Buying Opportunities

Yesterday I added 800 shares of OBDC to our retirement accounts. This brings the total share count to 2,800. If you are going to buy shares, be aware that the next Ex-Dividend date is 09/28/2023.

Revenue and Earnings Per Share (EPS)

Watch for trends when buying an investment.

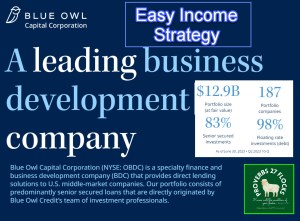

Dividends

Never depend on “other” or “special dividends.” They are nice, but you cannot have certainty that future payments will be made. For the same reason, you cannot be certain that the next quarter’s dividend will be the same or more than the current quarter’s dividend.

Diversification with High Yield

Business Development Companies often are high-yield investments. By “high-yield”, I mean the dividend yield is often over eight percent. That is often a warning flag for many investors, as the market’s overall yield is often less than two percent. However, when it comes to BDCs, I think the fear related to quality BDCs is often overblown.

Seeking Alpha Review

The following images paint a picture of Blue Owl that I believe is positive for the future.

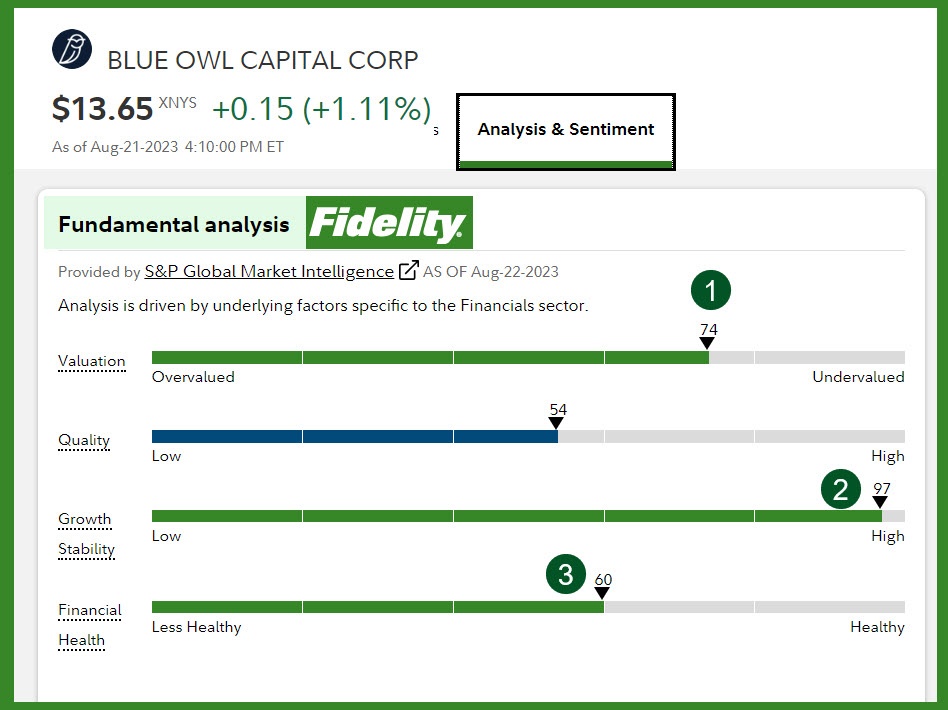

Fidelity Fundamental Analysis

There are many factors that can drive the price of an investment up or down. I am usually interested in companies that have growth potential. I believe OBDC fits that requirement.

For Your Consideration (Repeating what I said before)

If you are nearing retirement and you have not considered dividend growth investments, now might be a good time to start a transition to that type of income. Bear in mind that if you have Social Security, it is already like an annuity. You really should avoid buying an annuity unless you have no hope of making sound equity investments. Cindie and I can live on our Social Security income, so all of the dividend income can be put to work in charitable giving and in special times like an upcoming 2024 vacation to Hawaii with one of our beautiful granddaughters. That will be fun.

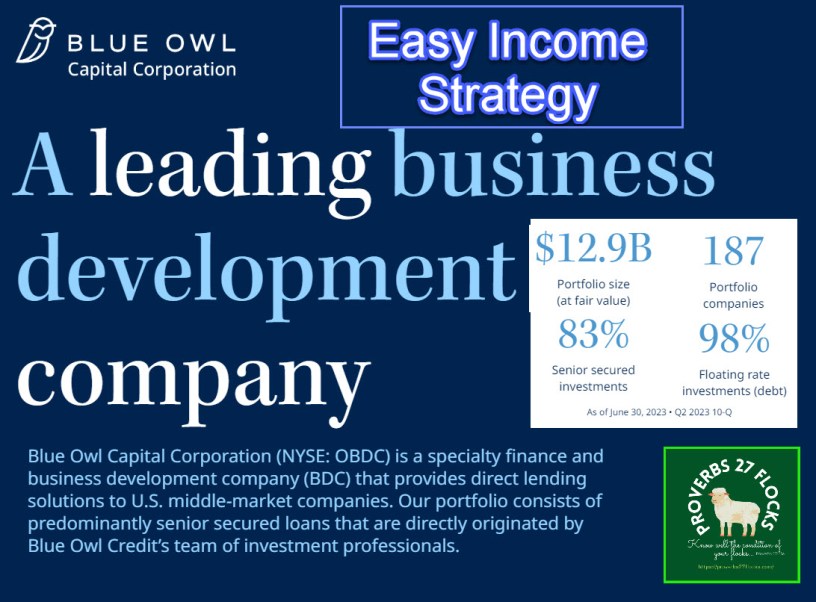

OBDC Business Profile

Blue Owl Capital Corporation is a business development company. It specializes in direct and fund of fund investments. The fund makes investments in senior secured, direct lending or unsecured loans, subordinated loans or mezzanine loans and also considers equity-related securities including warrants and preferred stocks also pursues preferred equity investments, first lien, unitranche, and second lien term loans and common equity investments. Within private equity, it seeks to invest in growth, acquisitions, market or product expansion, refinancings and recapitalizations. It seeks to invest in middle market and upper middle market companies based in the United States, with EBITDA between $10 million and $250 million annually and/or annual revenue of $50 million and $2.5 billion at the time of investment. It seeks to invest in investments with maturities typically between three and ten years. It seeks to make investments generally ranging in size between $20 million and $250 million.

My Buy Orders and Our Holdings

Here are the real numbers for the prices I paid and the total holdings in our combined accounts. We do not own the 50 shares that I hid. Those are owned by a friend I help with his investments.

Wayne’s ROTH IRA – Bought 300 shares of OBDC and added 100 shares of GSL

Wayne’s Traditional IRA – Bought 400 shares of OBDC