My Investment Plan Dictates My Behaviors

In 2015 I created a plan that I call the “Dividend Growth Investment Business Plan.” These five words tell a story. The first word, “dividend,” is that my primary objective for most of our investments is to have dividend income. That doesn’t mean that I don’t buy investments that don’t pay a dividend, but it does state a strong preference for dividend income. The second word is “growth.” Because inflation is real, and it eats into the purchasing power of every dollar, more dollars are needed to at least maintain the same “lifestyle” or charitable giving goals. Remember, even charities experience the same (or worse) inflation that you experience.

The third word is “investment.” Investment is different from trading. I would argue that most traders could care less about dividends. They want quick returns, and those are often viewed as synthetic dividends. One of my synthetic dividends is the cash I generate from stocks that don’t pay a dividend by trading covered call options. Investors invest with a longer-term perspective. So I don’t really have a written trading plan. I know what I will trade, but that is usually a very small slice of our total investment portfolio.

The fourth word is “business.” If you don’t treat your investments as a business, then you are likely to make short-term decisions based on emotions, not thoughtful data-based long-term objectives.

The fifth word is “plan.” A frightful number of adults have no plan. They have no financial plan, and no eternal perspective in their planning. The lack of a plan is probably the biggest missing piece in the long-term care of loved ones and the care of your own soul. A plan should include objectives and tactics for achieving the plan. The Apostle Paul had a plan: “For me to live is Christ.” He had a long-term plan too: “To die is gain.” Most people have a plan that says, “for me to live is me” and to die is a tragedy because I cannot take it with me.

A Plan Goal Statement

One of the first pieces in my “Dividend Growth Investment Business Plan” is a goal statement. The original statement said “$60,000.” The target date was: “when I am 70 years old.” Note there is a measurable component of $60K and a target date for achieving the goal.

Here is the original goal statement: “Goal: Generate a steadily increasing stream of dividends paid by excellent, low-risk companies. Numerical objective: Grow dividend income to $60,000 in five years – when I am 70 years old. Dividends eventually will be withdrawn as RMD’s from the non-ROTH IRA accounts so that income-producing investments will not be sold to fund RMD’s.”

There is a second element in the goal statement. It is that the dividends will be the fuel for the RMDs so that I don’t have to sell the stocks and ETFs that are producing income to cover the required minimum distributions.

To Achieve a Goal: Define Your Tactics

If the goal is to love my wife, then there are things on the honey-do list that can help me show her love, which is one way to make her life better. I can finish the garden path, stain and install the trim boards in our front entry, and get rid of some of the clutter of my accumulated “treasures.”

In the same way, to have dividend growth, I must select investments that will, for the most part, contribute to dividend growth and/or be sufficient to cover the RMDs. This means I have rules for both buying and selling investments. Buying rules are important. Selling rules are equally or more important. Never fall in love with an investment. Love should be reserved for God and people.

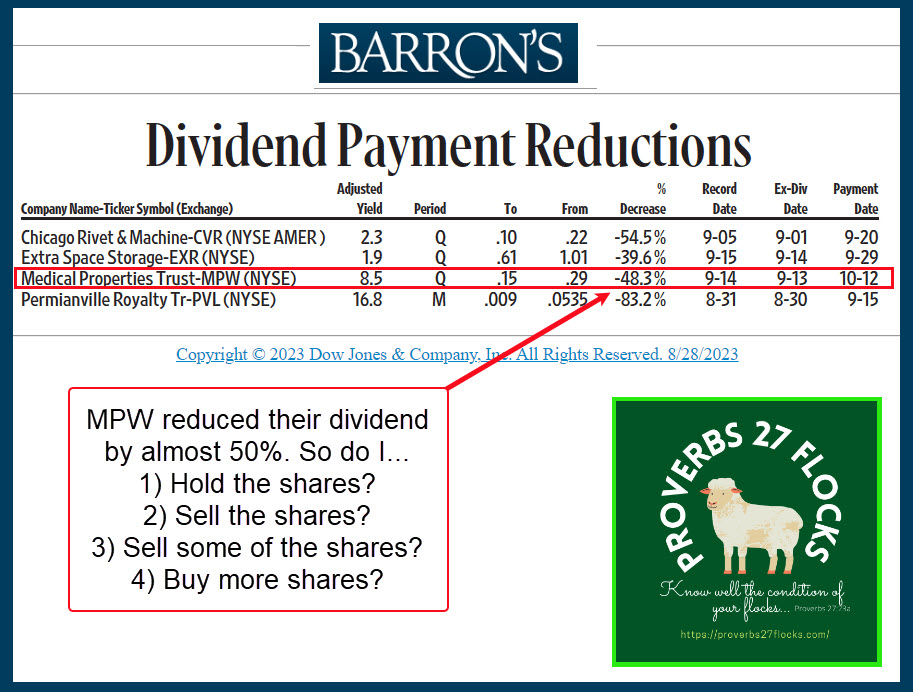

Now, I said all of that to address the reason for this post. The title of this post is, “When The Dividend Drops or Ceases.” The reason for this post is that MPW (Medical Properties Trust, Inc.) reduced their dividend by almost 50%. It was cut in half. But it was not suspended. A suspension means there will be no dividend. That would be a 100% cut.

My Rules Include a Caution

I’m not going to give you all ten of my selling rules. There is one of importance for this post. That rule states, “investigate and seriously consider selling a stock if the company’s directors cut, freeze, or suspend the company’s dividend.” If a company is not increasing their dividend, and certainly if it is cut or eliminated, then it is working against my goal. Therefore, I will seriously consider selling the shares when this happens. In the last ten years, for each time I can recall, I sold my shares in all cases except one. I did not sell my shares of Ford (ticker: F). I still hold the shares even though there was a time when Ford was not paying their dividends.

MPW Dramatically Cut Their Dividend

I now faced the same decision with MPW. I won’t hold you in suspense. I have decided to keep our shares. We currently own 4,600 shares of MPW worth $33,764 based on the August 30, 2023, closing price. I certainly would not recommend buying shares if you don’t own them, but I think the panic is overblown. There are certainly causes for concern, and that has caused concern on the part of many investors. The concerns do warrant caution. However, MPW says it has total assets of approximately $19.2 billion, including $12.5 billion of general acute facilities, $2.6 billion of behavioral health facilities and $1.7 billion of post-acute facilities. MPT’s portfolio includes 444 properties and approximately 44,000 licensed beds across the United States as well as in the United Kingdom, Switzerland, Germany, Australia, Spain, Finland, Colombia, Italy and Portugal. The properties are leased to or mortgaged by 55 hospital operating companies.

The big problem is that some of their properties are not paying the rent that is due. You would think hospitals could afford to pay their rent, but that is the problem. According to MPW’s press release, “NFFO for the second quarter ended June 30, 2023 was $285 million ($0.48 per diluted share) compared to $275 million ($0.46 per diluted share) in the year earlier period. Included in 2023 second quarter NFFO is roughly $68 million ($0.11 per diluted share) from the receipt of equity in PHP in lieu of cash for 2023 previously unrecorded but contractually owed rent and interest revenue from Prospect Medical Holdings, Inc. (“Prospect”). In accordance with accounting requirements, the value of MPT’s investment in PHP was established at roughly $655 million based on estimates from multiple independent third parties and the application of an appropriate marketability discount.”

If you receive “equity” in lieu of cash, you aren’t receiving income.

Why I Will Hold MPW

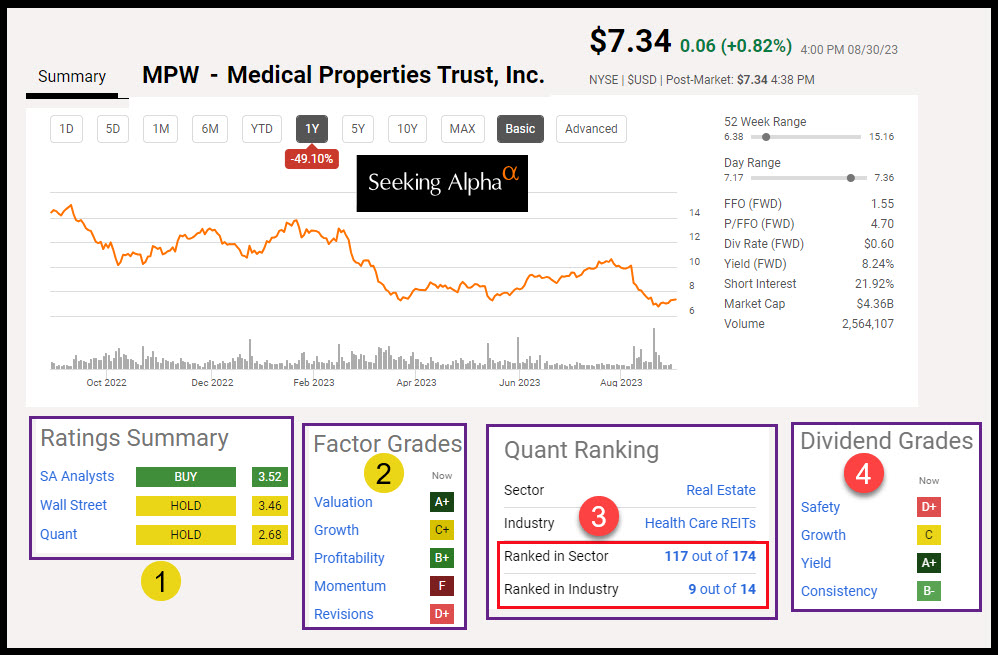

Just like my decision to hold our Ford shares, I plan to hold MPW because I have confidence that MPW’s management is facing the problems wisely. The risk remains, but I am willing to give MPW some room and patience. Furthermore, none of the Seeking Alpha ratings are “Sell.” At the present they are BUY, HOLD, and HOLD.

In addition, a recent headline said, “Barclays Adjusts Price Target on Medical Properties Trust to $10 From $12, Maintains Overweight Rating.” An overweight rating is a buy rating. The shares are currently trading at $7.34. If I wait, I believe there will be price recovery. In the meantime, the next dividend on our 4,600 shares will be $690. That eases the pain while we wait to see what happens. The ex-dividend date is September 13, 2023.

In fairness, it should be noted that another headline recently said, “JPMorgan Downgrades Medical Properties Trust to Underweight From Neutral, Adjusts Price Target to $7 From $9.” The jury is still out.

By the way, our annualized dividend income from our other investments is far more than we need, so we can afford to wait.

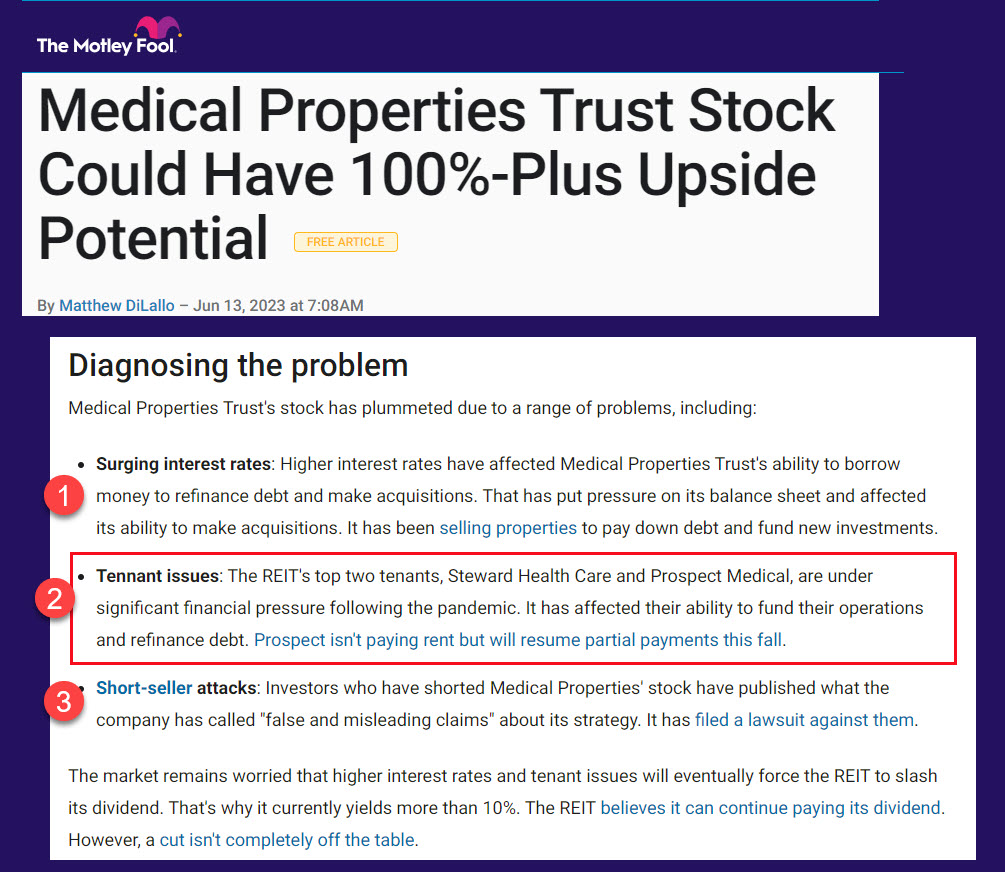

The Opinion of The Fool

In general, I don’t listen to fools. However, “The Motley Fool” article by Matthew DiLallo on June 23 suggests that “Medical Properties Trust Stock Could Have 100%-Plus Upside Potential.” LINK