Easy Income Strategy

Whenever I have extra cash from dividends, the sale of positions, or from options trades, I look for ways to put that cash to work. Cash is a lever, and I like to pull the lever with buys at prices that are reasonable for long-term dividend growth. There is a company headquartered in Chattanooga, TN that is in the Life and Health Insurance industry. It was founded in 1848. I plan to buy more shares.

As I was reviewing an ETF last week, one I looked at was IVOV – Vanguard S&P Mid-Cap 400 Value Index Fund ETF Shares. This ETF holds 302 equities. One of the top ten investments in IVOV is UNM. I had purchased 100 shares of UNM in April, so I took a second look and I like what I see.

Take A Tour Using Four Sources

The first stop on our tour will be Fidelity Investments. Unum Group has a “Very Bullish” Equity Summary Score (ESS) of 9.3. On a scale of one to ten, that is indeed very bullish. So the first stop in our tour says, “dig deeper.”

Wallmine

The second stop in our investing tour is Wallmine. I am usually curious as to the behaviors of insiders. Most of the insider activity is “Sale.” When you see something like this you should wonder why they might be selling. However, as I look at the sell prices, I am struck by the fact that they may all regret their decisions to sell. You can see that there were recent sales far below the current stock price. The Wallmine “Overall Analyst Rating” is HOLD. This is a yellow caution flag. It seems OK to own UNM, but perhaps it isn’t a good time to buy more. Our next stop: Seeking Alpha.

Seeking Alpha

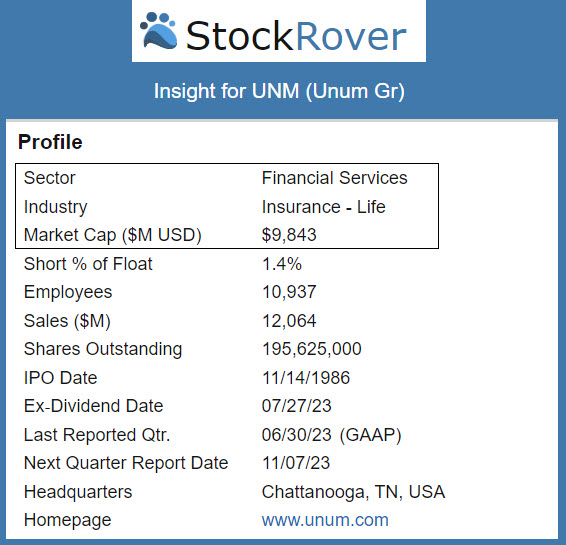

On Seeking Alpha the QUANT Rating is “STRONG BUY.” That second opinion is similar to the one Fidelity gave. Furthermore, UNM is 3 out of 20 in their industry, and it is ranked 152 out of a total of 4,669 possible investments. Now I feel a bit more compelled to add shares. There is one final stop in the tour: StockRover.

StockRover Merits a Long Layover

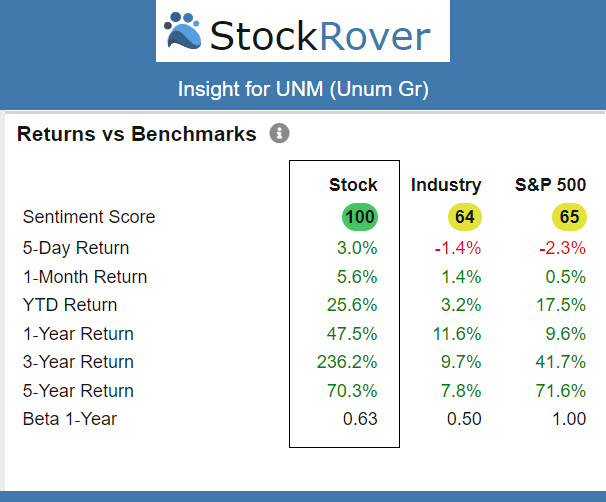

UNM has five “STRONG BUY” ratings and one “BUY.” There are currently six “HOLD” recommendations. That is not unusual. There are usually skeptics regarding just about any investment. At this point I’m almost convinced that I should add shares to my ROTH IRA. Before I do, I want to understand the dividends, the potential risks and returns, the profitability, the 5-year returns, and the scores for value, growth, quality, and sentiment.

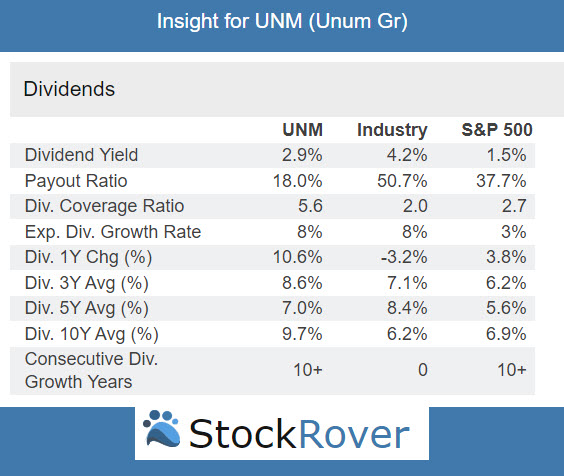

StockRover Dividend Information

UNM has a history of increasing dividends. Seeking Alpha says there have been 14 years of dividend increases and the 5-year rate for the increases is 7.36%. The dividend payout ratio is below 20%, so that makes the dividend attractive and reasonably safe. For comparison purposes, here are some images from StockRover.

UNM Risk/Returns

UNM StockRover Profitability View

UNM StockRover Returns Vs Benchmarks

UNM Company Profile

Unum Group, together with its subsidiaries, provides financial protection benefit solutions primarily in the United States, the United Kingdom, Poland, and internationally. It operates through Unum US, Unum International, Colonial Life, and Closed Block and Corporate segments. The company offers group long-term and short-term disability, group life, and accidental death and dismemberment products; supplemental and voluntary products, such as individual disability, voluntary benefits, and dental and vision products; and accident, sickness, disability, life, and cancer and critical illness products. It also provides group pension, individual life and corporate-owned life insurance, reinsurance pools and management operations, and other miscellaneous products. The company sells its products primarily to employers for the benefit of employees. Unum Group sells its products through field sales personnel, independent brokers, consultants, and independent contractor agency sales force. Unum Group was founded in 1848 and is based in Chattanooga, Tennessee.

Full Disclosure

I own 100 shares of UNM in my ROTH IRA. If the price does not charge up today, I hope to add another 100 shares. It is easy income. Although the yield is only 2.9% at the present time, $1.46 per share is a decent payout for a company with a solid track record.