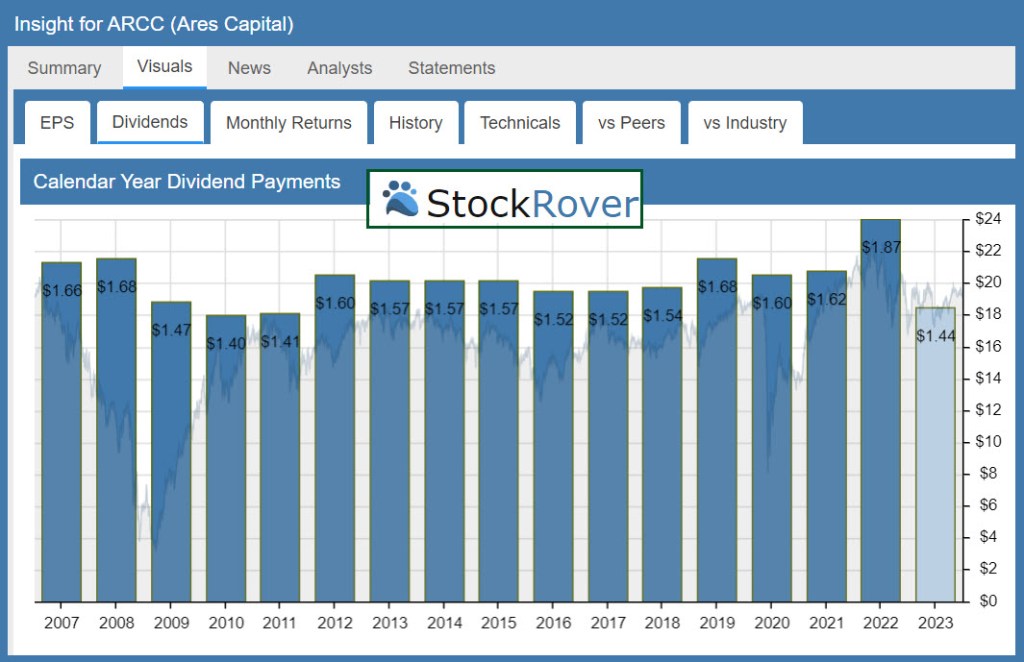

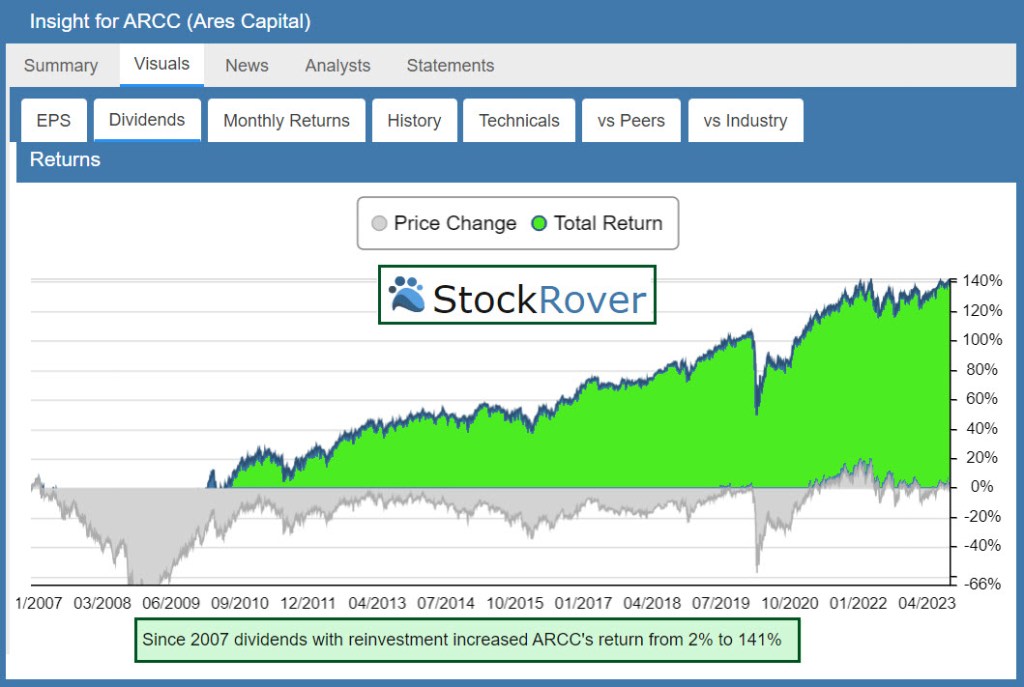

Analyzing Number One Mid-Cap ARCC

The following images from Seeking Alpha explain why we have $112K invested in ARCC. The dividends are immense. The total returns are solid. The Seeking Alpha QUANT Rating is very good. ARCC, on average, out-performs other BDC investments. This investment also has a good standing compared to the S&P 500 index. The S&P 500 index, however, does not have a dividend yield of 9.99%. In fact, ARCC beats bonds and any CD investment you might choose.

Summary

Sometimes I fear that my readers will inspect my holdings and draw the wrong conclusions. Just because I like ARCC, HP and SWKS, doesn’t mean you should buy shares. Most readers would do well to focus on good ETFs like VYM, SCHD, and DGRO. However, in retirement, income is certainly desirable. ARCC has given us $5,256 in the first half of 2023. It is reasonable to expect that our total income from this investment will exceed $10,000 this year. Give that some thought and then, without going crazy, buy some shares if they fit your investment strategy.

As always, don’t hesitate to ask questions. You should never make decisions based on these brief summary posts.