Remember the Goals

In February I talked about 2023 goal number five. This goal applies to growing income the easy way by reducing future income taxes. Taxable Income Planning should be on everyone’s radar. By way of review, the goal is: “This goal focuses on prudent tax payments for 2023 and lower potential taxes going forward. It also provides the potential of greater tax-free income for the balance of my life and for Cindie’s life. Simply stated, the goal is to move more investments from my Traditional IRA to my ROTH IRA.”

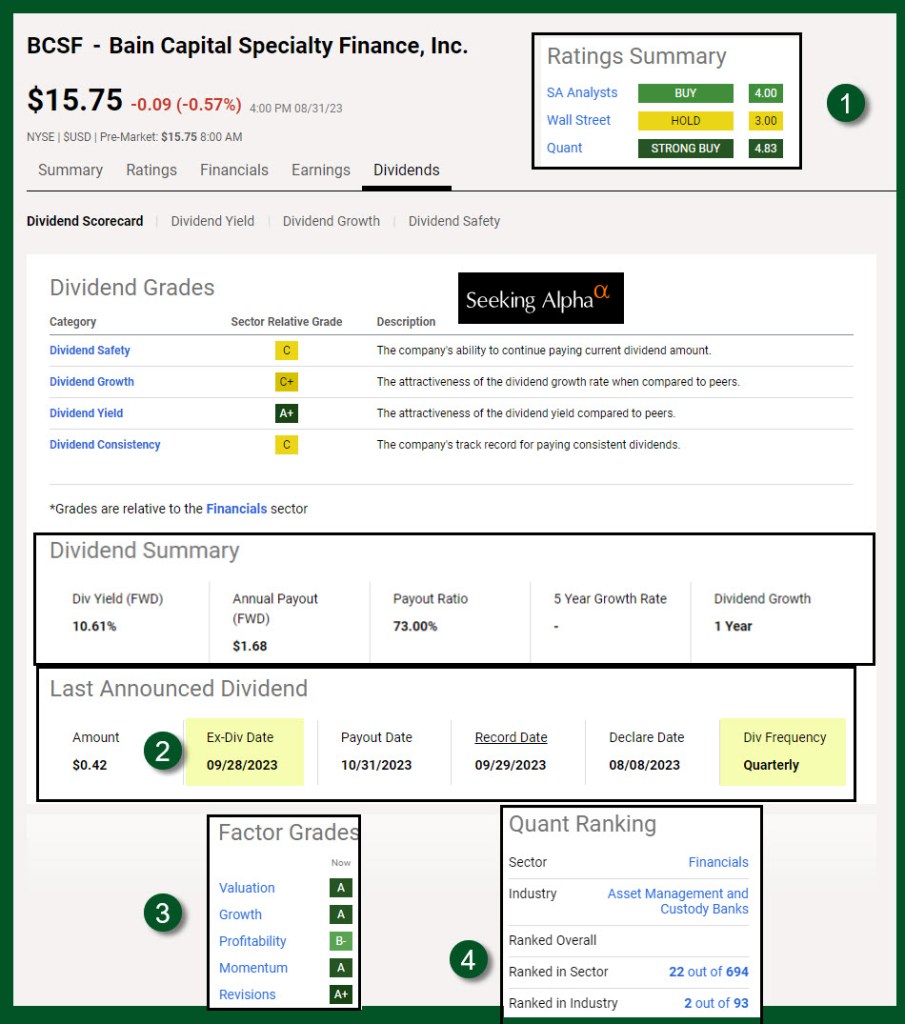

I recently acquired 500 shares of Bain Capital Specialty Finance, Inc. (BCSF) in my traditional IRA. As I reviewed our total potential income for 2023, I can still “create income” using a ROTH conversion and stay within the Federal 22% tax bracket. This makes a ROTH conversion attractive. The adjusted tax is really more like 17%, because of the way the tax brackets work. So for every $1,000 of assets converted, we will pay about $170 in Federal tax (and about $50 in Wisconsin state income tax.)

Review the Expected 2023 Tax Burden

If our gross income is $190,750, before itemized deductions, the upper bracket for our 2023 income taxes is 22%. However, due to our charitable giving, our actual “income” will be far less than $190K. It is reasonable to assume that our real tax will be around 15-17%. I always use a worst-case scenario so that I am not surprised when we file our taxes. It seems likely that our total tax will be more than last year’s tax, but certainly not an overwhelming increase.

In future years, however, because of the RMD requirements, our income might be more in 2024, so reducing the RMD is prudent.

Conversions MUST be done no later than December 31, 2023. On that date the value of my traditional IRA will dictate the RMD amount for 2024. I want the IRA balance to be as small as possible. Here are two tax bracket images to help you see the logic I am using.

Does BCSF Have a Future?

I would not convert under-performing assets or assets that don’t pay a dividend. I want the income that currently arrives in the traditional IRA to now appear in my ROTH IRA. If BCSF performs well, then I can reasonably expect about 1.5 years of tax-free dividends in my ROTH to cover the 2023 income taxes on the ROTH conversion. This image helps explain the logic.

This shows the current QUANT rating information for BCSF on Seeking Alpha. I did the conversion before the Ex-Dividend date of 09/28/23, so the next dividend of $0.42 per share will be tax-free in my ROTH IRA.

Moving the Shares

It is a quick and easy process to move the shares from the IRA to the ROTH. You start a transfer and select the shares you want to move. After reviewing my choices, the transfer is completed. I did this transfer at about 2:45 PM CST. This is important. If you want the closing price to be your transfer price, the conversion must happen before the market closes.

Edward Jones’ Ideas

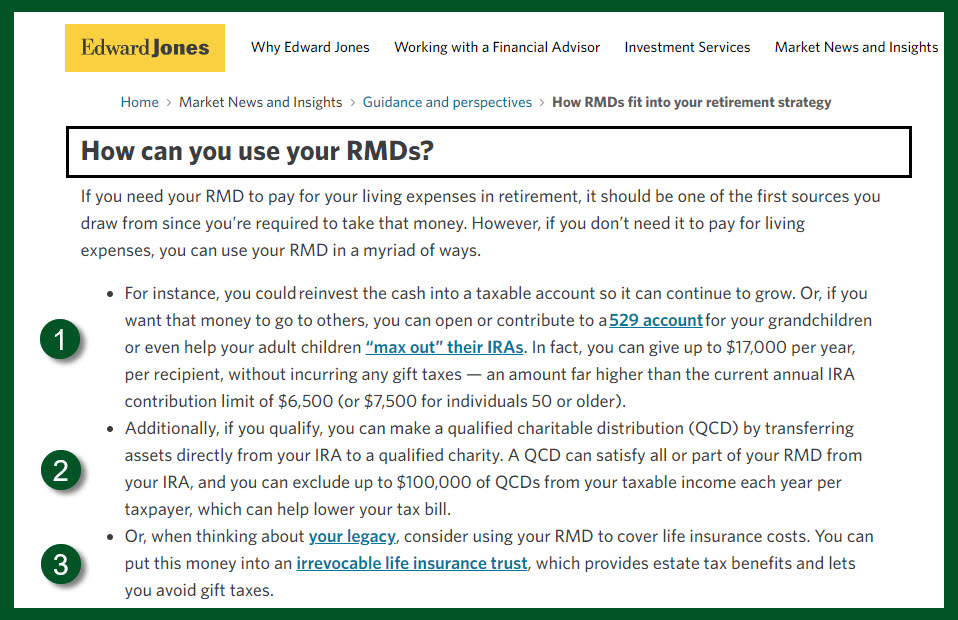

A recent article by Edward Jones gives some helpful thoughts about “How can I reduce future RMDs?” In that same article, they talk about, “How can you use your RMDs?” While I wouldn’t use the RMD to buy life insurance, I think the ideas about gift-giving are a wise way to use cash you don’t really need.

“Determining how much to take out of your retirement accounts can be complicated. There are many factors to consider, such as how your spending needs will likely change over time (whether planned or not). You’ll also need to think about how long your sources of income (Social Security, pension, retirement funds) need to last, how much income each will provide and when you’ll begin receiving those payments.” – Edward Jones

In Conclusion

Because the move of BCSF shares to my ROTH IRA has increased my ROTH estimated annual income by $840, in 2024 my ROTH IRA should produce over $40K in tax-free income. That is a real blessing. You can quickly see your estimated annual income on the Fidelity web site as shown in this illustration.