Why Real Estate?

REITS have an attribute that makes them Easy Money candidates. If you look at our overall stock portfolio, you will see that our top three sectors are Financials, Information Technology, and Real Estate. Real Estate currently occupies 12.9% of our total investments. If you buy income-producing real estate, you not only have property and buildings, but you also have the potential for rent payments. While our home is a real estate asset, it produces zero income.

Why Not Just VYM, SCHD, and DGRO?

Although I like ETFs, one of the problems with them, if you can call it a problem, is that an ETF like DGRO, SCHD, and VYM has little exposure to real estate. In fact, the combined real estate exposure of these three ETFs in our portfolio is only $3,491. Not surprisingly, they favor Financials, as do I. Therefore, I buy individual REITs for our portfolio of investments. We currently have $383,469 invested in real estate.

If you think about it, that is less than the value of our home. And, again, although our home may be worth more than $400,000, it is more of a drain on our cash than an addition to it. Property taxes and repairs come to mind as big budget items.

Easy Income Strategy Reminders

The goal of easy income is to have increasing income that requires little or no effort. When I buy any position, whether it is a stock or an ETF, I want to see gradually increasing dividends. So, just like financials or technology, real estate must contribute to our easy income.

Being Overweight (or Underweight)

I usually weigh myself daily. I have a goal weight and I tend to hover above that weight. Being overweight is usually not healthy. However, there are times when being overweight in your investments is just fine.

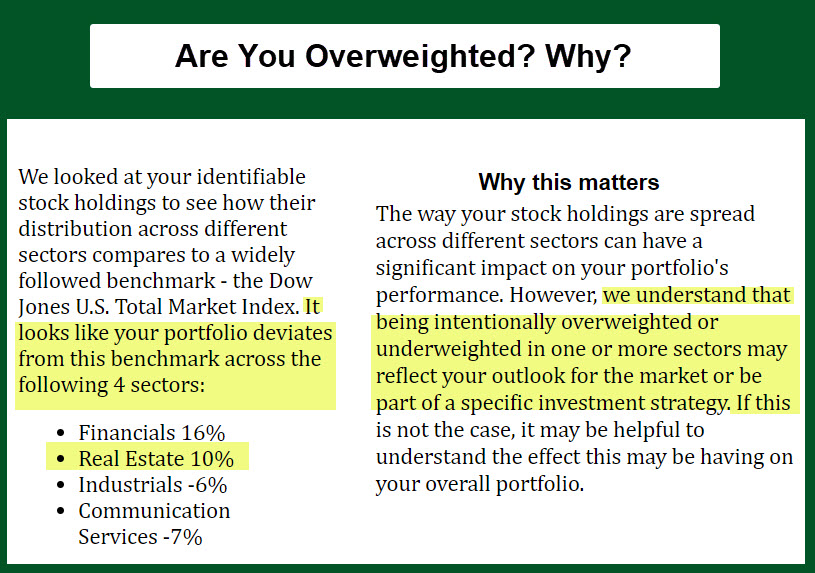

Fidelity cautions investors to be thoughtful about your weightings. In “Why this matters.” They say, “The way your stock holdings are spread across different sectors can have a significant impact on your portfolio’s performance. However, we understand that being intentionally overweight or underweight in one or more sectors may reflect your outlook for the market or be part of a specific investment strategy. If this is not the case, it may be helpful to understand the effect this may be having on your overall portfolio.”

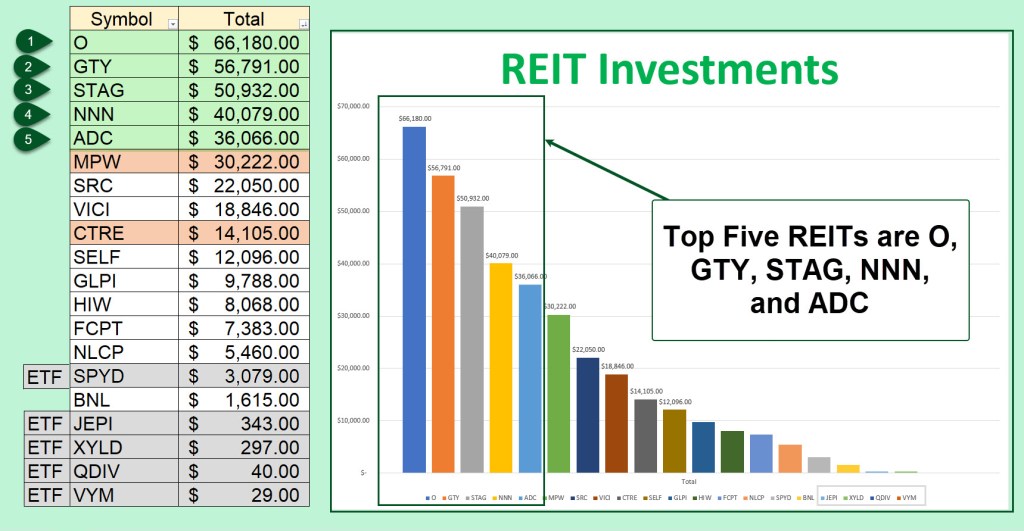

REIT Top Five Investments

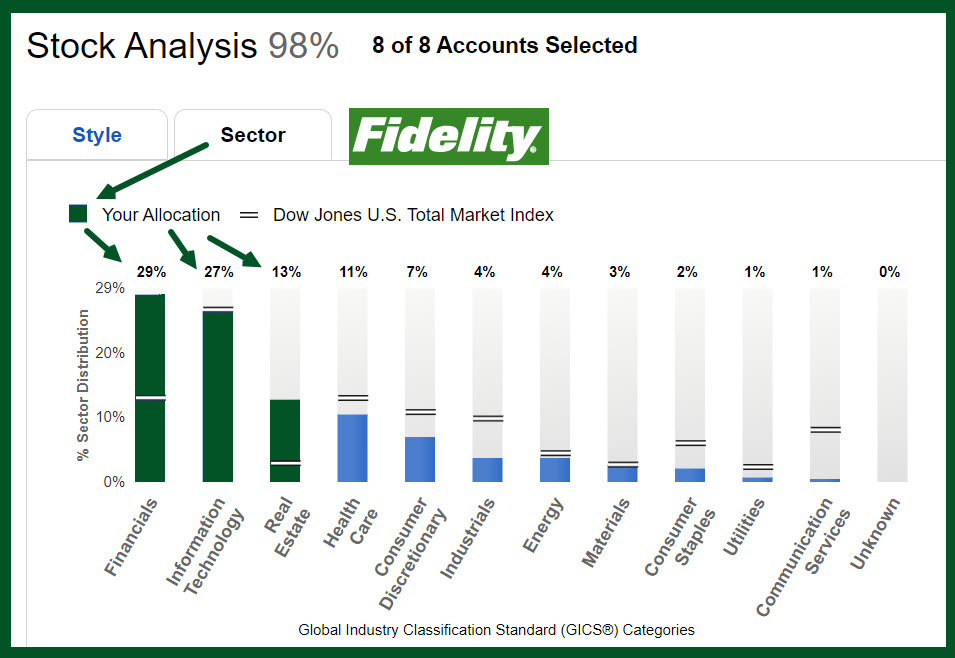

I am definitely “overweight” in financials (16%) and real estate (10%.) The Fidelity tool that is like my morning step on the scale is the Stock Analysis Tool. Here is an image that helps me see my weightings.

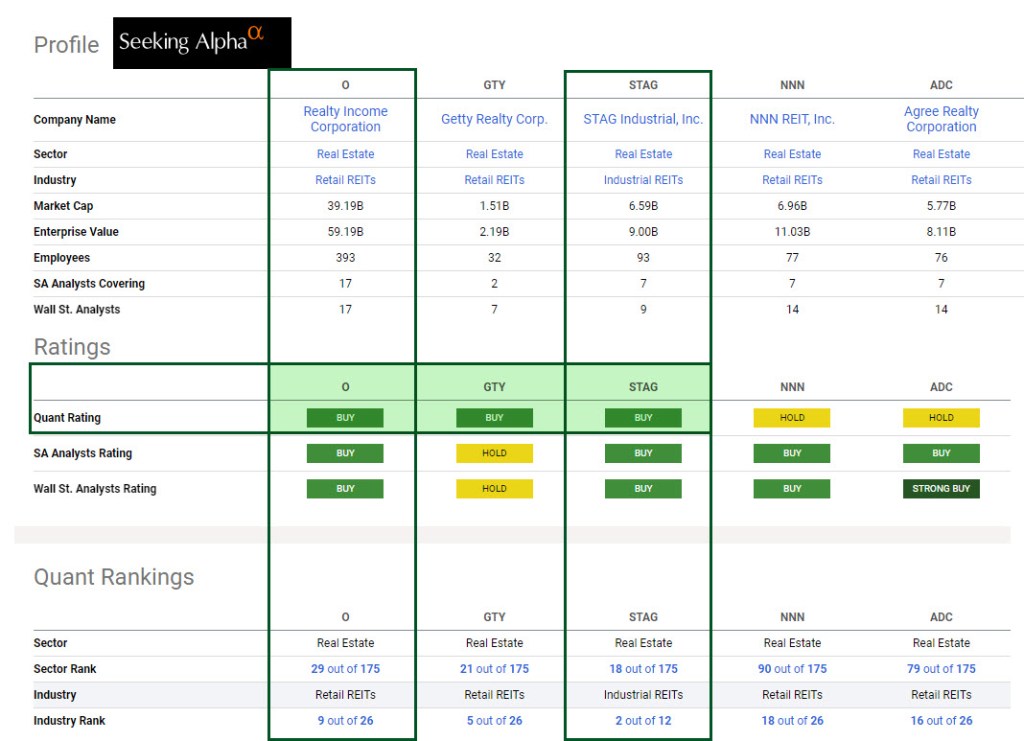

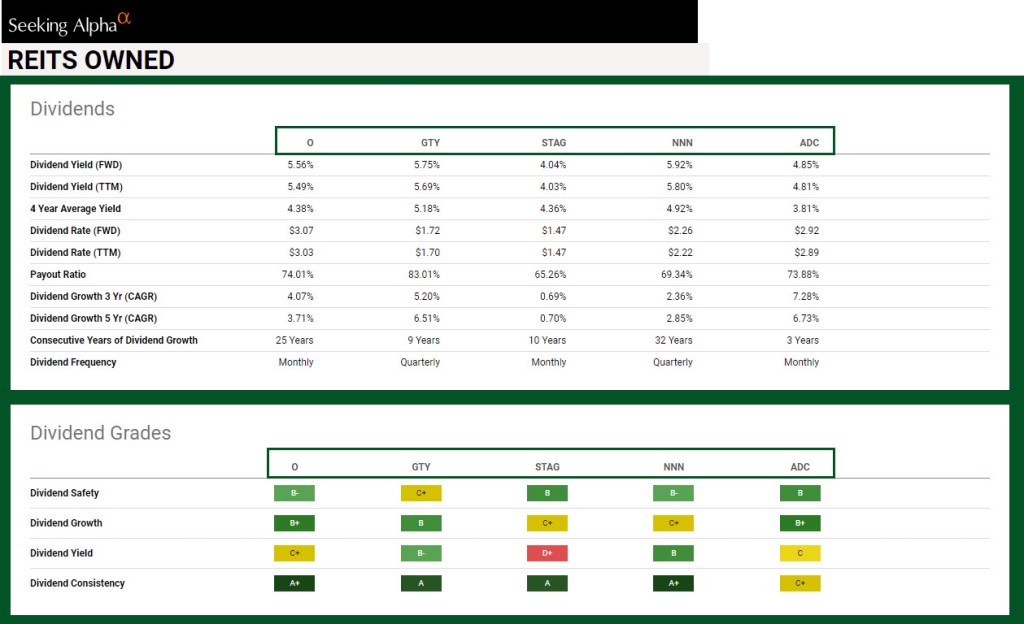

The top five in terms of dollars invested are O, GTY, STAG, NNN, and ADC. Here are a couple of views from Seeking Alpha. If you only wanted three ETFs, then I would recommend O, GTY, and STAG.