Is the Off the Assembly Line Car Better Than Custom?

It depends. Whenever I looked at used cars, most of them were as they rolled off of the GM, Ford, AMC, Toyota, Honda, Chrysler, or VW assembly lines. That is, they were built by the manufacturer with the manufacturer’s parts and assembly plants. Two times I bought a modified car. Both times I was stationed in Hawaii at a Naval Air Station. One of the cars was a 1961 Corvette convertible. It had custom wheels and a custom Hurst four-speed manual transmission. At least I think the transmission was aftermarket. I could be wrong. The other was an AMC Gremlin with an manual transmission. It never quite behaved itself, and I found out why: the wheels and tires were too big for the car. It ran better when I put the right tires on it.

Now I’m going to talk about “assembly line investments,” not necessarily just “Stocks.” There are a lot of standard unmodified funds (mutual funds and ETFs) you can invest for your retirement. Think VYM, DGRO, SCHD, and a thousand others that track an index like the S&P 500. But Fidelity wants you to have another choice that may sound better. You can tinker with this vehicle. They call it the “FidFolio.” I want to help you think critically about this type of special investing concept.

“Introducing Fidelity Solo FidFolios℠. Invest and manage a basket of stocks and ETFs with ease. Create your own custom index, trade with one click, and enjoy the potential to grow and diversify your portfolio. You’re in control.” – Fidelity Investments

So, are you really in control? Do you really want to be in control? Most of my readers don’t want to be in control. They want someone to give them advice and leave the heavy lifting to someone who has depth of knowledge in the investing world.

This Concept has a Cost

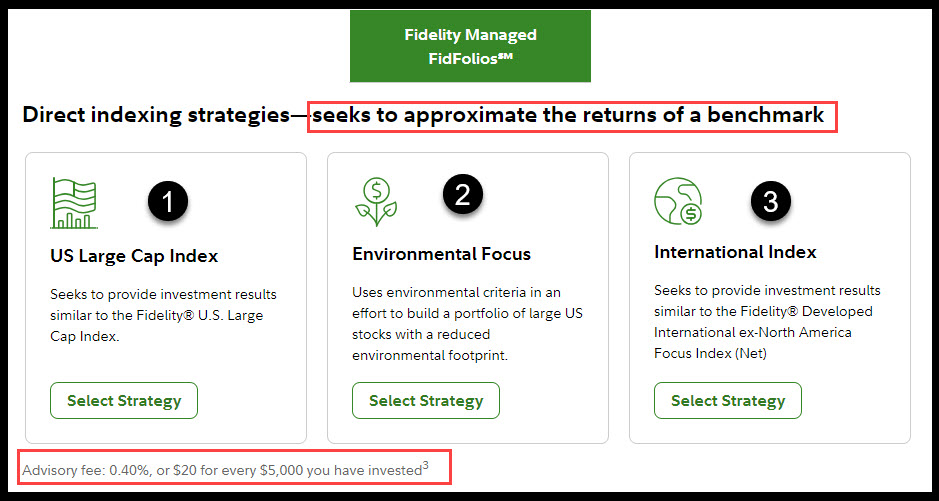

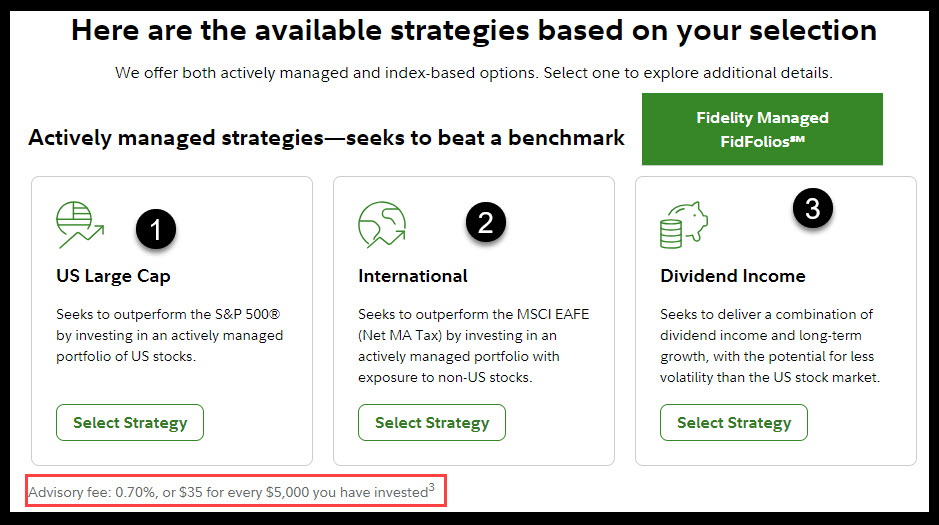

It appears there are two different cost structures. One will cost you 0.70% annually on your FidFolio balance. The other will cost you 0.40%. Therefore, if you have a $250,000 Fidfolio balance, your cost for the first service will be $1,750 per year. Bear in mind that you will pay far less than that if you only have $5,000. I ask you: “Does the person with $200K get a better value?” They really are not getting more in the way of services.

Fidelity has this to say, “Fidelity Managed FidFolios℠ strategies do not come with an advisor. All account activities, including opening your account and making updates to your preferences, take place online.” So the vanilla solution costs more the more money you have.

Fidelity goes on to say, “The fee for Fidelity Managed FidFolios℠ is based on the value of the assets in your account and an annual advisory fee rate of the strategy you choose, for which you will be billed quarterly in arrears. Note that when we make trades in your account you will not be charged any commissions.” So you may pay dearly at the beginning of the year if the stock market goes up dramatically, and then pay less during the remainder of the year if the account falls in value.

Rebalancing Thoughts

Advisors can sell investments when they think it is a good time to sell. That is often a “rebalancing” effort. FidFolios will take this approach. I question the value of frequent rebalancing. Sometimes that really means you are selling winners and buying losers.

Tax savings

Fidelity says, “We use tax-smart investing techniques—including tax-loss harvesting—designed to help keep more of your money working for you.” Well, that might be nice for a brokerage account, but it has little or no value with an IRA or ROTH account.

Customized Holdings

Fidelity says, “Build your portfolio, based on an approach you’ve selected and certain investment preferences you’ve provided. Note that you may exclude up to five individual stocks or two industries in your account.” I question the value of this. If you are trusting them to do the allocations for you, why would you want to tinker with their recommendations if you think they are offering value? I really question the value of the “Direct Indexing” model.

Direct Indexing Strategies

For the U.S. Large Cap Strategy, they are using the S&P 500 as a benchmark. If they beat the benchmark by at least one percent, then the 0.70% fee is, perhaps worth the cost. If they don’t you would be better off buying a low-expense S&P 500 Index Fund.

Dividend Income Strategy

They offer a dividend income strategy. That is, based on the expense ratio of 0.70%, just plain silliness. If the yield you expect is 2.7%, they are taking a cut and really giving you 2.0% yield. Why not just buy a dividend growth or dividend-focused low-cost ETF or mutual fund?

In Summary

I will add Fidfolios to my list of investment choices that is not needed and may actually be harmful for the uniformed investor. This is the same way that I feel about Target Date Mutual Funds, Retirement Date Mutual Funds, and RMD focused mutual funds. Whenever you see “customized” remember my AMC Gremlin. It had a jumpy transmission until I went to stock wheels and tires.