Sold 400 Shares of PFE and then…

On Friday I sold 400 shares of our Pfizer Inc holdings for a total cash addition of $14,547.88. This does not mean that I don’t like PFE as a long-term holding. However, PFE’s Ex-Dividend date was July 27, so I will receive the quarterly dividend for the shares on September 5. In addition, we still hold a combined total of 2,500 PFE shares with a current market value of $90,950. If I thought PFE was in trouble, I would not hold the shares. I would sell all of them.

You may recall my recent post about Blue Owl Capital Corporation (OBDC). As I explored the Business Development Company industry, I found another BDC that I think is a good investment. The ticker symbol of the BDC is BCSF. BCSF is Bain Capital Specialty Finance, Inc. Let me explain why I bought 500 shares of BCSF. BCSF is in the financial sector and is classified as an “Asset Management and Custody Banks” investment. It is not a dividend-growth investment like AVGO or many of our other larger holdings.

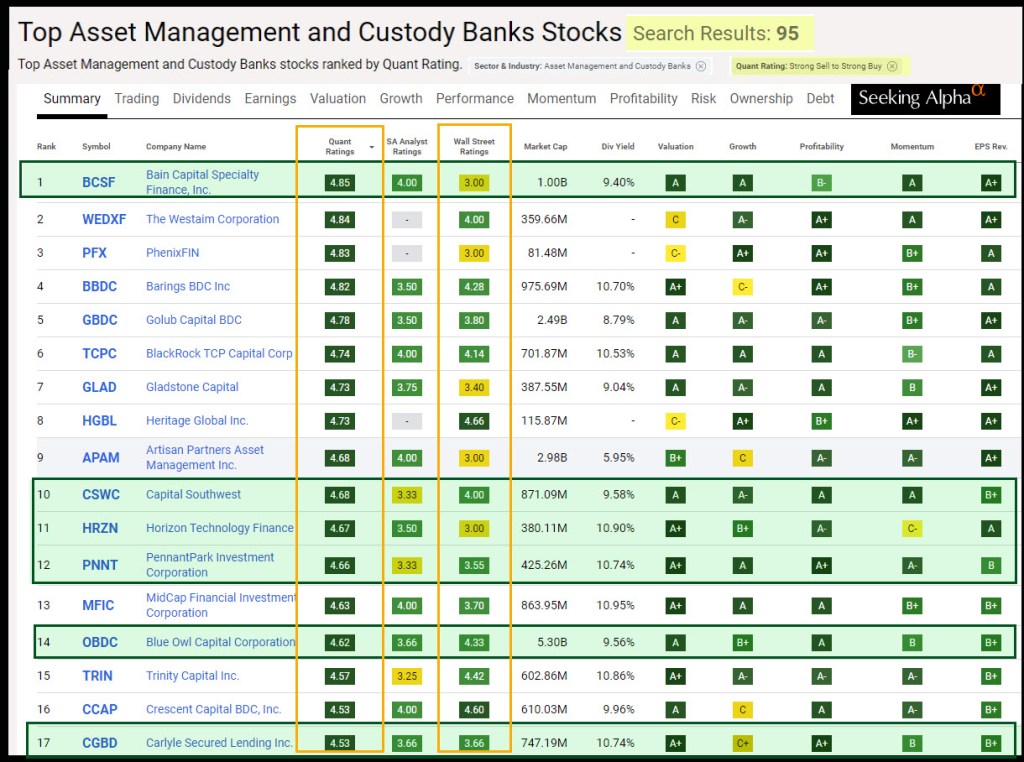

Seeking Alpha QUANT Rating

The QUANT rating for BCSF is very appealing. It is currently a “Strong Buy” with a numerical rating of 4.85 on a scale of 0.0 to 5.0. Wall Street analysts currently rate this investment as a “HOLD.” That isn’t too surprising. Many analysts are less enthusiastic about BDC investments in general. Some examples might prove helpful.

BDC MAIN (Main Street Capital) has a QUANT rating of 4.22 (BUY) and a Wall Street rating of 3.71 (BUY). BDC CSWC has a QUANT rating of 4.68 and Wall Street says 4.00. HRZN has a QUANT of 4.67 versus the Wall Street rating of 3.00. I am sharing MAIN, CSWC, and HRZN because we own shares of those BDCs as well. Let’s just say I am generally skeptical of the general views of Wall Street analysts. As the following illustration shows, the same is true for our CGBD, OBDC, and PNNT holdings.

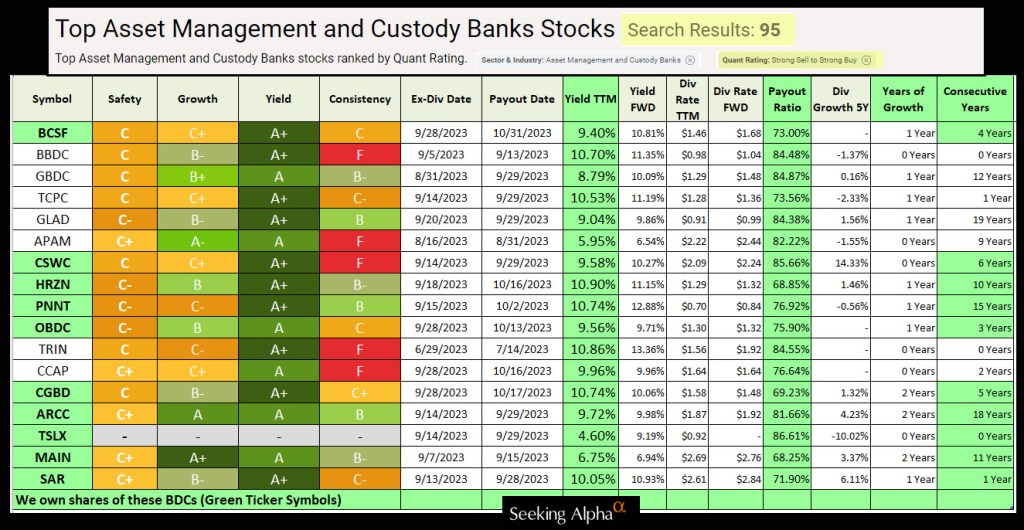

Dividends

BDCs are known for generally high yields. You get yield, like 9.40% for BCSF but you do this knowing the value of your shares is not likely to increase in the same way that shares of a technology company might grow. Therefore, I would not have a portfolio with a total focus on BDCs. I buy shares of technology companies like AVGO, HPQ, STX, and AMD for growth and BDCs for income. I filtered the Seeking Alpha dividend display to illustrate the high dividend yields and the dividend grades for the BDCs we hold, along with some we do not hold.

Diversification

As I mentioned in the post about OBDC, Business Development Companies often are high-yield investments. By “high-yield”, I mean the dividend yield is often over eight percent. That is often a warning flag for many investors, as the market’s overall yield is often less than two percent. However, when it comes to BDCs, I think the fear related to quality BDCs is often overblown. The thing I like about BDCs is that they invest in smaller companies and are usually actively involved in the businesses they invest in.

Fidelity Equity Summary Score

Fidelity’s Equity Summary Score is not usually a deciding factor for my investment decisions. However, an ESS of 9 out of 10 is very encouraging. The Ex-Dividend date is 09/28/23, so I will receive the $0.42 dividend on the 500 shares I purchased on Friday.

For Your Consideration (Repeating what I said before)

If you are nearing retirement and you have not considered dividend growth investments, now might be a good time to start a transition to that type of income. Bear in mind that if you have Social Security, it is already like an annuity. You really should avoid buying an annuity unless you have no hope of making sound equity investments. Cindie and I can live on our Social Security income, so all of the dividend income can be put to work in charitable giving and in other areas where we want to make a difference in the lives of others.

OBDC Business Profile

Bain Capital Specialty Finance, Inc. is business development company specializing in direct loans to middle-market companies. The fund seeks to invest in senior investments with a first or second lien on collateral, senior first lien, stretch senior, senior second lien, unitranche, mezzanine debt, junior securities, other junior investments, and secondary purchases of assets or portfolios that primarily consist of middle-market corporate debt. It typically invests in companies with EBITDA between $10 million and $150 million.

My Buy Orders and Our Holdings

I did a buy limit order for the 500 shares of BCSF and paid $15.58 for the shares for a total investment of $7,788. In other words, I used a little more than half of the proceeds to get the $0.42 per share in dividends. PFE pays $0.41 per share, so I am getting the same net annual dividend and have $6,869 I can put towards other dividend investments. That is a win-win for income in retirement.

Ticker Symbols of BDC investments in our portfolio include: BCSF, OBDC, CSWC, HRZN, PNNT, CGBD, ARCC, TSLX, MAIN, GAIN, and SAR. Our largest BDC holding is MAIN. ARCC is another large holding.