Don’t Sit in Front of Your Computer

Even retirees have limited time. While I do more work on my laptop than most people, a large portion of my time is spent preparing to teach or preach. I am currently teaching a series of lessons on the Old Testament book of Malachi via Zoom. Over fifty students are part of the class every Wednesday morning for twelve weeks. During my week I don’t want to spend too much time looking at our investments or looking for good opportunities. It is easier to set alerts and then wait for Fidelity to notify me of an opportunity.

What Do I Want to Know?

It boils down to opportunity. Alerts can help me know if it is time to buy more of an investment or if it might be time to sell some or all of an investment. Of course, the alert doesn’t give me information about why the investment went up or down in price, it only alerts me to a possible opportunity. For example, if an investment I may want to buy drops 3% in price, I can be notified of this price change. Also, if an investment rises to a 52-week high, it may be time to sell some or perhaps even all of an investment. The investor’s rule of thumb is to buy low and sell high. This can happen in a very short time, so receiving an alert is a helpful way to learn about the price activity without sitting glued to my computer.

The Fidelity Alerts Menu

To gain access to the Alerts Menu, you go to the “News & Research” drop-down menu. There are two tools I use on that menu. One is “Fixed Income, Bonds & CDs.” The other is “Alerts.”

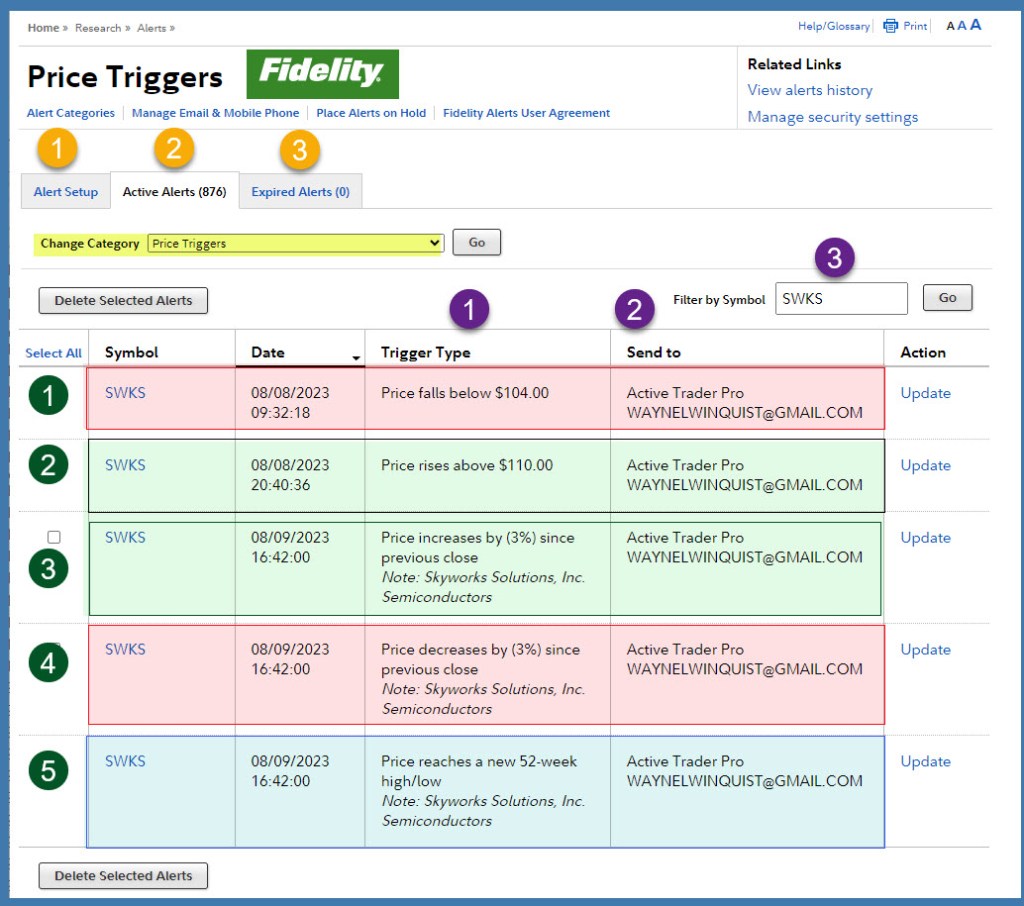

Price Triggers

There are three sets of numbers on the following illustration. The orange numbers are the main choices. If I want to set up an alert, I choose “Alert Setup.” When I want to search for Active Alerts, I select that option. And if I want to see which alerts have triggered, I choose orange number 3. If an alert triggers, it automatically expires. However, you can go to that menu and turn it back on at the end of the day.

The three purple numbers show the types of triggers I have set for SWKS (Skyworks Solutions.) There are five different types of alerts (green) that can prove helpful. I like first two because they are triggered when a specific price is triggered. The other three help me to quickly see wide swings in the price of the SWKS shares. I typically have the alerts sent to my email address and to Active Trader Pro. That way I receive updates to my iPhone and don’t have to be on my laptop to know what is going on with SWKS.

Fidelity Active Trader Pro

The nice thing about the Fidelity ATP software is that I can quickly see price alerts on the Trade Armor screen. In this example you can see the High Price Alert (1) and the Low Price Alert (2). Unfortunately, ATP does not show the other three types of alerts because they are based on daily percentage changes or 52 week high/low data. You can, however, see my cost basis (3).

Dividend Growth Story for SWKS

Skyworks has a good dividend growth story. Therefore, if I have to buy-and-hold the shares, I am willing to do so. However, I do believe that the semiconductor market is oversold and that buyers will start to come back when sanity returns about this important ingredient to so many products in today’s world.

Seeking Alpha Ratings Overview

It would not be prudent for some investors to buy SWKS. Notice that the current QUANT rating is a hold. Sometimes I buy an investment even if the QUANT rating is not BUY.

Skyworks Business Profile

Skyworks Solutions, Inc., together with its subsidiaries, designs, develops, manufactures, and markets proprietary semiconductor products in the United States, China, South Korea, Taiwan, Europe, the Middle East, Africa, and the rest of Asia-Pacific. Its product portfolio includes amplifiers, antenna tuners, attenuators, automotive tuners and digital radios, clocks and timings, circulators/isolators, DC/DC converters, demodulators, detectors, diodes, wireless analog system on chip products, directional couplers, diversity receive modules, filters, front-end modules, hybrids, light emitting diode drivers, low noise amplifiers, mixers, modulators, optocouplers/optoisolators, phase locked loops, phase shifters, power dividers/combiners, receivers, switches, synthesizers, timing devices, technical ceramics, voltage controlled oscillators/synthesizers, and voltage regulators. The company provides its products for the usage in aerospace, automotive, broadband, cellular infrastructure, connected home, entertainment and gaming, industrial, medical, military, smartphone, tablet, and wearable markets. It sells its products through direct sales force, electronic component distributors, and independent sales representatives. Skyworks Solutions, Inc. was founded in 1962 and is based in Irvine, California.

Full Disclosure

I only own 100 shares of SWKS. I have bigger investments in AVGO and AMD. I think AVGO and SWKS are Easy Income Strategy investments.

I have not used alerts. I’m going to look that up for my think or swim platform.

LikeLiked by 1 person