What is a Blend?

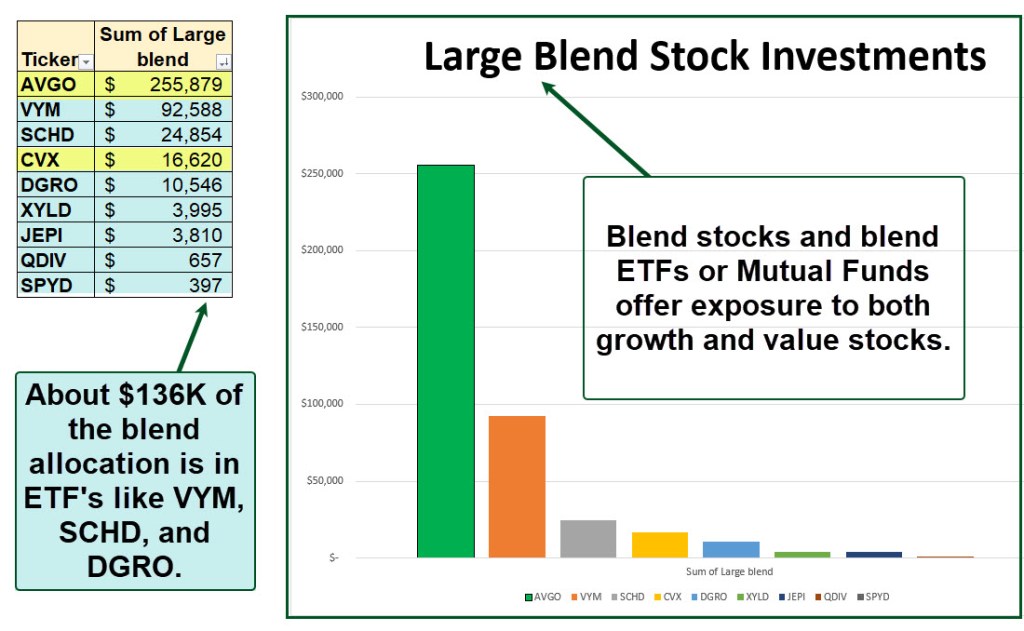

I enjoy blends. Sometimes it is a V8 juice. Sometimes it is a Culver’s frozen custard with a blend of peanut butter cups. You can also have blended investments. A blend investment seeks to get the benefits of both a value stock or fund and a growth stock or fund. Some investors focus on value investing and others prefer growth equities. In general, I think it is wise to have diversification, and a blend strategy can help you broaden your stock market exposure. One good way to do this is to invest in quality dividend ETFs like VYM, SCHD, and DGRO.

Value, Blend, and Growth

Sometimes it is difficult to know if an individual stock is a value, growth, or blend investment. Fidelity’s tools help you spot this. However, be careful when looking at the middle category called “blend.” One of our top ten investments is AVGO. AVGO is clearly a large-cap investment. Those in the growth camp might include AVGO as a growth investment. Others, like me, view it as more of a value investment at this stage of the company’s history.

If we look at the value and growth scores on StockRover, we can see that AVGO has a higher growth score than value score. The important thing isn’t whether or not AVGO is this or that, it is if the position fits with your investment strategy. In my case, AVGO is a great addition to the information technology stocks in our portfolio. Most investors are afraid to buy shares of AVGO, because each share will cost you about $830. But it is better to buy one share of AVGO than 55 shares of AT&T (T). You get more shares for your investing dollar with T, but you sacrifice in other ways that you may regret five years from now.

Our Top Ten Large Cap Blend Investments

We don’t have a top ten. The focus is really on AVGO, VYM, and SCHD. The following graph shows the allocations. Bear in mind that large cap value is our largest style category, and small cap value is number two. So large cap blend comes in third place, and this is largely due to our sizable investment in AVGO.

AVGO’s Metrics

These images from StockRover help illustrate why I like AVGO as a dividend growth investment and it is one of our top ten investments. Please realize that I also trade covered call options on our AVGO shares. The 2023 YTD total options income for AVGO is currently $8,321. Dividends for the same time period total $2,760. So AVGO gives me more income from options trading than from dividends. This is due to the reality that AVGO’s stock price is high and the options trade weekly.

Summary

I don’t encourage trying to create a “blend” portfolio. Rather, focus on quality stocks and ETFs or low-cost mutual funds. Don’t buy 50 shares of an “ok” stock – seek one share of a far better investment. That might be VYM or AVGO, or some other investment with a good mix of value and growth. AT&T’s total returns won’t be satisfactory in the long run, in my opinion.