In My Opinion…

If you were to study the GPS (Guided Portfolio Summary) page that shows the sectors I invest in, you would see that I prefer Technology, Financial, and Real Estate stocks. That is not just by happenstance or coincidence. There is definitely a method behind my madness. This does, of course, introduce some stomach-churning volatility as the market can punish any sector in a recessionary or depression-fearful economy.

You should also notice that I am light in the overall market perspective in Consumer Discretionary, Industrials, Consumer Staples, and especially in Utilities and Communication Services. This has not always been the case. In the past I have had a much heavier allocation of dollars in Utilities and Communication Services. However, now I avoid these sectors. The only reason you can see that I own any of these investments at all is because the ETFs I like invest in these sectors as a part of their overall diversification approach.

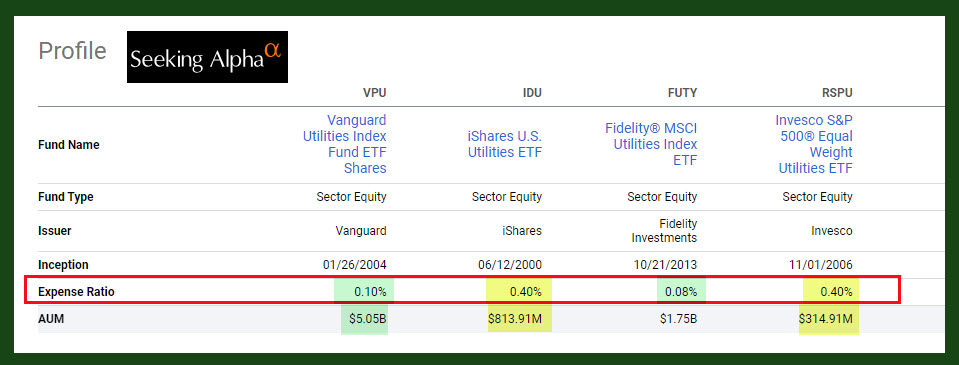

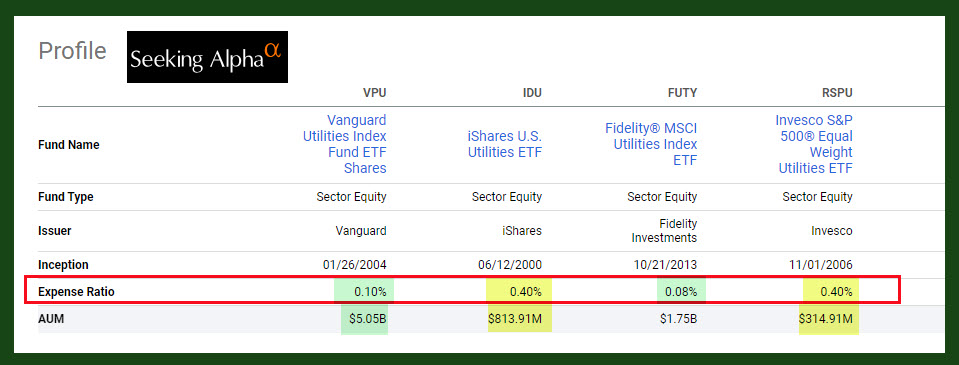

The reasons for my dislike for Utilities and Communication Services is simple. They will not grow at the same rate, in my opinion, as the sectors I prefer. Let’s take a look at the Utilities Sector as an example. We will examine the following pieces of four utility ETFs: VPU, IDU, FUTY, and RSPU. The pieces we will look at are from Seeking Alpha and include the ETF grades, ETF expense ratio, Assets Under Management (AUM), Dividends, Performance, Total Returns, and Concentration and Risk.

Utility ETF Grades

The ETF grades show a lot of red for VPU, IDU, FUTY, and RSPU. Compare those grades with SCHD, DGRO, and VYM. There is no comparison. My favorite ETFs win every time. As we move through this post, I think you will understand why this is so.

ETF Expense Ratio

The expense ratios for VPU and FUTY fall within my preferred ratios. The other two do not.

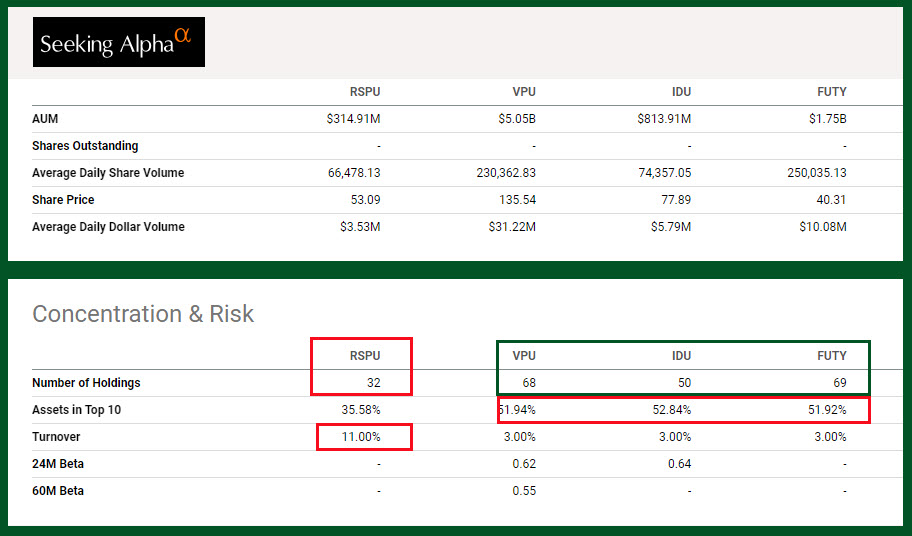

Assets Under Management (AUM)

By the same token, AUM for VPU and FUTY are acceptable. I think the other two are less desirable. If an ETF holds less than $1B in assets you should consider the risks of investing in a smaller fund.

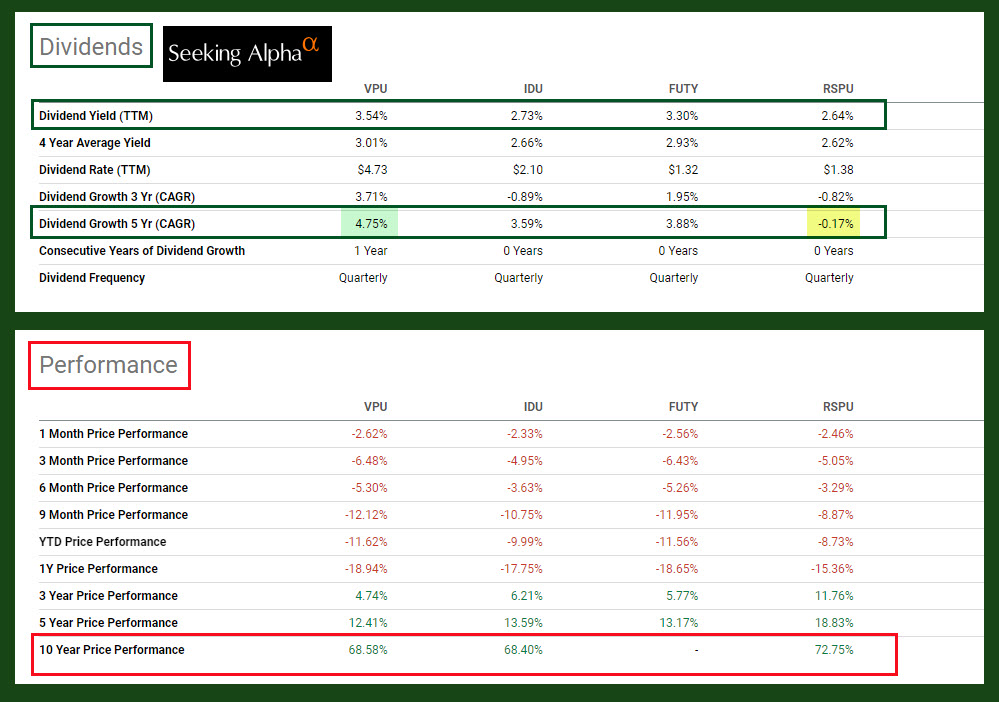

Dividends

VPU has both the best current dividend yield and the best 5-year dividend growth. RSPU is a failure in this regard.

Performance

Performance is a helpful indicator, but it is better to look at total returns. “Performance” is price returns. The Utility ETFs have adequate performance, but that isn’t sufficient, in my opinion.

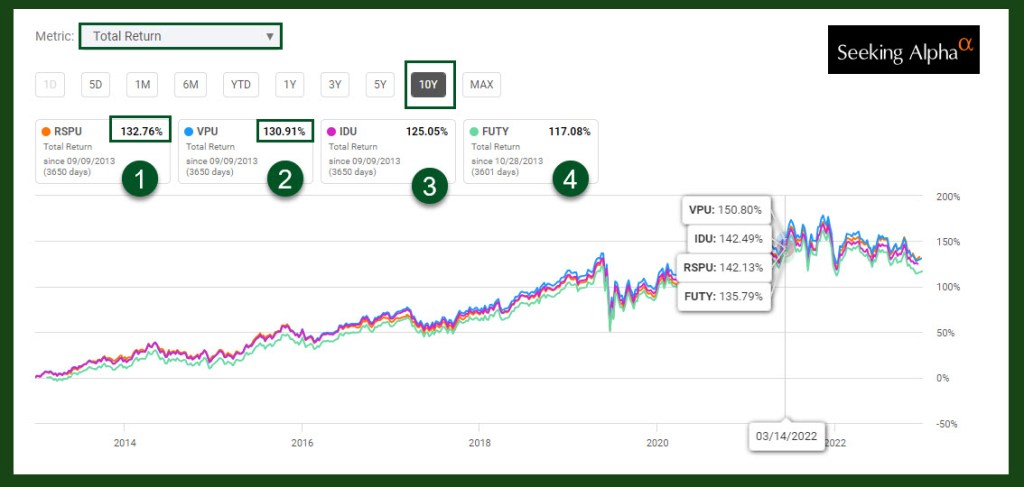

Total Returns

The total returns for the utility ETFs, at first glance, seem quite good. RSPU may be a failure for dividend growth, but it is clearly the winner for total returns. This includes dividends and an increase in the RSPU share price. Part of this is due to the fact that this ETF has an equal weighting of the utilities (no one utility is favored over the others) and the focus on a few number of companies.

Concentration and Risk

All of these utility ETFs hold less than 70 positions. While that is diversification, it is nothing like the diversification in SCHD, DGRO, and VYM. SCHD has 104 positions, DGRO has 433, and VYM holds 465 companies.

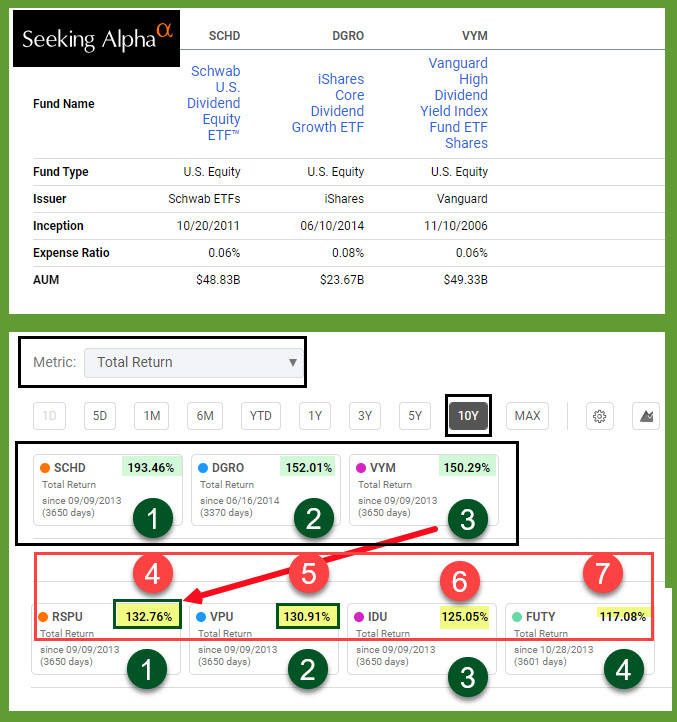

Comparing Utility ETFs with SCHD, DGRO, and VYM

The best way, in my opinion to come to my conclusion to avoid utilities is by looking at the following total returns illustration from Seeking Alpha. Over the long run, my three favorite ETFs easily beat the Utility ETFs.

Another Investment Type to Avoid

I am not a big fan of passenger airline stocks. I have owned some shares of this industry type in the past, but I tend to avoid them now. There are just too many unknowns that can wreak havoc on their business model. Those factors include fuel costs, pandemics, and high labor costs.

Full Disclosure

Cindie and I own significant holdings in VYM and also hold shares of DGRO and SCHD. We do not hold shares of the following investments.

VPU Vanguard Utilities Index Fund ETF Shares

IDU iShares U.S. Utilities ETF

FUTY Fidelity® MSCI Utilities Index ETF

RSPU Invesco S&P 500® Equal Weight Utilities ETF