Remember the Goals

In January I talked about 2023 goal number four. What is the fourth goal for 2023? Answer: To have a weekly options trading focus. My results 2023 YTD have not measured up to my expectations. However, part of this is due to the fact that options trading is, well, optional. You don’t have to do it if you already have sufficient income from other sources. Cindie and I have Social Security and our growing dividend income is very robust. Therefore, options trading income isn’t a requirement. It is only a supplement for additional income. For example, in August I flew to Montana to spend some time with one of our nephews. I decided to trade some options to cover the cost of the flights and the expenses while I was in Montana.

Here is my previously stated 2023 options trading goal: “The goal will be to triple the number of cash covered puts on stocks that trade weekly options. The weekly part of this equation is important. I don’t want too much cash locked up for more than two weeks at a time. I think, using this strategy, that I can easily reach a total of $105K in options income in 2023. However, the goal isn’t so much a dollar amount, but a more disciplined approach to trading weekly options.”

Note that the goal wasn’t about the dollars, it was more about the discipline. That part, I believe, has been a success. I will share how I used a more disciplined approach.

How To Measure Success?

There are multiple ways to recap my YTD 2023 success. First of all, the idea that I can sell an option to buy my shares (a covered call option) has a best-case scenario. The best case is that I keep the premium I received as income, the options contract expires, and I get to keep my shares. So far in 2023 I have had 137 contracts expire. That is beautiful.

Shares I kept: The 137 contracts covered 344 total contract shares in various companies. Each contract is for 100 shares. That means I was offering to sell 34,400 shares of those companies where I sold a contract and kept my 34,400 shares of stock.

Shares Called Away: Sometimes the price of my shares rises to or above the contract price. When that happens, I get to keep the original premium and my shares are automatically sold and given to the options contract buyer. This happened with 28 contracts for a total of 6,100 shares of stock in various companies. I received over $261,500 for these shares. Of the 28 contracts, 23 were for shares that I intended to sell anyway, so getting an options premium on top of my selling price was a win-win for these contracts. In other words, I only had five contracts that were called away that I had hoped I could keep.

PUT Option Results: Put options are contracts where I offer to buy someone’s shares if the share price drops to a price I deem reasonable. I want to buy some shares, but I don’t want to pay the current market price. I could just enter a buy limit order for the share price, or I can enter a put option contract and earn some extra dollars and get the shares at my price. This happened eleven times YTD for a total of $52,450 in cost for the shares I acquired. My put option profit on all puts was $3,134. This reduced the cost of the shares I purchased by that amount.

Covered Calls and Covered Call Rolls

The lion’s share of the trades has been covered call options. A total of 325 trades fit this category. The income received thus far for these trades is $40,225. This total takes into account the cost of rolling an option to a different date, often at a higher contract price. That works to my advantage, as I get to keep my shares and get an additional chunk of income.

Total Options Income 2023 YTD

In summary, total options income stands at $43,359. This falls far short of my goal for the year, but that is OK. It is unlikely that I will reach my $105K goal, but I have had a good year. One way to see that is to look at the dividend income for the shares that did not sell.

Dividends Received: Another way to measure YTD success is just to look at dividend income. That number is within my expectations. YTD dividend income is $102,098.18. $32,677.85 of that number is tax-free dividend income in our ROTH IRA accounts.

The Disciplined Approach to Options Trading

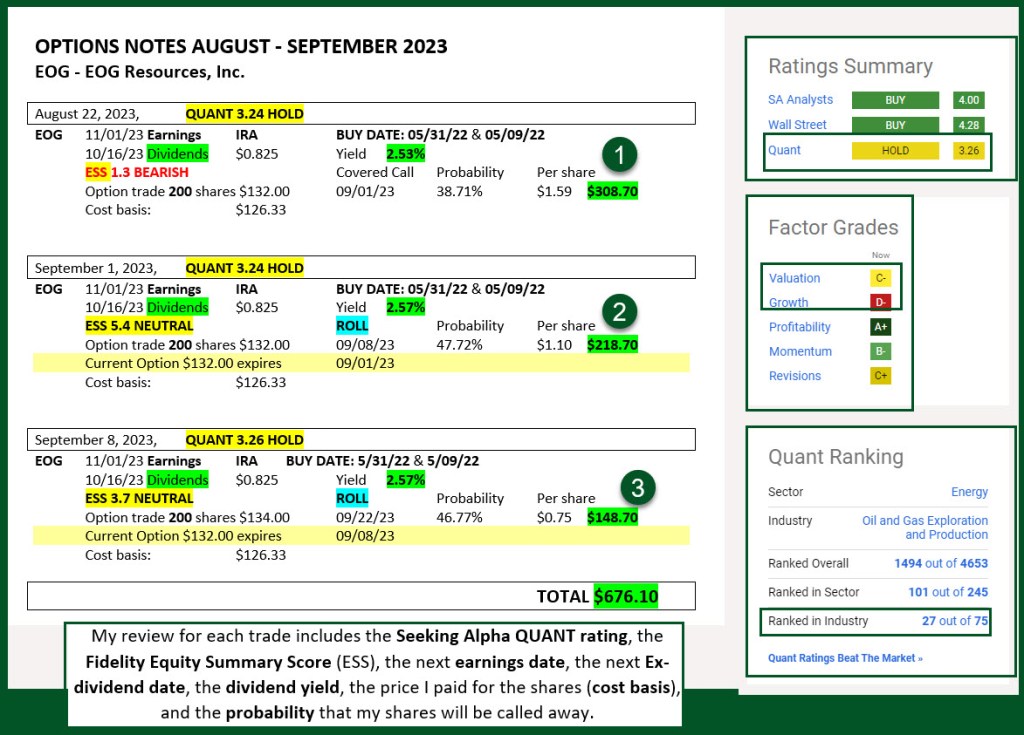

Options Trading Worksheet: One of the ways I increased my discipline in this aspect of our investments was to create a Word document that helps me consistently look at the data that should drive an option’s trading strategy. For me, I want to know the Seeking Alpha QUANT rating, the Fidelity Equity Summary Score (ESS), the next earnings date, the next Ex-dividend date, the dividend yield, the price I paid for the shares, and the potential that my shares will be called away. This is a “probability” number expressed as a percentage. I try to keep this below 50%, but often shoot for 20% or less most of the time.

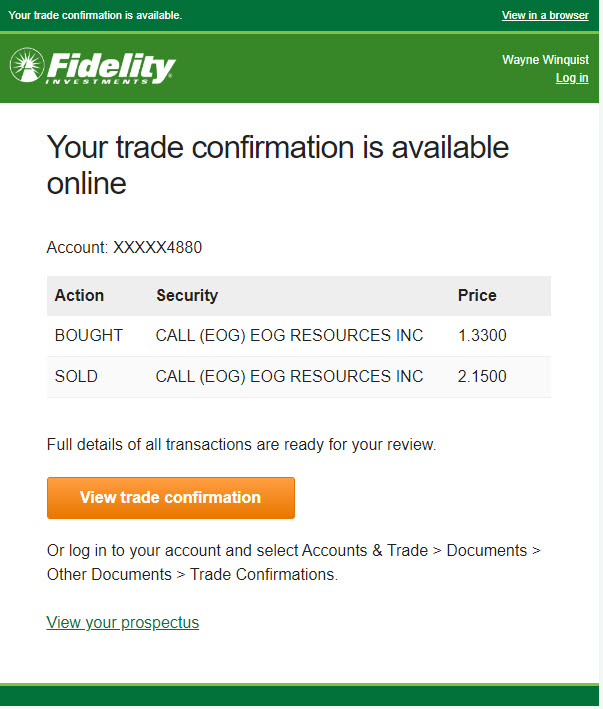

Here is an example of three trades of the 200 shares of EOG Resources, Inc. (EOG) held in my traditional IRA. As a result of these trades I collected $676 in options premiums. This took me about 30 minutes of work. That is $338 per hour.

In Conclusion

There are many ways to get income in retirement. Most can receive Social Security. Many can expect to receive some income from their IRA or ROTH IRA accounts. But those who have the willingness to learn can also supplement their income trading options.