Buying Opportunities

There are four primary types of investments of interest to me. The first, of course, are dividend growth investments. IBM has 23 years of dividend growth history. VZ has eighteen. NNN has 34 years of dividend growth.

The second type is BDC high yield investments like OBDC. This month I started a position in OBDC which has a yield of 9.45% and is called “Blue Owl Capital Corporation.” Another BDC is CSWC, and I added some shares in July as well.

The third type is speculative. Usually the dollars involved is very small. Examples in the month of July were OGI and MULN. Both are very high risk, but only about $600 are in this category.

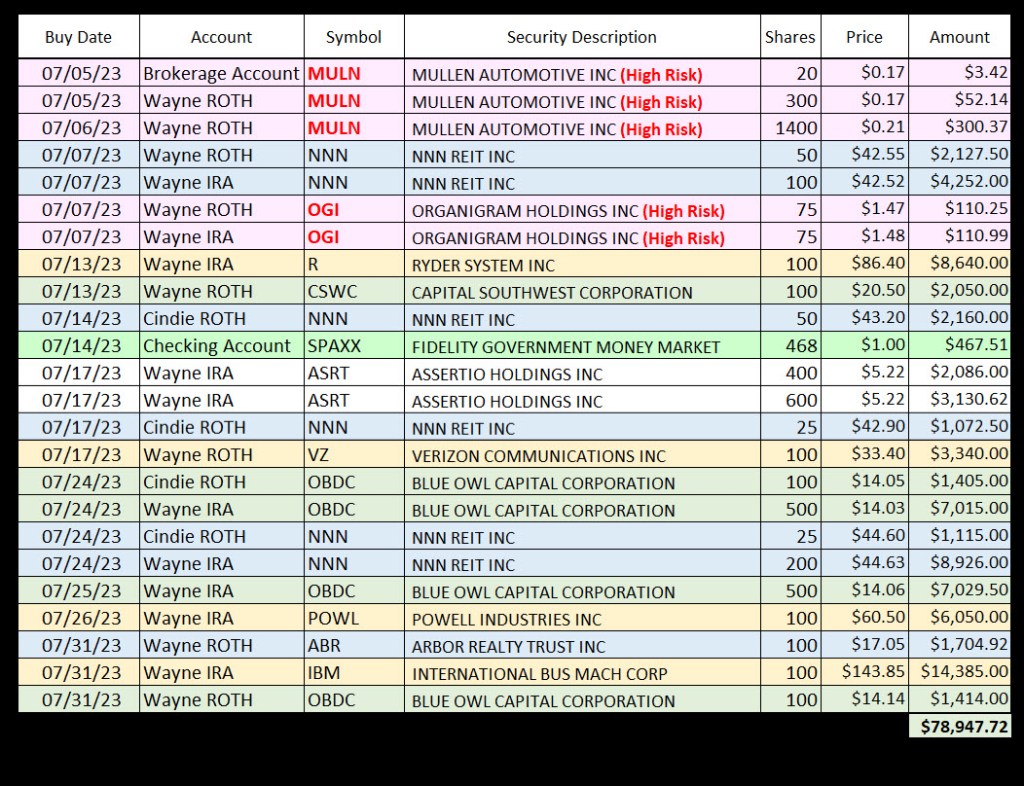

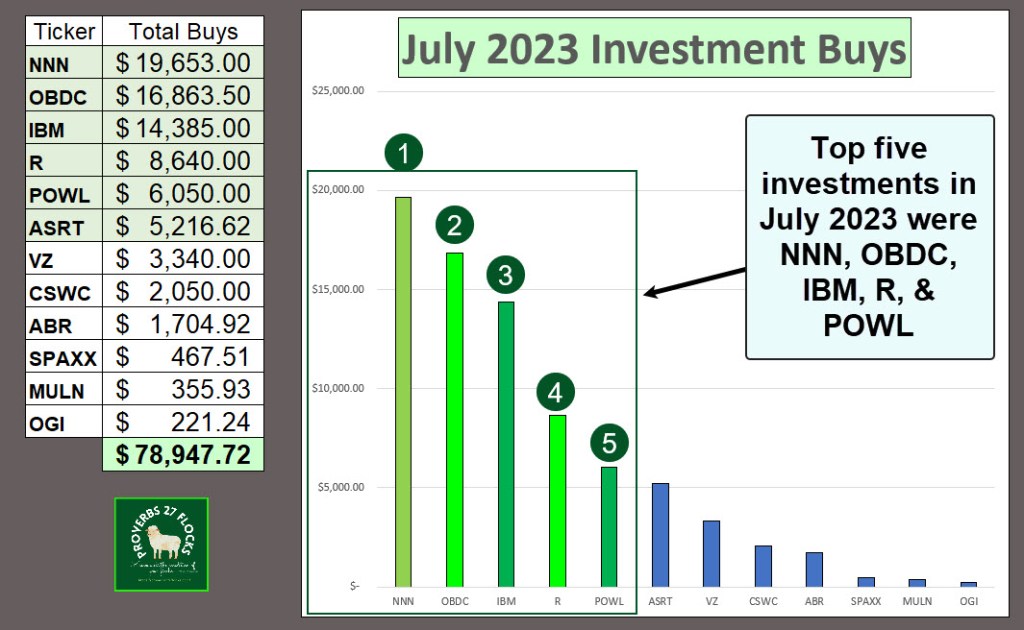

Finally, I buy some shares to turn around and sell using covered call options. During July I bought shares of R, VZ, POWL, and IBM to turn into covered call options trades. The first image is a list of the trades by buy date. The second is a graphical image that shows the dollars by ticker symbol for the buys. I do not show the options trades.

The following graph helps illustrate that NNN (a REIT) was my largest investment in July. I already owned shares, so this was an addition. NNN was followed by a new position: OBDC. IBM, R, and POWL round out the top five.

Shares Sold

During July I sold shares of CCAP, EPRT, SLRC, EVAZ, HCKT, OGI, PANL, and PBR. The careful reader will realize that I bought OGI and sold the shares. I decided that it was time to exit and focus on other speculative positions like MULN. Several of these were short-term investments and I decided to use the proceeds to buy shares of VYM in August.

Most of my readers are not active traders, so buying investments like VYM, NNN, and other dividend growth stocks makes sense. I just like a little more spice in our portfolio.

Dividends Received

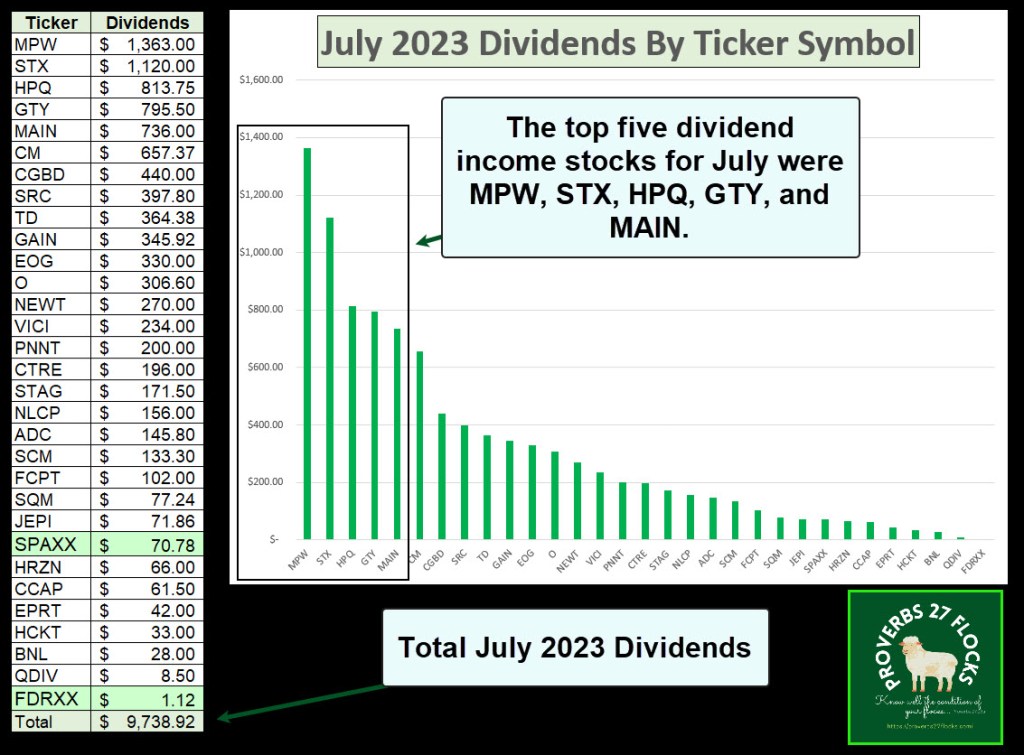

YTD 2023 dividends for all of our accounts now stands at $90,112.73. On an average monthly basis, that would be $12,873 per month. July is not one of the peak dividend months. Total interest and dividends in July were $9,866.26. That is not surprising. In fact, most investors have very little in the way of dividends in July and August. The next big month will be September. One of the reasons for July’s success is the monthly dividend stocks. In the following illustration, GAIN, MAIN, and O fit that role.

However, Canadian bank TD paid a dividend, as did MPW, STX, HPQ, and GTY. MPW and GTY are REITs and STX, and HPQ are both technology sector investments.

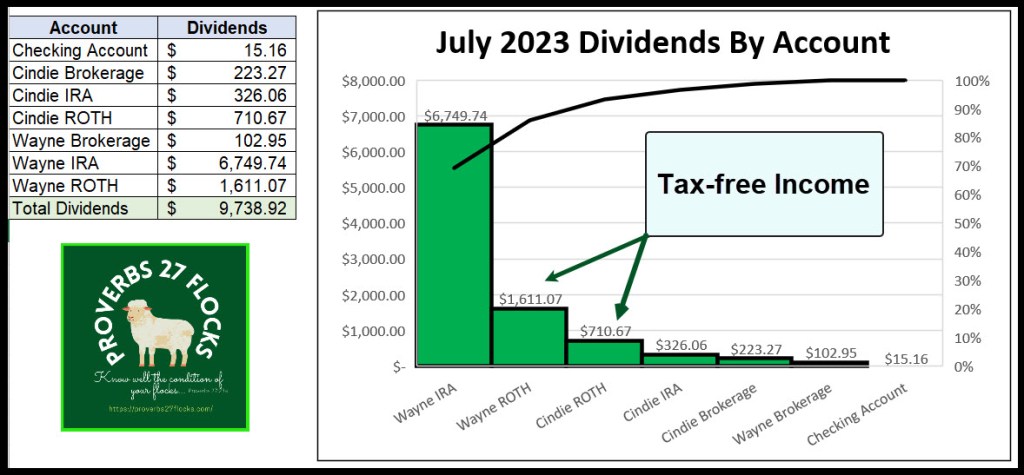

Dividends By Account

It is not surprising that my IRA is the workhorse, as it has the most total assets. But the combination of my ROTH and Cindie’s ROTH contributes nice tax-free income as well.

Options Income

Although I did some options trades in July, the total dollars earned was less than a normal month. Even so, total YTD options income is $38,644. This is another income stream for retirees who are willing to learn how to trade covered call options. Most of that income was earned January through June of this year.

For Your Consideration

If you are nearing retirement and you have not considered dividend growth investments, now might be a good time to start a transition to that type of income. Bear in mind that if you have Social Security, it is already like an annuity. You really should avoid buying an annuity unless you have no hope of making sound equity investments. Cindie and I can live on our Social Security income, so all of the dividend income can be put to work in charitable giving and in special times like an upcoming 2024 vacation to Hawaii with one of our beautiful granddaughters. That will be fun.