Do You Know What You Are Buying?

Given the widespread lack of understanding of various investments, I will start a series of posts about mutual funds. Mutual funds are often the only choice you have from a list of investments offered by employers for 401(k) and 403(b) accounts – and similar types of accounts. Therefore, it is good to know what to look for when you select your mutual funds.

I want you to consider “kicking the tires” on potential investments. The “kick the tires” idiom usually means: “To try or examine something carefully before you buy it or drive it.”

However, kicking the tires is not the best way to check tire pressure. You need a gauge for that. One web site says, “if you go to check out a car, don’t kick its tires in an effort to check its roadworthiness. According to Action Gator Tire, kicking a car’s tire will not give you an accurate reading of a tire’s inflation pressure or anything else you might be looking for. Instead, kicking any of the tires will most likely only tell you if your shoes are hard enough to kick an immovable object.” LINK

Therefore, I want to give you some gauges to help you see where a mutual fund is a lemon or a classic. Let’s start with a definition.

What is a Mutual Fund?

Rather than give a technical definition, I prefer to simplify the definition. A mutual fund is a collection of defined assets (stocks, bonds, cash) used to create diversification, investment growth, and income. If you want a more complete and comprehensive understanding, then Investopedia is a good place to add to your knowledge.

“What Is a Mutual Fund? A mutual fund is a financial vehicle that pools assets from shareholders to invest in securities like stocks, bonds, money market instruments, and other assets. Mutual funds are operated by professional money managers, who allocate the fund’s assets and attempt to produce capital gains or income for the fund’s investors. A mutual fund’s portfolio is structured and maintained to match the investment objectives stated in its prospectus.” INVESTOPEDIA LINK

Fidelity’s Simplicity RMD Mutual Funds

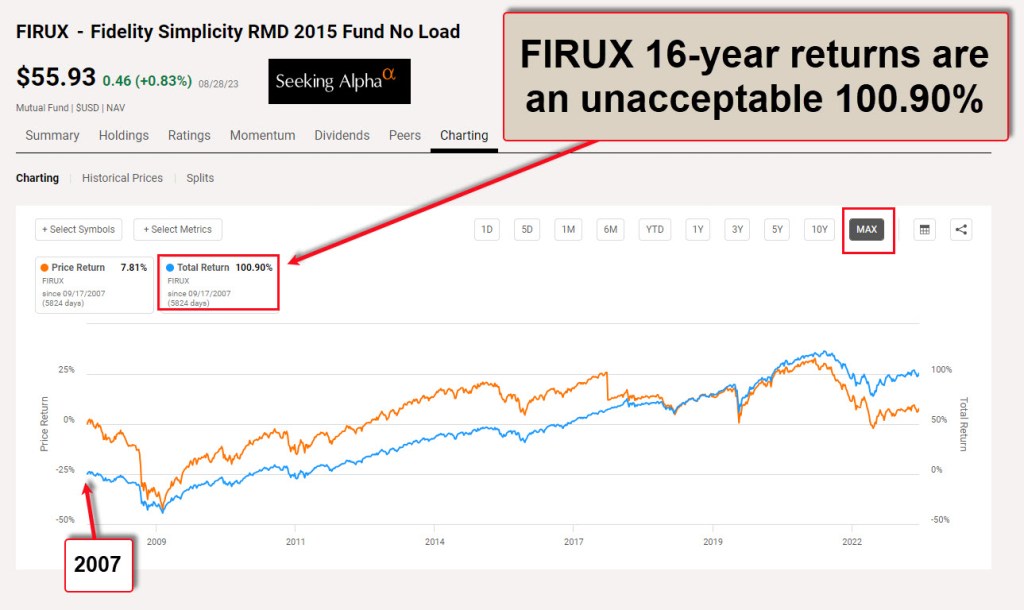

To save you some time, I will tell you I would not buy this product. But I think you need to understand why I would avoid it. The ticker symbols are FIRUX, FIRRX, FIRNX, and FIRMX. They are marketed as “simplicity” but simplicity is not a word that means “excellent” or even “average.”

The concept behind the funds is appealing. When you reach your retirement years, and when you attain the age of 73, you will be required to take withdrawals (RMDs – Required Minimum Distributions) from non-ROTH retirement accounts. If an investment could give you income for your RMD withdrawals, that would be helpful.

Here is Fidelity’s take on their RMD mutual funds: Fidelity’s Simplicity RMD Funds can:

• Take the guesswork out of difficult investor decisions through a diversified, age-appropriate asset allocation mix that regularly re-balances.

• Combine with Fidelity’s automatic withdrawal service to support RMD withdrawal calculations and distributions.

• Allow you to consolidate assets in your retirement account into a single fund strategy that can simplify and streamline RMDs.

Here is another mind-numbing description from Fidelity: “The fund’s investment objective is intended to support a payment strategy designed to be implemented through a shareholder’s voluntary participation in a complementary systematic withdrawal plan that will enable shareholders to receive regular payments from the fund based on their expected required minimum distributions from certain types of retirement accounts as mandated by the Internal Revenue Service (IRS).” Really? What does that mean?

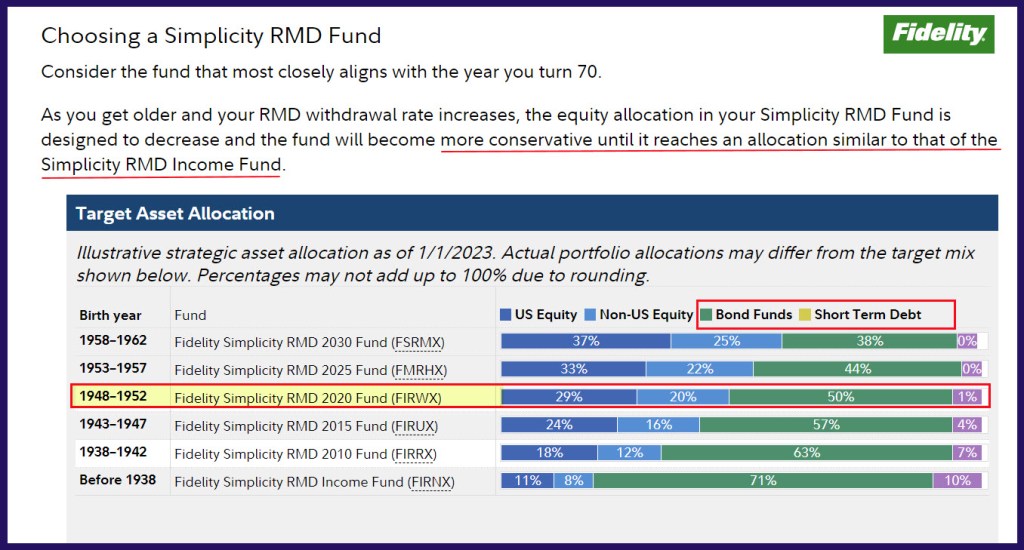

Choosing a Fidelity Simplicity RMD Fund

The following illustration was one of the first things I saw on Fidelity’s website. What should jump out to you is the increasing allocation of bonds for older investors. Because I was born between 1948-1952, Fidelity’s FIRWX would give me 50% bonds. That is not an inflation-wise strategy. FIRWX pays a monthly dividend, but the total return since 2007 is only 116.68%. In other words, in the last 15 years, the return has not even come close to VYM’s 10-year total return of 159.34%. FIRWX’s 10-year return is an appalling 70.27%.

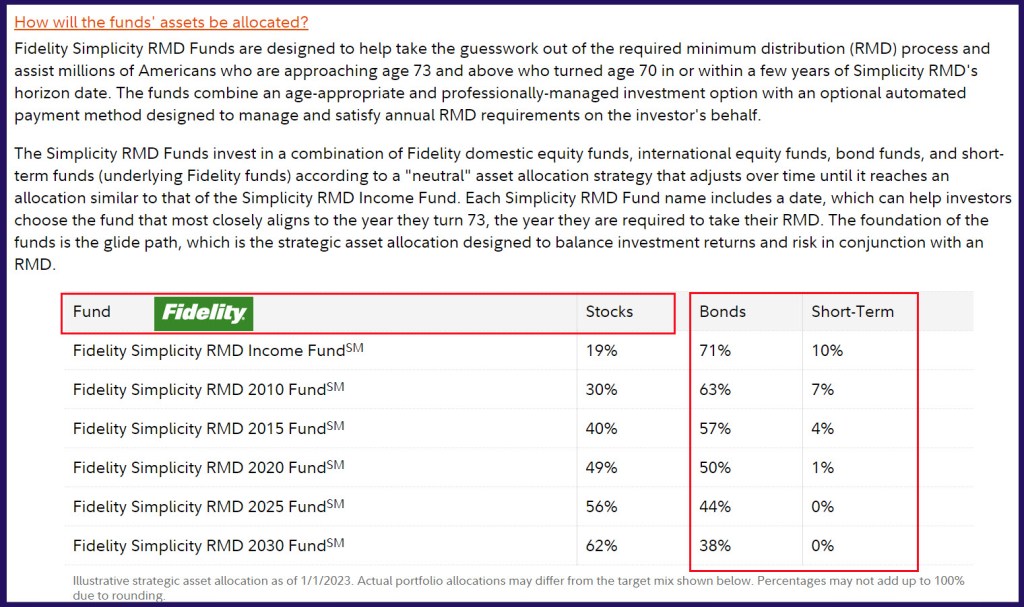

How will the RMD’s Funds be Allocated? Grade Fail

As you age, the common recommendation of financial advisors is to increase your bond holdings and reduce your stock holdings. That is what the RMD funds do. Here is an illustration of that reality. I cannot think of too many scenarios where having 71% of your retirement assets in bonds makes any sense whatsoever.

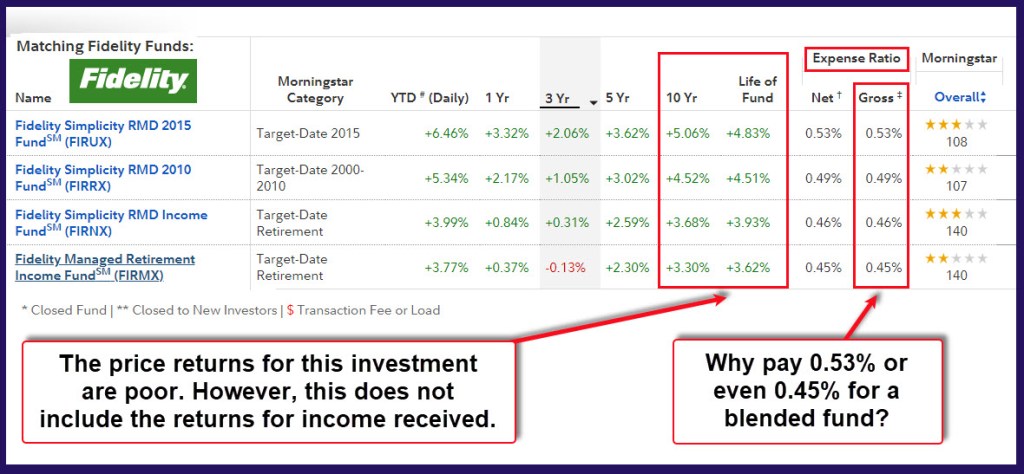

RMD Mutual Fund Expenses – Grade FAIL

The expense ratios on these funds aren’t terrible, but they certainly aren’t great. They range from 0.45% to 0.53%. Let’s do the math. Assuming you have $750,000 in your account, each year Fidelity would ask for about $3,975 to manage your money at 0.53%. That $4K will no longer be working for you. So, as we look at the tire pressure, there is a slow leak of your funds. Let’s assume you live 20 years and pay $4K each year for 20 years. Say “goodbye” to $80,000 of your retirement funds if you are able to maintain a balance of $750K.

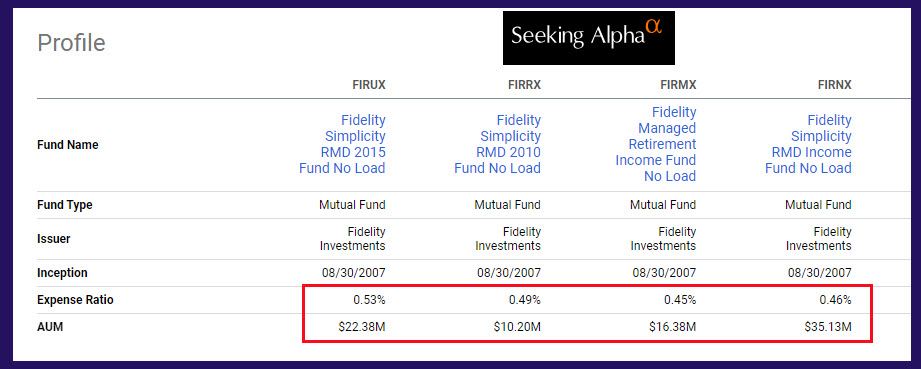

Simplicity Mutual Fund AUM – Grade FAIL

When purchasing any ETF or mutual fund, understand the size of the fund. This is called “AUM” or assets under management. For VYM, the AUM is $49.75B. Any fund smaller than one billion dollars should cause you to step back and wonder why no one else wants that vehicle. For FIRWX the AUM is $52.5 million dollars. That is microscopically small. The following shows how small the current RMD mutual funds are. They are tiny, and that isn’t cute.

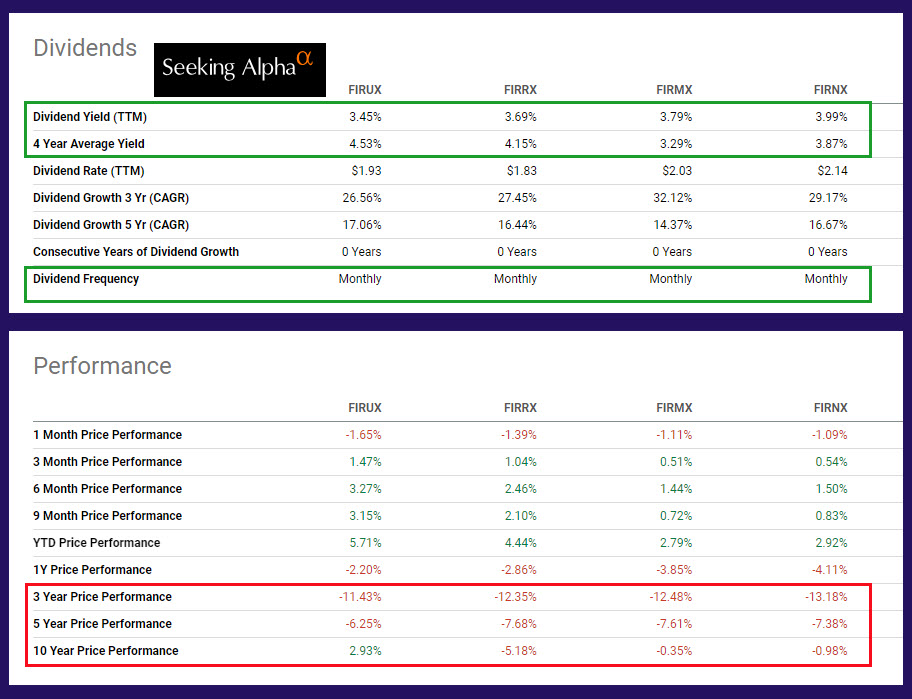

Simplicity Fund Dividends – Grade PASS

As you can see in the following image, these funds have a yield above 3% and they all pay monthly. In retirement that is a good thing. However, 3% is nowhere near what our total portfolio produces. My current average yield approaches 5% with better 10-year growth. So I won’t fail these mutual funds, but I would give them a passing grade of “C.”

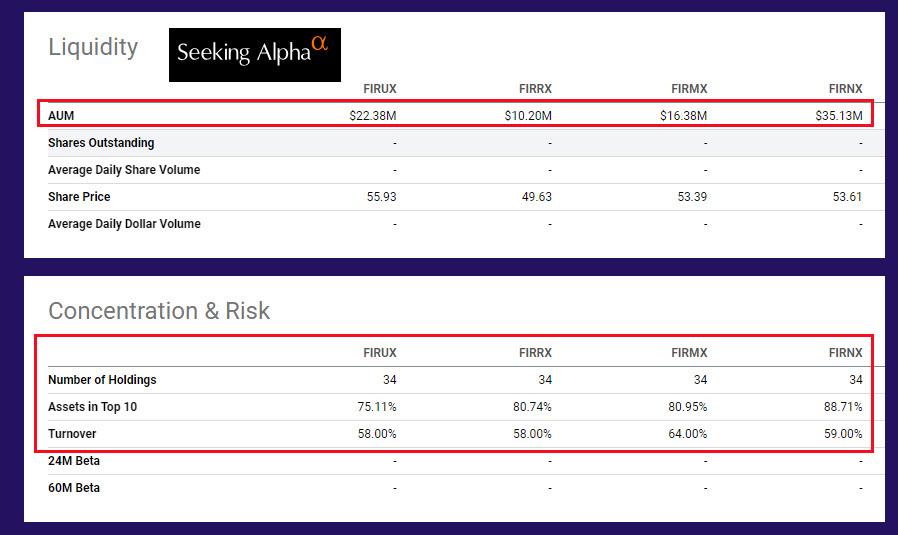

Simplicity Fund Holdings – Grade FAIL

As you may already suspect, these funds hold other funds. In the case of FIRUX, there are 34 holdings. The top ten holdings make up 75% of the total. The top three holdings are Fidelity Series Investment Grade Bond (32.52%), Fidelity Series 0-5 Year Inflation-Protected Bond Index (7.48%), Fidelity Series 5+ Year Inflation-Protected Bond Index (6.21%), etc. In other words, lots of bonds. The good news is that there is some kind of “inflation protection.” However, I’m not certain exactly what that means. It clearly has not shown up in the 10-year total returns.

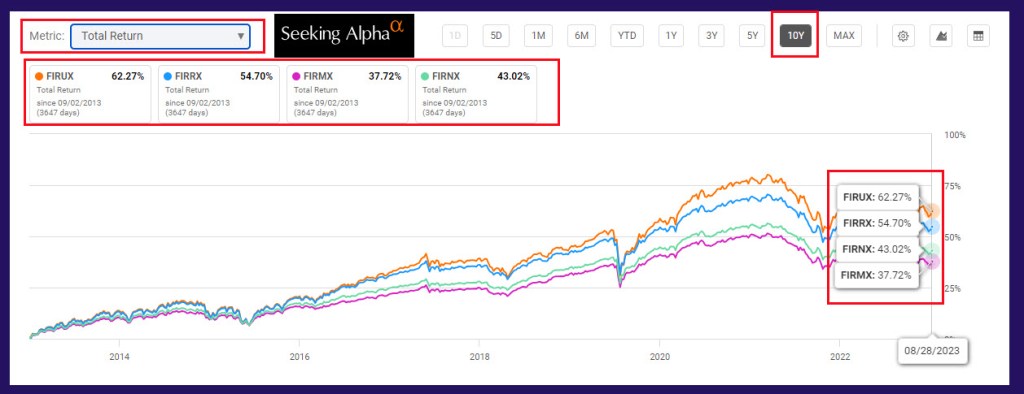

Ten Year Total Returns – Grade FAIL

If you look at VYM’s ten-year total returns, you will see that they are 159.34%. Now look at the ten year returns for the four Fidelity Simplicity RMD mutual funds and weep.

Total Returns Matter

Before I finish “kicking the tires” let’s review. These funds have mediocre performance, a mix of investments that are destined to underperform over a long period of time, and that really aren’t simplicity. The fund expenses eat away at your future returns with no sound reason to pay the expenses. These are complicated investments. I believe dividend growth funds like VYM, SCHD, and DGRO make far more sense for the RMD needs for the vast majority of investors.

The final nail in the tire is illustrated here. Performance matters. FIRUX won’t be a fund I could ever recommend. Don’t read the word “simplicity” and think, “I like simple.” You shouldn’t.