One Size Does Not Fit All

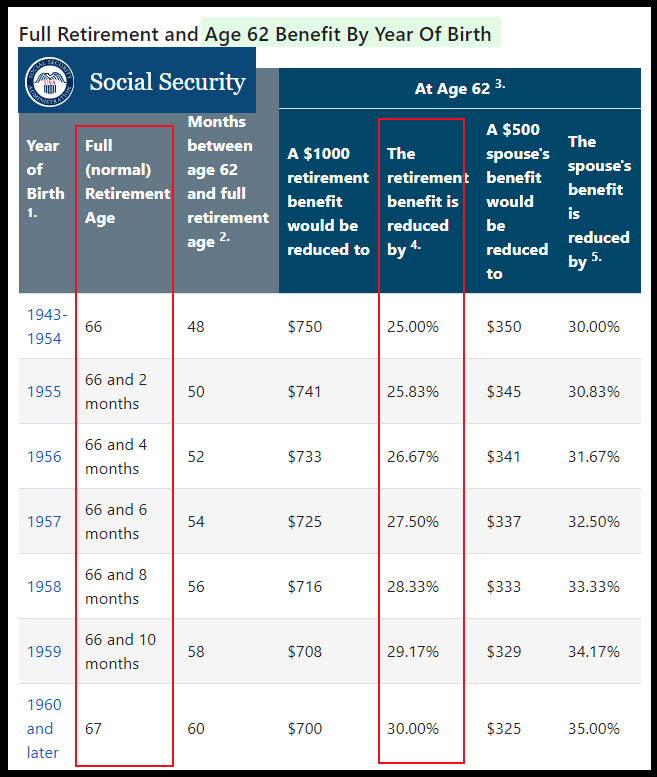

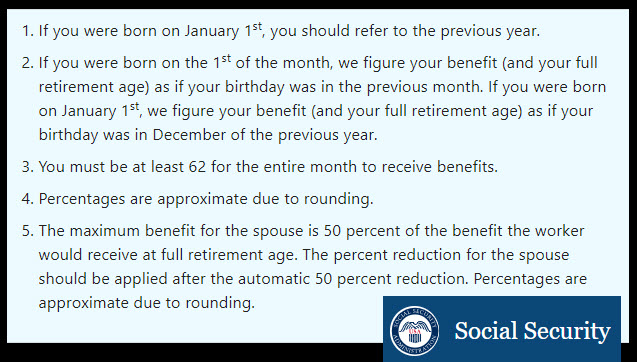

If you search the internet for “when to take social security benefits” you will get many potential websites and ideas. The goal of this post is not to replicate those posts. However, I did include links to two good resources. One is to the Social Security Administration website and the other is Investopedia. The common wisdom is that you should delay until your Full Retirement Age (FRA). That varies depending on when you were born. The following chart from SSA shows the ages.

Bear in mind that as the population ages, it is likely that the government will increase the FRA. There are a couple of reasons for this. One is that people are living longer and the strain on the system is greater. Furthermore, as the population ages, the number of people receiving benefits grows but the number of people working may not be able to support the growing population receiving SSA benefits. Let me suggest some questions you need to ask yourself before you wait until you reach your FRA.

Questions Are Important Before Retirement

Far too many get to their retirement years not having asked the right questions or even having a real plan in place for their retirement years. The answers to the questions will vary based on your health, needs, family responsibilities, and other financial resources. No one buys a new car without asking questions. It is a big expense. The same is true for buying a new home or buying life insurance. I think the same discipline is needed when it comes to planning for retirement.

It is probably wise to consider at least three sets of questions. They are, but not necessarily in order of importance, financial questions, life purpose questions, and reality check questions.

Financial Questions

There are multiple sources of potential income. If you did, or are doing, a good job saving for the future, then Social Security is not going to make or break your financial situation in retirement. Let me suggest the following eight questions. The first four are questions related to your budget and expenses.

- Do I have a practical, working budget so that I know what my true living expenses and needs are? What will change when I retire?

- Am I saving enough now so that there will be income from my ROTH, traditional IRA, 401(k) or similar retirement savings accounts?

- Do I have all of my debt paid? Entering retirement with car payments and mortgage payments can strain the budget.

- Can the projected Social Security monthly income cover most or all of the budgeted monthly expenses?

- What will be my expected monthly dividend income if my dividends increase by 4% per year until I retire (and after I retire.) Will that income pay the bills?

- Do I have a mix of investments that will easily create income in retirement? If not, then when should I start making some changes so that my portfolio of investments provides income?

- Do I need an annuity to give me more “guaranteed income.” Before you answer that question, remember that Social Security is a form of annuity. You probably don’t need a second one.

- Do I have skills that can be used to gain income in retirement? For example, I trade covered call options. It is easy for me to earn $40,000 per year doing a few simple trades every week.

- How much will my income tax be in retirement? You need to realize that withdrawals from non-ROTH accounts will result in potentially big income tax payments. Those reduce your spendable income.

Life Purpose Questions

It really boils down to “what is my purpose?” That question can be further refined by asking, “How can my purpose be realized or fulfilled if I live past the FRA?” Far too many enter retirement without purpose. They don’t have hobbies, a mission, or some compelling projects and opportunities to serve others. If you know your purpose, then you can answer many of the other questions with more clarity. If your purpose is to love God and love people, then perhaps you don’t need as much income as you might otherwise need if your purpose is “to see the world.” Most people need your time, encouragement, and practical help more than they need any money you might give them.

Reality Check Questions

Can I put the Social Security income to work now? What happens if I die one month after my FRA? The reality we all face is that today may be the last day of our lives. The way Social Security is structured assumes you will die sooner after age 67 than after age 62. Do the math. If you are destined to die at age 75, then taking Social Security at age 62 gives you thirteen years of income. If you take it at age 70, you get a higher payout, but only for five years. The Social Security Administration is not stupid. They know and do the math.

AAII Taxes in Retirement

I wrote a letter to the editor of the AAII Journal. The topic was “Navigating Taxes in Retirement.” They published my response in the August AAII Journal. Here it is:

I decided to take Social Security at age 62 and give up the benefits of waiting until later. My reasoning was as follows: 1) I had retired from all employment and the amount I received at age 62 was more than sufficient to cover all basic living expenses; 2) In a tax-advantaged way, I could move assets from my seven-figure traditional IRA to my Roth IRA to reduce the impact of RMDs at age 73; 3) I am a dividend-growth investor and set a goal to have income from my IRA investments exceed the RMD so I would not be forced to sell assets starting next year at age 73 to cover the RMD; 4) Our taxable brokerage accounts are relatively small compared to our IRAs and Roths, therefore, it is very easy to manage taxes from smaller traditional IRA withdrawals; and 5) I trade covered call options and cash-covered puts, which provide additional income in all of the eight accounts my wife and I own.

—Wayne W. from Wisconsin

Before You Make Your Decision

“There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced.” – SSA.GOV

Your Likely Longevity

“So much of the strategy on maximizing Social Security retirement benefits depends on guesses as to how long we’ll live. Of course, anyone could die in an accident or get a dire diagnosis next week. Putting aside these unpredictable possibilities, how long do you think you’ll live? How are your blood pressure, cholesterol, weight, and other health markers? How long have your parents and other relatives lived?” – INVESTOPEDIA