Social Security is an Investment – Not!

Because so many people wrongly think that Social Security will provide security in retirement, they don’t save for retirement. In fact, those that do save are not really thinking about saving at all. Almost 50% of American families have saved nothing for retirement.

Sometimes I am asked what the bare minimum retirement savings should be. That is hard to define, because there are many variables. However, it seems prudent to try to save at least $500,000. That may seem like a lot of money, but if you start early, it really is not a difficult goal. Here is a simple way to look at it. If you have saved $500K, and you don’t want to sell your investments as the years go by, then you might expect to get about $25,000 per year in income on $500K based on current 1-year CD interest rates. If you add Social Security to the interest income, then you have a rough idea of how much your monthly income from Social Security and investment income will be.

Dreadful American Family Retirement Savings

The Wall Street Journal published an interesting chart earlier this month. 49.5% of American families have saved nothing. Furthermore, as you can see, about 93% of families have less than $500K in retirement savings. What is perhaps even more disturbing is that fully 80% of families have less than $100K saved. If you multiply $100K by 5%, you will find your annual income from your investments will be $5,000. That is, I think, a recipe for insolvency. Zero savings times 5% is zero income for 49.5% of families.

If the total population of the USA is over 335 million people, according to the information on the US Census Bureau website, 78% of the population is 18 or older. How many are over the age of 50? Over 120 million men and women fall into that category. Therefore, about 36% of the entire population is over 50, and about 46% of all adults are over 50. Let that sink in. That means far too many older adults have probably saved very little for retirement. They think they can live on Social Security.

Social Security Return on Investment

A recent Fidelity Viewpoints article exposed some myths about Social Security. Some of what was written was absolutely true. But one purported myth was “Myth #2: You’ll never get back all the money you put into the program.” That myth said, “Everyone’s situation is different, but if you live a long time, you may collect more than you contributed to the system.” The writer also acknowledges that you don’t have an account with your money set aside. Everything is in one big pool, and that pool is being drained by an ageing population. If you die, before you collect, you get zero.

Another questionable statement was, “one of the most powerful features of Social Security is that it provides an inflation-protected guaranteed income stream in retirement, ensuring against the risk you’ll outlive your savings.” The government has a strange way of calculating inflation. They include things that probably don’t matter much to you. So your inflation may actually be significantly higher than the government’s magical number, but they only adjust for inflation based on their definition of inflation.

Wayne’s Social Security Return on Investment

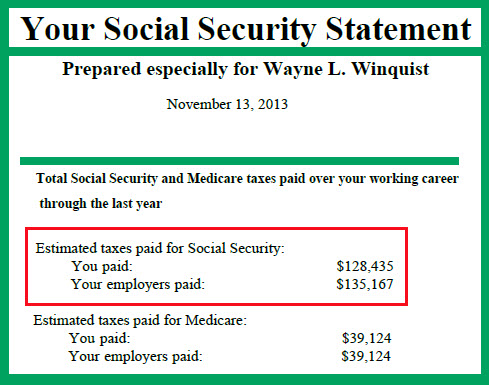

According to my 2013 Social Security statement, I paid an estimated $128,435 in Social Security taxes. Given the fact that I have already received about $230,000 (after deductions for Medicare coverage) in the last 9.5 years, you might think that I got a fair amount of income for my initial “investment.” There are two problems with this thinking. One is that my employers also paid, since 1969, a total of $135,167 in taxes, bringing the real total to $263,602.

The second problem is that my money did not grow with inflation based on any prudent investing by the government. From 1969 through 2009 (40 years) my dollars could have grown exponentially if I had invested the same $128K in my own retirement account. Therefore, I will never really get a good ROI on my Social Security “investment.”

When Will You Die?

According to the Centers for Disease Control and Prevention, life expectancy is 76.4 years. If you wait until you are 70 to start taking benefits, you may only collect benefits for about seven years. Males average 73.5 years and females 79.3 years. Many don’t even make it to age 65 after paying into Social Security for forty or more years. Therefore, not only does Social Security have a questionable ROI, BUT your ROI may also be zero. It is also likely that you won’t get what you paid into the system.

The Unknown

None of us really knows our expiration date. As Fidelity said, “A key consideration for when you claim Social Security benefits is maximizing your income for a retirement that could last longer than 30 years.” But 30 years is a terribly optimistic number if the average male retires at 65 and lives eight more years. Therefore, I started taking Social Security “early” and I realized that I locked in my potential future income, with small increases due to inflation. But everyone, in the end, is not getting a better deal. The payments are based on mortality. Insurance companies and Social Security both know the odds.

Recommendation

If you are depending on Social Security to cover the costs of living in retirement, it is time to get serious about saving. That probably means you need a budget and some spending changes. Social Security benefits will replace about 40% of the income you earned while you were working. If you earned $60,000 per year, then Social Security will replace $24,000 of that income. That may be enough if you live off of the grid and off of the land, but it won’t work for most retirees.

The reality is rather grim. “According to a Vanguard study, Social Security provides 90% or more of income for 35% of retirees, and between 50% and 90% of income for another 29%. Just 36% of retired seniors rely on their benefits to produce less than half of all income.” SOURCE: The Motley Fool

Furthermore, if you think “playing it safe” by buying bonds and other “safe” investments is the best course of action, then you better hope you will die young. You need investment growth, and you won’t find that in bonds, CDs, or annuities.