Understanding Investing Terms

Understanding language is important, as is the context of words. This is true in every field of study. For example, my wife used to laugh when I would tell one of my computer operators to flush a job. I was not suggesting that they take a job to the restroom and dispose of it. Rather, in the context of our discussion, I was telling them to kill or cancel the program that was running.

In the world of investing, it is important to know what you are buying and what you own. This is true of mutual funds, ETFs, and equities. Two important terms have to do with the market capitalization of a company and the other has to do with the nature of the investment.

Market capitalization is often expressed as large, medium, and small. As you might expect, a company with a large capitalization is a very big company with a high market value. Those in the middle of the pack are mid-cap stocks, and those on the small or micro size fall into the small-cap category. The S&P 500 index is made up of large cap stocks.

“The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.” LINK

Value, Blend, and Growth

Another aspect of each investment is the perception and expectations of the market. If a company is mature and unlikely to grow dramatically, it is called a value stock. Value stocks often pay dividends, and the value of the shares can go up, but not as much as the stocks of rapidly growing companies.

Growth stocks tend to be faster-growing investments. However, they tend to retain earnings for investing in and (hopefully) growing the business. As a result, many growth companies do not pay dividends. Of course some do, but the dividend yield will generally be smaller.

A blended investment is one where the company has the attributes of value and growth. For example, AVGO (Broadcom Inc) is classified as a large blend stock. So is CVX (Chevron.) ETFs and mutual funds can be blends as well. VYM has both large value, large blend, and large growth companies. However, it is weighted more to value/blend than to blend/growth.

Stock Analysis

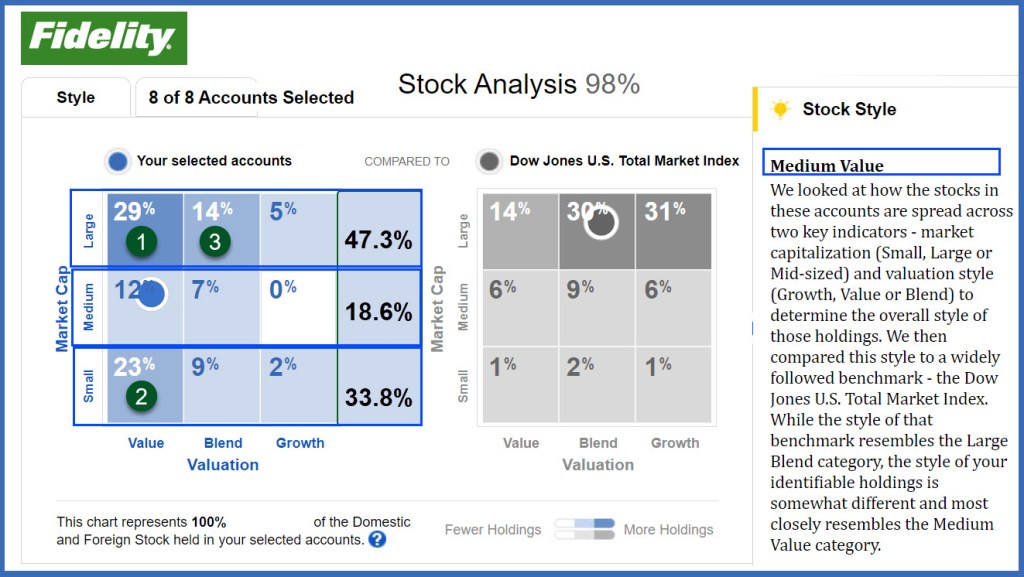

The regular reader should not be surprised to learn that I tend to prefer value stock investments. I also have about half of our investments in large cap companies. The following image illustrates the way our portfolio is positioned.

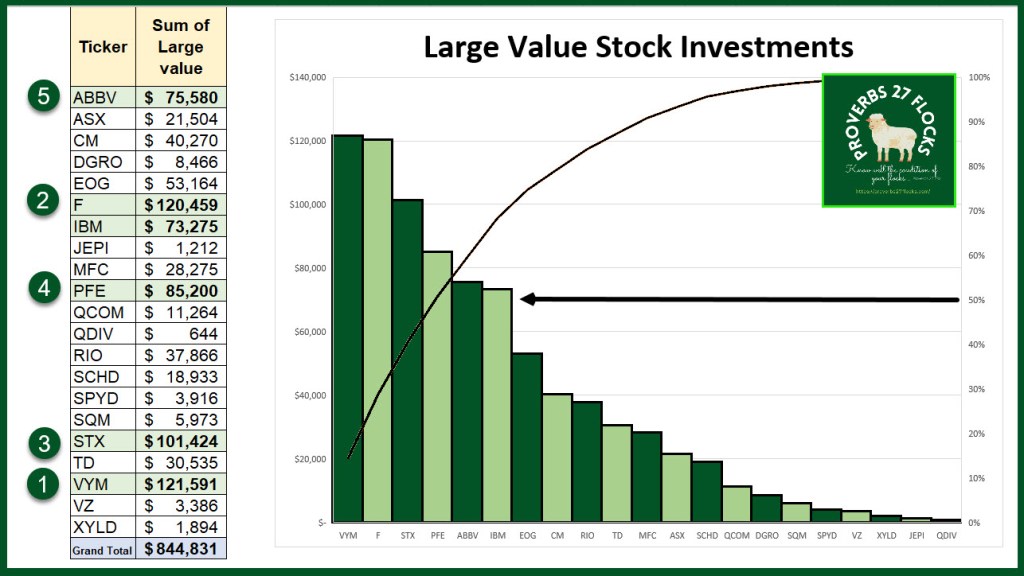

Our Top Five Value Investments

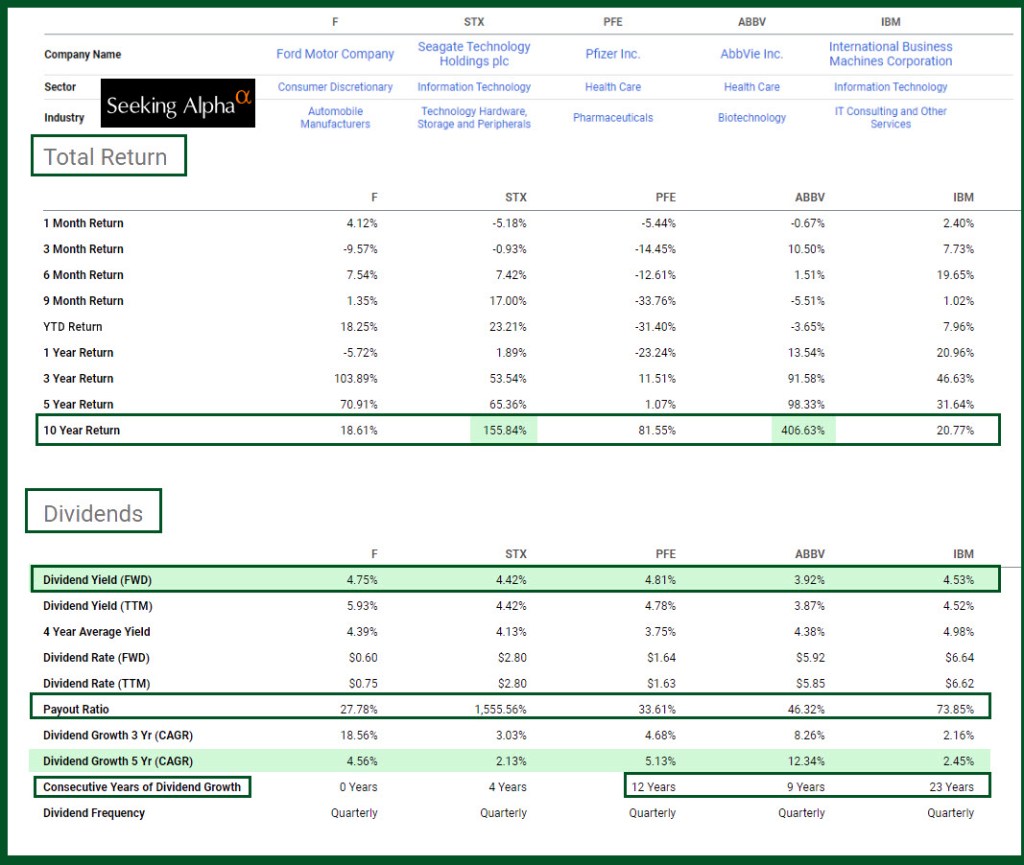

Our top five include VYM as number one, so I will also mention the top five stocks after VYM. They are, by the current total value of each investment, F, STX, PFE, ABBV, and IBM. The following shows all of our current large cap value investments with a graph that shows each of them. It should not come as a surprise that I tend to favor technology and healthcare companies in the large cap space. VYM’s total value in our accounts is more than $121K. Remember, we are only looking at the large cap value portion of the investment in this article. Our total VYM assets are worth about $292K.

Please remember that the top five value investments are not necessarily our top five investments. For example, we have sizable positions in AVGO and MAIN. However, AVGO, as stated earlier, is a blend investment and MAIN is not a large cap investment. MAIN is a small value BDC investment.

Seeking Alpha Ratings and Metrics

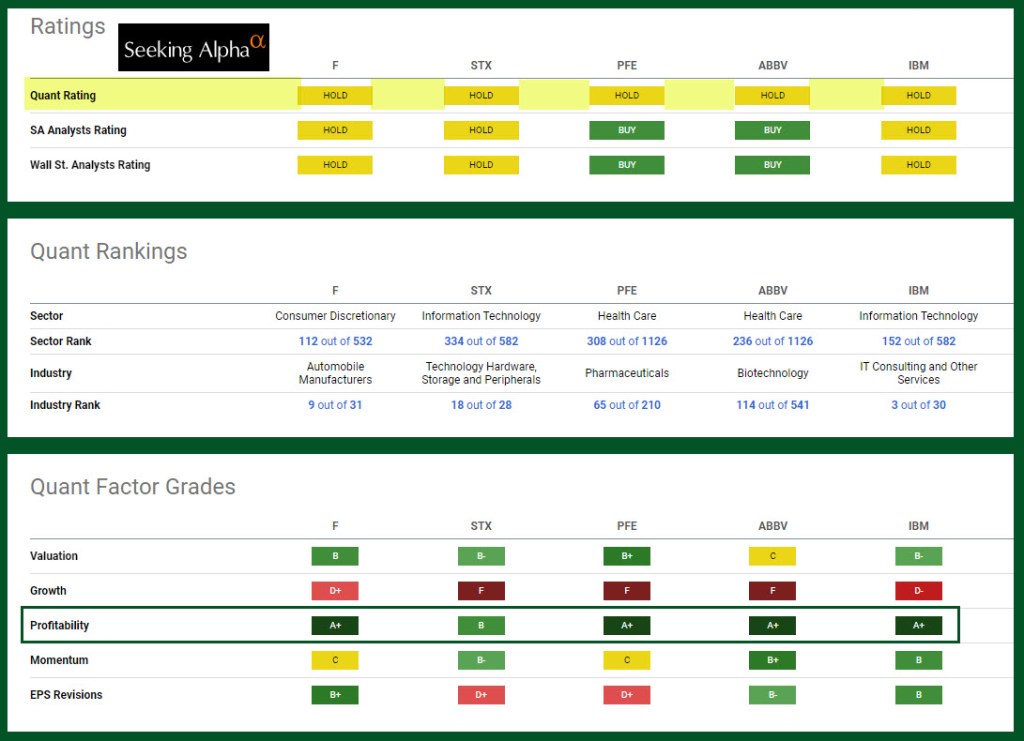

If you examine the top five investments by 10-year returns, dividend growth, QUANT rating and rankings, you might think I have some rather average investments. However, they do have some common traits. For example, all of them have dividend yields of about 4% or better. In addition, each of them has a history of dividend growth. It is also important that while there is an overlap in sectors, each of them is in a different industry classification.

Summary

The purpose of this post was to help you think more critically about your investments. What are you trying to accomplish and achieve? If you are younger than 50 years old, then having a heavier weighting in growth stocks may benefit you in the long run. If you are retired, then having large-cap value stocks that pay a dividend can be a great way to keep income flowing into your checking account. Do you know what eggs are in your investment basket? If not, and if you are a Fidelity customer, take the time to find out if your investment mix matches your goals or not.